Eoneren

Crypto is widely thought to be in a winter with Bitcoin (BTC-USD) falling from nearly $70K per coin to $19K since the Fed started hinting the end to easy monetary policy in November 2021.

Bitcoin chart (stockcharts.com)

However, crypto is probably here to stay:

Given large declines in the price of Bitcoin etc. since last year, which probably halted its momentum in substituting for money, it is less of a threat to traditional monetary systems and more of a curious oddity – this might give it more breathing room from governments that jealously guard their monopoly over money printing.

Hence it appears regulatory and policymaker attention has waned compared to when crypto was in its heyday last year.

While crypto might be in a winter, I believe Coinbase (NASDAQ:COIN) (despite falling c.80% from its peak) allows investors to gain exposure to crypto without making directional bets on the crypto market, and despite its current shrinking revenues and large losses, is a contrarian bet worth considering.

Reason #1: Coinbase has an attractive business model, which relies on three pillars:

- Risk-free: Coinbase takes a cut of trading volumes and it does not undertake risk, which is a great business model. As long as crypto exists and people are trading it, then Coinbase makes money.

- A certain amount of trading activity: Crypto does not need to be hot for Coinbase to do well, it just need some amount of trading activity. As we will further show in the valuation section, if crypto maintains the current level of activity and undergoes some consolidation, it will be profitable enough for Coinbase to sustain its current valuation.

- Creditworthiness: Coinbase has $5.7bn in cash on hand and public internet searches do not turn up significant negative news on its creditworthiness. Though creditworthiness was not that prioritized when people invested in crypto for its “decentralized” functions, crypto traders may now find that tepid institutions that are regulated by the government (including banks and listed companies such as Coinbase) seem like well-behaved angels by now, compared to the litany of negative events we’ve seen in the past year in the crypto field, such as the collapse of Terra/Luna (LUNC-USD). Coinbase may benefit if the public gradually shifts to more creditworthy platforms, which is sort of ironic, re-centralizing what was originally designed to be decentralized.

Reason #2: There are also long term stories underpinning Coinbase’s future trajectory, “a cherry on the top.”

In the long run, I am of the opinion that crypto is likely still going to exist, even if as a collector’s item or a means of moving money.

In an uncertain world, crypto might rise again someday, probably in a less chaotic manner than seen in 2021 and 2022, but as an alternative asset actively traded and perhaps even somewhat used in day to day transactions.

After all, there are many countries that have serious problems with inflation (which is much worse in developing countries than developed countries), it’s not inconceivable that part of their citizenry switches to crypto for at least some transactions. For example, Turkey currently has an annual official inflation rate of 80%. Similarly, Argentina’s inflation rate is also 70+%.

The monetary system is showing strains after decades of MMT, examples of which are plentiful:

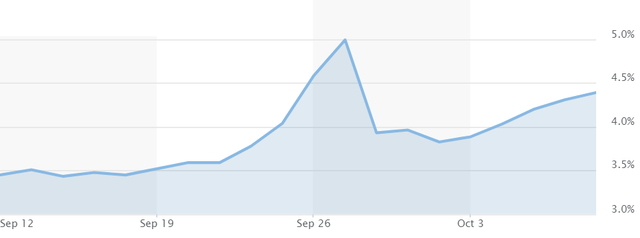

British 30-year government bond yields briefly rose from 3.5% to 5% as shown below merely a few days after the UK announced its budget plans on Sept 23 which the UK government responded to by getting the central bank to pledge to buy more bonds by printing money.

UK 30 year gilt yields (Marketwatch)

Source: Marketwatch

Objectively speaking, it looks like MMT may have lulled policymakers into complacency where they feel there are few consequences to money printing due to the low inflation of the last three decades (which might be transitory).

So in a future period where the monetary stability is in doubt, for example from surging and seemingly untamable inflation or low interest rates and high rapid credit creation, interest in crypto may surge again and Coinbase might achieve premium valuations.

Best of all, Coinbase does not need a boom in crypto to justify its current valuation. Even if crypto just plods along like collectible baseball cards, it would probably still be enough (see below). But if the above mentioned occur, then Coinbase’s valuation would surge as imagination takes hold, which would provide additional upside.

How to value Coinbase?

My valuation hypothesis is show below. At current market prices, the market is pricing the equity value of Coinbase at $13 bn, which I believe could just be justified by crypto trading volumes at a “normal” non-overheated level. Any potential boom (from monetary instability or increased use in transactions) would just be the icing on the top.

Source: Coinbase financials from Seeking Alpha

1. Direct comparable listed companies:

Exchanges are a great business model. Once people get used to using your exchange, then it’s a cash cow. The Chicago Mercantile Exchange (CME) had $4.6 bn in revenue in FY21, but had a net profit margin of almost 56%, corresponding to a market cap of $65 bn. Similar figures for the ICE, as shown below.

|

Market cap |

FY21 Revenue |

FY21 net profit |

|

|

$65 bn |

$4.6bn |

$2.6bn |

|

|

$52bn |

$7.1bn |

$4bn |

|

|

$15 bn |

Q2-22 revenue $0.8bn |

Q2-22 revenue $-1 bn |

Source: Financials of respective companies, linked to Seeking Alpha

By contrast, Coinbase had already achieved $0.8bn revenue in Q2-22 (albeit this fell almost two thirds from the $2.5 bn peak in Q4-21), so this is a run-rate of c.$3bn despite the crypto crash. Coinbase is not profitable yet as it is still investing in R&D for new products and services but it could potentially become profitable at some point once it becomes a mature company and there is less need for opex and R&D.

2. Comparable products:

Source: Bitcoin from coinmarketcap.com; gold from World Gold Council, see links above

Compared to gold, bitcoin is much more actively traded, with trading volumes equal to turnovers of 18-27 times total stock of bitcoin annually (compared to just 3 times for gold), which might be due to its novelty.

3. Profit forecast

|

Crypto value |

Annual turnover of total crypto |

Average transaction fees |

Coinbase Market share |

Trading Volume Revenues |

Net profit margin |

Net profit |

|

$1 trillion |

300% |

0.2% |

20% |

$1.2bn |

60% |

$0.7bn |

|

$2 trn |

300% |

0.1% |

20% |

$1.2bn |

60% |

$0.7bn |

|

$5 trn |

300% |

0.1% |

10% |

$1.5bn |

60% |

$0.9bn |

Source: author’s calculations

Annual turnover of crypto at 300% is extrapolated off annual turnover of gold as calculated above.

I believe Coinbase can eventually achieve at least 10-20% market share, if not much more (personally I feel optimistic that Coinbase’s competition will evaporate in the coming recession and Coinbase might even end up with a huge market share, like 50%), and can achieve at least $0.72bn in steady state profits (which is P/E of c.18 with the current equity value of $13bn). This is because Coinbase is relatively well capitalized with $5.7bn in cash reserves (it has $3.4 bn of long-term debt, of which $1.4bn matures in 2026, and $2bn in 2028 and 2031). Effectively it has $5.6 bn in cash for the next few years which will be give it staying power. By comparison, its non-listed competitors probably are not as well capitalized.

Coinbase has already laid off 18% of its workforce in Jun-22 and can cut much more deeply to achieve a low or no loss position.

Better incentivized management: The CEO owns 20% of Coinbase stock. At current prices, he’s worth about $3 billion, even if Coinbase falls to net cash valuations (i.e. $2-$3 billion), the CEO would still be worth hundreds of millions of dollars.

This is not the case for some of the founders/owners of other large crypto trading platforms.

Coinbase is the ideal consolidator: The current high interest rate, asset bubble bursting environment is bound to at least burst some of the other crypto exchanges or make them think about merging given the lack of differentiation and operating losses in a tough environment. What better partner to merge into than a listed, well-capitalized company?

Note that this is still a very risky investment. Trading volumes could continue to fall materially for crypto in the current recession as trading activity for products of all sorts (especially the more marginal, speculative alternative type) shrink, which means Coinbase could easily fall a lot more. However, I posit that Coinbase could be entering a buy valuation – $13 bn for a piece of what may be the predominant crypto exchange in the future is a bargain.

Existing competition from other crypto exchanges is fierce and Coinbase has been losing market share for the past half year. Currently, Coinbase has about 6.3% market share in Bitcoin in Jul-22 (a decline compared to 10.7% in January-22). Perhaps its competitors are able to find staying power and Coinbase is unable to meaningfully gain market share.

Average transaction fees could continue to fall, in some cases, transaction fees for bitcoin have been cut to zero (but nothing’s ever really free, see Robinhood, so I believe exchanges will still make money somehow).

Competition from more traditional payment platforms may intensify (e.g. PayPal has already offered crypto buying and selling services), though as Coinbase is focused on crypto and it may be faster in rolling out new suites of products and services.

A more conservative investor may wish to wait for more positive catalysts before committing to a position, e.g. for Coinbase’s competition to actually fold and the wave of consolidation to start happening.

To sum up

I believe Coinbase might be a good way to gain exposure to crypto (i.e. selling pickaxes to gold miners) and it is fairly valued even if crypto assets do nothing but fluctuate going forward.

I foresee the crypto exchanges are likely to massively consolidate (perhaps fueled along by a collapse in the less-capitalized competition) and Coinbase is best placed to gain a lion’s share of the market. If this consolidation scenario plays out, I would judge the current $13 bn equity value.

But this is also quite risky as if the consolidation doesn’t work out or market pessimism in the short term over Coinbase could send valuations diving to much lower levels.

If the consolidation does occur with Coinbase attaining a lion’s share of the market and/or crypto becomes hot again if we enter a period of monetary instability, then I would portend that Coinbase’s valuation could easily surge multiple times.

For more cautious investors, it may be worth waiting for signs of consolidation occurring before committing.

Editor’s Note: This article was submitted as part of Seeking Alpha’s best contrarian investment competition which runs through October 10. With cash prizes and a chance to chat with the CEO, this competition – open to all contributors – is not one you want to miss. Click here to find out more and submit your article today!

Be the first to comment