MarcelC/iStock via Getty Images

Uranium is crucial to the world’s energy security and decarbonization plans. While I believe NexGen Energy Ltd. (NYSE:NXE) has the best uranium development project in Arrow, it’s currently stuck in Lassonde limbo with near-term risks skewed to the downside. It trades at 0.7 NAV, which is a fair price for a developer that still needs to finance construction. However, I would be a buyer of NexGen on any significant market correction.

Background

NexGen Energy is a uranium exploration and development company primarily focused on advancing the ‘Rook I Project/Arrow Deposit’ (“Arrow”) in Southwestern Saskatchewan.

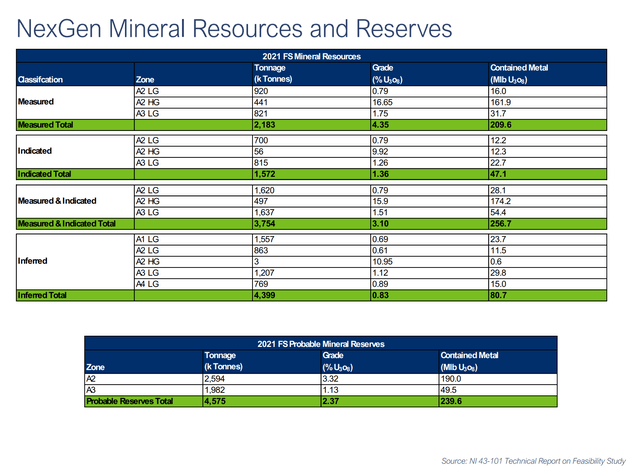

The Arrow project is one of most advanced uranium development projects in the world and has measured mineral resource of 2.18 million tonnes (“MT”) at 4.35% U3O8 and indicated resource of 1.57 MT @ 1.36% U3O8 for a total of 257 million lbs of M&I resources (Figure 1).

Figure 1 – NexGen mineral resource and reserves (NexGen investor presentation)

Arrow Is A Tier 1 Asset

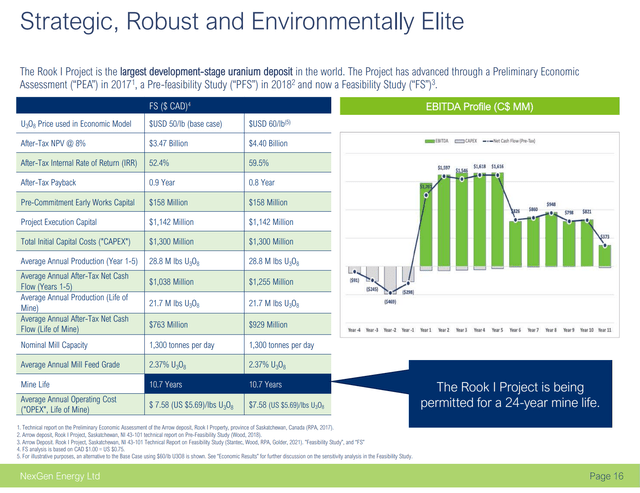

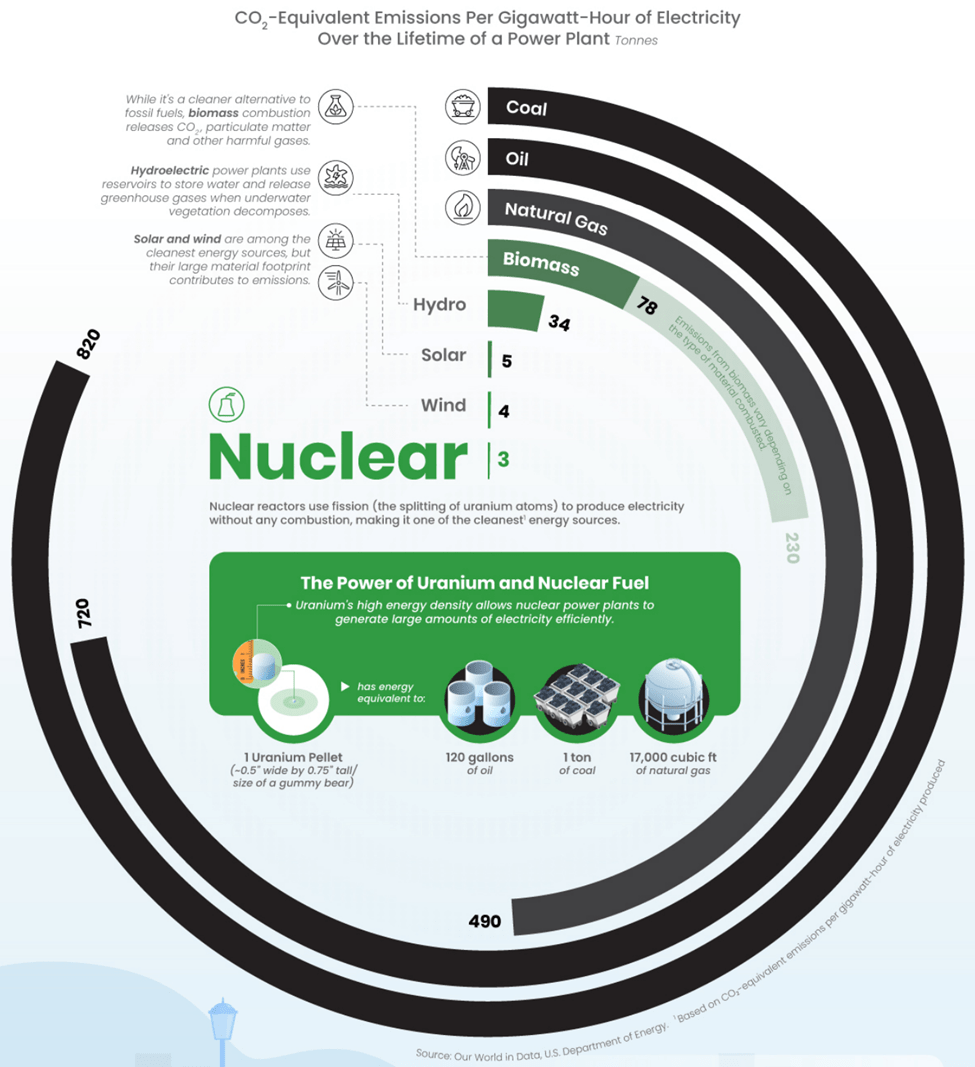

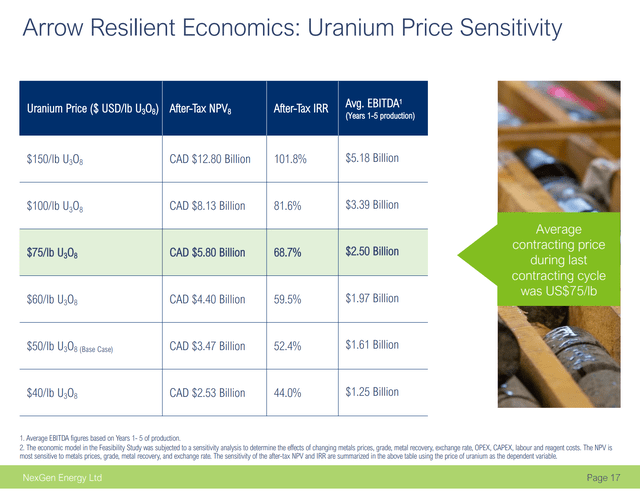

According to the latest feasibility study completed in 2021, Arrow has some eye-popping economics (Figure 2). At US$50/lb U3O8, Arrow is envisioned to generate over C$750 million in average annual after-tax cash flows from producing 28.8 million lbs of U3O8. With an estimated capital expenditure of C$1.3 billion, this translates to almost C$3.5 billion in project NPV and 52% IRR.

Figure 2 – Arrow has robust economics (NexGen investor presentation)

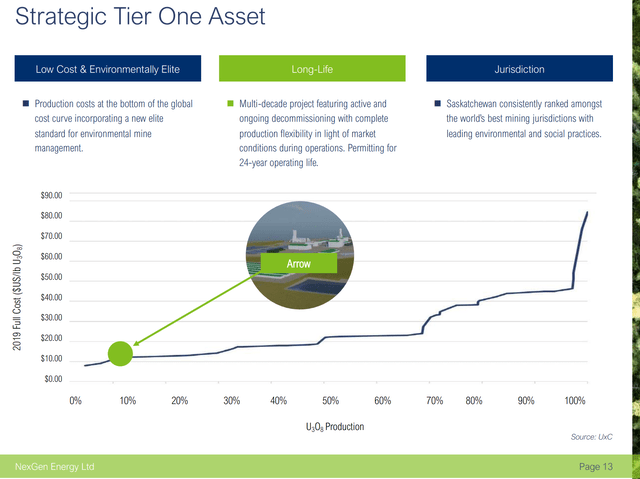

For context, Cameco Corporation (CCJ), the $10 billion market cap uranium mining leader, has production capacity of 30 million lbs of U3O8. So Arrow by itself is almost equivalent to all of Cameco. Furthermore, with its estimated bottom decile mining costs, Arrow should be mining profitably in all price scenarios (Figure 3). Arrow is the true definition of a ‘tier 1 asset’.

Figure 3 – Arrow has bottom decile mining costs (NexGen investor presentation)

Bull Case for Uranium Suggests Even More Upside

As I outlined in my article on the URA ETF, there is a bull case for uranium built upon the twin macro tailwinds of ESG and energy security. To briefly recap, nuclear fission emits just 3 tons of CO2 per GWh of electricity, on par with Solar and Wind, and is 270 times less polluting that Coal (Figure 3).

Figure 3 – CO2 equivalent emissions per GWh (Sprott Physical Uranium Trust)

At the same time, Russia’s invasion of Ukraine has led governments around the world to reassess their energy security, with many like Belgium, reconsidering nuclear after shunning it for years.

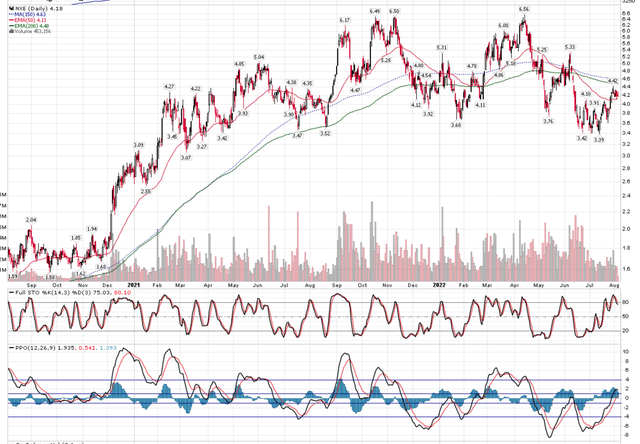

The result is U3O8 price that has rallied significantly from the $20 lows a few years ago, with some analysts expecting much higher prices to spur additional production (Figure 4).

Figure 4 – Uranium price (tradingeconomics)

Lassonde Curve Suggests A Long Period Of Rest

With robust project economics and a rosy picture for uranium prices, is there anything to not like about Arrow?

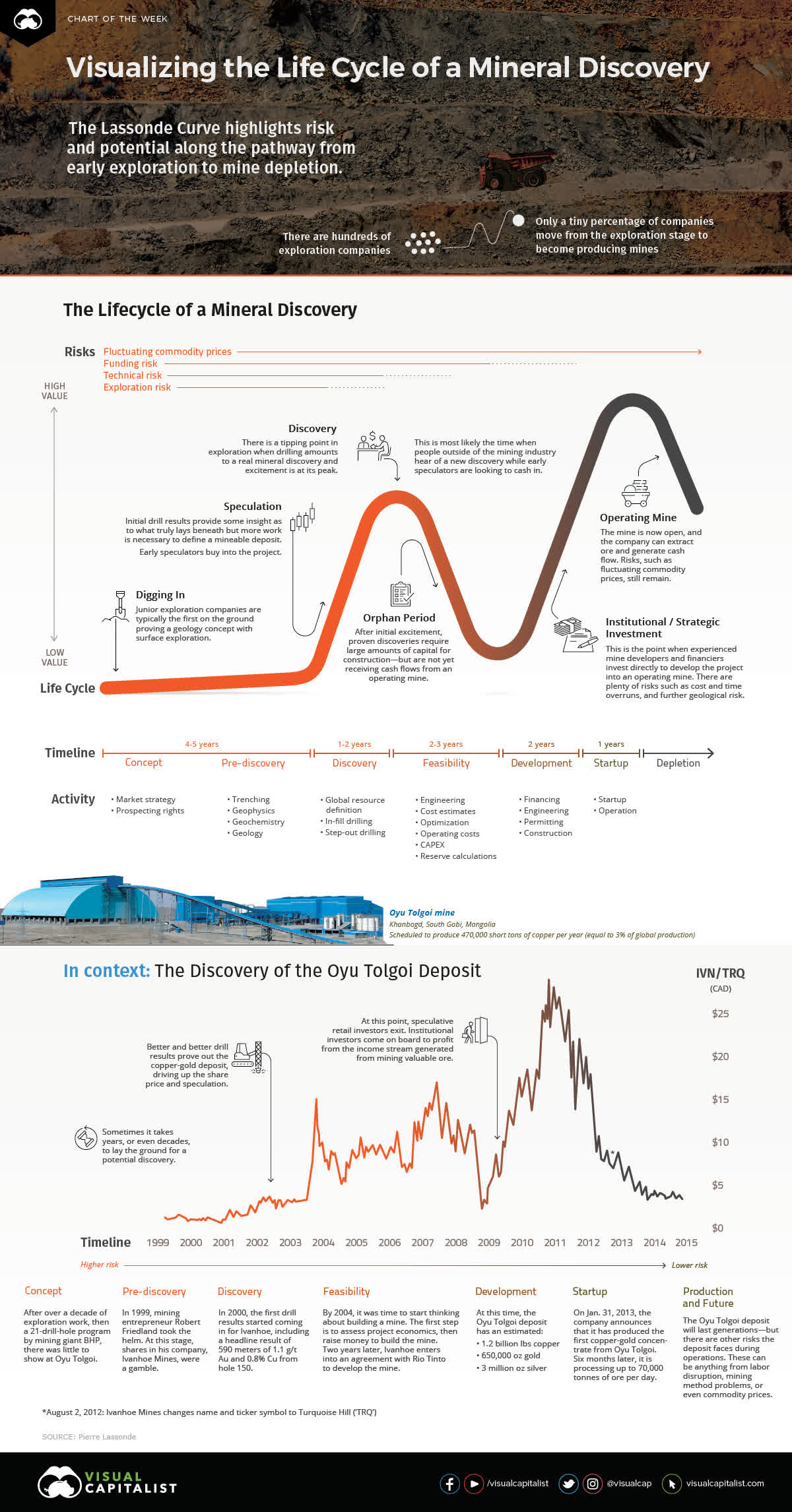

The answer is the Lassonde Curve (Figure 5). As I mentioned in my article on MAG Silver Corp. (MAG), there is a general lifecycle to mineral discoveries and development.

Figure 5 – Lassonde Curve (visualcapitalist.com)

Typically, the value / stock price of a mineral discovery runs up during the discovery phase, as speculators bet on ‘how big can it get’. Once the size of the project is determined and the project enters the feasibility and development phases, the stock price goes ‘fallow’, as this is usually where economic reality, permit delays and cost overruns occur. Finally, as the mine starts producing, the stock price takes off, as cashflows begin to flow.

While MAG Silver is transitioning to production, NexGen is just beginning the development phase for Arrow.

Recent EIS Is First Step Of Many

A few weeks ago, NexGen announced it had submitted a draft Environmental Impact Statement (“EIS”) to the Saskatchewan Ministry of Environment (“SME”) and the Canadian Nuclear Safety Commission (“CNSC”). While the submission of the EIS is an important milestone, it is one of many.

Now the Provincial and Federal regulators will review the technical, environmental, and social merits of the project, with a public review process to follow. It is unclear how long this review process could take, but Cameco’s Cigar Lake mine may offer some clues, as it is also situated in Saskatchewan.

Cigar Lake Timeline As Guide

Uranium mineralization was first discovered at Cigar Lake in the 1980s, and a joint venture led by Cameco was set up to develop the project. A Pre-feasibility study was delivered to the JV partners in 1993, and an Environmental Impact Statement was filed in 1995. Public hearings on the project concluded in 1997 and the project proceeded to regulatory licensing in 1998. Initially, Cameco expected production at Cigar Lake to begin in 2003 (according to Cameco’s 1999 Annual Information Form). However, construction was delayed multiple times until 2005, with production expected by 2007. Unfortunately, the mine experienced multiple flooding events in 2006 and 2008 and actual ore production did not begin until 2014, more than a full decade later than originally envisioned.

While Arrow is not expected to experience the same kind of technical difficulties as Cigar Lake (the Arrow deposit is basement-hosted unlike Cigar Lake, which is hosted in sandstone and has to be frozen using the jet-boring technique before it can be mined), the timeline above does highlight the time delay risk in mine development.

Using Cigar Lake as a rough guideline, Arrow still needs to complete the EIS and public review phase, which could take 2 years. Then the mine licensing could take another year. Finally, the feasibility study expects a mine construction time of 4 years. So adding it all up, we could looking at late 2020s or early 2030s before U3O8 ore is mined at Arrow.

NexGen Trading As An Option On Uranium

In the meantime, NexGen is trading like a call option or leveraged bet on uranium prices. When uranium prices surged to $65 in April, NexGen traded up to $6.56 per share. However, as uranium prices declined to $46 and equity markets experienced a steep selloff, NexGen’s share price declined by almost 50% to $3.40 (Figure 6). Recently, both have recovered, with uranium trading near $50 and NexGen trading at $4.40.

Figure 6 – NXE trading like a call option on uranium (Author created with price chart from stockcharts.com)

Unfortunately, as NexGen is caught in the development phase of the Lassonde Curve, long-term investors will continue to be whipped around by the commodity price and general market sentiment.

Current Valuation Is Fair

NexGen currently has a C$2.5 billion market cap, which is approximately 0.7x the C$3.5 billion NPV of the Arrow project, using US$50 U3O8 price. I believe this is a fair valuation as first production is still years away and the company still has to finance the actual capital expenditures of $1.3 billion, so further dilution is to be expected.

Where Would I Buy NexGen?

NexGen conveniently provides a uranium sensitivity table in its investor presentation, reproduced here as Figure 7. Given I think fair value is 0.7x NAV for NexGen’s current stage of development, I would be a buyer of NexGen if it trades at 0.5x NAV at prevailing uranium prices. i.e. at US$50/lb U3O8, Arrow has an NPV of C$3.5 billion. So if NexGen’s stock price were to trade off to C$3.60 (C$1.75 billion market cap), that would be an attractive entry.

Figure 7 – Arrow uranium sensitivity (NexGen investor presentation)

Risks To Owning NexGen

As we have mentioned throughout this article, NexGen is currently in the development phase of its Lassonde Curve and risks are skewed to the downside. For example, the EIS and public review process could take longer than expected. To NexGen’s credit, they have secured support from indigenous tribes near the Arrow project including Clearwater River Dene Nation (“CRDN”), the Birch Narrows Dene Nation (“BNDN”), and the Buffalo River Dene Nation (“BRDN”).

Furthermore, with surging inflation, the capital costs in the feasibility study could already be out of date. For example, recent capital expenditure blowouts in Canada have cratered stock prices for mining companies like IAMGOLD Corporation (IAG), Argonaut Gold (OTCPK:ARNGF), and Ascot Resources (OTCQX:AOTVF), just to name a few.

Finally, one upside risk is that Arrow will eventually be built, but maybe not by NexGen. As we have mentioned previously, the Arrow project is a tier 1 asset that any major mining company would love to have in their portfolio. If equity markets were to weaken significantly, don’t be surprised if a BHP (BHP) or Rio Tinto (RIO) swoops in and buys the company.

Conclusion

While I firmly believe uranium is crucial to energy security in the coming years and NexGen’s Arrow project is a tier 1 ‘best in class’ uranium project, I think near-term development risks are skewed to the downside. It currently trades at 0.7x NAV at US$50 U3O8, which is fair. However, I would be a buyer of NexGen on any significant market correction.

Be the first to comment