Warrior Met Coal is enjoying increased production of coal agnormark/iStock via Getty Images

Warrior Met Coal, Inc. (NYSE:HCC) touts a YTD performance of +53.04%. My takeaway is that HCC is still a buy. The recent Q3 earnings report revealed that this company was able to produce a massive YoY improvement in sales. The $390.2 million for Q3 2022 is 92.7% higher than Q3 2021’s $202.5 million. The Q3 net income of $98.4 million is 256% higher than Q3 2021’s $38.4. The stock market had a lukewarm response: the 5-day performance of HCC is only +1.32%.

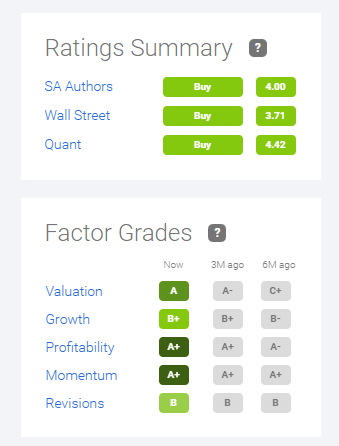

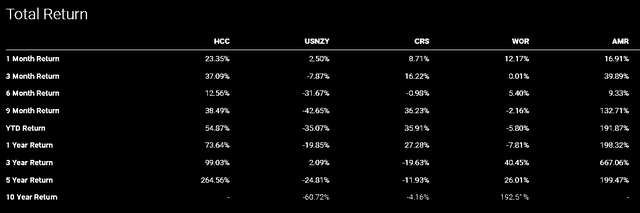

Seeking Alpha Quant still grades HCC as an A+ momentum stock. Compared against its steel industry peers, HCC’s 1-month total return of 23.35% is notably higher. The chart below illustrates the upward momentum of Warrior Met Coal’s stock, which is unabated.

Why Not Rake in the Profit?

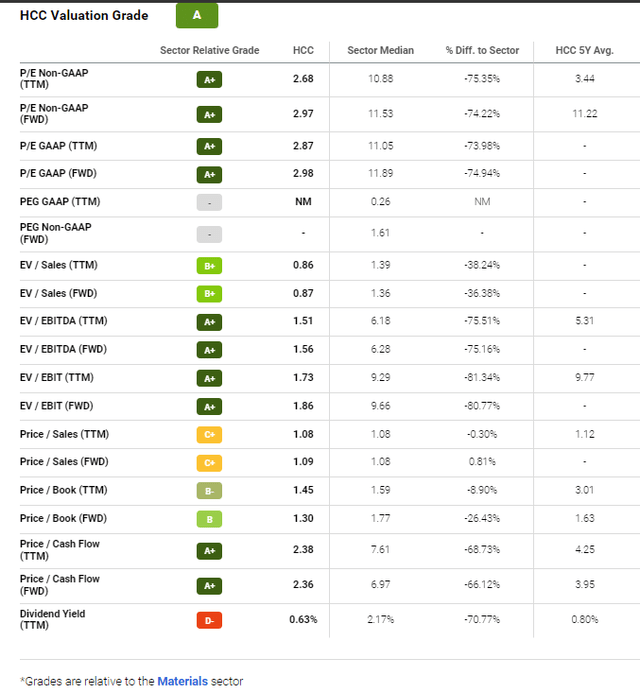

HCC is a buy because that +53% YTD gain has not changed its relative undervaluation. Compared to its Materials sector peers, HCC’s forward GAAP P/E is only 2.98x. This is 75% lower than the sector average of 11.89x. Warrior Met Coal’s forward EV/EBITDA is only 1.86x. This is again 75% lower than the sector average of 6.28x. The significant undervaluation is a good incentive to average up or go long on HCC.

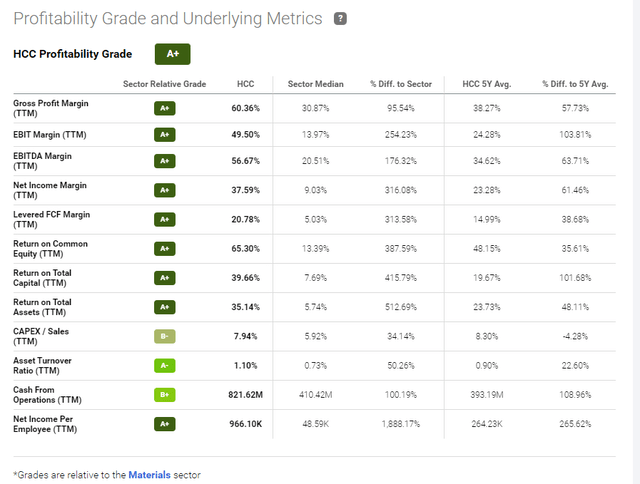

A forward P/E of 2.98x is a gross market aberration. Warrior Met Coal is already profitable and has a TTM revenue CAGR of 94%. This significant undervaluation will eventually be corrected. HCC has a remarkably high net income margin of 37.59%. This is 316% higher than the Materials sector’s average of 9.03%.

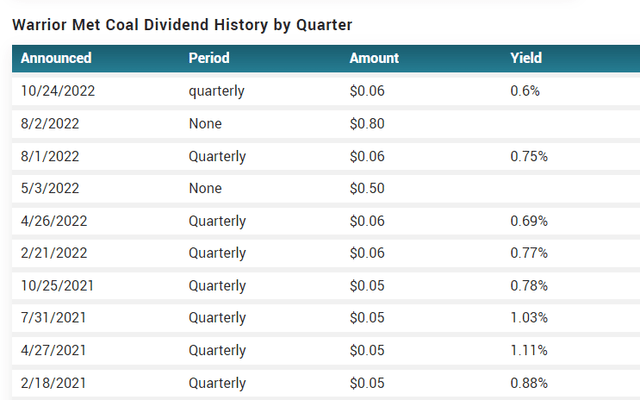

The high TTM net income might eventually help Warrior Met Coal management improve its subpar dividend yield history. Dividends are immediate rewards for the loyal shareholders of HCC. A more generous dividend payment may inspire more income investors to go long on HCC.

Being on the radar of income investors could ultimately help raise the exceptionally low 2.98x forward P/E of HCC.

Technical Indicators Are Still Optimistic

The stocks are now hostage to the market’s emotional cycle of optimism or pessimism. Let us appreciate that after a 53% YTD gain, HCC’s Relative Strength Index [RSI] score is only 63.61. This is still below the oversold level of 70. RSI is an easy barometer of market emotion. The chart below says HCC’s RSI score never dipped below the neutral level of 50 since late September. The optimism for HCC is, therefore, consistent.

Another easy gauge to know the market’s emotion is Exponential Moving Average, or EMA. The EMA indicator is now bullish for Warrior Met Coal’s stock. The closing price of HCC on November 4 was $38.04. The EMA indicator is bullish when the 5-day EMA is greater than the trailing EMA averages. The 5-day EMA of $37.65 is greater than the 13-day EMA of $36.70. The 13-day EMA is higher than the 20-day EMA of $35.79. The 20-day EMA is higher than the 50-day EMA of $33.75.

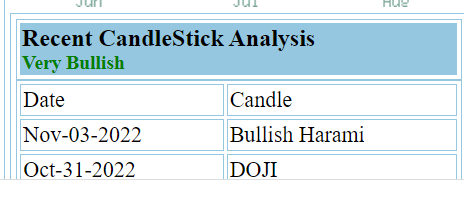

If you believe in candlestick patterns, the screenshot below should assure you that the upward momentum of HCC has enough gas.

StockTA.com

These technical indicators are what I use to know the dominant emotion of the market. Exploiting the optimistic herd emotion for Warrior Met Coal is judicious.

Downside Risk

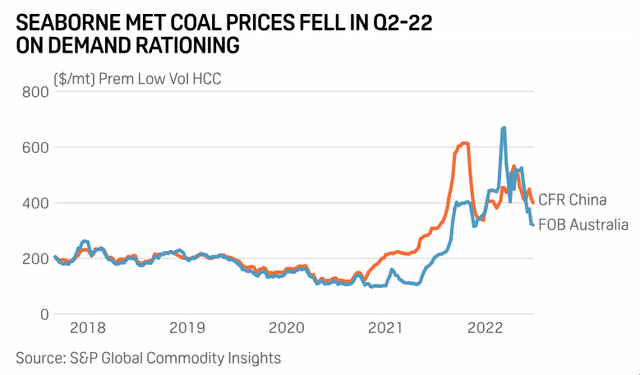

I Googled it, and there’s been no serious collapse in the price of Met Coal. The price trend for Met Coal has been on a downward trend since Q2 of this year. However, the price has not yet dipped below $200.

The Q3 earnings report said Warrior Met coal produced 1.6 million short tons of met coal. It sold 1.5 million of those during the quarter. HCC’s average net selling price for Q2 was $248.13 per short ton of met coal. In the year-ago quarter, the company only produced 1.1 million short tons. If there are more dips in pricing, Warrior Met Coal could work harder to produce more met coal.

The 500k additional tons produced in Q2 is despite the 19-month long dispute with striking mine workers. BlackRock (BLK), the largest shareholder of HCC, has called for the company to resolve its dispute with striking miners. It is HCC’s headwind that management seems unable to come to terms with its employees being on strike.

My takeaway is that the super-cheap valuation of HCC could be exploited. Management can use some of that $98 million in Q3 net income to do share buybacks. The repurchased shares could be distributed to all its coal mine workers. Incentivizing the still-striking workers with equity stakes in Warrior Met Coal might resolve their grievances.

Settling the dispute between management and miners is necessary. The $14.10 billion global metallurgical coal industry is still growing at a 2.4% CAGR. Warrior Met Coal is a leader in this niche industry that caters to the $874 billion global steel industry (3.13% CAGR).

My Verdict

My buy recommendation for HCC is just my opinion. Do your own due diligence. Exercise your critical thinking. Evaluate HCC according to your own biases. This article’s thesis is aligned with the buy recommendations of Seeking Alpha Quant and Wall Street analysts. I did my own detective work. I agree with their bullish assessments of Warrior Met Coal. You should consider acting on our collective optimism for HCC.

Seeking Alpha

Investing in a stock when the momentum indicators are bullish is shrewdness at its highest level.

Increasing profitability should also result in higher Met Coal dividend payments to shareholders. Going forward, the exceptionally low valuation of HCC stock might encourage management to make share buybacks. Shares repurchased could then be distributed to all employees, whether they are part of the on-strike group or not.

Be the first to comment