Andrii Yalanskyi/iStock via Getty Images

Author’s note: This article was released to CEF/ETF Income Laboratory members as part of our CEF Weekly Roundup on November 2nd, 2022. Please check latest data before investing.

Eaton Vance equity CEFs cut distributions

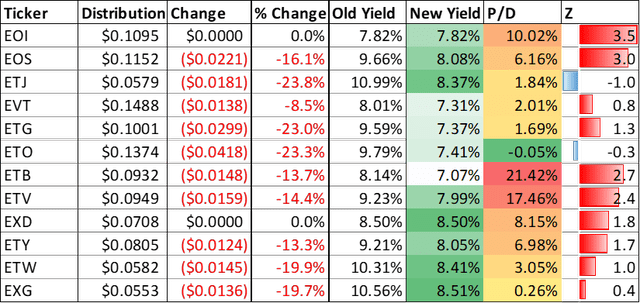

Fresh off the presses, is the announcement of Eaton Vance equity CEF distributions for November, which includes a number of cuts. I’ve made a separate table summarizing the distribution changes below:

Tickers mentioned: (EOI) (EOS) (ETJ) (EVT) (ETG) (ETO) (ETB) (ETV) (EXD) (ETY) (ETW) (EXG)

Of the 12 equity CEFs, 10 of them made cuts, ranging from -8.5% for EVT to -23.8% for ETJ. The reason for the cuts is simple: since equity funds with managed distribution plans rely mostly on capital gains to fund their distributions, in a bear market these gains are unavailable therefore these funds have to reduce their payouts in order to conserve NAV. Nick explained this previously in more detail here: Income Lab Ideas: Analyzing Equity CEF Distribution Sustainability.

Despite our service being focused on income CEFs and ETFs, I’m actually quite agnostic to distribution cuts and boosts. The reason is that the distribution comes from the NAV, whether it is “earned” or “unearned”, and hence should not have an effect on total return at least in principle. (This is why one of our mantras at the Income Lab is: don’t just look at the yield!). However, investors often behave irrationally with regards to the yield; for example, bidding up funds with high and stable distributions to unwarranted premiums.

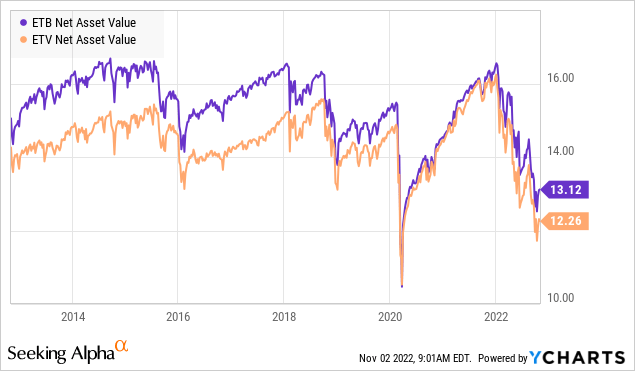

The two most expensive funds in the Eaton Vance suite right now, ETB (+21.42% premium, -13.7% cut) and ETV (+17.46% premium, -14.4% cut), have kept their distributions stable since the Great Financial Crisis in 2008. Therefore, these two funds may see heightened selling pressure over the next couple of days as investors process this surprise. Our Taxable Income portfolio owns ETG (+1.69% premium, -23.0% cut) and ETW (+3.05% premium, -19.9%); these are not as expensive relatively speaking but may still see valuation pressure as well due to their cuts. The portfolio also owns EXD (+8.15% premium) as well which did not reduce its distribution. EXD might fall in sympathy with the rest of the suite, or alternatively, it might catch inflows from sellers of the other funds who want to switch to EXD for its higher yield.

It is interesting though that these funds did not cut during the bear market of 2020, despite the NAV declining to even lower levels than they are now. This could be because of the managers (correct) belief that the COVID crash was only temporary, but that the current bear market will last longer and hence the need to preserve capital by reducing distribution payouts.

Income Lab

What is certain though is that if the current bear market continues, equity CEFs from other fund families will be forced to follow suit and reduce their distributions as well in order to preserve NAV. This is why valuation is so important: an overvalued CEF is likely to suffer a greater decline in price on any negative news such as a distribution cut compared to a less expensive CEF. Remember, don’t just look at the yield!

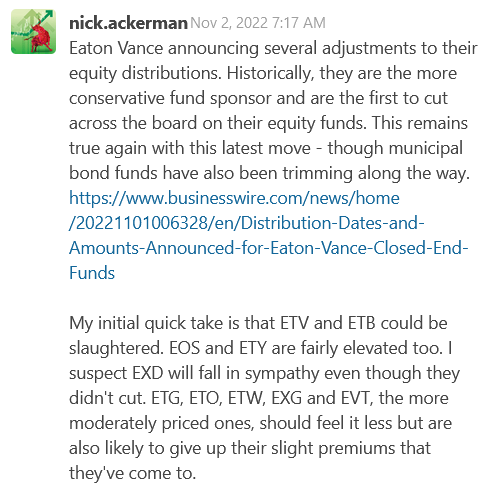

Nick had this to say in the member chat area:

Income Lab

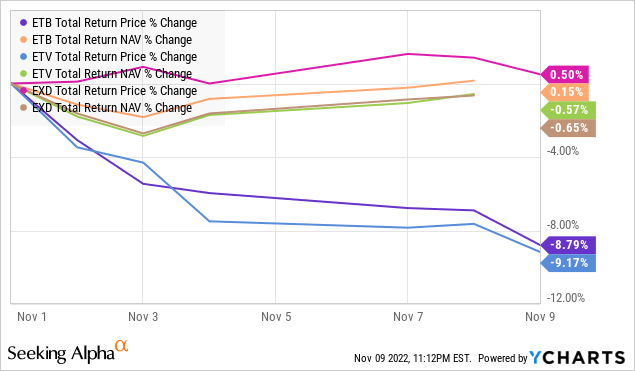

November 9th, 2022 update: As Nick and I expected, ETV and ETB, the two most expensive CEFs among those that reduced their distributions, dropped the most over the last couple of days. Members who acted on our alert could have saved themselves a few dollars by rotating out of ETV and ETB when the news of the cuts first hit the press.

Strategy Statement

Our goal at the CEF/ETF Income Laboratory is to provide consistent income with enhanced total returns. We achieve this by:

- (1) Identifying the most profitable CEF and ETF opportunities.

- (2) Avoiding mismanaged or overpriced funds that can sink your portfolio.

- (3) Employing our unique CEF rotation strategy to “double compound“ your income.

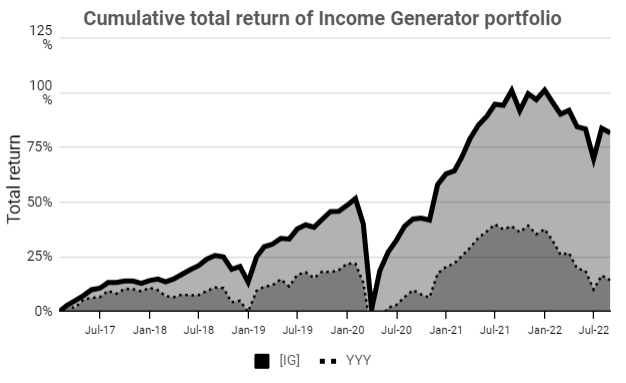

It’s the combination of these factors that has allowed our Income Generator portfolio to massively outperform our fund-of-CEFs benchmark ETF (YYY) whilst providing growing income, too (approx. 10% CAGR).

Income Lab

Remember, it’s really easy to put together a high-yielding CEF portfolio, but to do so profitably is another matter!

Be the first to comment