Thomas Barwick/DigitalVision via Getty Images

At that darkest moment, while drowning in the Abyss of Emotional Bankruptcy, reflect on this universal truth: the difference between success and failure is one more time.”― Ken Poirot

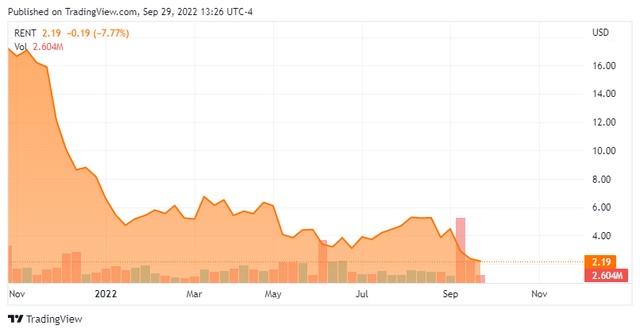

Today, we shine the spotlight on Rent The Runway (NASDAQ:RENT) for this first time. This unique retail concept came public late in 2021, right at the end of the IPO boom of last year. The company has delivered solid revenue growth, but profitability remains an issue and the stock has been pummeled in the unforgiving market environment. Management recently announced a major restructuring plan, will this be enough to right the ship? An analysis follows below.

Company Overview:

This fashion retailer is located in Brooklyn, New York. Through Rent The Runway, customers can subscribe, rent items a-la-carte and shop resale from over 800 designer brands. These include items such as evening wear and accessories to ready-to-wear, casual, maternity, outerwear, blouses, knitwear, jewelry, handbags, activewear, ski wear, home goods and kidswear. The stock currently trades right around $2.25 a share and sports an approximate market capitalization of $150 million.

Second Quarter Results:

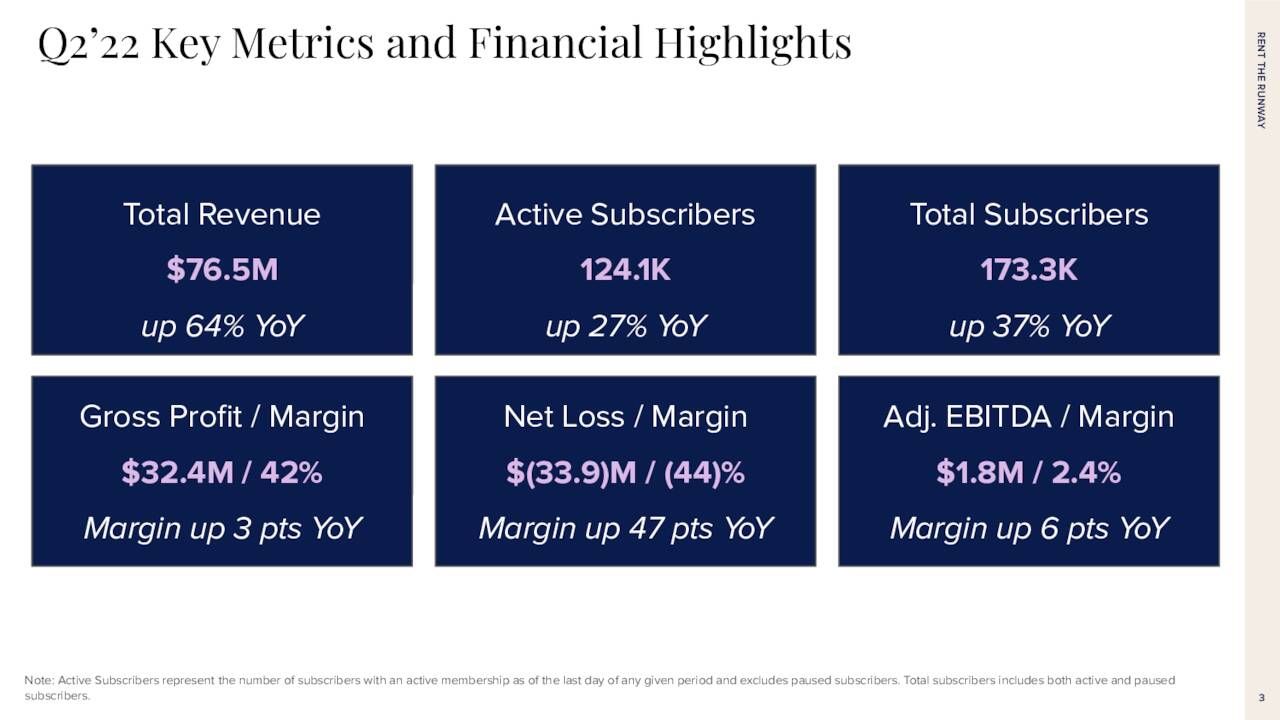

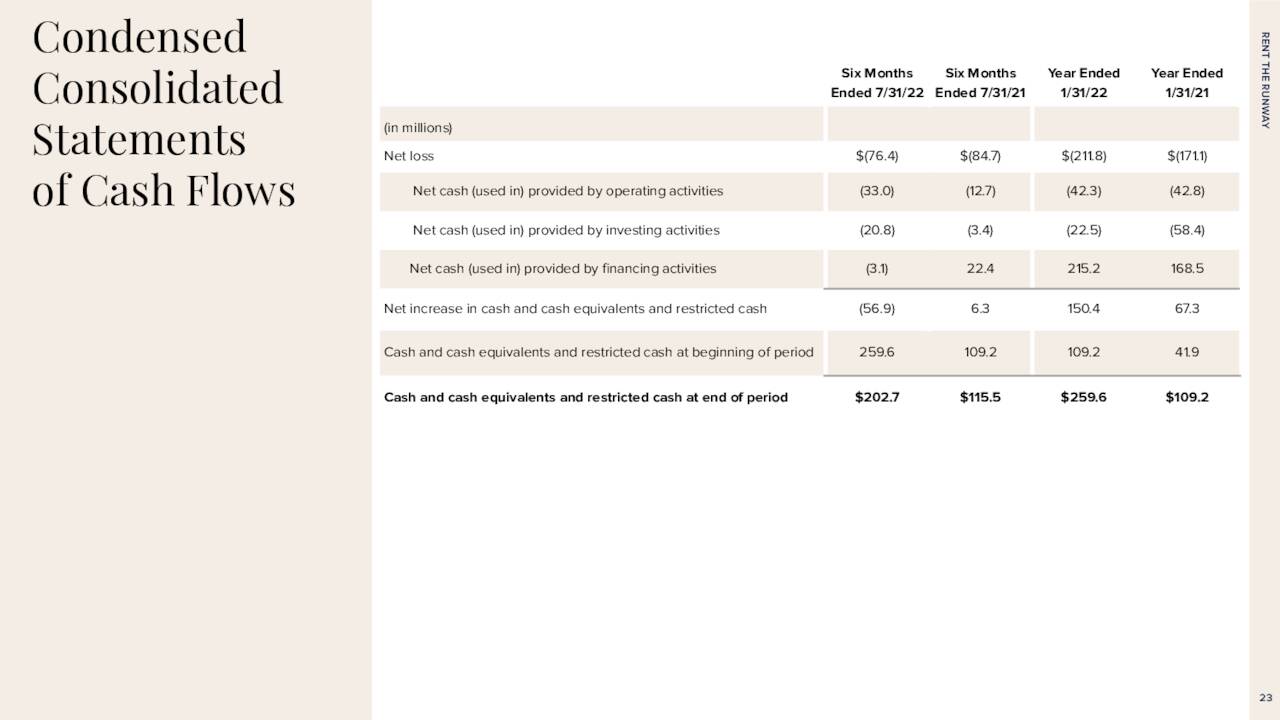

On September 12th, the company posted second quarter numbers. The company lost 53 cents a share as revenues surged more than 60% on a year-over-year basis to $76.5 million. Both top and bottom line numbers nicely beat the consensus.

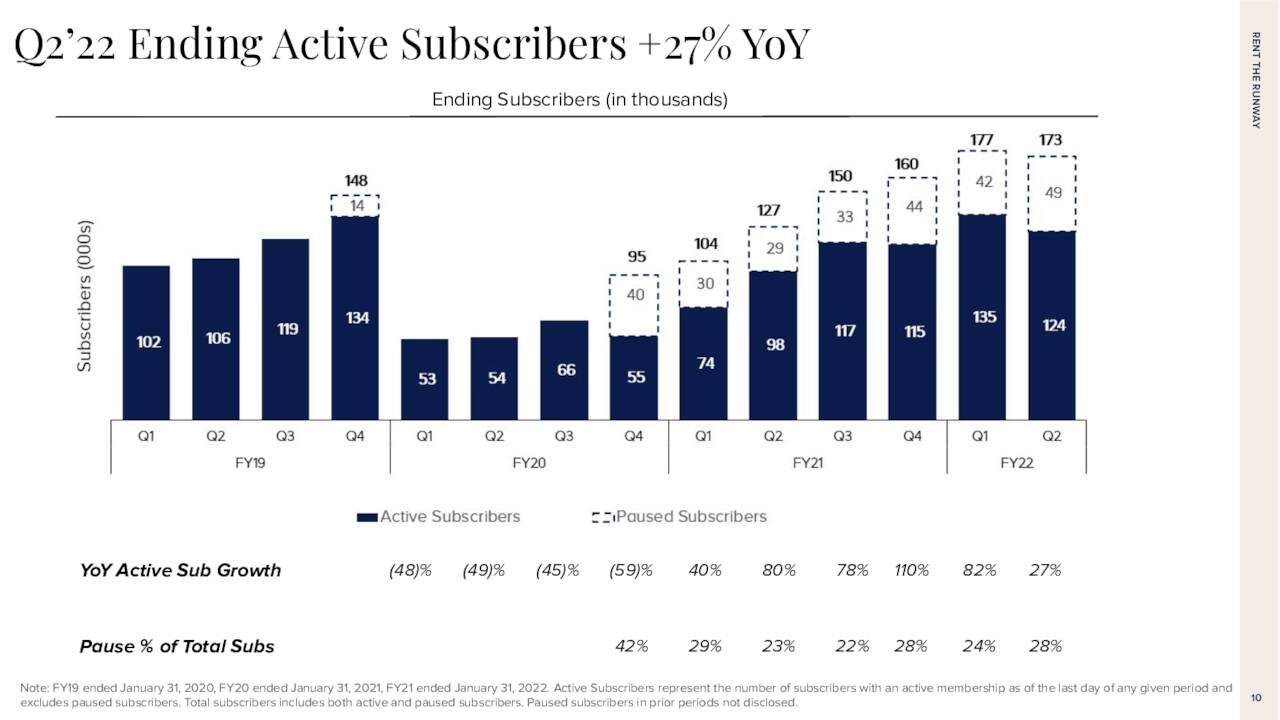

September Company Presentation

The company also saw a 37% increase in subscribers compared to 2Q2021 ending the quarter with just over 173,000. It should be noted that active sub growth dropped eight percent in the quarter vs analyst consensus calling for seven percent growth and decelerating from 17% growth in the first quarter of this year. Active sub growth was up 27% from the same period a year ago at just under 127,000 active subscribers. Gross margins also rose three percent to 42%. Management guided to $285 million to $290 million in revenue in FY2022.

September Company Presentation

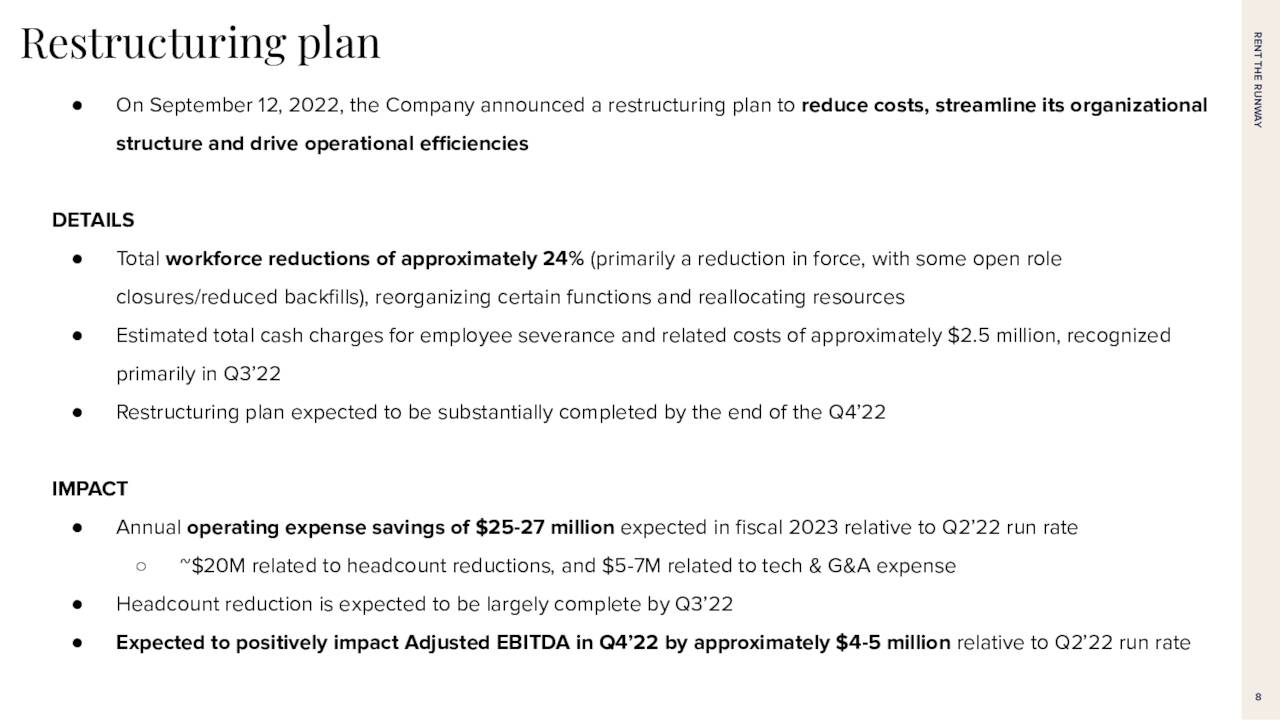

Leadership also announced a large restructuring plan that will cut annual costs by $25 million to $27 million and hopefully boost the company to profitability over time. Among other things, this effort will result in the layoffs of 24% of the company’s workforce and an approximate $2.5 million charge.

September Company Presentation

Analyst Commentary & Balance Sheet:

The analyst community seems happy to give the company the benefit of the doubt at the moment. Since the restructuring plan was announced, eight analyst firms including Wells Fargo, Barclays and Goldman Sachs have reissued Buy ratings. Price targets proffered range from the $6 to $8 a share. Credit Suisse seems to be the lone skeptic maintaining their Hold rating and $4 price target. The analyst at Credit Suisse noted that ‘this online retailer is more susceptible to macro pressures than anticipated‘.

September Company Presentation

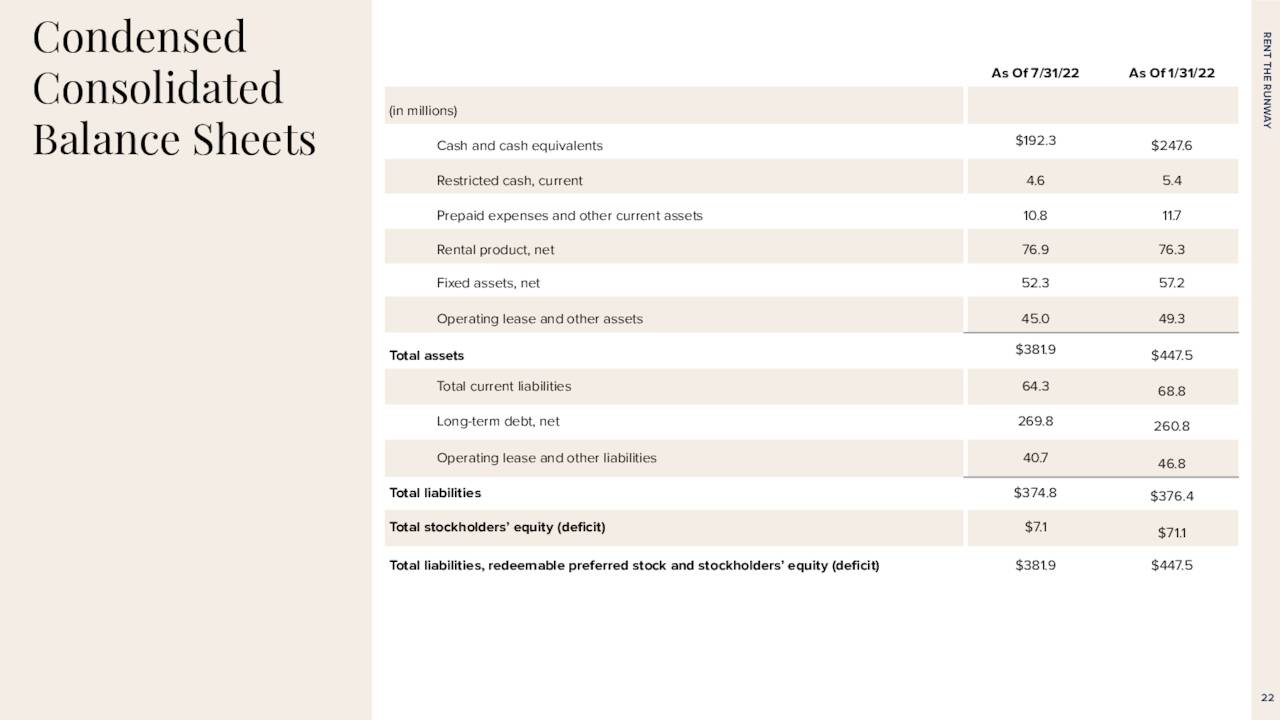

Not surprisingly, nearly 15% of the outstanding float in currently short in RENT. Insiders have been frequent but generally smallish sellers of the shares throughout 2022 despite the declining stock price. No insider purchases have occurred in the shares since the company came public. The company ended the second quarter with just over $190 million in cash and marketable securities on its balance sheet against just over $290 million in long term debt. The company had a net loss of $33.9 million in the second quarter of this year.

September Company Presentation

Verdict:

The analyst firm consensus has the company losing around $2.25 a share in FY2022 even as revenues rise just over 40% to just under $290 million. Revenue growth is projected to slow to around 20% in FY2023 and losses will come down slightly to $1.90 according to analysts.

An article on Seeking Alpha in late July speculated that new initiatives at the company could significantly improve margins. Obviously, these were not enough to avoid the more drastic measures management was forced to implement this month.

The analyst community seems to be signaling that these changes will greatly improve the outlook for Rent The Runway. However, with the country heading into recession and the consumer losing buying power against the ravages of inflation for five straight quarters; this is not a niche of the market I want to be in at the moment. Therefore, I have no investment recommendation on RENT for now. I will probably circle back on this company that has destroyed shareholder value faster than a New York minute since it came public to see if this restructuring plan is pushing the firm in a more promising and profitable direction.

We cannot have, but can lose, everything.”― Mokokoma Mokhonoana

Be the first to comment