thekopmylife/iStock via Getty Images

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note’s date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Dare To Dream

Quietly, very quietly, while nobody has been looking, something strange has been happening to the most scary of scary stocks. No, not the hurtling descent into the abyss. That was played out in plain sight. As all institutional talking heads are now telling you, it’s all over for growth for, like, a generation. Which makes this trend a mystery. Because surely it couldn’t be that wise folks on the TV are saying one thing but doing another … could it?

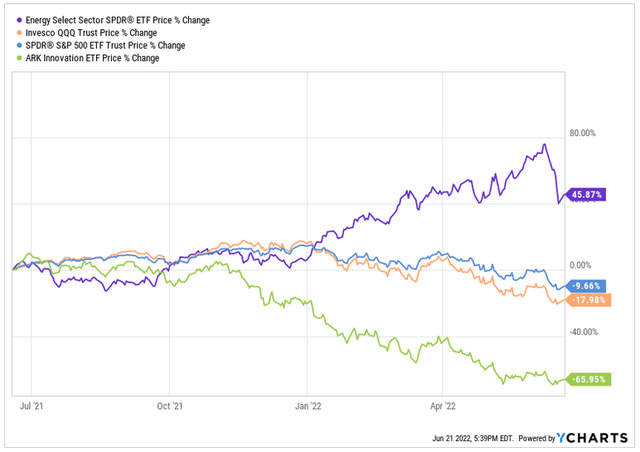

First, here’s the story of the last 12 months. Energy has hogged all the money, the major indices have dumped, and high-beta names positively dug for victory.

Sector Rotation Chart I (YCharts)

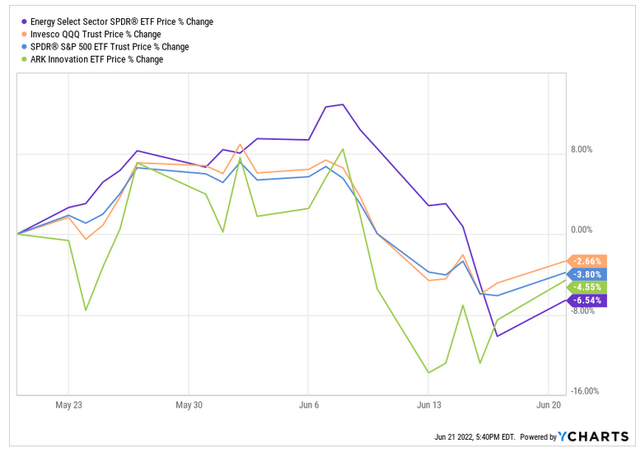

Now let’s look at the last month. Everything down, energy down the most as money rotates out of the sector (cashing in the spectacular recent gains).

Sector Rotation Chart II (Ycharts)

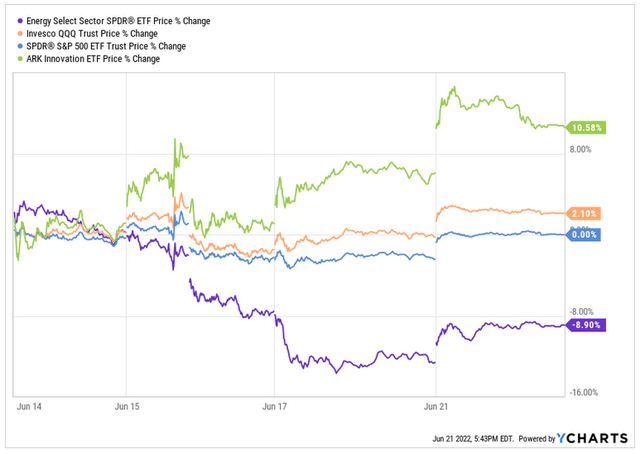

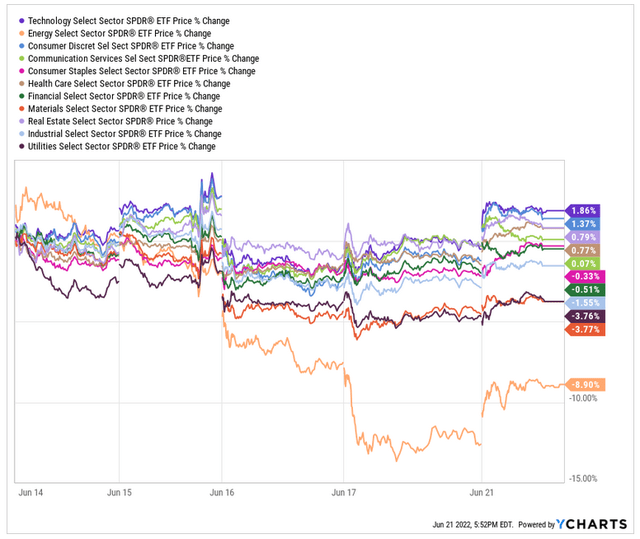

And the last five days?

Sector Rotation Chart III (YCharts)

Zoinks. Energy down 9%, S&P flat, Nasdaq up a little, and high-beta ARKK up 11%.

It’s almost as if Big Money has decided to rotate out of energy and into some doomed-forever sectors. Here’s the last five days again. Tech (XLK) – up. Consumer Discretionary (XLY) – up. Bunch of stuff flattish. Utilities, materials, energy? Down.

Sector Rotation Chart IV (YCharts)

We believe this is set to continue awhile. And if we’re right, it can pay to know some single-name stocks set to benefit.

We think Dynatrace (NYSE:DT) is set to move up if indeed money does rotate back into growth. This is a software company with superb fundamentals (high growth and cash flow positive) – a leader in its field (enterprise observability, since you ask), with limited competition, and with a chart that we believe to be bullish.

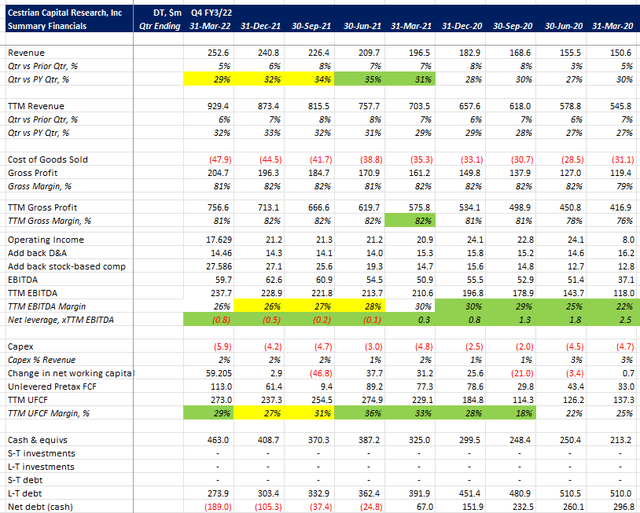

First let’s look at the numbers.

DT Fundamentals I (Company SEC filings, YCharts.com, Cestrian Analysis)

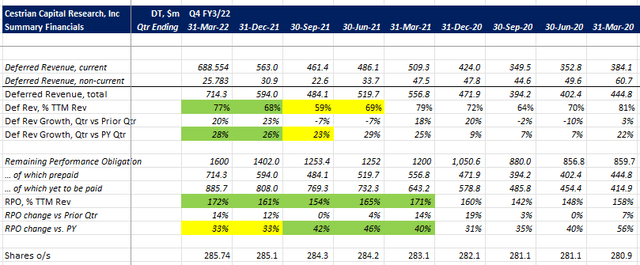

DT Fundamentals II (Company SEC filings, YCharts.com, Cestrian Analysis)

Some highlights here:

- Revenue growth has been consistently in the high 20s-low 30s % range for the last three years. Quarter-on-prior-year quarter growth has slowed a little recently but long-term contract growth, measured by RPO growth, remains at or around the level of TTM revenue growth suggesting that 25-35% range can hold up.

- EBITDA and unlevered pretax FCF margins remain strong. Few companies can grow revenue in the 30% range whilst also delivering 29% TTM unlevered pretax cashflow; Dynatrace has done so, and that’s without undue levels of stock-based compensation.

- The balance sheet has improved from $360m net debt at IPO to $190m in net cash at the most recent quarterly report. The business generates cash every quarter so this level is more than adequate to keep the wolf from the door.

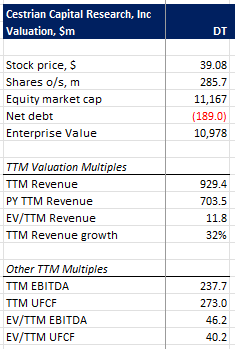

Let’s turn to fundamental valuation.

DT Valuation (Company SEC filings, YCharts.com, Cestrian Analysis)

Now, the knee-jerk reaction that will shortly appear in comments below will be along the lines of, OMG 12x TTM revenue that’s ridiculous you are dreaming if you think that world is ever coming back. But the fact is that software companies like this were being acquired for those kinds of revenue multiples in the middle of the 2009 crash. And the reason is simple – and that is to say, fundamentals. When the world around you is looking shaky, owning a business that can grow at 30%, generate 30% cash flow margins, and have a book of forward contracted business equivalent to 1.7x TTM revenue – that’s some margin of safety right there.

We believe Dynatrace offers a compelling risk-adjusted buy right now. In our Growth Investor Pro service we rate the stock at Accumulate, meaning we believe long-term investors can be rewarded from gradually building up a stake in the company over time at these kinds of prices – adding a little on red days here and there and then holding for the long term.

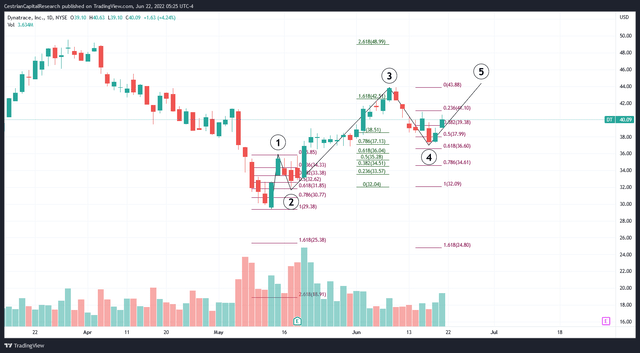

Here’s what the stock chart looks like.

DT Stock Chart I (TradingView, Cestrian Analysis)

From the March 2020 lows, the stock put in what looks to have been a larger-degree Wave 1 up; we say that because the recent lows were located at more or less exactly the 0.786 retracement of that Wave 1 up, which is a textbook definition of a Wave 2 retracement.

Since then the stock has moved up somewhat. Let’s zoom in.

DT Stock Chart II (TradingView, Cestrian Analysis)

From the May low we see a Wave 1 up, a 2 down, a Wave 3 up peaking right around the 1.618 extension of Wave 1 (a good sign that our wave count is correct!) then a Wave 4 down and, potentially, a Wave 5 up. Now, if the stock can climb above say $44 in the coming week or two then we can say that’s five waves up off the low which is evidence of a recovery.

The market is in our view too fragile to bet the farm on these sorts of opportunities. It’s also too fragile to simply load up on value names which, as we’ve seen from the rotation charts above, may not be the store of value that folks are expecting going forward. Better in our view to tread carefully and in particular take advantage of the proximate nature of recent lows to place stop-losses that are both valid (i.e., if broken that’s meaningful) and not too painful (i.e., not so far away that if broken a big hole has been blown in your account).

We believe accumulation of DT for the long term to be a sound idea, and we think that using a stop-loss in the $28 zip code – that’s a touch below the recent lows – can provide some protection.

Price target? Well, if that larger-degree chart is correct then a larger-degree Wave 3 could take the stock to new all time highs and beyond, indeed $92/share – more than a double from here – isn’t silly. But nobody would believe us if we said $92 stock price target right now. Because when the market is down hard nobody believes bull targets except permabulls, and when the market is up big nobody believes bear targets, except permabears, and since having a fixed view is like having no judgment whatsoever (because we can all keep on repeating the same mantras everyday if we want, doesn’t mean we have any insight), there’s no point talking to perma-anythings. Here’s our simple take. The company fundamentals are very strong, the stock looks like it might have bottomed already, you can keep safe with a stop-loss just below that bottom, and there’s a good chance that money comes back into these beaten-up sectors like software and that can lift some boats all around. And so we think this is a good opportunity. Oh and by the way – the owner of the buyout crucible in which DT was formed – Thoma Bravo – has been buying back its old favorites recently. SailPoint Technologies, for one. Mr Bravo himself has been all over CNBC recently telling everyone how tough it’s going to be for software names, long path to profitability and blah. At the same time the firm has a big ol war chest of money from the Retired Janitors Of America to spend on…. unwanted software stocks! So, don’t be surprised to see names like this be acquired if the stock price remains suppressed. A take-private would be unlikely to give you a banzai return on this name but it would likely be a solid return from here. So, if the growth sector does attract rotated money, all good. If not, and the stock stays in the doldrums, a bigger friend may arrive with a check for you; and if not, your stop-loss can keep you out of the workhouse. What’s not to like?

Cestrian Capital Research, Inc – 22 June 2022.

Be the first to comment