brightstars

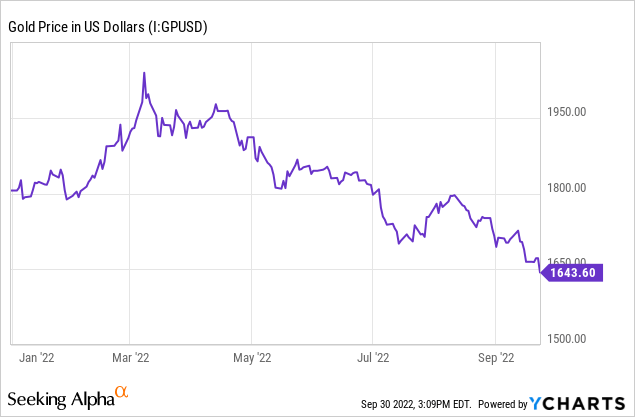

It’s been several months since I last covered precious metals or any related tickers in the sector. In February, I theorized global uncertainty would be a catalyst that would push metals higher. Since that article, gold (XAUUSD:CUR) enjoyed a pop above $2k/oz but has since sold down about 15%. While frustrating, this is more of a symptom of a broader risk-off environment than a failing of metal as an investment in my view. I take that position because of a 17% decline in the S&P 500 over the same timeframe.

Since early March highs, it’s been nearly seven months of joyless bleeding for gold investors. Despite the declines in the price of the metal, I still believe exposure to the asset is a prudent move. In this article, I’ll explore why gold hasn’t lived up to my expectations from earlier this year and I’ll detail why Sprott Physical Gold Trust (NYSEARCA:PHYS) is the largest single holding in my entire investment portfolio.

The Dollar Is Eating Everything

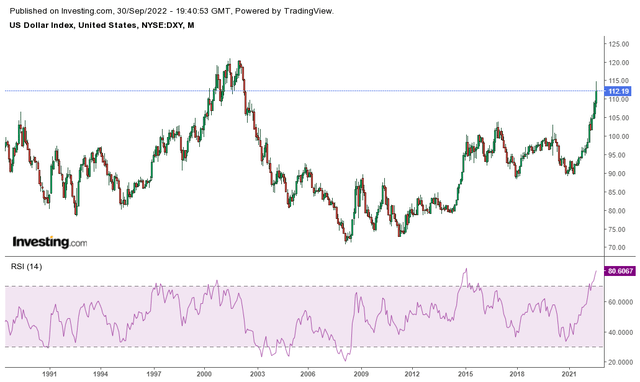

There is no doubt that strength in the US dollar has put a considerable amount of pressure on just about every risk asset from stocks, cryptos, metals, and everything in-between. USD has been an absolute wrecking ball and we can see it when looking at the dollar measured in foreign currencies through the DXY:

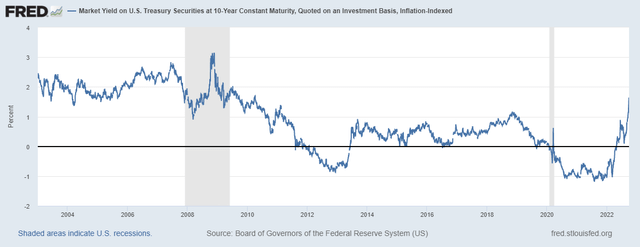

DXY is now at a 20 year high and just came within a stone’s throw of 115. While the fundamental macro setup may justify this dollar surge, technically the dollar is now the most overbought it has been in 7 years. We’ve also seen a huge rip higher in treasury yields, which generally puts pressure on gold historically.

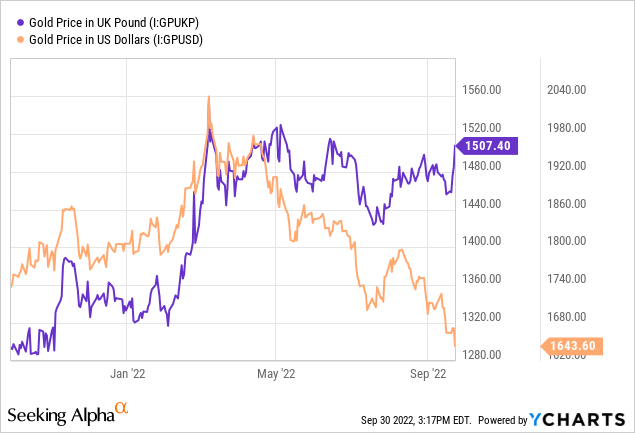

The negative yield on treasuries story that greatly benefited gold during COVID is now gone. Because of this, gold hasn’t been able to shake the dollar rally. That said, gold is holding up just fine in other currencies. Take for instance, the British pound. Here we see gold still priced near highs.

Notably, there has been a surge in XAU/GBP over the last 48 hours or so since the Bank of England has pivoted from quantitative tightening back to debt purchasing. The question now is how far is the Federal Reserve from pivoting as well? While many take the view the Fed is committed to fighting inflation and will remain steadfast in its mission to tighten, the BoE had a similar stance a week ago and inflation is still highly elevated in the UK. I’ve made my case for a Fed pivot before.

Why PHYS?

In my view, the best way to own gold is in its physical form – either in bars or jewelry. But the physical form isn’t necessarily the best way to buy gold if your sole objective is price appreciation in a retirement account. Buying physical gold will often put you several hundred bps behind on the asset the moment you take the custody if you’re buying from a traditional coin or bullion dealer.

| Dealer | Gold Ask | 1 oz Gold Eagle | Premium |

| SD Bullion | $1,673 | $1,872.68 | 11.94% |

| JD Bullion | $1,673 | $1,864.72 | 11.46% |

| APMEX | $1,673 | $1,870.09 | 11.78% |

| Average | 11.73% | ||

Source: Company websites, 1-9 unit check/wire pricing

As you can see in the table above, the average premium for a Gold Eagle is almost 12%. This is rather large but not exclusive to just the coins or rounds. Even the random 1 ounce bar premiums for physical metal make the case for a less expensive alternative.

| Dealer | Gold Ask | 1 oz Bar | Premium |

| SD Bullion | $1,673 | $1,751.83 | 4.71% |

| JD Bullion | $1,673 | $1,766.51 | 5.59% |

| APMEX | $1,673 | $1,766.79 | 5.61% |

| Average | 5.30% | ||

Source: Company websites, 1-9 unit check/wire pricing

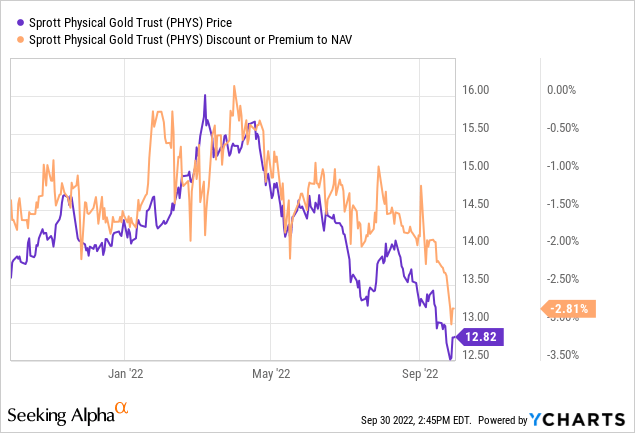

Because of this, investors who want exposure to bullion without a premium have to look elsewhere. With respect to miners or ETFs, trusts like Sprott that are fully audited are a nice meet-in-the-middle asset in my opinion because of the liquidity of the public market shares coupled with the lower volatility compared to the miners. In addition to that, the fund shares often trade at a discount to net asset value rather than a premium.

At a 2.8% current discount to the net asset value of the trust shares, PHYS is the cheapest it has been in the last 12 months both in terms of dollar denominated pricing and in terms of the discount the shares trade to the underlying value they represent. Given just a 0.42% net expense ratio, I think the value proposition skews to buyers at such a large NAV discount.

Risks

The biggest risk to gold in my eyes is continued dollar strength. There is clearly demand for what is seen as a safe haven asset compared to other currencies. While the dollar is very overbought from a technical perspective, there is no reason the rally can’t continue if the Federal Reserve continues raising interest rates and rolling off treasuries. Another potential risk is jurisdiction and government confiscation. While I wouldn’t have thought this to be a significant risk in Canada 12 months ago, I’m a bit more inclined to believe even G7 governments may take extreme measures to keep citizens out of assets that can potentially be used to circumvent currency debasement. This is especially true if other central banks give up on fighting inflation as the BoE just did.

Summary

The Fed is certainly signaling that it is going to keep the foot on the gas regarding rates and balance sheet tightening, we’ve heard a lot of this before. Ben Bernanke said the balance sheet would roll off. Janet Yellen articulated the same. In reality, neither of them were actually able to accomplish balance sheet reduction and I have a lot of trouble believing this time will be any different with a debt to GDP ratio at WWII levels.

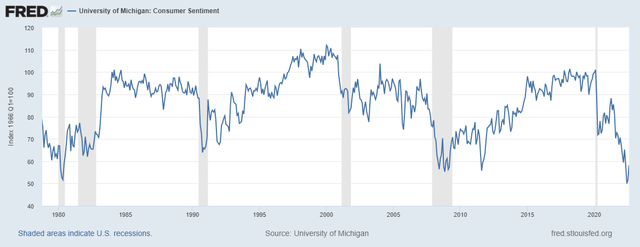

We have not yet seen the full economic ramifications from the rate hikes that we’ve had over the last several months. But with higher rates, we’re going to see pressure on broad consumer spending that will ultimately lead to layoffs. If consumer sentiment is any indication, we already have serious problems. The Fed will pivot. And whenever that pivot happens, gold will make new highs in dollars as well. Or maybe this time it really is different.

Be the first to comment