puhimec

Self-control is the chief element in self-respect, and self-respect is the chief element in courage.”― Thucydides

We concluded our first article around Rhythm Pharmaceuticals, Inc. (NASDAQ:RYTM), “Potentially Time To Fatten Up On Rhythm Pharmaceuticals,” in late February of 2021 in the following way:

RYTM seems to have a risk/reward profile worthy of a small ‘watch item’ position in the early innings of 2021 which looks like it has the potential to be an inflection year for Rhythm Pharmaceuticals.”

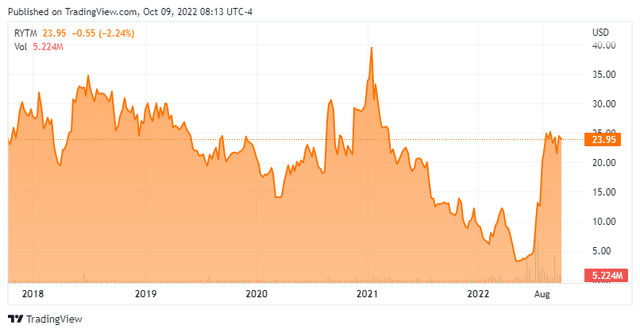

This is a name I have been playing via covered calls like most of my biotech holdings. Now nearly a year and a half later, the stock basically trades flat to where it was at during our last piece on this name. The stock has had a very volatile ride in 2022 to this point. Therefore, it is a good time to circle back on Rhythm Pharmaceuticals and update our investment thesis around this concern below.

Company Overview:

This Boston based small cap biopharma concern is focused on the development and commercialization of therapeutics for the treatment of rare genetic diseases of obesity. The stock trades around $24.00 a share and has an approximate $1.3 billion market capitalization.

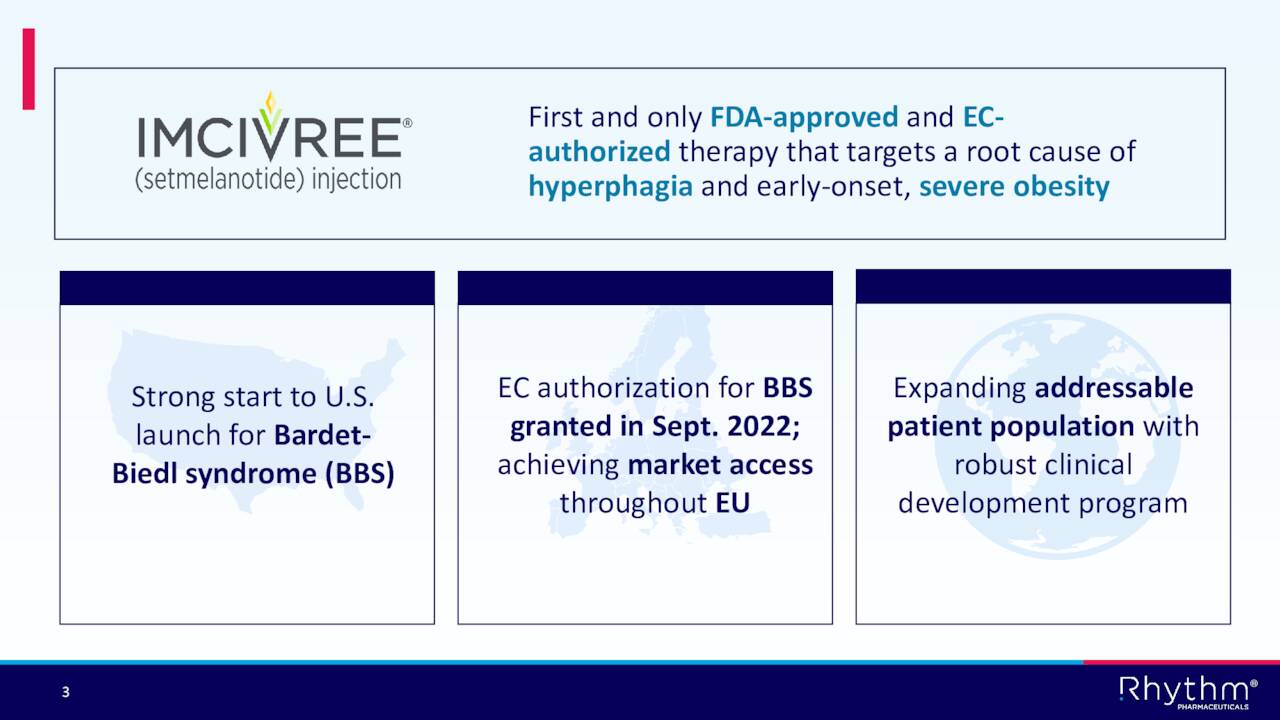

September Company Presentation

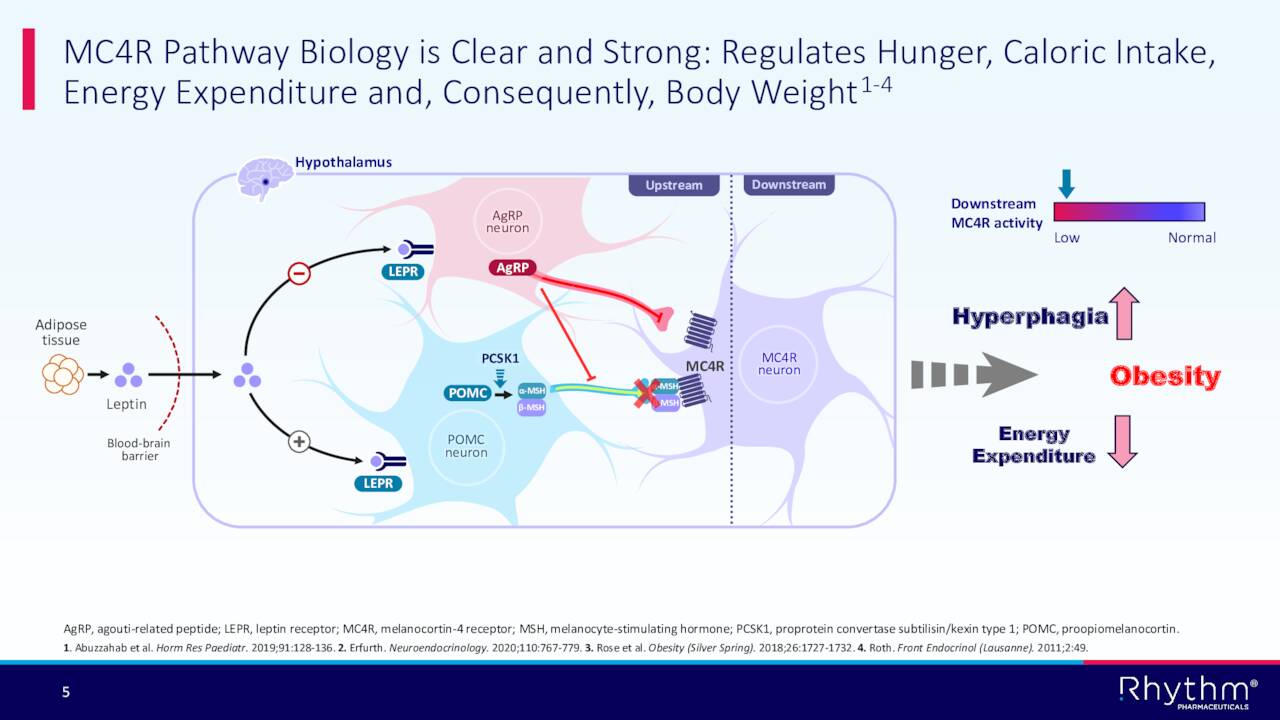

Rhythm’s development approach targets the melanocortin-4 receptor (MC4R) pathway, which is responsible for regulating weight and hunger. The company’s main asset is a compound called setmelanotide which is known by the brand name Imcivree. This drug has been approved for chronic weight management in adult and pediatric patients 6 years of age and older with obesity due to proopiomelanocortin (POMC), proprotein convertase subtilisin/kexin type 1 (PCSK1) or leptin receptor (LEPR) deficiency confirmed by genetic testing in both the U.S. and Europe. Commercialization began in the first half of 2021.

September Company Presentation

Imcivree got a more recent FDA approval in June to treat obesity and control of hunger in certain patients with Bardet-Biedl syndrome (BBS). The company also received the same approval in Europe last month. BBS is a rare affliction that affects approximately 5,000 individuals total in the U.S. and Europe. It should be noted that the FDA rejected the company’s sNDA for Imcivree medicine for the treatment of rare genetic disease Alström syndrome early this summer.

The company also has an exclusive licensing agreement around Imcivree with RareStone LTD. They will be in charge of the development and commercialization of Imcivree in China, including mainland China, Hong Kong and Macau. Rhythm received a $7 million upfront payment for this arrangement and is also eligible for milestone payouts as well as royalties on commercialized sales.

September Company Presentation

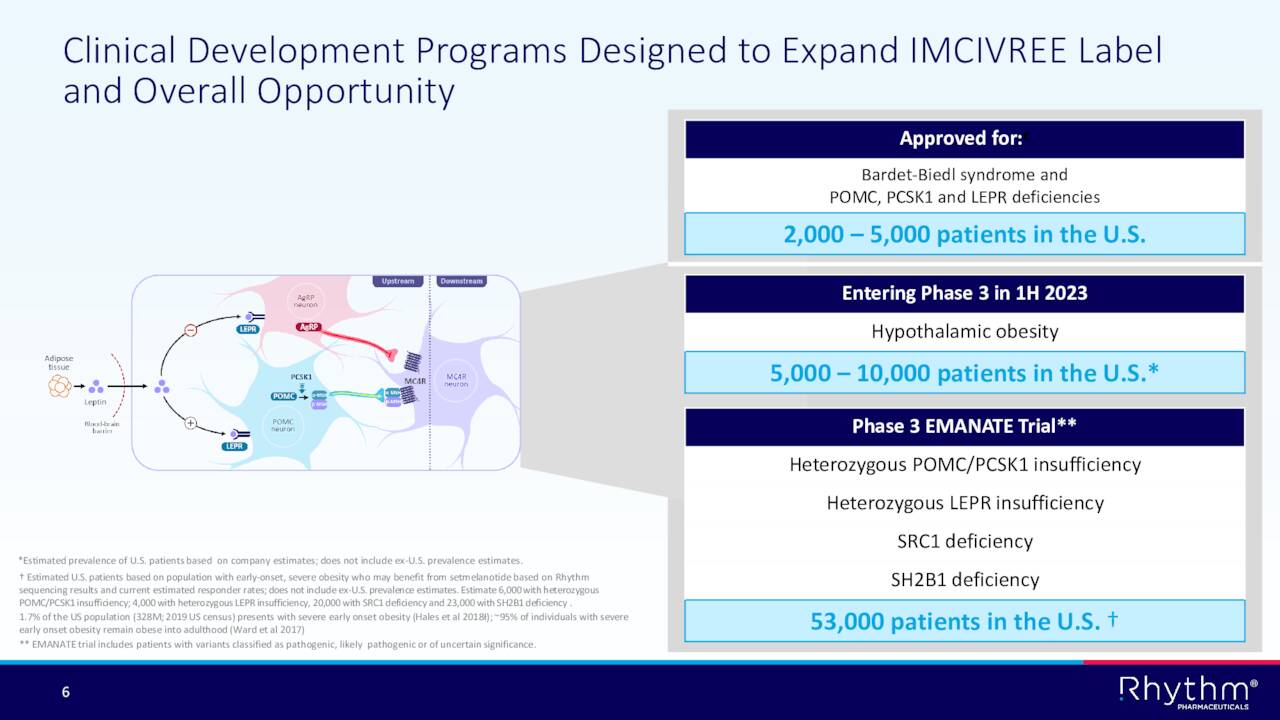

The company is working diligently to expand the indications that Imcivree is approved to treat.

September Company Presentation

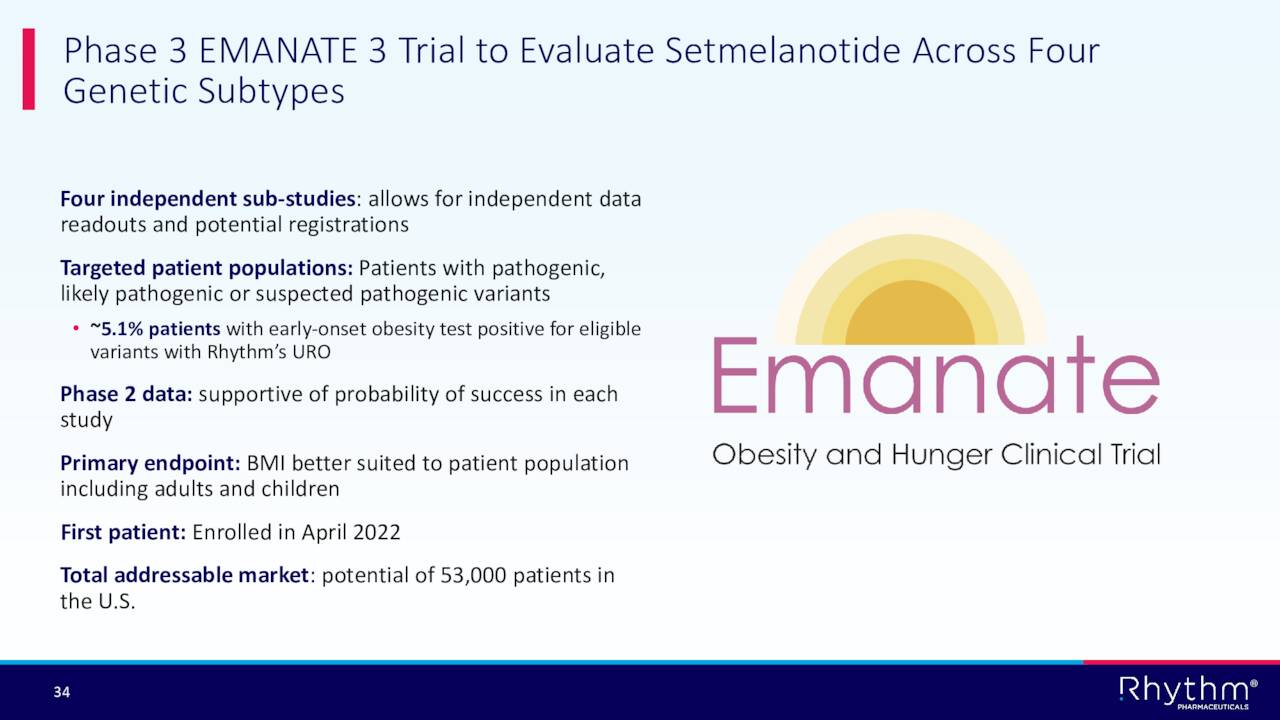

The company enrolled the first patient in what could be a game changing trial for Rhythm called “Emanate.” This Phase 3 trial will evaluate Imcivree across four genetic subtypes that impact over 50,000 individuals in the U.S. alone.

September Company Presentation

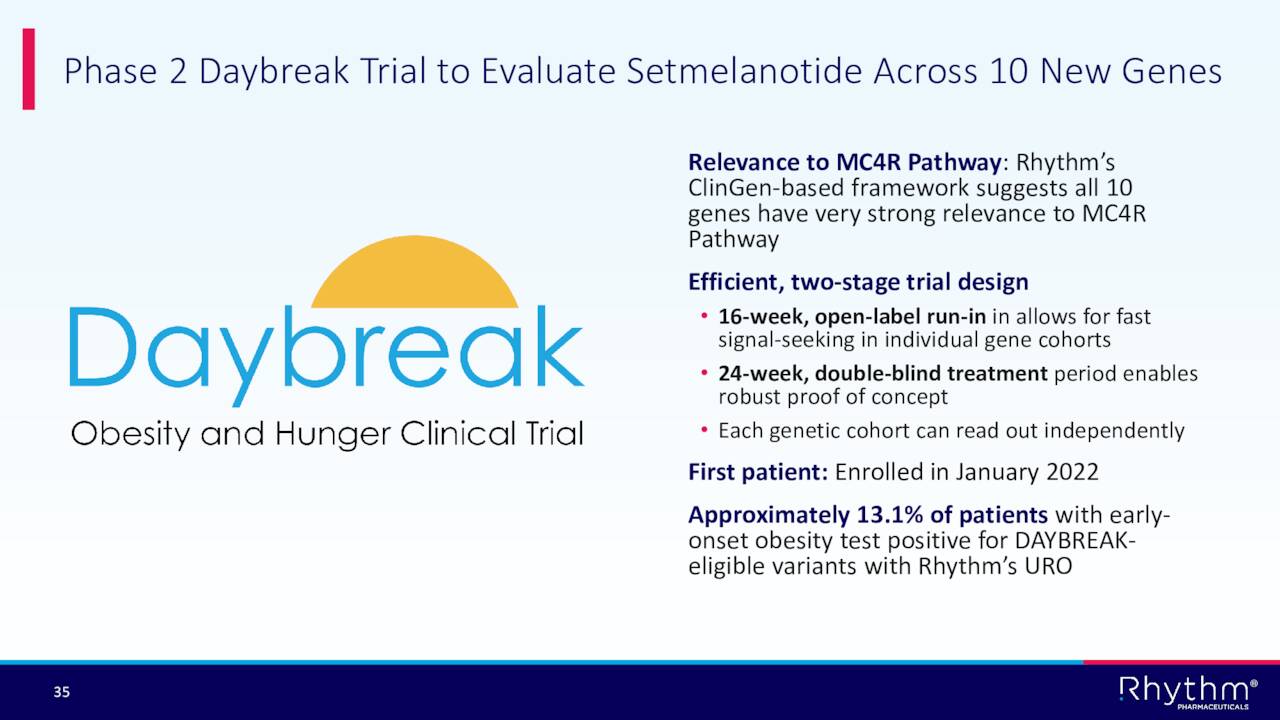

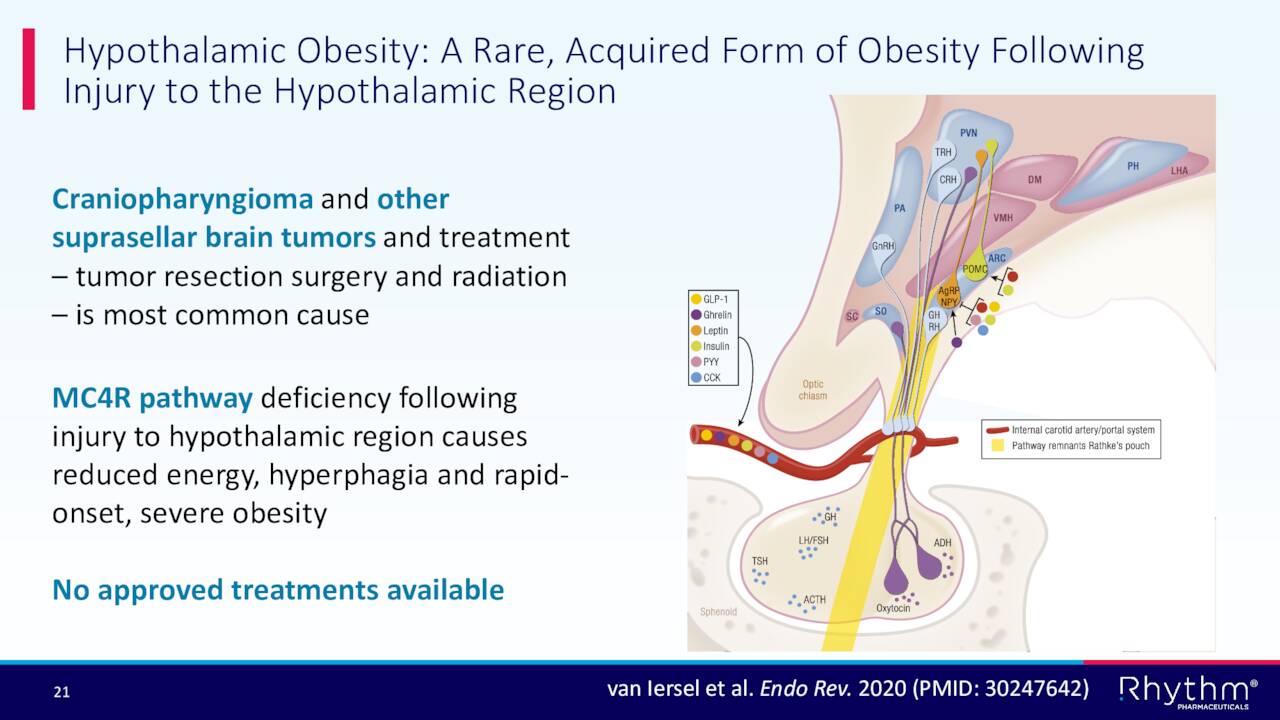

In addition, the company has a Phase 2 trial called Daybreak currently ongoing and plans to initiate a Phase III study to evaluated Imcivree to treat Hypothalamic Obesity in the first half of 2023.

September Company Presentation

Second Quarter Results:

The company posted second quarter numbers on August 2nd. The company had a GAAP loss of 89 cents a share, better than a nickel a share above expectations. During the quarter, the company had net product revenues of $2.3 million from Imcivree versus just $300,000 in the same period a year ago. License revenue relating to the company’s out-license arrangement with RareStone was $6.8 million, compared with nothing in 2Q2021.

Analyst Commentary & Balance Sheet:

Since second quarter results posted, four analyst firms including Goldman Sachs and Needham have reissued Buy ratings on Rhythm Pharmaceuticals. Price targets proffered range from $25 to $35 a share. Meanwhile, both Morgan Stanley ($16 price target) and Bank of America ($25 price target) have maintained Hold ratings on the stock.

September Company Presentation

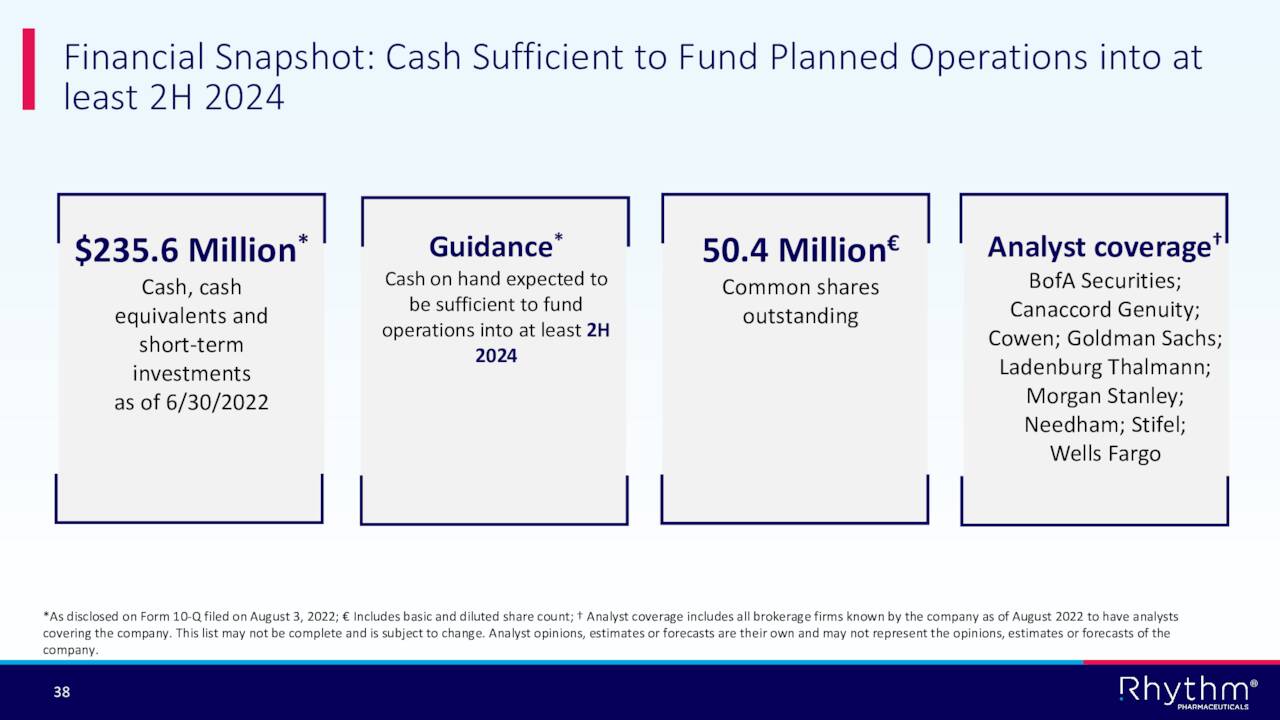

Nearly 15% of the outstanding float is currently held short. Several insiders have sold approximately $400,000 worth of shares in aggregate so far in 2022. That has been the only insider activity in the equity so far this year. The company ended the second quarter with approximately $235 million in cash and marketable securities on its balance sheet against no long term debt. The company did an approximate $100 million capital raise in mid-September, bolstering these cash reserves. The company also has a $100 million royalty financing arrangement with HealthCare Royalty Partners.

Verdict:

The current analyst firm consensus has Rhythm Pharmaceuticals losing nearly four bucks a share in FY2022 as revenues rise to some $25 million from basically zero. In FY2023, they see that loss being cut to just over three bucks a share as revenues rise north of $65 million, albeit there is a wide range of sales estimates ($33 million to $95 million).

September Company Presentation

Imcivree has a small target population, but that should hopefully increase significantly over the next few years as new indications are approved. The company has made nice progress in 2022 with the approval for BBS in both the U.S. and Europe. It also has addressed its financing needs for the moment and continues to advance its pipeline into new indications.

That said, the stock is up some 125% in 2022 and hitting against analyst firm price targets. The company is also years away from profitability. I plan to maintain my watch item holding within covered call positions in RYTM for the time being. However, I don’t think I would be chasing this name via straight equity given the shares recent run up in this uncertain market.

Do not bite at the bait of pleasure till you know there is no hook beneath it.”― Thomas Jefferson

Be the first to comment