marchmeena29

Brief Overview of LendingClub’s Q3 report

Before we go through LendingClub’s (NYSE:LC) Q3 report, I would like to point out that it pales in comparison to SoFi’s (SOFI) Q3 report, but the two companies have very different valuations, and we continue to own both of them within TQI’s Moonshot Growth Portfolio. While LendingClub’s Q3 results (and guidance) may not match up to SoFi’s performance, they were solid.

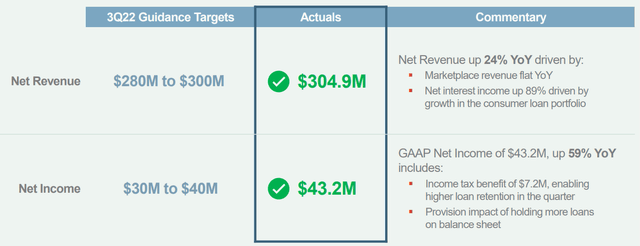

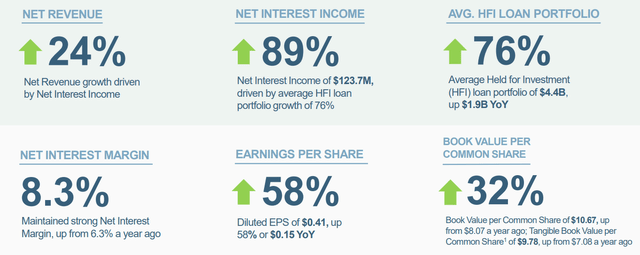

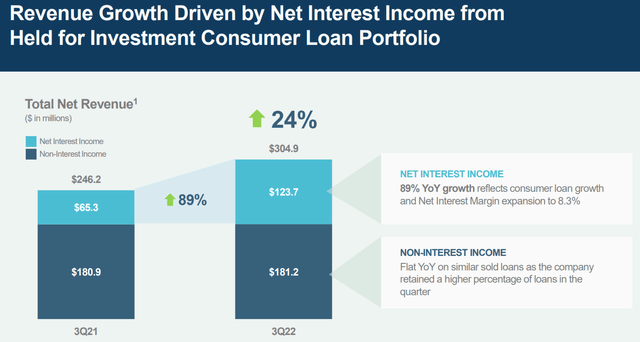

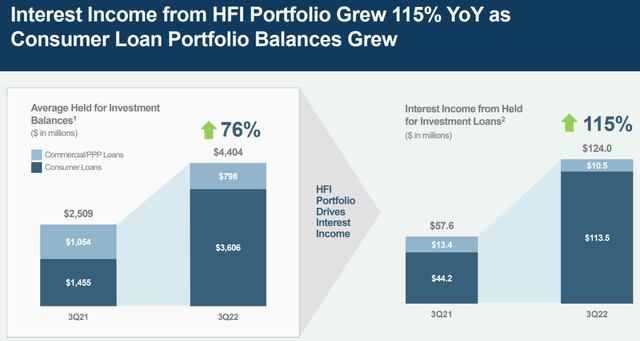

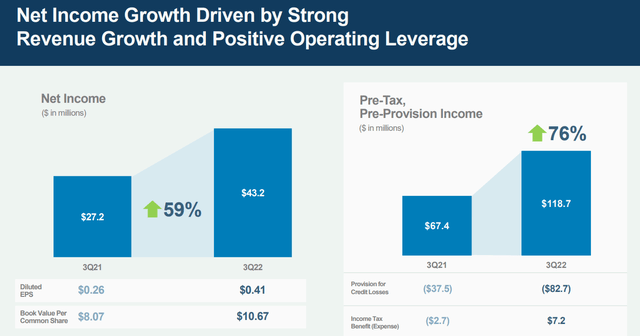

In Q3, LendingClub reported net revenues of $304.9M (up 24% y/y) and net income of $43.2M (up 59% y/y). With marketplace revenues staying flattish y/y in Q3, an 89% y/y rise in net interest income drove solid top-line growth for LendingClub this quarter.

LendingClub Q3 Earnings Presentation LendingClub Q3 Earnings Presentation

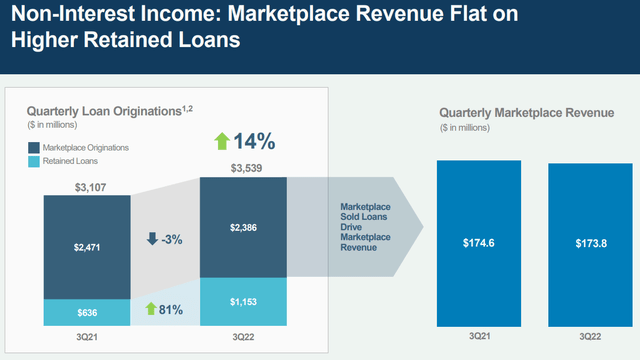

The significant 89% y/y jump in LC’s net interest income resulted from the company holding onto a greater share of loans originated, as evidenced by the 81% y/y jump in retained loans. In Q3, marketplace revenues for LendingClub were down 15% q/q and flat y/y, which reflects weak investor demand for loans in a rising interest rate environment.

LendingClub Q3 Earnings Presentation LendingClub Q3 Earnings Presentation

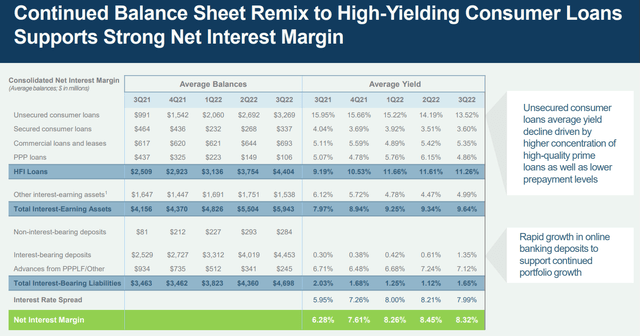

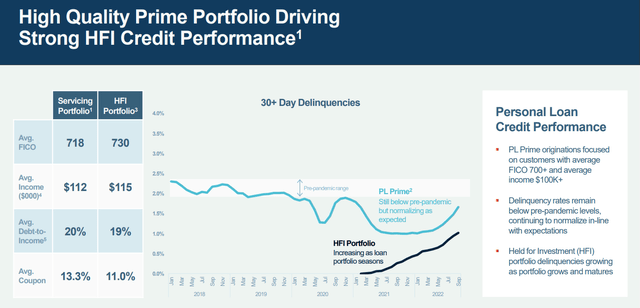

In the face of a challenging macroeconomic environment, LendingClub is shifting its loan book towards lower-risk consumers (higher FICO scores: 730+), reducing the average yield in the process. Furthermore, LendingClub’s interest-bearing deposits ($4.45B at the end of Q3) saw a significant jump up to 1.35% from 0.81% in Q2 2022. These dynamics are pressurizing LendingClub’s Net Interest Margins, which came in at 8.32% this quarter.

LendingClub Q3 Earnings Presentation LendingClub Q3 Earnings Presentation

As per LendingClub’s management, the company is prioritizing credit quality over lending quantity. And this strategy is clearly visible in LendingClub’s data.

LendingClub Q3 Earnings Presentation LendingClub Q3 Earnings Presentation

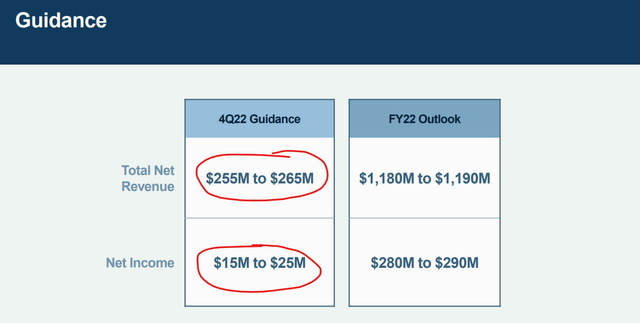

Being a digital bank allowed LendingClub to deliver solid top-line and bottom-line growth in Q3; however, the slowdown in marketplace revenues is set to continue in Q4, with net revenue expected to decline ~5-8% y/y to a range of $255-265M.

LendingClub Q3 Earnings Presentation

In the context of LendingClub’s growth story, a quarter with negative growth rate is uninspiring (and somewhat troubling), but the company being risk-averse in the face of a highly uncertain environment is the right way to manage the business in the long run. The rising interest rate environment is unfavorable for LendingClub, and a stabilization in interest rates (or a FED pivot [pause or rate cuts]) should become a significant tailwind for its business in 2023. LendingClub’s valuation (forward P/E of 7x) remains undemanding, and the company has a clear path to grow revenues (and earnings) at a healthy clip for several years to come.

Implications on Upstart (From SoFi And LC)

Upstart (UPST) is set to report earnings on 8th November 2022, and if I am reading it correctly, SoFi and LendingClub results do not bode well for Upstart. SoFi added ~$2.8B in Personal Loans to its balance sheet, which was nearly equal to the personal loans SoFi originated in Q3. This means SoFi retained all the personal loans it originated in this quarter. On the other hand, LendingClub retained ~33% of its loan originations in Q3 (higher than the management guidance of 20-25%) and registered a 15% q/q drop in marketplace revenues.

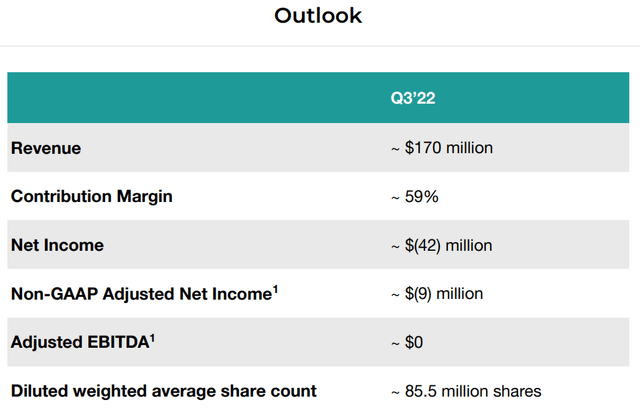

Now, Upstart has guided for a sharp decline in revenue for Q3; however, considering SoFi and LendingClub’s lending activity (and lack of selling of loans), I believe that the investor appetite for loans has probably gotten worse this quarter as yields have continued moving higher. Unlike SoFi and LendingClub, Upstart doesn’t have low-cost deposits to rely upon (to prop up its lending activity), i.e., it lacks balance sheet power. And this exposes Upstart’s business model to further contraction in lending volumes (and, by extension, revenue).

Upstart Q2 2022 Earnings Presentation

Realistically, Upstart could fall short of the lowered expectations for Q3, and the guidance for Q4 may further disappoint investors, leading to a further decline in the stock price. Hence, I suggest the implementation of option hedges to guard against a significant drop in the stock. As you may know, I am currently hedged with a PUT debit spread ($25/$12.5) (more details here). Going into this earnings report, I am more nervous than excited, and I will not be deploying more capital in this counter before internalizing Q3 results and management’s outlook for the business going into 2023.

Thanks for reading, and happy investing. Please let me know if you have any thoughts, questions, or concerns in the comments section below.

Be the first to comment