Baris-Ozer

Rental properties have been a proven method for achieving early retirement. Numerous early retirement and wealth-building websites highlight the virtues of investing in real estate rental properties as a great way for rapidly compounding wealth and building a stream of passive income to fund the living expenses of an early retiree.

Given that they are so easy to finance with long-term fixed rate mortgage debt, rental properties are fairly easy to acquire without having to save up hundreds of thousands of dollars first. Furthermore, until this past year mortgage debt was extraordinarily cheap with interest rates firmly in the low single digits over the past decade thanks in large part to the Federal Reserve buying up trillions of dollars in mortgages. As the Mises Institute reported earlier this year:

Runaway house price inflation continues to characterize the U.S. market. House prices across the country rose 15.8% on average in October 2021 from the year before. U.S. house prices are far over their 2006 Bubble peak, and remain over the Bubble peak even after adjustment for consumer price inflation…Unbelievably, in this situation the Federal Reserve keeps on buying mortgages. It buys a lot of them and continues to be the price-setting marginal buyer or Big Bid in the mortgage market, expanding its mortgage portfolio with one hand, and printing money with the other…The Federal Reserve now owns on its balance sheet $2.6 trillion in mortgages. That means about 24% of all outstanding residential mortgages in this whole big country reside in the central bank, which has thereby earned the remarkable status of becoming by far the largest savings and loan institution in the world.

Thanks to this artificially cheap debt, it became remarkably easy to buy a rental property with 75-80% debt and quickly turn a mid-single digit cap rate into a double digit cash on cash yield. Then, there was the tremendous appreciation that single family homes experienced over the past decade thanks to a combination of the cheap mortgage debt fueling strong investment demand for properties with significant international buyer interest as well as the Airbnb, Inc. (ABNB) boom and chronic undersupply in some markets. As a result, rental properties generated tremendous returns for investors over the past decade.

However, moving forward we think that high-yield stocks are a better investment vehicle than rentals for achieving early retirement. In this article, we explain why and also share some of our top picks of the moment.

#1. The Residential Real Estate Boom Is Over

The biggest reason why we think that high-yield stocks will outperform rental properties moving forward is simply that the residential real estate boom is over. In particular, rental properties are no longer the lucrative cash cows that they used to be.

First and foremost, U.S. housing is at historically unaffordable levels. Between prices hovering near all-time highs and mortgage interest rates soaring to levels not seen in years, the cost of buying homes – whether with cash or with a mortgage – is more burdensome than ever. This is particularly pronounced for investment properties given that rents have not risen in-line with interest rates or even prices in many markets. Furthermore, interest rates on rental properties are typically higher than they are on owner occupied homes. As a result, gone are the days of buying an investment property with 20 percent down and instantly juicing the cash flow yield into the double digits. Now, investors are fortunate if they can simply achieve cash flow neutrality on a rental property when financing it with 75-80% debt.

This means that rental properties are no longer the great cash flow machines that investors looked to for amassing a passive income stream quickly. Furthermore, with buyers being forced out of the market due to sky-high interest rates and purchase prices, appreciation is also decelerating rapidly and in fact is beginning to lead to falling housing prices in many markets, with further declines being predicted for the coming years.

This means that rental property buyers today will be suffering from the double-edged sword of lower appreciation rates alongside a weaker cash flow stream. As a result, now is not a very good time to be using rental property real estate as the vehicle to achieve early retirement.

#2. High-Yield Stocks Are Truly Passive Income

Another reason why high-yield stocks are so much better than rental properties is simply due to the fact that stocks are truly passive investments whereas owning rental properties – especially a portfolio of them – is more akin to owning and operating a business. Between the triple T’s (tenants, toilets, and trash), the legal and personal liability risks, and the less efficient transaction process, land-lording can be a tremendous hassle. Yes, you can hire a property manager to help take some of this trouble off of your hands, but in the process you are forfeiting between 6-10% of our revenue to pay them. As a result, your cash flow will take a pretty big hit and this extra expense may tilt the risk-reward against you, especially in less favorable real estate markets like the present.

In contrast, stocks come with no tenants, toilets, trash, legal or personal liability, and the transactions are highly efficient with commission free trading that can be performed instantly at the click of a mouse. If you make an investing mistake, macro conditions simply move against your investment, or you simply need to instantly liquidate a part of your investment to pay for an emergency, you can do it with little difficulty. In contrast, rental properties are not easily divisible and are much more costly and timely to transact. As a result, once you have built a passive income machine from your stock portfolio, you can kick back, relax, and enjoy retirement while letting the dividends flow into your account with only periodic monitoring and portfolio adjustment required.

#3. Many High-Yield Stocks Are Attractively Priced

The final reason why we prefer high-yield stocks to rental properties at the moment is simply due to relative value. While rental properties are likely to deliver very underwhelming total returns moving forward, certain high-yield stocks look attractively priced with double digit annualized total returns likely.

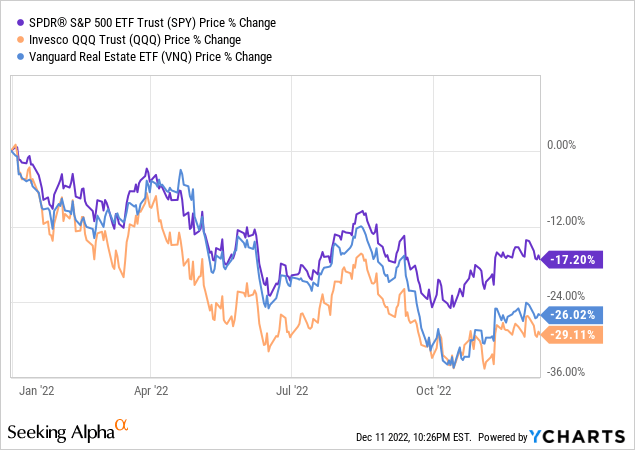

Thanks in large part to the significant declines in the stock market this past year, with major pullbacks in the S&P 500 (SPY), Nasdaq (QQQ), and REITs (VNQ), there are numerous attractive opportunities to buy high-yield stocks at compelling values:

Here are some of our favorites:

The REIT sector as a whole is very attractively priced right now, and we especially like triple net lease REITs like Realty Income (O), W.P. Carey (WPC), Spirit Realty Capital (SRC), and Essential Properties Realty (EPRT) due to their attractive combination of current yield, consistent annual growth, and recession resistance. Outside of triple net lease REITs, Simon Property Group (SPG) looks like a compelling value and for investors with more risk tolerance, Medical Properties Trust’s (MPW) dividend yield looks mouth-watering at the moment.

We also see significant opportunity in bank stocks. While the likes of JPMorgan (JPM) and Wells Fargo (WFC) look undervalued, we find even more value in the off-the-beaten path parts of the market, including ~8% yielding New York Community Bancorp (NYCB), whose yield is well covered by earnings and whose management just completed a merger that renders the business more immune to interest rate swings while retaining its recession resistant posture. You can read our recent exclusive interview with the company here.

A third area where we are seeing a lot of opportunity at the moment is in alternative asset managers. Global blue chip Blackstone (BX) looks quite appetizing after its latest sell-off, while Latin American powerhouse Patria Investments (PAX) just held its investor day and guided for a 15-20% fee related earnings per share CAGR over the next several years along with what should be an average dividend yield on current cost of ~10%. You can read our recent exclusive interview with the company here.

Last, but not least, we think that energy midstream (AMLP) remains very attractively priced. For those who do not mind dealing with the K1 tax form, our top picks are Energy Transfer (ET) and Enterprise Products Partners (EPD) with high single digit to double digit forward yields, investment grade balance sheets, and solid growth profiles. For those who wish to avoid the K1, Kinder Morgan (KMI) looks particularly attractive to us at the moment.

Investor Takeaway

While rental real estate has been a great way to pursue the early retirement dream over the past decade, investors should probably look elsewhere in the current environment. Thanks to a sharp pullback in the stock market this year, high-yield stocks look quite attractive at the moment. We shared several of the most promising sectors and opportunities of the moment and we are investing in these and a multitude of other similarly attractive opportunities at High Yield Investor, including investment grade preferred stocks, undervalued high quality closed-end funds, and numerous high-yielding equities across numerous sectors.

Thanks to our approach to investing in high quality high-yielding stocks in conjunction with opportunistic capital recycling over the past two years since launching our portfolio, we have managed to significantly outperform the market and make significant progress in building up a passive income stream thanks to our current 7.2% weighted-average dividend yield.

Be the first to comment