wundervisuals/E+ via Getty Images

Introduction

Cardinal Energy, (OTCPK:CRLFF) has a few levers to pull in terms of oil quality, but gets most of its daily production from heavy oil water flooding projects in the North, South, Midale, and Central areas. In mid-2021 it completed a bolt-on acquisition of Venturion Oil to optimize its Central area heavy oil operations.

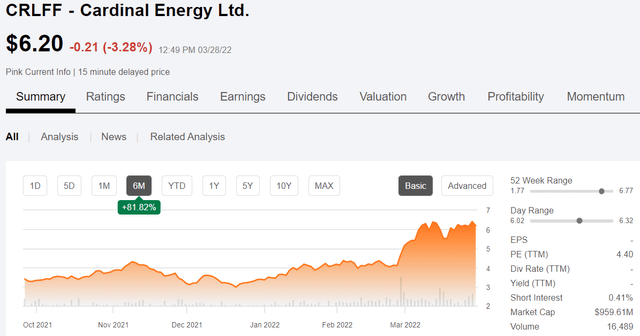

Cardinal share price graph (Seeking Alpha)

At ~22K BOEPD, the company is a fairly small player as compared with some Canadian giants in the heavy oil space, like Canadian Natural Resources, (NYSE:CNQ) with more than a million BOPD of output. But that can work in its advantage, as the law of large numbers hasn’t kicked in yet and there is potential for significant growth in the supportive environment that exists for oil and other petroleum products.

Like many companies in this space, Cardinal had a “near-death” experience in 2021 due to the Corona virus shutdown. It has since recovered nicely from that bottom and is trading at multi-year highs. In short, the easy money has been made, and we need to see what upside remains for investors entering at or near current prices.

The thesis for Cardinal Energy

Cardinal has operations in several key Canadian plays, most of which are in the well-known Western Canada Sedimentary Basin. This gives it a chance to compete in several different markets – light oil, heavy oil, gas, and NGLs. Cardinal is unhedged for 2022 giving it full exposure to the higher prices now being received.

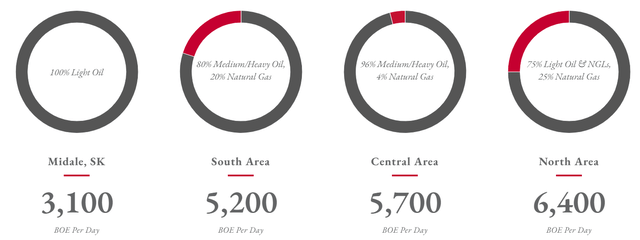

Cardinal daily output (Cardinal Energy.com.ca)

In the North area the focus is on light oil-40 API gravity, gas and NGLs. It has four principal producing areas in this region. The Grande Prairie, House Mountain, Mitsue, and Mica plays, from which it water floods ~6,400 BOEPD from formations of moderate depths. It has 38 future drilling locations identified for production maintenance from these low decline zones.

The Central and South areas produce mostly heavier oils below 30 API gravity. These wells are on water flood in a number of areas, and comprise over half the company’s net production.

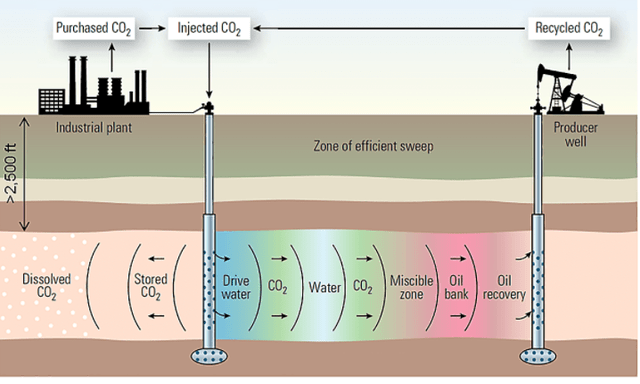

In the Midale region it practices both water and Co2 flooding in water is termed Water Alternated Gas-WAG, flooding where both water and gas are injected into the formation. The Co2 creates a miscible zone that thins the oil and helps drive it toward the producer wells. Cardinal figures it has another 50-years of operating life in this reservoir.

Co2 Flood graph (Cardinal.com.ca)

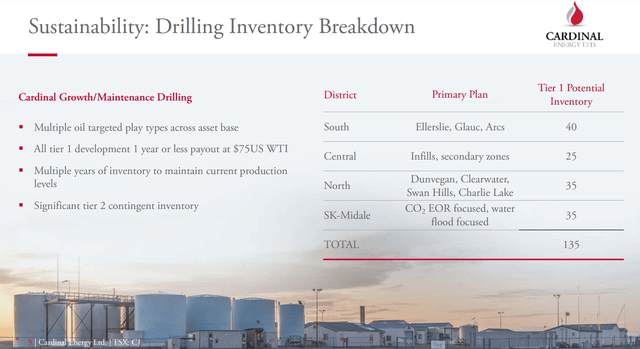

These are all long life, low decline projects that require only modest capital investment in the form of new wells to maintain output, and grow it incrementally in this market. This is evidenced by their low F&D costs, currently running CAD$5.56/ bbl. Cardinal has grown production YoY by 16% organically, and has a long runway ahead of it as the slide below indicates.

Note – Tier I locations are those that are geologically and commercially advantaged in the operators assessment of their potential.

Cardinal drilling inventory (Cardinal.com.ca)

Canadian crudes – WCS, are sold at a discount to WTI that can fluctuate somewhat according to market conditions. Currently the discount is $11.00 which accounts for extended shipping distances to get crude from the marketing hub in Hardisty to other markets closer to refineries.

Risks for Cardinal

Canadian companies are under the same sort of political pressure as American companies, although perhaps to a slightly lesser degree. Nonetheless this pressure has manifested itself in the Canadian operators a reaction similar to their American cousins. An article in Reuters discussed this attitude toward growth by Canadian operators –

Despite the surge in oil prices to 11-year highs, Canadian companies are wary of spending aggressively to grow production after the pain of 2020’s pandemic-induced oil price collapse. Investors are demanding strict capital discipline, while environmental opposition to new fossil fuel projects and the Canadian government’s plans to cap carbon emissions are also deterring growth.

Q-4/2021 for Cardinal (all $ in Canadian unless noted)

In the fourth quarter of 2021, adjusted funds flow increased 293% to $53.5 million ($0.36 per basic share) as compared to the fourth quarter of 2020. Adjusted funds flow for 2021 increased to $132.5 million, a 202% increase over 2020. During 2021, Cardinal reduced its net debt position by $68.6 million or 28% of the balance at the end of 2020. Net debt decreased to $178 mm at YE 2021. Capex has been increased from $75 mm to $90 mm, a 17% increase.

Cardinal carries a very modest $3.5 mm of cash on the books and is totally focused on reducing debt through cash flow. At current prices and forecasted spending, they expect their net bank debt to be approximately $140 million at the end of the first quarter of 2022. If commodity prices remain strong, the company expects to reach the phase one net debt target in the second quarter of 2022. The maturity date of their RBL is May of 2023, so if the company maintains its debt repayment schedule, the entire debt should be repaid by then.

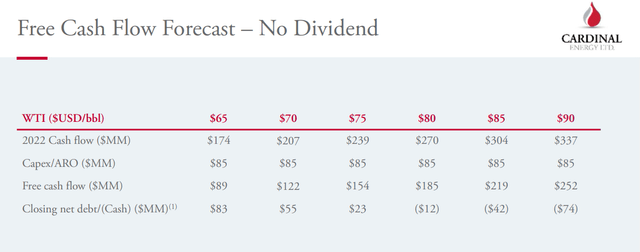

Cardinal Dividend sensitivity (Cardinal.com.ca)

In this scenario Cardinal anticipates reinstating its dividend in the second half of 2022.

Looking ahead in 2022

Cardinal has increased its capital program for 2022. The initial 2022 budget of $75 million in capital spending and $9 million of abandonment and reclamation spending (“ARO”) will be increased by $15 million.

To date in the first quarter of 2022, Cardinal has completed the drilling and completion of eight wells. Two Dunvegan light oil wells were drilled and completed and have commenced production following meeting their type curve expectation. Two Ellerslie multi-leg horizontal wells were drilled and completed in the Brooks area of southern Alberta. The first well has been on production for approximately two weeks at rates double their type curve expectations in the area. The second Ellerslie well is expected to be on stream this week. In addition, Cardinal’s first four Clearwater wells at Nipisi have been drilled and completed and are also expected to commence production this week.

The remaining ten wells of their budgeted drilling activity for 2022 will be focused on select developments at Midale, Brooks and in the Central Alberta area.

A possible catalyst for Cardinal

The four wells in the Clearwater play could be outperformers to the typical water flood well. The Clearwater has drawn a lot of interest in recent times and we have written up extensively in articles on Headwater Exploration, (OTCPK:CDDRF), PrairieSky Royalty, (OTCPK:PREKF), and a couple of others. The reason this play is drawing such interest is partly in its oil quality, 10-20 API gravity crude, and a stacked gas play. The thermal condition of the oil play is such that the oil flows without steam injection, saving huge amounts of upfront capital outlay.

In the event my theory does pan out it could be impactful to the stock.

Your takeaway –

The company is trading at about 8.5X OCF at present, a little steeper than we normally like. But, multiples are increasing for oil and gas companies in this environment. We just have to see if we can justify it.

On a Price to Flowing Barrel basis the company also is a little expensive coming in at $52K per BOE, still well below WTI though. Analyst expectations also suggest the company may be fully valued at current levels. The low end of the range at CAD$8.00 is just above their current price of CAD$7.20, representing a potential 12% upside. The high end of the range is CAD$11.00, which would be a 50% bump higher. In market movement the last month or so it’s held the $6.00 range pretty closely, suggesting that forward momentum has decreased somewhat.

Given the metrics we discussed above and the sharp ramp in Cardinal’s share price this month, I not inclined to chase this one. I would be patient and wait for a dip back toward their 60 day moving average in the $4s someplace. Cardinal could be a company we want to own, but not at its current price.

Be the first to comment