JohnnyGreig/E+ via Getty Images

Investment thesis

AppHarvest (NASDAQ:APPH) is another highly speculative stock listed during the 2020/2021 SPAC bubble. The sustainable agriculture company went public at a $1 billion valuation even though it had not yet generated any revenue. The stock quickly surged to a high of over $40 per share before slowly tanking over 90% to its current price of $3.47.

It’s been a year and a half since the company’s merger. I still don’t feel AppHarvest has adequately demonstrated that it can make a profit. The business is spending cash at a high rate. Management is relying more and more on debt-based financing to fund operations and expansion. I’m concerned that this strategy may become unsustainable as rates rise and the cost of debt increases.

The company’s mission sounds very interesting. However, I want to focus on the business’s cash flows and its balance sheet. All of the likely outcomes I see for this business require heavy dilution or high amounts of debt. For these reasons, I’m avoiding this stock and I don’t recommend taking or keeping any position.

Proof of cash flow

AppHarvest has yet to really prove that its core business model is profitable and consistent. I think this is very important if it wants to justify its high capital expenditure costs. But even after five quarters of generating revenue, the business is still yet to generate a positive gross profit. I understand that the company needs to scale, so it can offset its operating expenses. What concerns me is that the business is losing money on its core operations.

The most detail the company has recently provided is in its last 10-Q. The filing said COGS was negatively impacted by “the higher costs of contract labor incurred due to a challenging local labor market and higher natural gas and electricity costs.”

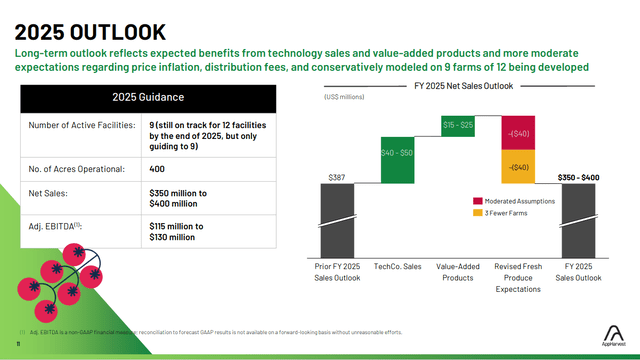

AppHarvest’s 2025 goals will require high capital expenditures (AppHarvest Q2 2021 Earnings Deck)

In its last earnings call and recent press releases, management has said that AppHarvest is in “hyper growth” mode. I think this sort of statement implies that profitability and cash burn aren’t major concerns. But I think the company’s actions show that management is quite concerned about their spending rate. Over the past few months, the business has cut half of its non-operating employees.

In June 2021, the company broke ground for a salad greens facility in Morehead, Kentucky. In its last 10-Q filing, the company wrote that construction is now on hiatus. This is apparently due to a lack of financing. It’s clear the business is feeling some strain from its high cash outflows.

The business also doesn’t have a great track record of projecting revenue and profitability into the future. A post published on the company’s website shortly before the company’s SPAC merger guides for $25 million in revenue and a $30 million adjusted EBITDA loss for the 2021 year. In reality, the business generated only $9 million in revenue and recorded an adjusted EBITDA loss of $70 million (plus a bottom line loss of $166.2 million).

The business’s core operations aren’t generating any meaningful profit. I don’t feel that potential shareholders have enough visibility into exactly when this may be fixed. In the meantime, the business is spending a lot of money to keep its operations going. I believe this is the core issue facing the company.

How long does AppHarvest have?

This brings me to my key question: Even if AppHarvest can execute on their plans, how much time do they have before they run out of money?

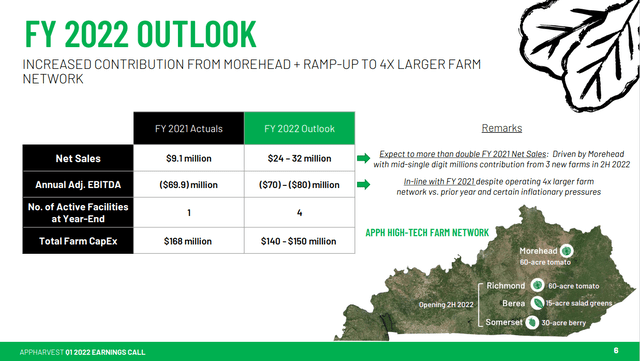

AppHarvest FY 2022 Guidance (AppHarvest Q1 2022 Earnings Deck)

According to the company’s guidance, management expects about $100 million to $110 million in capital expenditures for the remaining three quarters of the year. That’s on top of an estimated $52 million to $62 million in adjusted EBITDA loss.

Last year, AppHarvest had $100 million in negative operating cash flow. The business’s adjusted EBITDA reported a $70 million loss. I’m going to assume a similar ratio in operating cash flow to adjusted EBITDA for the remainder of this year. From this calculation, I estimate that AppHarvest will need about $80 million in cash to continue operating for the rest of the year. This amounts to about $180 million to $190 million in cash flowing out of the company. I find this extremely concerning, especially considering that the high end of revenue guidance is only $32 million. It’s going to have to be funded by cash on hand, equity, and/or debt.

Where’s the money coming from?

As management outlined on its last earnings call, there are three major sources of cash that we are aware of. These are:

- The company’s balance sheet (just under $98 million)

- The company’s credit facilities (approximately $58 million)

- Equity facility (up to $100 million)

I’m going to assume the business will not be cash flow positive before the end of the year. Assuming management meets its targets, the company will have to start diluting shareholders before the end of the year. Analysts don’t see the business becoming profitable in 2023 or 2024. In order to hit its long-term growth targets, the business will likely have to raise even more cash.

The company has a positive book value, but about $3.80 per share of this value is tied up in the company’s property and equipment. These are custom properties and specialized equipment which are not going to be easy to sell at the value recorded on the balance sheet. Looking closer, we can see that AppHarvest’s debt already exceeds its cash on hand by about $0.63 per share.

Of course, most of this debt comes with regular interest payments. This additional cash outflow will make it even more difficult for the business to turn a profit on its bottom line. At the very least, the business would have trouble meaningfully expanding its operations for some time.

Upside risks

I don’t believe the company is going to be able to execute on its goals without additional funding. However, there are some sources of funding that are both low interest and non-dilutive. These include ESG loans, nonprofit grants, and even government funding. The business could also take out asset-backed loans against its facilities (which it has done in the past).

The stock’s price may be highly volatile, especially in the short term. Any news about financing or sales may cause the stock price to jump by double digits (upwards or downwards). Additionally, the stock’s multiples may change depending on the market’s pricing of unprofitable growth companies. I don’t recommend trading this stock without a clear goal in place.

Valuation

It’s difficult for me to put a price target on AppHarvest’s stock. I don’t feel that the company has shown enough evidence of how profitable its core operations may be. This would be necessary for me to create a discounted cash flow model or use comparables to calculate a specific valuation. In situations like this, I look at a business’s current valuation and work backwards to find what I believe is a fairer valuation multiple.

- AppHarvest’s stock is currently trading at over eleven times the high end of its 2022 revenue guidance.

- This is in an industry which typically has low gross margins.

- The company’s business model also can’t scale quickly like a software business.

- Creating new facilities and revenue streams will require heavy capital expenditures.

I think a business with these characteristics would be more fairly valued at one or two times price to forward sales. This could be as a result of the company’s share price dropping or its revenue increasing.

Final verdict

I think it’s possible that AppHarvest becomes a successful company. But this may come at the cost of a highly levered balance sheet and significant dilution to the company’s shares. These are risks I’d want management to deal with before I’d consider investing (even if the company’s shares drop to a more reasonable valuation). I’d only consider buying this stock if management secured funding for ongoing capital expenditures and the company started showing positive gross margins.

I do really admire the company’s goals. Sustainable agriculture is going to be an important industry in the future. Unfortunately, I just don’t believe AppHarvest’s finances are healthy enough for me to buy its stock. I think the risk to reward is simply too unfavorable for me to recommend buying or holding this as an investment.

Be the first to comment