narvikk

Introduction

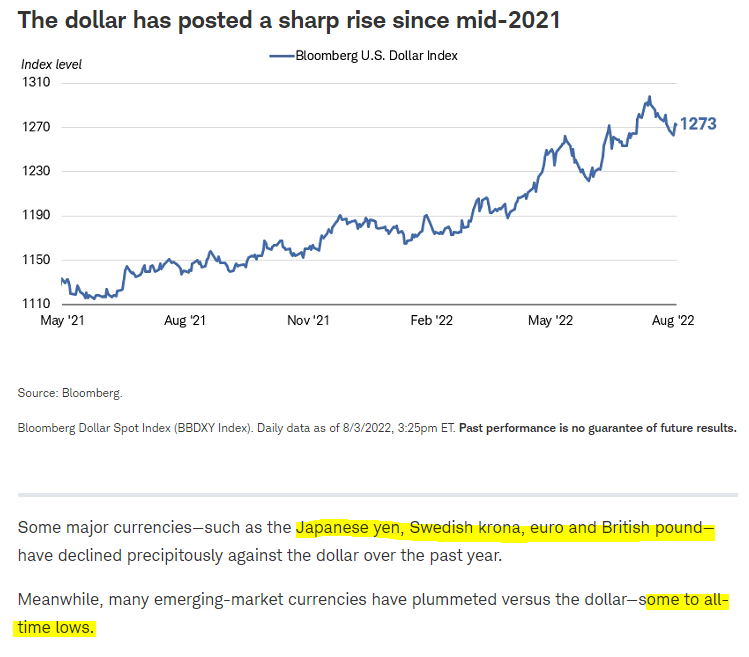

Over the past few months, have you noticed that European companies have underperformed US peers by a significant margin? It is not just the economic outlook that is at play. In fact, currency effects have contributed to a 20% decline YoY in valuation for companies that operate with the Euro. Japanese companies are down almost 40% YoY thanks to a weak yen. US investors who want strong returns should capitalize on this weakness by using their USD to purchase foreign assets at a discount. Just like how you travel to countries where the USD can go a long way, these currency effects will have interesting effects on your total return.

Charles Schwab

Due to the complicated nature of foreign exchange and their impacts on companies, it is important to assess every company on an individual basis. However, as long as the company reports in an alternate currency from the USD, investors can purchase assets at a discount. Also, companies themselves will have changes to their performance, and this can be seen in reports with varying terms such as “constant currency basis” or “forex benefits”. The problem is, the effects only can be reflected in returns if the USD becomes weak again in the future. While currencies typically cycle and the USD is expected to weaken eventually, it is important to realize it may take some time and occur at a slow rate (in contrast to the major swings of 2022).

Charles Schwab

Finding Value Abroad

Japan Cases

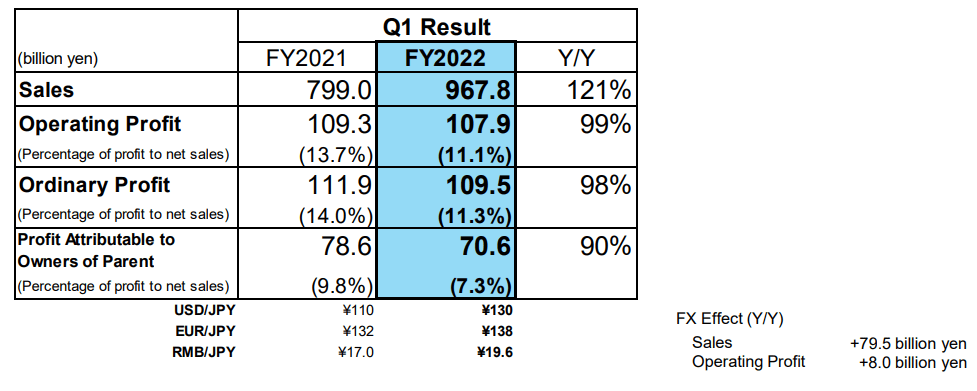

There are two major ways US investors can take advantage of a strong dollar. First, by purchasing foreign assets at a reduced price. Or, by buying foreign exporters, regardless of price, and watch their financial performance increase. Two examples I have discussed before are Japanese rail operator Central Japan Railway (OTCPK:CJPRY) and Daikin Industries (OTCPK:DKILY). For fixed assets or raw goods, imagine you are a tourist visiting the region. Your USD can now buy almost 1.5x as much product or goods as compared to just a year ago. For exporters such as Daikin, their exports are the goods or services being bought up by global businesses. Some companies tick one box, while others tick both boxes, so assess carefully.

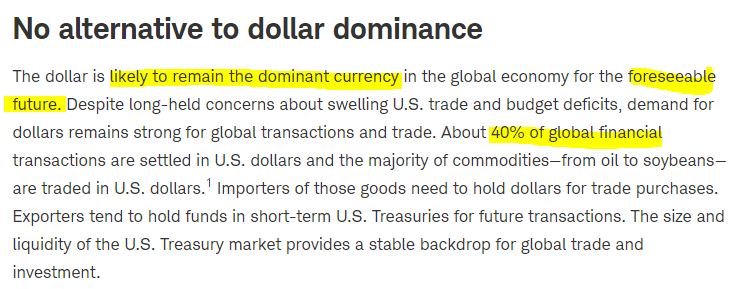

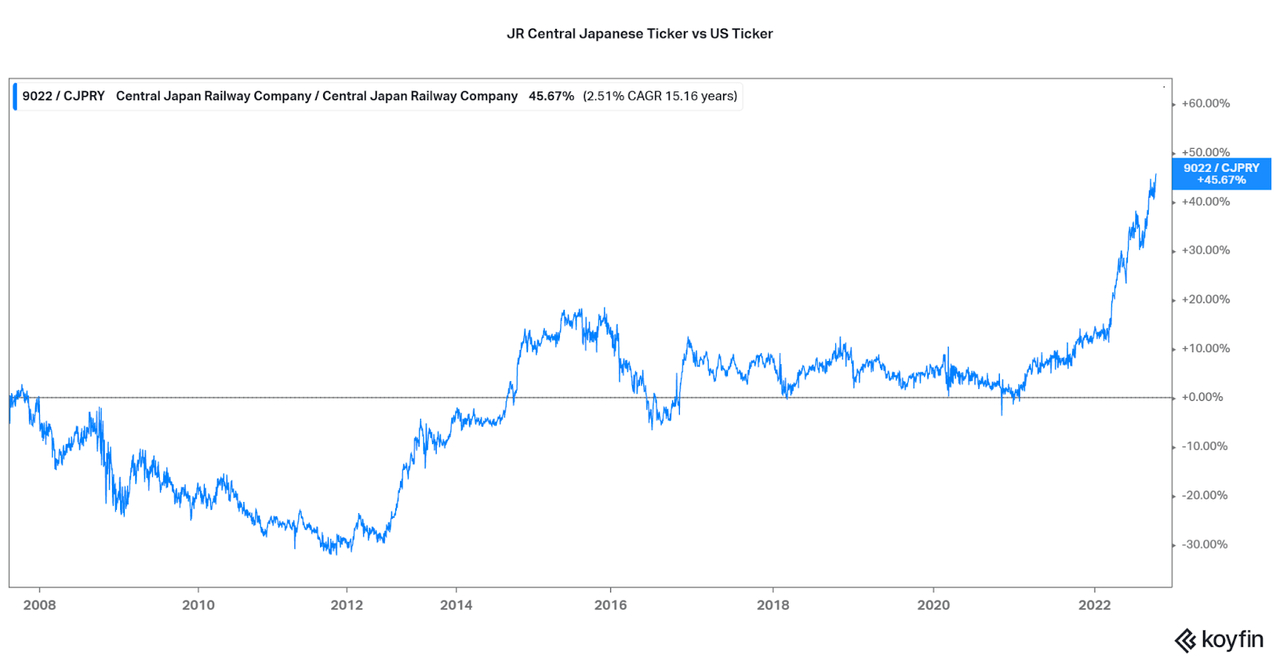

In JR Central’s case, the benefit is US investors can now buy fixed assets such as rail lines and real estate on the cheap (along with a tourism return turnaround play). The chart below highlights the extreme differences in price performance for the two assets: the Tokyo Exchange listed 9022 compared to the US ADR CJPRY. So, over the past year, 9022 has increased by over 45% compared to the US listing, all from forex benefits. Looking at 9022, investors would believe that the price is rising rapidly, but actually the valuation from the US perspective is falling, or at least remaining the same (see ADR price chart below). Therefore, I believe US-based investors are able to take advantage of the exchange rates to buy assets at a bargain price.

Koyfin Seeking Alpha

Not every foreign company can be considered an exporter, so be careful when assessing foreign assets. Along with the raw valuation benefits as discussed above, exporters will also likely outperform US-peers in a similar industry. As of the recent earnings, we can see the benefits of forex as an increase in revenues of 80 billion yen or $550 million USD. Look for the company to continue outperforming other peers in the HVAC market as revenues can be reinvested in further global expansions. See my article for more details.

Daikin Investor Presentation

Japan is one of the countries that looks the most enticing to US investors because of strong export capabilities and Yen weakness compared to most currencies. This is primarily due to the country choosing to keep interest rates low while the rest of the world rises. However, upon economic weakness in a post-inflation era, the Japanese Yen may become a safe haven once again and allow for a normalization of value. A 40% return just from forex benefits seems enticing, but it will only occur the next time the Fed becomes dovish rather than the current hawkish stance.

Other Japanese companies I have covered recently (and have forex benefits) include Seven & i Holdings (OTCPK:SVNDY), NTT (OTCPK:NTTYY), Sony (SONY), Nippon Steel (OTCPK:NPSCY), Nippon Prologis (PLD), Nidec (OTCPK:NJDCY), Sumco (OTCPK:SUOPY), Toshiba (OTCPK:TOSYY), Tokyo Electron (OTCPK:TOELY), and ORIX (IX). These names suit a wide range of investors and have additional unique catalysts, and I would recommend seeing which names may suit your portfolio.

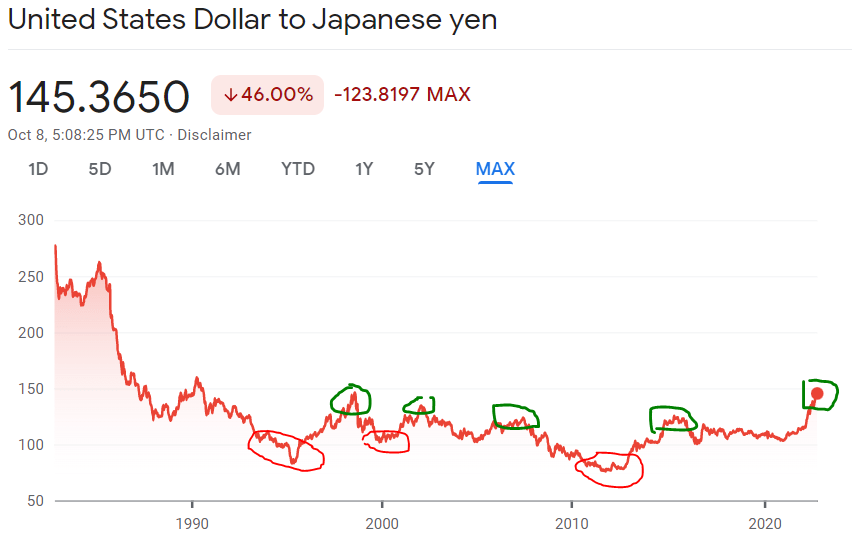

See the image below for the time periods when the Yen performed well (when to sell Japanese assets) vs. when the Yen was weak (when to buy Japanese assets). Since deflation in the 90s, the typical USD to Yen range has been between 100 and 150, with investors looking to buy at 150, sell at 100. Do note that the Yen performs well during US bear markets, so using this method may reduce losses during bear markets.

Google Finance

European Cases

Moving beyond Japan, we will begin with Europe. The problem is that Europe faces additional headwinds such as energy inflation and risky geopolitics that have hurt valuations and performance. There is economic weakness, and some companies are underperforming (EU is not known for high growth either way). However, smart investors can choose high-quality names and find steep discounts that will perform well when markets normalize. Although, forex benefits are a little harder to determine, but essentially think of it this way:

-

USD (strongest) > Euro/Pound > Yen (weakest)

Therefore, all European companies (Western at least) that have significant exposure to the US are set to perform well. Unfortunately, very few European companies gain the majority of revenues abroad. This prevents the full USD to Euro benefit of 20% YoY from applying to the financials, but US investors can still buy assets on the cheap.

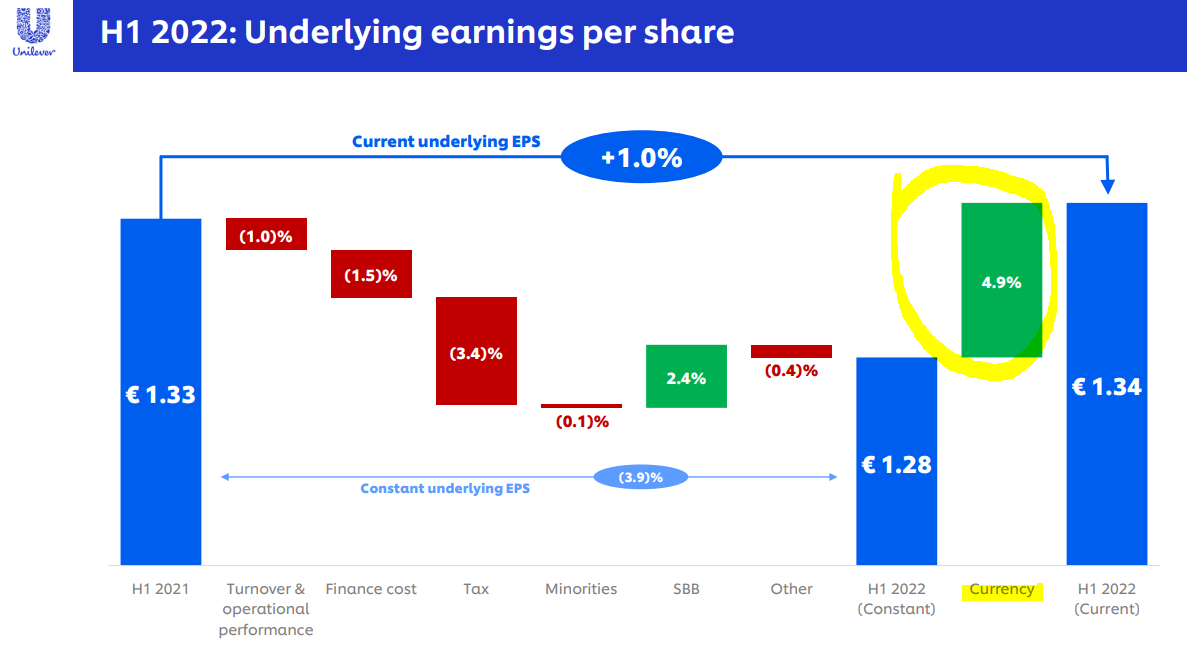

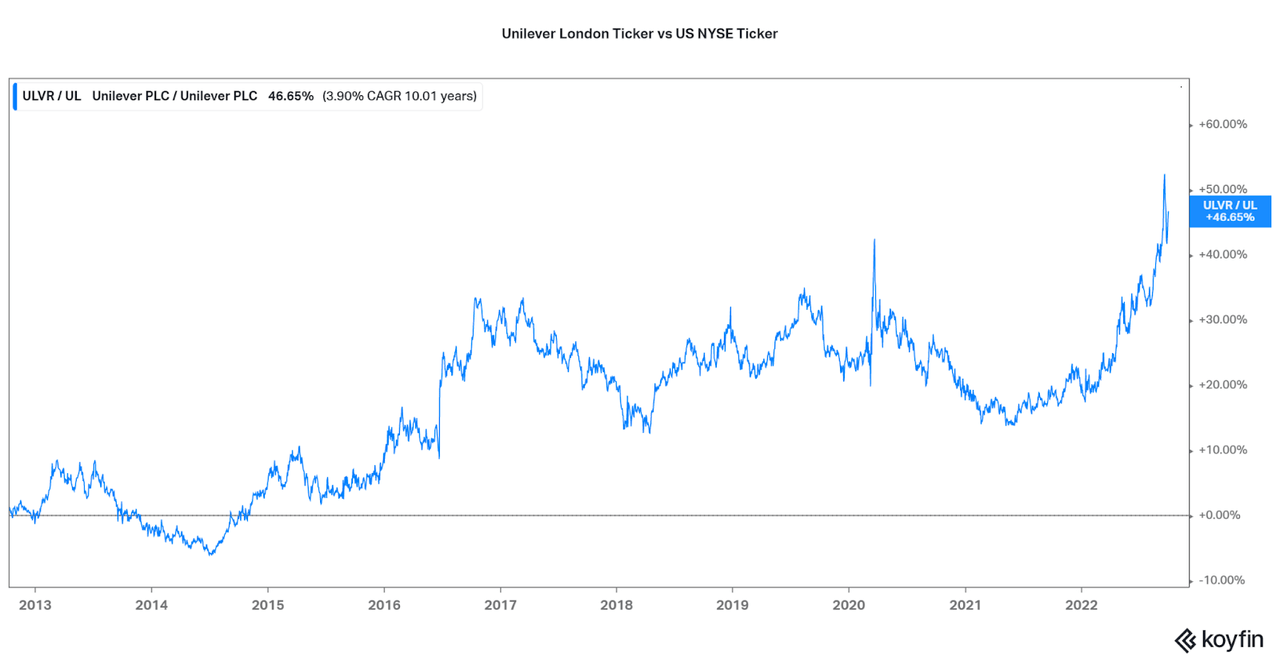

I will use UK-based Unilever (UL) as an example. The company has global sales so there is a tug-of-war between the forex benefits, currently at a 5% increase in earnings for the first half of 2021. However, the London exchange ticker’s price has outperformed the US ADR by over 20% over the past year. This means that US investors have a free 20% discount.

Unilever H1 2022 Investor Presentation Koyfin

As you can see, ULVR has outperformed UL by ~20% over the past year, almost in line with the rate of inflation. However, looking at the actual ticker price, ULVR has risen ~2% over the past year while UL has fallen ~18%. This is how US investors gain a discount because if currencies revert, UL will rise by 20%. The extra 5% earnings growth also helps the company offset their current decline in earnings for this year, and investors may see that forex benefits may match or equal new investments. So look at company finances carefully to see if there are any benefits to be found.

Some major holdings with noticeable benefits, either from a discount or export benefits, are as follows:

-

ASML (ASML): One of the main drivers of advancements in the semi industry, ASML is cheap to buy for US investors, but the Euro is relatively flat compared to major customer currencies. Taiwan Dollars (TSMC)(TSM) and Korean won (Samsung)(OTCPK:SSNLF). However, it is nice to be able to buy the tech at a 20% discount.

-

BNP Paribas (OTCQX:BNPQY): French multinational bank, the fourth most systematically important in the world, has seen only a 3% increase in earnings thanks to currency benefits, but is at a 20% price discount for the US ADR compared. Avoid Swiss banks that do not have forex benefits due to the USD to Swiss Franc.

-

Novo Nordisk (NVO): Pharma companies are global in nature, perfect for gaining forex benefits. NVO is trading at a 20% discount YoY. Other pharmas to consider include AstraZeneca (AZN) and GSK (GSK).

-

Genmab (GMAB): A Danish company that licenses out their expertise in monoclonal antibodies to other drug developers. Operates in Euros and is at a 20% discount.

-

SAP (SAP): Software exporters at 20% discount YoY, with enough global sales to see some forex benefits. Reports in Euros, while Accenture, Atlassian, and others operate in USD, so be careful. North American revenues are seeing a 15% YoY benefit just from currency differences.

-

Continental Aktiengesellschaft (OTCPK:CTTAY): Tire and Auto parts manufacturer with 50% of revenues from Europe, 20% from North America. Also at a 20% forex discount, 0.23x price to sales!

-

Sofina Société Anonyme: US Investors can buy this Belgian holding company at a nearly 20% discount. The current USD valuation of $6 billion corresponds to a NAV of $9.6 billion USD.

-

Metso Outotec Oyj (OTCPK:OUKPY): Global mining tech supply company based in Finland, operating with Euro. However, due to the nature of sales, current reports indicate that currencies are having a ~2% impact on earnings.

-

Industrials: Unfortunately, as shown with the Metso Outotec case, commodities tend to operate in USD. Linde (LIN) is German, but has negative currency benefits of ~2-5%. Irish names such as Eaton (ETN), Trane (TT), and Johnson Controls (JCI) have no benefit as they still operate with USD and are valued in USD. May see negative currency benefits as well with global operations.

Going Further Afield For Major Exporters

Emerging markets and other major nations are a mixed bag in terms of their forex benefits. However, the same theories apply when considering your global investments. Many emerging markets see continual weakening of their currencies due to high inflation compared to the US, so those companies that export goods to North America or Europe will have strong performance. Here are a few examples.

Colombia – Tecnoglass (TGLS) is a major exporter of architectural glass and primarily has sales in the US. The Colombian Peso has continually weakened compared to the USD, so TGLS can have exporters advantage to reinvest in operations cheaply in their home nation. Performance has been great over the years and expansions into the homebuilding markets will allow for even more growth. I still keep them as a small diversifier in my portfolio.

XE.com Seeking Alpha

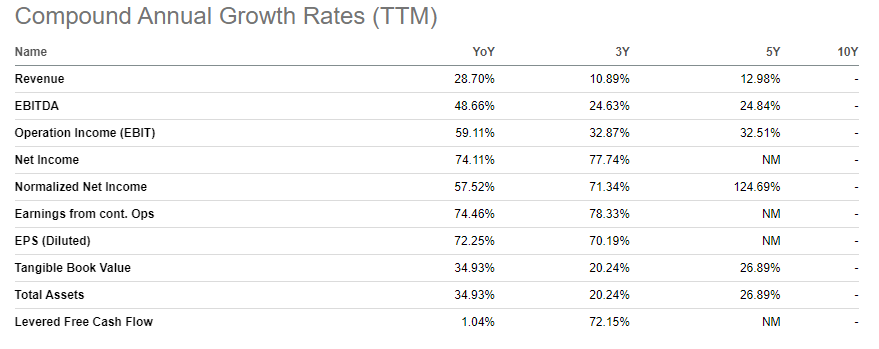

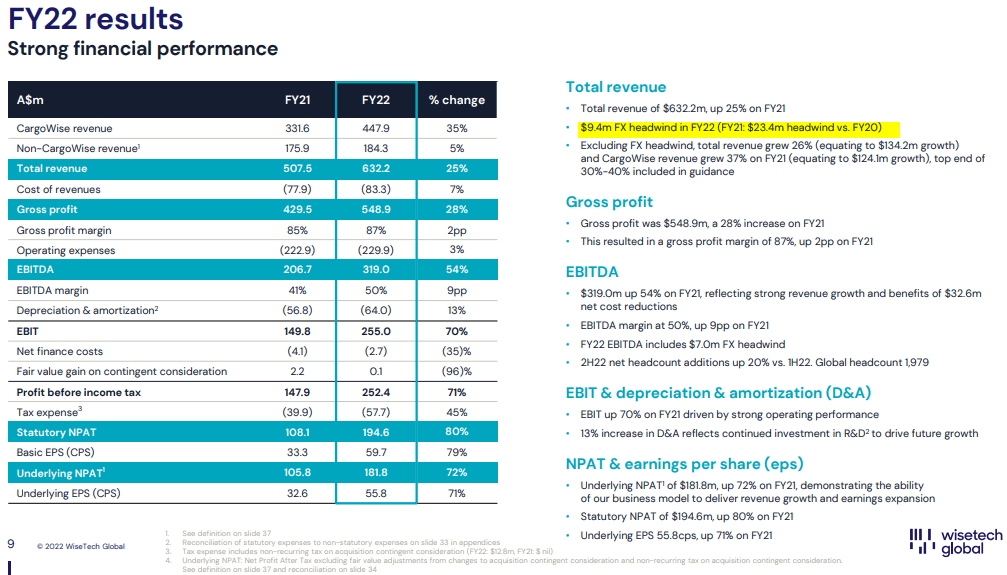

Australia – WiseTech Global (OTCPK:WTCHF) is a supply chain software developer that is growing fast and extremely expensive. Through the first half of calendar year 2022, no forex benefits were seen, but the AUD has weakened significantly over the past six months. Therefore, I expect forex benefits moving forward, in the few % points, compared to steep headwinds in years prior. Combined with a current 10% (and growing) discount in purchase price for US investors, I believe that the investment is becoming tantalizing. Certainly a holding to perform further research on.

WiseTech Investor Presentation

Other Areas to Think About

-

Mining Companies: BHP (BHP) and Rio Tinto (RIO) operate with a wide range of currencies but current forex benefits are seen to be offsetting inflationary costs (BHP presentation). Look to buy a range of foreign mining royalties or assets at a discount.

-

Real Estate: Look past US REITs and buy asset companies in other companies. Companies such as Eurozone Vonovia SE (OTCPK:VONOY), Australian Goodman Group (OTC:GMGSF), and Singaporean City Developments Limited (OTCPK:CDEVY) allow investors to buy a range of real estate at a discount. Check under the sector “Real Estate Developers” for more foreign listings than under “REIT” sectors.

- ETFs: For those not wanting to pick individual stocks, I highly recommend investing in foreign ETFs as an easy, lower risk way to leverage forex swings. While I would reduce exposure to the S&P 500 (SPY)(VOO), ETFs such as Vanguard FTSE Developed Markets (VEA) are a great way to invest in many of the assets I have discussed in this article. The past 10 years of weak performance (operationally and forex) are set to change moving forward, so keep that in mind (so don’t compare poor historical performance, buy the assets while they are cheap). Also, individual countries have ETFs to take advantage with such as iShares MSCI Japan (EWJ), France (EWQ), Germany (EWG), and Australia (EWA).

- Currency Trading: There are also funds that track the currencies directly, and these can be used the same way as holding cash in varying denominations. Major funds include the Invesco Yen (FXY) and Euro (FXE) trusts.

Conclusion

While forex is not a direct means to a strong investment end, savvy investors can take advantage of these economic cycles. There is also no need to be a day trader, as long-term investors can use the topics I covered to build diversified portfolios that may outperform the market. But, don’t forget all the other factors that make great investments beyond swings in currencies.

It will be important to assess the pros and cons for each company, but if you (as a presumably US-based investor) already favor certain foreign holdings, it may be time to load up on those rather than US-based holdings. Also be careful of the effects of a strong dollar on US companies as exporters such as Apple (AAPL) or Microsoft (MSFT) may face weakness. Some companies also spend significant risk management in regards to the management of forex cycles, and so watch for risks to be mitigated with larger firms.

I did not even come close to covering all the strong assets that are out there, but feel free to share your favorite global assets below. Also, remember that foreign exchange benefits rely on a return to prior levels, but if secular changes in interest rates occur, these benefits may not be lasting. However, the past 20-30 years had economic patterns for a reason, and it is unlikely that 20th century risks may return (stagflation, Japan boom and bust, etc.). The reasons why are the topic of other articles, but it is a topic to keep in the back of the mind.

Thanks for reading.

Be the first to comment