Cindy Ord

This much is clear: investors aren’t taking very many chances right now. With volatility back at all-time highs, and with fears of an ultra-hawkish Fed deeply coloring sentiment, growth stocks across the board have seen their stock prices slashed.

Few companies are as affected by this mood swing as Robinhood (NASDAQ:HOOD). Not only is Robinhood’s stock itself impacted by investors’ risk-off attitude but the sharp devaluation in asset prices and general unease in the markets has also sapped trading activity on its platform. Across the board, Robinhood’s key trading segments across equities, options, and cryptocurrencies have seen massive y/y declines.

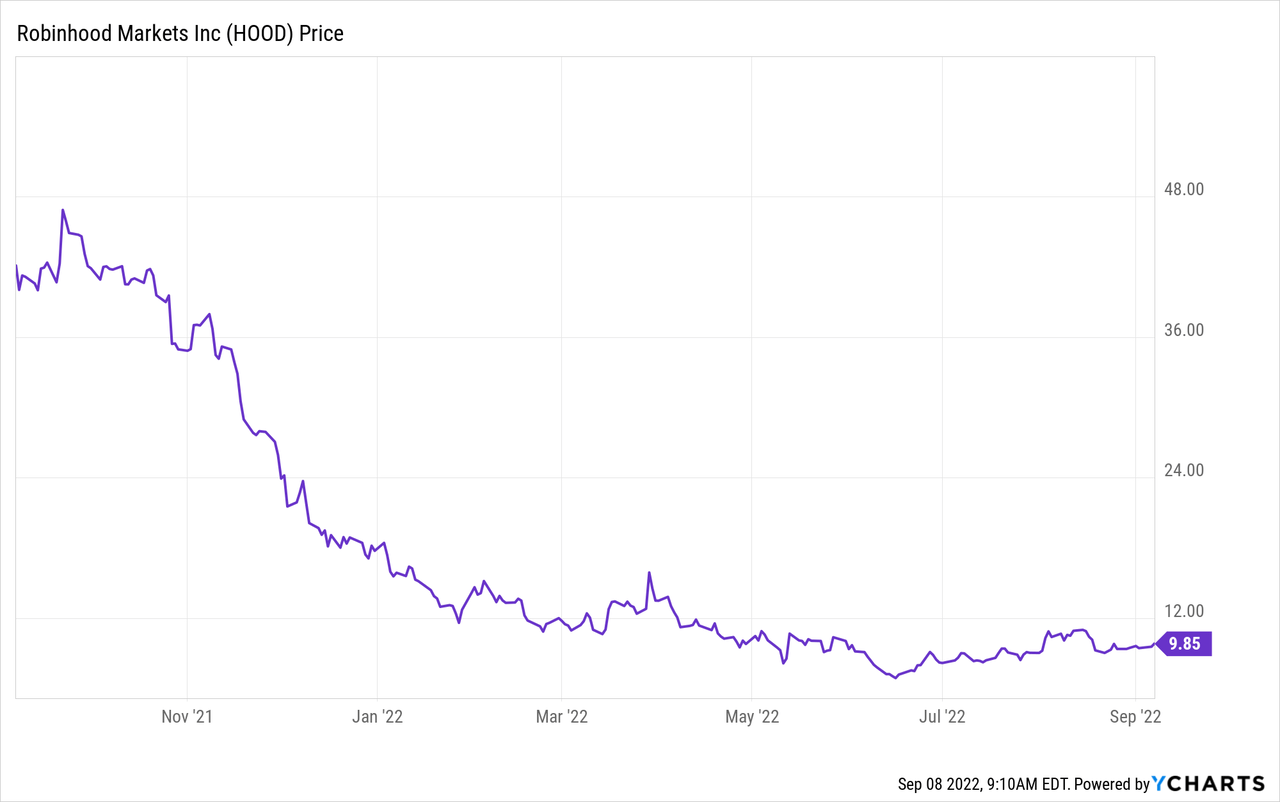

Accordingly, shares of Robinhood are down nearly 50% year to date. And over the trailing twelve months, the stock is down by a jaw-dropping 75%. Many investors are now wondering: is Robinhood going to flame out as quickly as it was built?

I’ve given the same advice when it comes to real estate stocks like Zillow (Z) and Compass (COMP) – after a decade of relatively sanguine behavior in all asset markets since the ’08 recession, we have to remember now that markets are volatile – but that doesn’t mean we’ll be in a downtrend forever. The question we have to ask ourselves is simple: will people continue to trade stocks and cryptocurrencies (namely, the young millennials and Gen Z customers who make up the bulk of Robinhood’s users), and will interest in the markets resume once we’re out of the current crunch? Most rational people would say yes.

For that reason, I remain bullish on Robinhood, and I’ve continued to add to my position in the stock as it continues to drop. Though Robinhood requires some patience as it has a direct correlation to how the broader market is doing, I admire that the company is turning a laser eye on its expenses – slashing not only marketing spend but also its operating headcount – to enable it to survive through this trough period. At the same time, the company is not sacrificing innovation, continuing with impressive product rollouts including crypto wallets and IRA accounts that will continue to broaden its investor base.

Here is my long-term bull case for Robinhood:

- Robinhood is dominating in the millennial/Gen Z demographics that will soon overtake the bulk of worldwide wealth. Traditional brokerages are still catching up to Robinhood’s popularity. Market cycles have always occurred and will continue to occur; there will be periods of frenzied trading and there will be periods of calm. But over the arc of time, Robinhood’s share of market activity will grow.

- Product innovation never stops. Part of what makes Robinhood so appealing is that it’s often first-to-market (or at least, first to popularize) many new key features. Crypto trading, cash advances, and easy access to low-cost margin were some of Robinhood’s key defining advantages.

- Retirement accounts. More to the point above: it’s needless to say that retirement account balances represent a large swath of global wealth. Robinhood is very near rolling out new IRA accounts, which will hopefully bring a fresh boost to its assets under custody.

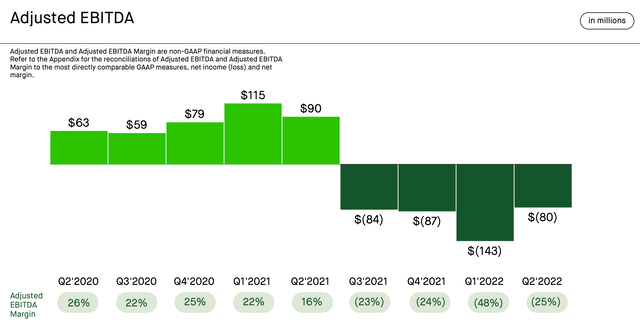

- Profitability in mind: When trading volumes were high in 2021, Robinhood generated positive adjusted EBITDA every quarter. Though adjusted EBITDA has now swung negative, the company is making targeted structural adjustments to its workforce to enable it to maintain profitability going forward. While the down cycle in the markets won’t last forever, the belt-tightening and operational discipline that Robinhood is exercising now will certainly sustain.

Valuation is also quite modest. At current share prices near $10, Robinhood trades at a market cap of just $8.67 billion. After we net off the $13.58 billion of cash and user cash on Robinhood’s latest balance sheet against $5.79 billion in funds owed to users, Robinhood’s resulting enterprise value sits at just $880 million. This is less than 1x next year’s Wall Street consensus revenue of $1.84 billion (+36% y/y; data from Yahoo Finance).

Don’t count Robinhood out just yet: trust the app’s popularity among younger consumers as well as its history of profitability during more active trading times. Stay long here.

Q2 download

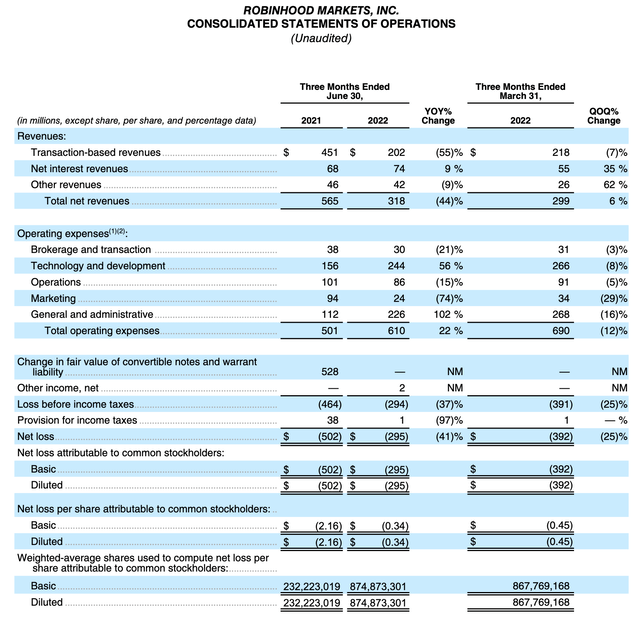

Let’s now go through some of Robinhood’s latest quarterly highlights in greater detail. The Q2 earnings summary is shown below:

Robinhood Q2 results (Robinhood Q2 earnings deck)

As shown in the chart above, Robinhood’s Q2 revenue dropped by a stunning -44% y/y to $318 million, slightly missing Wall Street’s expectations of $320.5 million. The major driver here was a -55% y/y decline in transactional revenue. By trading type, here’s how that breaks down:

- Options: down -32% y/y to $113 million

- Crypto: down -25% y/y to $58 million

- Equities: down -44% y/y to $52 million

Needless to say, Robinhood doesn’t generate too much revenue from “straight equities” and is counting on a crypto rebound for its recovery. In slightly better news, however, Robinhood’s net deposits grew 22% y/y in Q2, and rising interest rates and spreads helped the company’s net interest revenue grow 9% y/y to $74 million.

Vlad Tenev, Robinhood’s CEO, notes that many of its younger customers are experiencing a recession and a market downturn for the first time, which has put an extra chill on trading activity. Per his prepared remarks on the Q2 earnings call:

For our customers, many of whom are younger, it looks like they may be facing a recession for the first time in their adult lives if the last two quarters of negative GDP growth or any indication.

Customers are seeing this high inflation along with high interest rates, bear markets and stocks and a crypto winter. And this all adds up to less money to spend and therefore, less to save and invest. You can also see this reflected in the drop in assets under custody that we reported. Despite strong net deposits of over $5 billion in Q2, you can see that our assets under custody dropped.

And this shows that customers have been hurt by devaluation across crypto currencies and growth stocks in particular. And while we can’t control the macro environment, we’ve been hard at work building products to help our customers navigate it. Products like the Cash Card, Stock Lending and high yield on their uninvested cash.”

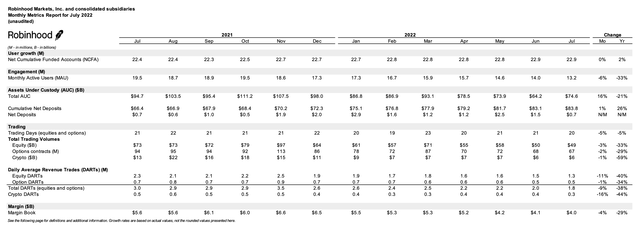

The company’s user metrics for July, which it publishes monthly, show that total funded accounts remained flat to June, but that trading engagement (as measured by MAUs) declined. We expect similar trends to play out for August, which saw tremendous volatility driven by the Fed’s hawkish rate statements:

Robinhood July metrics (Robinhood press release)

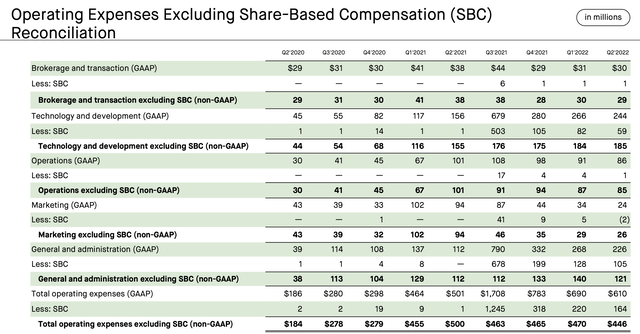

This being said, we are encouraged by the company’s commitment to cost discipline. As shown in the chart below, most of Robinhood’s core opex categories are down y/y, especially marketing, which it slashed by more than two-thirds. Overall, opex excluding stock comp of $446 million is down -11% y/y:

Robinhood Q2 opex trends (Robinhood Q2 earnings deck)

Robinhood’s adjusted EBITDA loss of -$80 million also improved sequentially versus Q1:

Robinhood adjusted EBITDA (Robinhood Q2 earnings deck)

In August, the company announced that it was laying off 23% of its global workforce of 2,600. The company notes that these moves, enacted to help Robinhood stay solvent through an extended market crunch, have not resulted in sacrificing any products or features on the company’s roadmap.

Key takeaways

I continue to view Robinhood as an iconic app that has clout with the next generation of investors, who will resume trading activity as the markets cycle back upward. The issues that Robinhood is facing are common across the entire brokerage industry (and by the way, Robinhood remains the most-downloaded brokerage in the U.S.). Don’t lose sight of the long term here and use the dip as a buying opportunity.

Be the first to comment