RiverNorthPhotography/iStock Unreleased via Getty Images

Who said old traditional companies can’t transform themselves? UPS (NYSE:UPS) has risen from the pandemic with a revitalized free cash flow position and altered investment story. The dramatic pull-forward in shipment volumes has enabled UPS to greatly increase free cash flow generation, which in turn has reduced its leverage position and given it the ability to reward shareholders with a huge dividend increase and share repurchases. After the recent dividend increase, the stock is offering an attractive 3.2% forward yield. The stock otherwise offers a way to invest in the overall growth of e-commerce at a valuation and with capital allocation policies that should appeal to value investors.

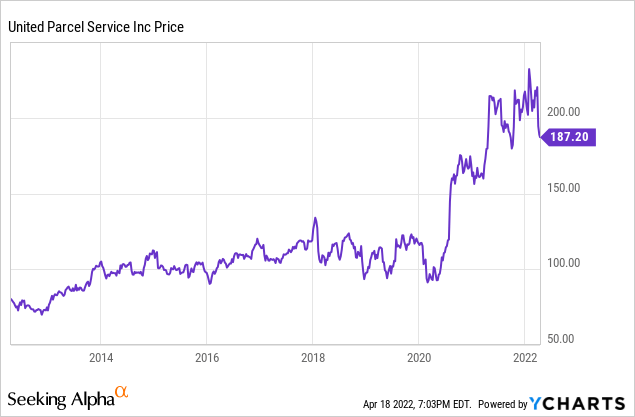

UPS Stock Price

After nearly a decade of stagnating stock prices, UPS saw its stock break out during the pandemic and keep its gains ever since.

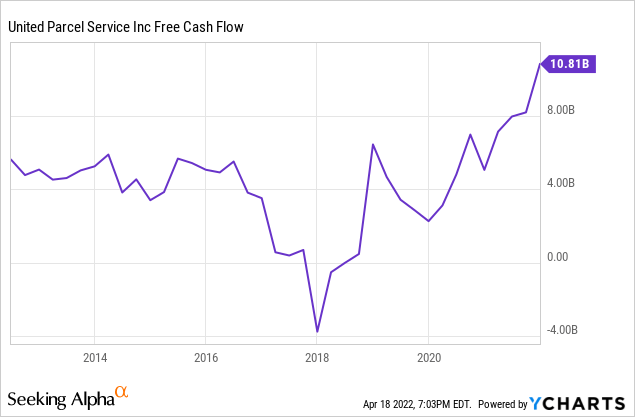

These gains aren’t necessarily short-lived. UPS saw its free cash flow generation break out of the annual $4 billion level over the past many years to finally show meaningful growth.

With the company guiding for continued free cash flow generation, there is little reason to think that UPS hasn’t earned the post pandemic stock price.

UPS Stock Earnings

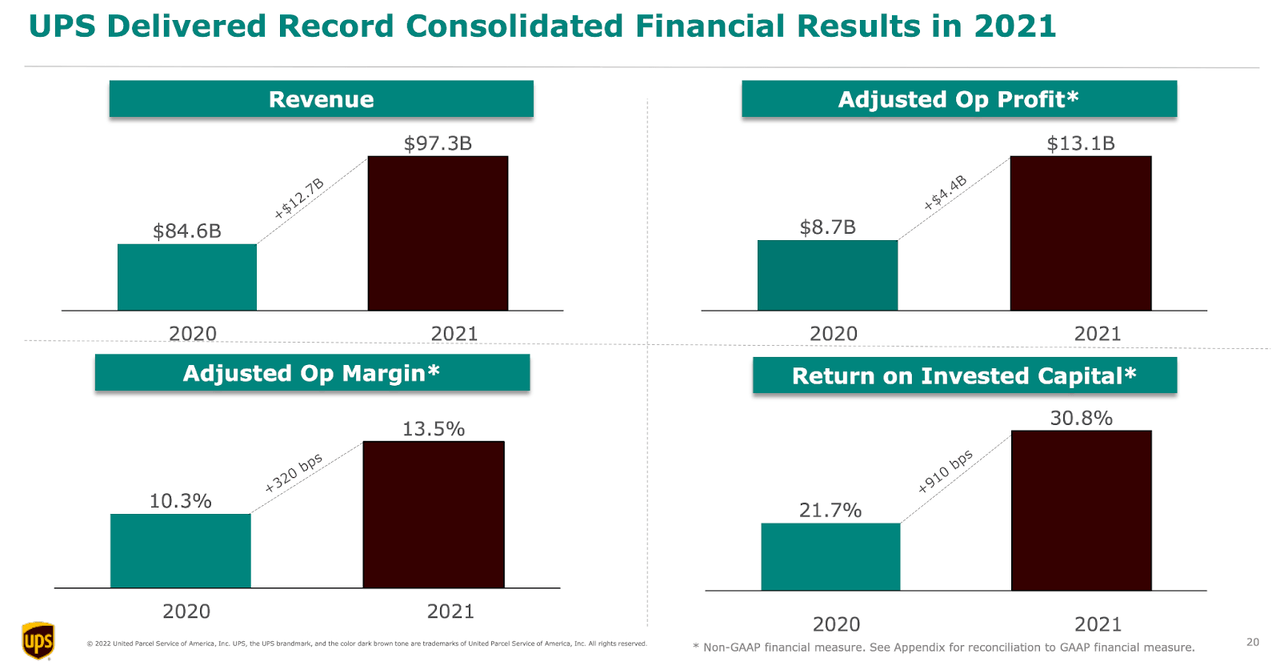

In 2021, UPS grew revenue to $97.3 billion and operating profit for $13.1 billion. These reflected another year of accelerated growth as the company benefited from the growth of e-commerce.

UPS 2021 Q4 Presentation

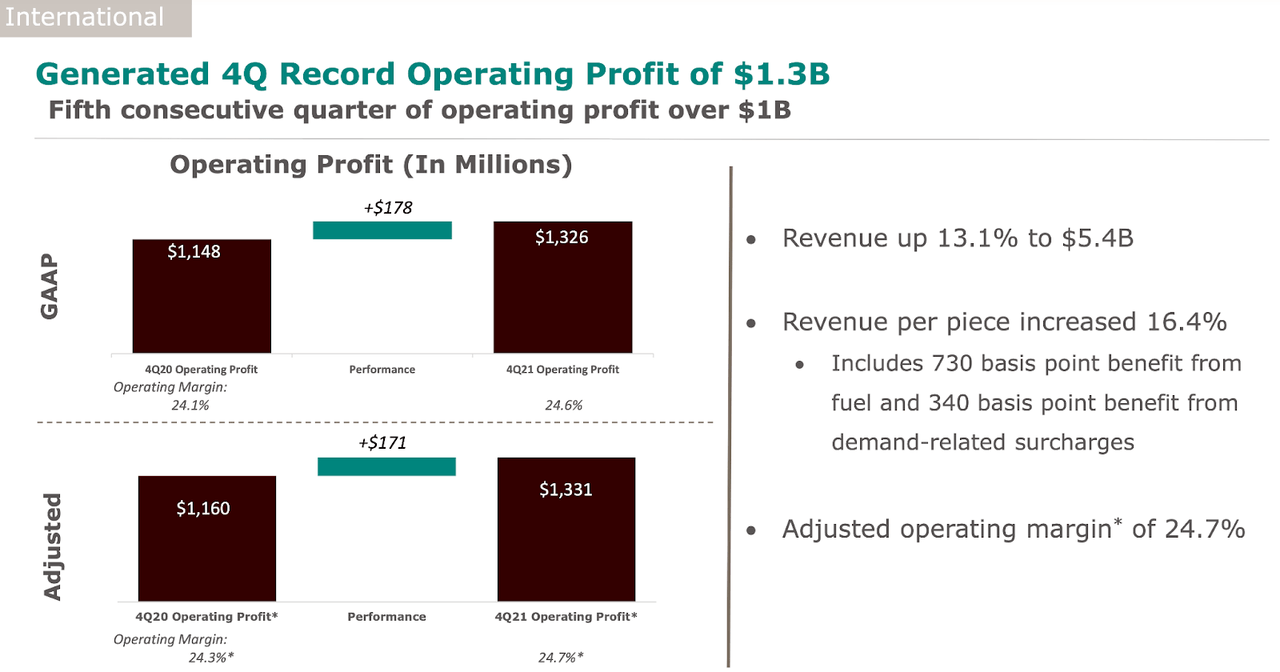

In the fourth quarter, UPS was able to modestly increase operating profit from its international operations, as it offset year over year volume declines with price increases.

UPS 2021 Q4 Presentation

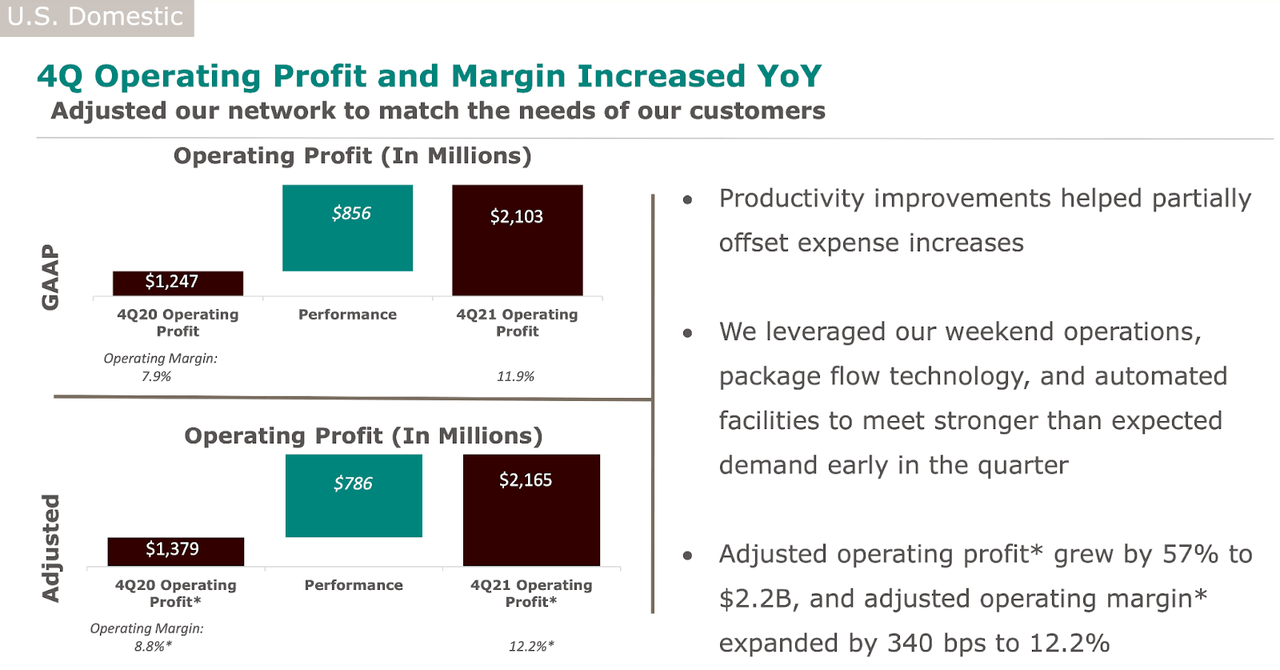

Instead, it was the domestic operations which drove the bulk of the margin gains, as the company eked out some volume growth and significant price increases.

UPS 2021 Q4 Presentation

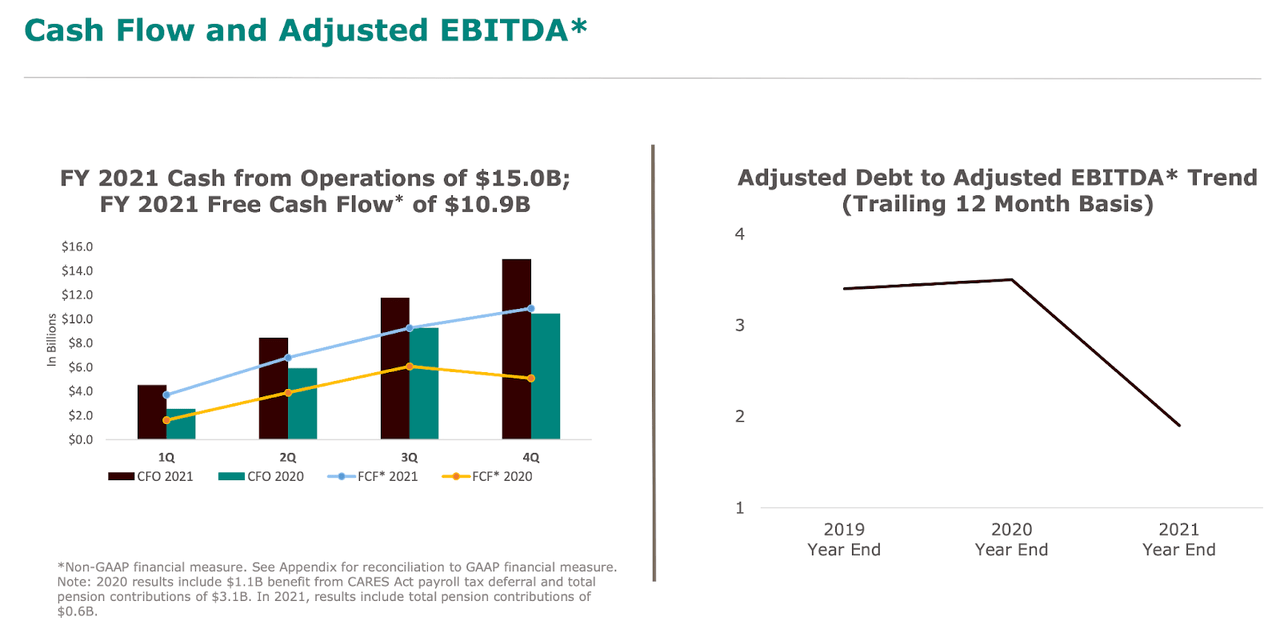

Overall, UPS generated $10.9 billion of free cash flow in 2021 and reduced its leverage ratio to 1.9x debt to EBITDA.

UPS 2021 Q4 Presentation

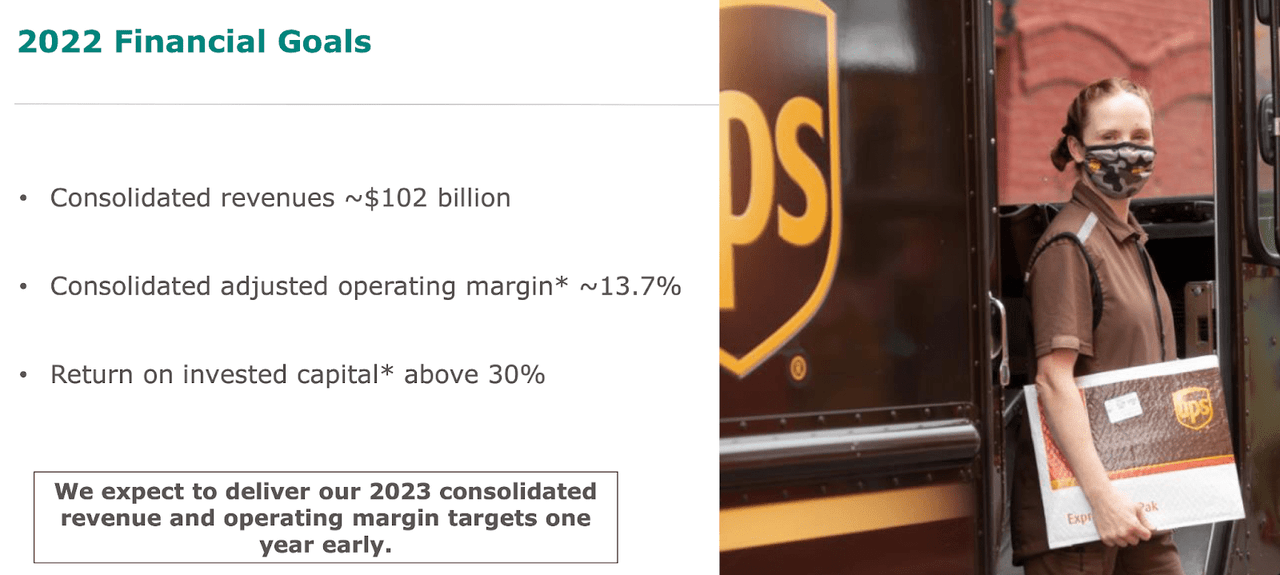

Looking forward, UPS has guided for modest revenue growth to $102 billion and for operating profit to increase to around $14 billion.

UPS 2021 Q4 Presentation

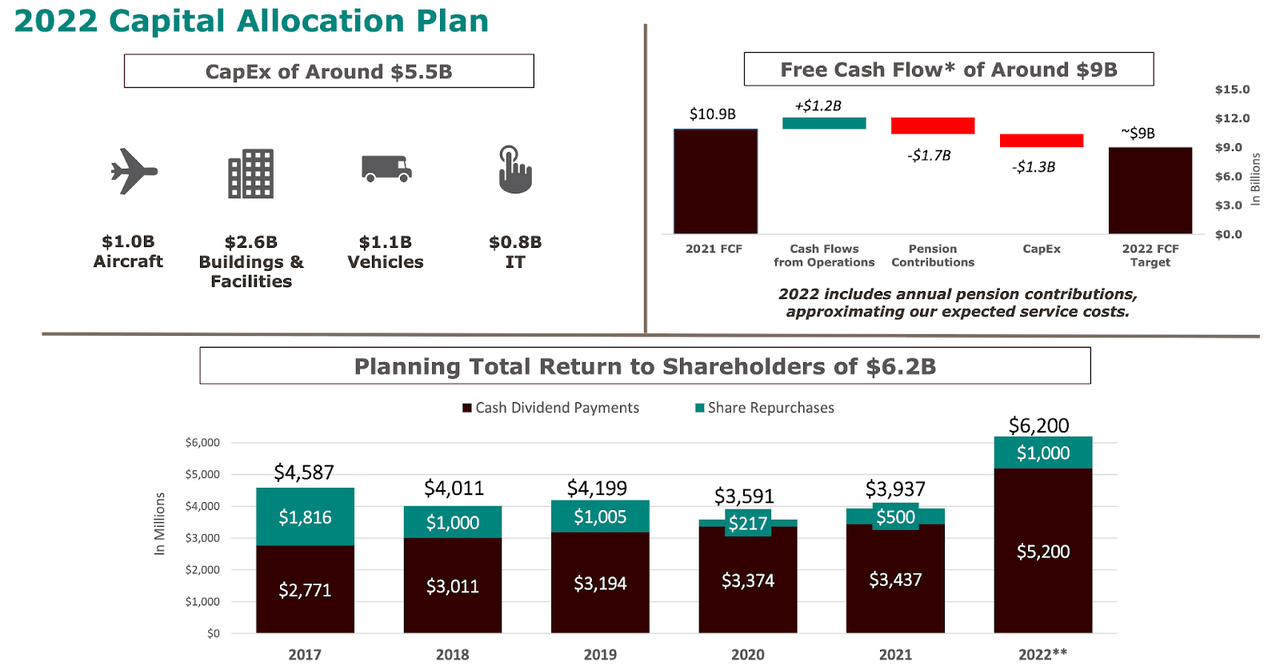

UPS has guided for free cash flow to dip down from $10.9 billion in 2021 to $9 billion in 2022. This is a function of both expected headwinds due to the company having prefunded some service costs in 2020 (making free cash flow in 2021 unusually higher) and also increased capital expenditure plans.

UPS 2021 Q4 Presentation

On the conference call, management did imply that the planned $1 billion in share repurchase represents more of a “floor” as the company does have $4.5 billion left in their authorization.

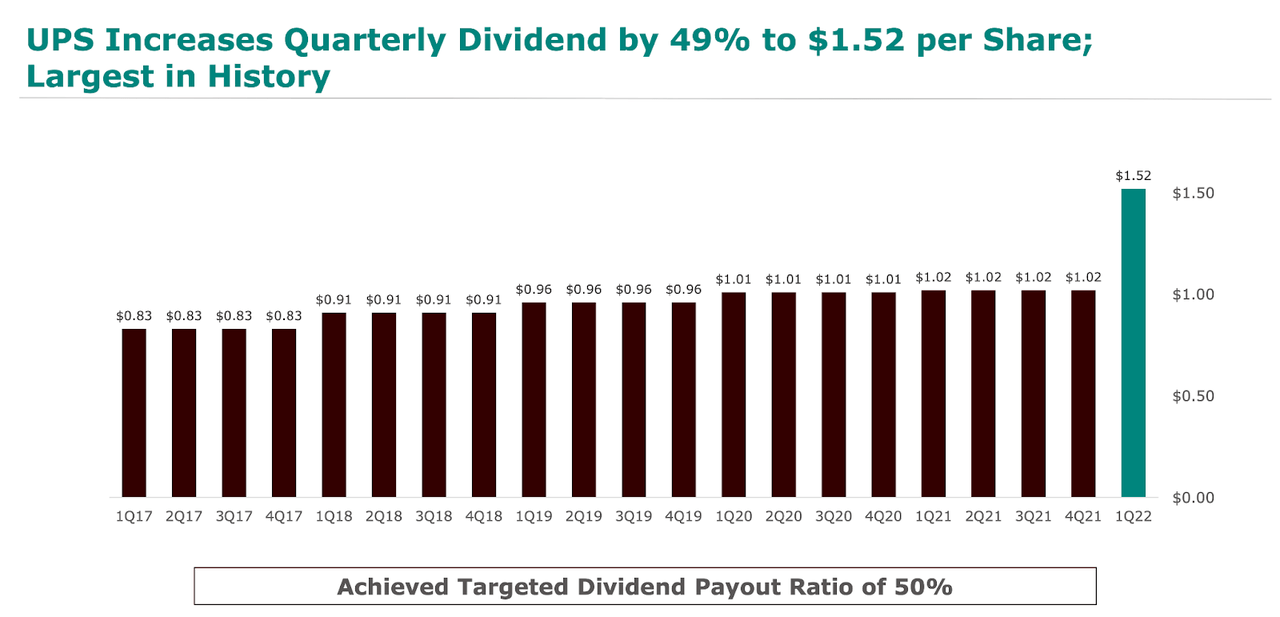

UPS Dividend

UPS had previously slowed down its dividend growth program due to stagnating free cash flows. However, with free cash flow booming in 2021, it has decided to increase its dividend by 49% to $6.08 per share annualized.

UPS 2021 Q4 Presentation

That represents a dividend payout ratio of around 50%, leaving plenty of cash available for both share repurchases and capital expenditures. I do not expect the company to have to pay down net debt because the current leverage ratio is already much lower than historical levels.

Is UPS Stock A Buy, Sell, or Hold?

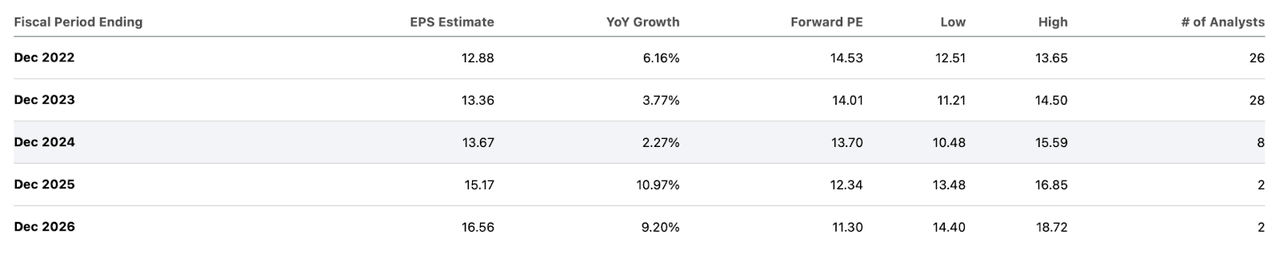

Wall Street consensus estimates call for minimal earnings growth over the next few years.

Seeking Alpha

That kind of growth profile is not sexy though the estimates prove conservative. Regardless, with the stock trading at less than 15x forward earnings, even modest growth makes for a decent investment thesis. I expect Wall Street to continue viewing UPS as a low risk proxy to invest for the growth of e-commerce, as UPS is not directly tied to the fate of any one particular retailer but instead should benefit so long as e-commerce continues to grow. Further, as the company continues to invest in growth capital expenditures, it may be able to eventually realize efficiency gains which may allow for greater free cash flow. As it stands, the company has guided for around $6.2 billion of cash to be returned to shareholders through dividends and share repurchases in 2022. As of recent prices, that represents a shareholder yield of 3.8%, but I note that based on management guidance, there is yet another $2.8 billion of free cash flow unaccounted for. The company might apply that excess cash flow to accelerated share repurchases, or use it to reduce debt. While UPS is not a tech stock, I nonetheless expect the stock to experience multiple expansion as it is offering what appears to be a perfect package: an attractive e-commerce secular growth story, conservative balance sheet position, and a generous shareholder yield. I can see UPS trading up to at least 18x earnings, representing a stock price of $232 per share. The stock has around 27% total return upside to that target.

What are the risks here? The reader might be wondering if rising oil prices would negatively hurt UPS. UPS applies fuel surcharges which allows it to pass on the cost of rising fuel costs to its customers. That said, the high fuel surcharges are decreasing profitability for e-commerce customers, which may in turn lead to higher e-commerce prices and finally lower demand from end consumers. UPS is working toward a carbon neutral strategy, but has set 2050 as being the target year for achieving that goal. I wouldn’t be surprised if UPS sees some volatility in its earnings trajectory in the near term, but as long as oil prices eventually normalize to historical levels, I still see UPS as being a secular growth story.

Another risk is that the combination of modest growth and modest shareholder yield (relative to total free cash flow generation) may mean that the stock could sustain some multiple compression. The 3.2% dividend yield arguably offers some downside protection, but if the company returns to its previous levels of dividend growth (or stagnation to be more accurate), then a 5% dividend yield would not be out of the question. This is a name which I can see going up directionally over the long term, but with some volatility along the way. I rate the stock a buy with 27% total return upside to my $232 per share price target.

Be the first to comment