FG Trade Latin/E+ via Getty Images

fuboTV Inc. (NYSE:FUBO) caught my attention soon after coming to the public market as the company is clearly operating in an interesting segment of the streaming market and is riding the macro trend of cord-cutting. I was never interested however in owning the shares because the price was quickly bet up to astronomical levels that made any investment thesis totally unrealistic.

With the shares now trading 92% down from the highs reached in February 2021, I thought it would be interesting to have a second look at the company and see if it is a bet worth taking.

Overall, the business is still growing nicely but is far from reaching any economic scale. Worse even, fuboTV is still operating at negative gross margin, has a problematic balance sheet, and is walking an uncertain path towards profitability. I have my doubts that the company will ever figure out a sustainable way to operate, and there is actually a substantial possibility that Fubo will go out of business. Not my favorite bet to take, but let’s dive deep more in details as to why the company has so many issues.

A flawed business model in a tough market

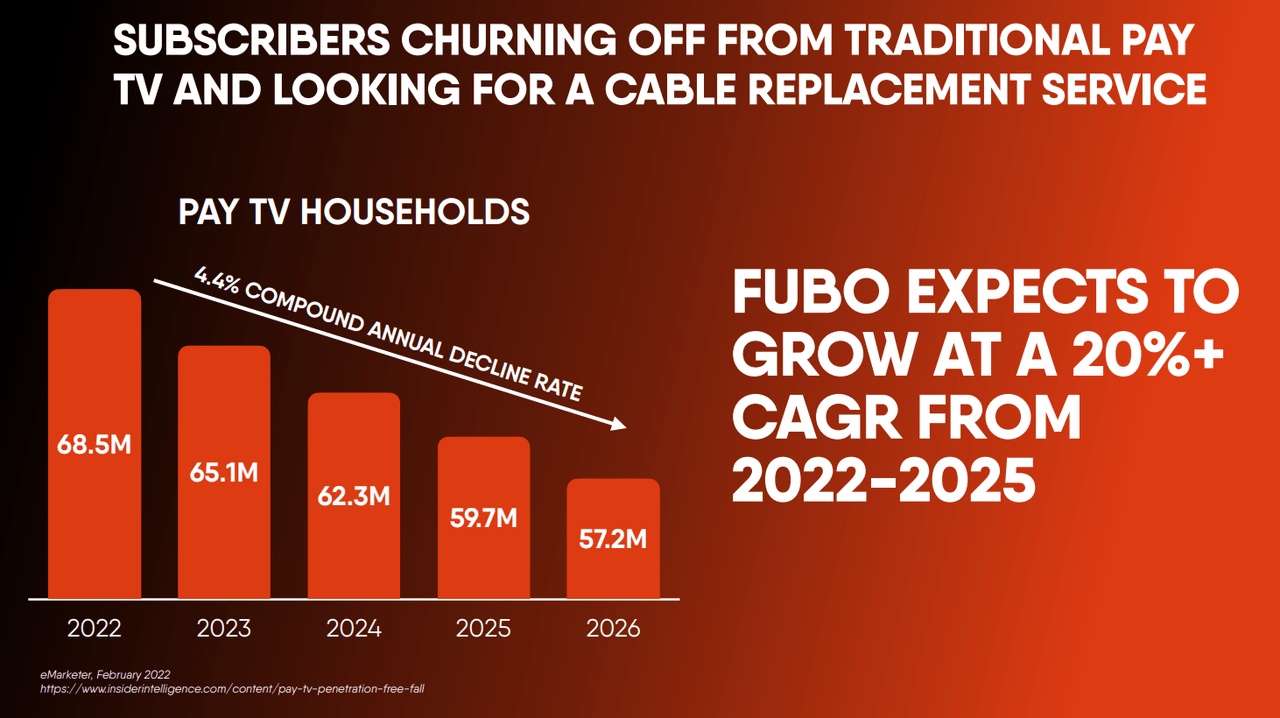

Fubo is a streaming service strongly dedicated to live TV and sports products. The business is trying to capitalize on the cord-cutting trends primarily in the United States: an increasing number of customers over the past decade have been abandoning traditional cable or satellite subscriptions in favor of streaming services which are generally cheaper and more user-friendly.

When initially launched, Fubo was pricing itself incredibly cheap ($7 a month) while offering mainly niche sports that obviously do not attract many customers. Over the years, the company has started to offer more and more channels and is now pricing its offerings starting at $69.99, very high compared to the past but still lower than some traditional offerings.

FUBO Investor Day presentation – eMarketer data

The main problem with Fubo’s business is that basically all the money coming in through subscriptions has to be almost entirely handed over to content owners for sporting rights. This makes Fubo’s business inherently low margin if not supported by additional revenue streams that do not strictly depend on the content shown.

On this topic, the latest Q2 2022 earnings report shows that the company is improving its advertising business (+32% YoY), but at the same time average revenue per user (ARPU) fell in the same period 18% to $7.25 per user. The advertising business is starting to reach interesting levels ($21.7 million in the last quarter), as this additional revenue stream will help the platform raise its gross margin meaningfully. However, the majority of Fubo’s growth seems to reside in the “Rest of world” user segment, which is extremely under-monetized compared to the North America’s one. As per last quarter report, Fubo has 947,000 customers in NA and 347,000 in ROW, however, only $5.8 million revenue was generated by the ROW customers (less than 3% of the total revenue).

A crucial question will be if Fubo is able to successfully monetize all of its customers outside North America. However, the road is uphill, especially on the advertising side. Meta Platforms (META) and Pinterest (PINS) are two examples of much bigger businesses which always struggled to boost their ROW advertising ARPU to U.S. levels, hence at this stage I cannot say I am optimistic on Fubo’s road ahead considering its perilous state at the moment.

In addition to advertising revenue, Fubo also announced in 2021 the launch of Fubo Sportsbook in Iowa. The idea was to integrate the streaming live TV with an interactive platform that let the customers also place bets on the games in real time. The launch was welcomed by the market as one more way to achieve profitability, away from a direct dependency from the licensed content. Fast forward just one year, and the company has recently announced a strategic review of the project, as it was too costly to produce in-house. The company will review how to move forward through partnerships. The only thing certain is that wagering is far from offering any meaningful contribution to Fubo’s profits.

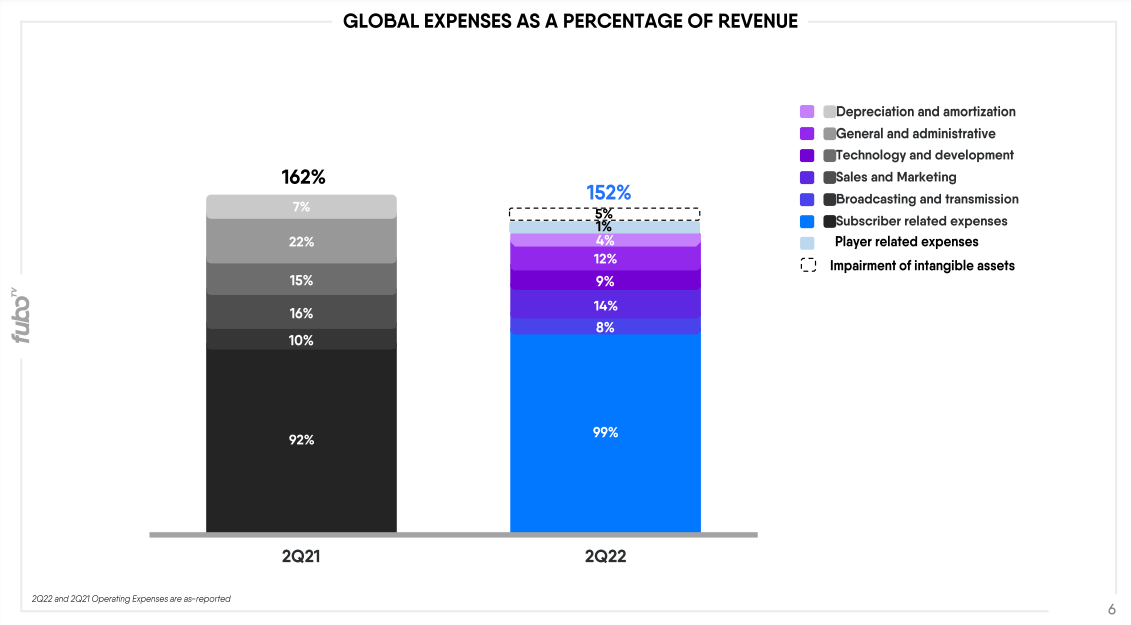

The question with Fubo is if the company will manage to correct its unsustainable business model. As shown in the slide below, the company is still spending more than it brings home in order to be able to operate. Particularly worrying is that “Subscriber related expenses,” which are structural for the business, actually increased their impact on overall revenue, from 92% in 2Q 2021 to 99% in the current quarter. The result is big losses that are actually increasing YoY: from a loss of $94.4 million in the same quarter last year, the company now reported over $172.4 million of losses on total revenue of $221 million.

Fubo Q2 2022 Earnings Report

The company’s balance sheet does not also offer a sustainable cushion for the uncertain times ahead. The company has about $372 million of cash and short-term investments and $392 million of long term debt, while also burning through cash quarter after quarter. Since becoming public, the company has yet to post a single quarter with positive cash from operations, which means that the company will need to raise cash at some point. We are, however, no longer in 2021, when stock prices were sky-high and the cost of capital was historically cheap. Raising money will be costly for the company and potentially very dilutive for existing shareholders in case the management also initiates secondary offerings.

Some growth ahead, but it might not be enough

The company is still guiding towards growth in number of customers, albeit at slowing speed compared to the past: for FY2022, Fubo is estimating 1.3 million customers, up from 1.13 million recorded for the full year 2021 published in February (roughly 15% growth). The long term projections presented by the company during their Investor Day in August also estimate 15% subscriber growth CAGR until 2025, when Fubo hopes to reach the 2 million subscribers milestone.

Despite the growth shown in the past, the company’s financial position is still quite troubling. The company is still posting negative gross margins of -6.38%, which is a terrible position to be in for any business. Fubo, in particular, is operating in a tremendously competitive market which translates to generally high operating expenses as well, needed to fund the company’s path to profitability (or rather, survivability) and to acquire customers. Fubo might be one of the few players in town in its niche of live sports via streaming, but in reality the company is directly competing with all sorts of rivals in the streaming discretionary spending category, such as Netflix (NFLX), Disney+ (DIS), HBO max and many others.

It’s hard to assess the valuation of a company with a fundamentally broken business model in its current stage. Fubo has no earnings or free cash flow (or even positive operating cash flow) at this point to compare with competitors of its size. Fubo is literally fighting for its survival and betting everything on ancillary revenue from advertising or sportsbook to play out nicely in the future. There are basically no metrics available to shareholders for valuing such a business because its current model is unsustainable. One could argue that trading at P/S of 0.69 is cheap, especially compared to historical values for the stock. However, considering that with the current run rate the company will soon need to raise cash or go out of business, that seems even too expensive for my taste.

I can see a future where Fubo manages to reach a sufficiently high user base in order to monetize its platform via advertising and fund its existence via additional revenue streams. If that should happen, we will look again at the shares trading at $3.69 and regret not buying. I can also see many other futures in which the company does not attract sufficient users, is not able to increase ARPU in non-U.S. customers, and is unable to raise prices, as it practically has no moat over competitors. This seems to me a far more probable future, and as such I would not recommend anyone owning shares at this stage.

Be the first to comment