bluecinema/E+ via Getty Images

Investment Thesis

Apple (NASDAQ:AAPL) is two weeks away from its ground-shaking fiscal Q4 2022 results. I argue that decreasing disposable incomes will meaningfully affect Apple’s near-term prospects.

Furthermore, even though in the past few years Apple’s competitors couldn’t keep up with Apple’s technological breakthroughs, this is not quite the same today.

Brands are something consumers aspire to, and Apple will continue to provide that feeling. But not for all consumers.

As more and more consumers struggle to make ends meet, Apple’s fiscal 2023 could struggle to deliver against high expectations baked into its share price

Competition for Decreasing Disposable Income

The world came out of the pandemic feeling generally wealthy. We had few potential places to spend outside of our homes, so we mostly saved money. Today, consumers around the world have largely run through those savings.

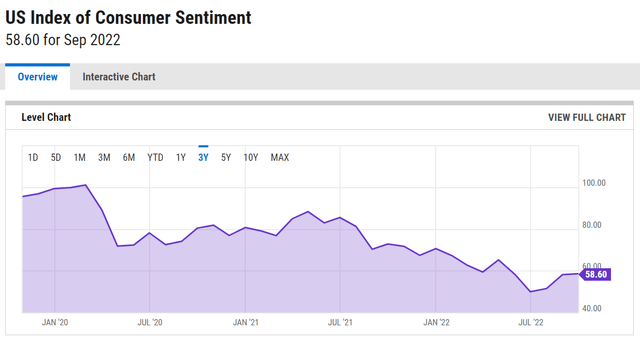

We are entering a period of weaker consumer confidence.

There are three different elements that are weighing on consumer confidence. There’s high inflation, rising rates, and higher energy bills. These elements impact affluent consumers to a lesser extent than they impact households in lower and middle-income brackets, of course. But they nevertheless have a widespread impact on all iPhone consumers.

Investors are quick to note that Apple’s Services are the thesis driver of the business model. And that sounds reasonable, after all, it’s a very high-margin segment. However, the fact remains that it only accounts for approximately 25% of the overall Apple business.

And Apple needs iPhone sales to be strong, to support its valuation. The iPhone is 50% of the underlying business. And we can’t lose sight of that.

Competition is Not a Thesis Breaker, But Yet Another Headwind

When consumers are feeling wealthy, they want to treat themselves to higher quality products. But when consumers are feeling the pinch, their spending habits rapidly change. We’ve seen this trend being discussed on both Walmart (WMT) and Costco (COST) earnings calls.

And of course, Costco’s demographics, and Apple’s demographics have very little overlap. But at the same time, everything counts.

Moreover, we know that Apple’s iPhone 14 Pro/Pro Max haven’t got material improvements over its previous models. In fact, there’s the argument to be had that flagship competitor’s products are mostly indistinguishable from iPhone’s flagship product.

Indeed, according to Tom’s Guide, stand-out features of the Pixel 7 include both its camera and its Tensor G2 chipset, allowing for powerful AI and machine learning capabilities.

Also, keep in mind that the Pixel 7 is $200 cheaper than either the iPhone 14 or the Galaxy S22 (OTCPK:SSNLF).

So, consumers can either shell out more out of their pockets for a new phone that isn’t all that different from previous models. Or they move beyond the Apple ecosystem and opt for competitors’ devices, with similar capabilities.

And while for many investors changing out of the ecosystem feels like blasphemy, today’s apps operate just as easily on both iOS and Android.

The point that I’m making here is not about fiscal Q4 2022 earnings. The point that I’m arguing is that fiscal 2023 will likely struggle to meet analysts’ expectations.

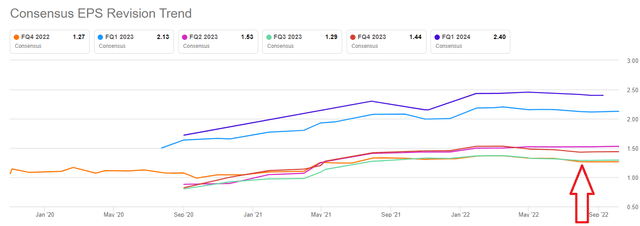

What you can see here is that despite all that’s happening in the macro environment, analysts are still busily upgrading Apple’s EPS estimates for next year since the start of September. How much more data do analysts really want? Are they struggling to read the room?

APPL Stock Valuation – 22x Next Year’s EPS

As it stands right now, analysts’ EPS estimates have Apple’s growing its EPS figures in fiscal 2023 by roughly 6% y/y. How is that possible? In what scenario can Apple grow its EPS next year, when the rest of the world is potentially eyeing up a global recession? This simply doesn’t make any sense to me.

Nevertheless, let’s assume that I’m wrong and that analysts are correct. And Apple is indeed able to continue growing in fiscal 2023 even while the global economy contracts.

That would leave Apple priced at 22x next year’s EPS. There’s simply no justification for paying more than 20x forward earnings for a company whose EPS is growing at single digits in my opinion.

The Bottom Line

The biggest value investor of all has a massive Apple position. Surely that means that the valuation is adequate for the ”buy and hold forever” investment crew?

Well, what makes sense for Berkshire Hathaway (BRK.A)(BRK.B) isn’t necessarily what makes sense for everyone. Berkshire just needs to keep up with inflation over the long term.

Indeed, keep in mind that Berkshire’s recent Apple purchases were made during the summer before the macro environment took a turn for the worst. Since then, Berkshire has been more aggressive in buying into oil companies, that are offering a much better risk reward.

Up until now, Apple has remained one of the last tech companies standing strong, despite everything that has taken place in the background. For now, there’s a near consensus view that Apple’s valuation will be fine. I don’t believe that to be the case.

Be the first to comment