Makiko Tanigawa/DigitalVision via Getty Images

The Story

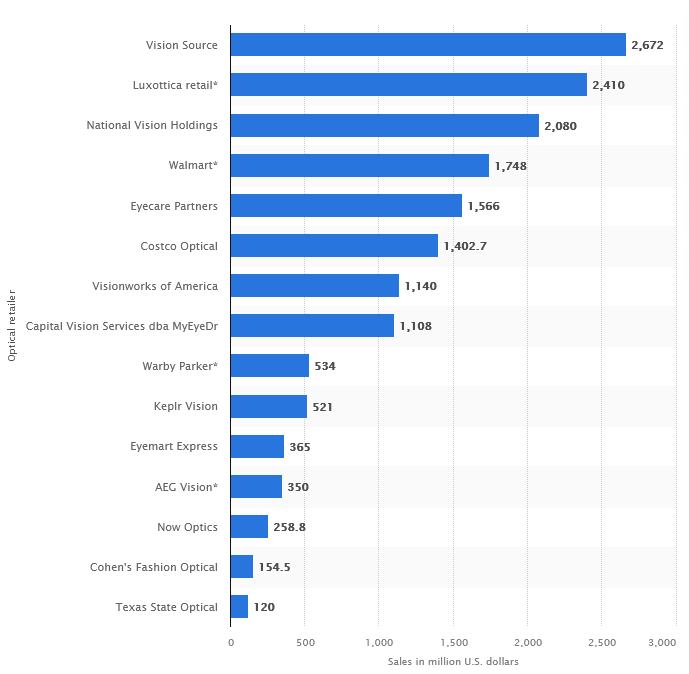

National Vision Holdings (NASDAQ:EYE) is the third largest optical retailer in the US. It was formerly acquired and sold via IPO by private equity, which occurred in 2017. Store count has grown a 7% compounded rate since 2006, currently at 1,332. Below is a look at the revenue of the top players in the retail optometry space, as of 2021:

Statista

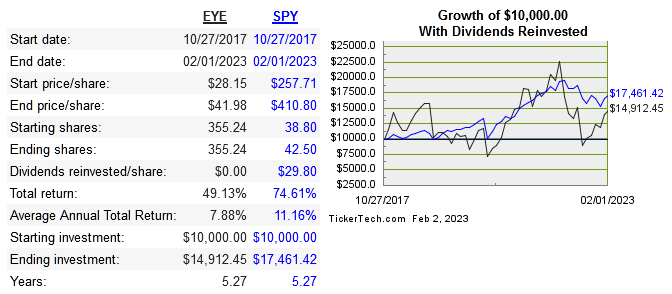

Next is the share price performance of EYE since IPO:

dividend channel

The is basically the only play on this specific sector of retailing in the public markets. The overwhelming majority of competitors are privately owned, so it’s a bit difficult to comp to peers. Warby Parker Inc. (WRBY) would be the closest, but even then it’s not an apples to apples comparison, since Warby Parker is primarily online and only has a mere 120 retail locations. WRBY is however a disruptor to this sector, and they are a much younger, smaller and faster growing business. Nevertheless, below are the return on capital metrics:

|

Company |

Revenue 10-year CAGR |

Median 10-Year ROE |

Median 10-Year ROIC |

EPS 10-Year CAGR |

FCF/Share 10-Year CAGR |

|

EYE |

7.9%* |

4.3 |

2 |

-1.3 |

n/s |

|

WRBY |

20.9% |

-29.3 |

-29.3 |

n/a |

n/a |

*5-year

**3-year

EYE has been profitable every year as a public company, and free cash positive for most as well.

Capital Allocation

The primary mode of reinvestment has simply been to open new stores. They’ve made no acquisitions and don’t pay any dividends. The table below shows how capital has been raised and allocated:

|

Year |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

|

FCF |

-3 |

2 |

64 |

158 |

163 |

23 |

|

Long Term Debt |

562 |

571 |

888 |

979 |

908 |

929 |

|

Equity Issued |

372 |

20 |

15 |

0 |

0 |

0 |

|

Store Count |

1,013 |

1,082 |

1,151 |

1,205 |

1,278 |

1,332 |

They estimate peak store count will be around 2,150 which gives us an idea of the runway.

Risk

The company is clearly still in growth mode, it’s just a slow grower. So the biggest risk revolves around whether the growth is funded effectively and also whether margins can expand as store count increases. So far returns on capital have been reverting to the mean, and I’m skeptical about seeing a reversal as more stores open. Debt is high relative to FCF, but debt hasn’t increased in four years, so right now it’s not causing an issue.

There is also the disruptive risk of competitors like WRBY. It’s not yet clear whether WRBY will end up taking significant market share, but the pandemic gave them tailwinds which inevitably took some action that would have otherwise gone to a retailer like EYE.

Valuation

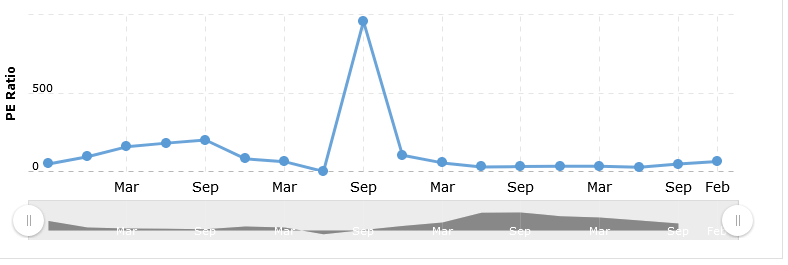

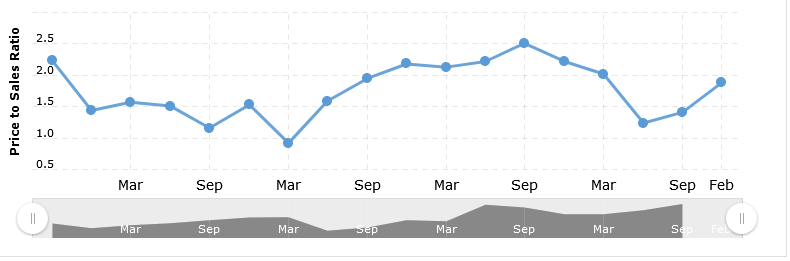

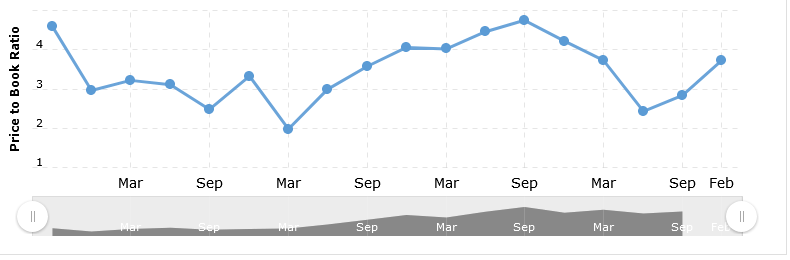

Shares peaked in 2021 like tons of other names and came crashing down 55%, but since that bottom it has been recovering and is up almost 60%. Let’s take a look at the price multiples and historical trends of the multiples as well:

|

Company |

EV/Sales |

EV/EBITDA |

EV/FCF |

P/B |

|

EYE |

1.8 |

19.3 |

151.6 |

3.7 |

|

WRBY |

2.9 |

-16.1 |

-16.1 |

6.7 |

Source: QuickFS.net

macrotrends

macrotrends

macrotrends

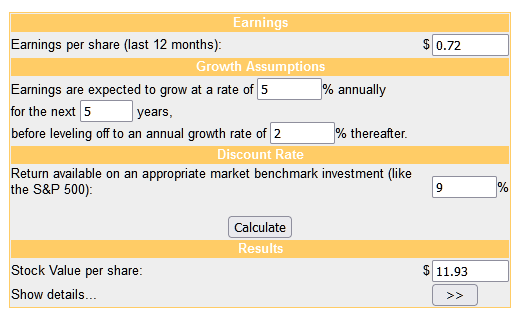

The stock is clearly being re-rated on sales and book value multiples. This isn’t good news for a growth investor, because the top line simply isn’t growing enough to justify these multiples. Next is the DCF model:

moneychimp

Conclusion

While this company is technically growing, I think a better long term play on this industry would be a disruptive name like WRBY. This article is about whether or not to invest in EYE, and the bottom line is that this business is average quality in terms of returns on capital. The multiple really matters for me here, because the underlying business growth rate doesn’t justify a sales multiple of 1.8 while a fast growing, disruptive peer in WRBY is priced at only 2.9. To buy at the current multiples means you would need much higher fundamental growth in addition to higher ROIC to actually generate alpha, and even then it would likely take many years for that to come to light.

This doesn’t mean they are a bad business, but the combination of high price and real risk from disruptive competitors will be keeping me away from this stock as a long term investment. The business quality plus growth potential certainly isn’t enough to justify getting in at almost any price. If a much better price were offered up soon, I would still be skeptical. This is a slow growth business, and even an undervalued price would work itself out to eventually average returns beyond roughly five years.

Be the first to comment