svetolk/iStock via Getty Images

Investment Thesis

Open banking has the potential to transform financial services because the financial data and information present in a transaction will enable individuals and businesses to access better financial products with less friction.

Instead of waiting for a taxi, people call Ubers. Instead of staying in a hotel, people stay in Airbnbs. Instead of renting movies from Blockbuster, people stream from Netflix or another streaming provider.

The internet has transformed the way people go about life and many of the ways in which people express themselves and communicate. However, money and how it moves is one area that hasn’t been greatly affected by the internet up until recently, with the evolution of open banking, partially enabled by cloud-based internet deployment, and the wide adoption of smartphones.

Open banking will enable more people to access affordable financial services as companies will look to offer embedded services, as the evolution of open baking enables companies to better serve their customers, retain them, all while driving higher margins. The evolution of open banking has the potential to make for a more inclusive economy where consumers are rewarded with better financial services that aren’t derived from the issuance of consumer debt and late fees.

I believe we’re going to see AI and machine learning play a larger role in fintech, and help embedded finance tools become smarter and provide more value to consumers… By leveraging AI, companies can be more agile and offer different incentives based on consumer behavior. Companies that really nail the customer experience with payments, while protecting them from bad actors, will stand apart from the competition.” – Randy Kern, Marqeta CTO

Introduction To Open Banking

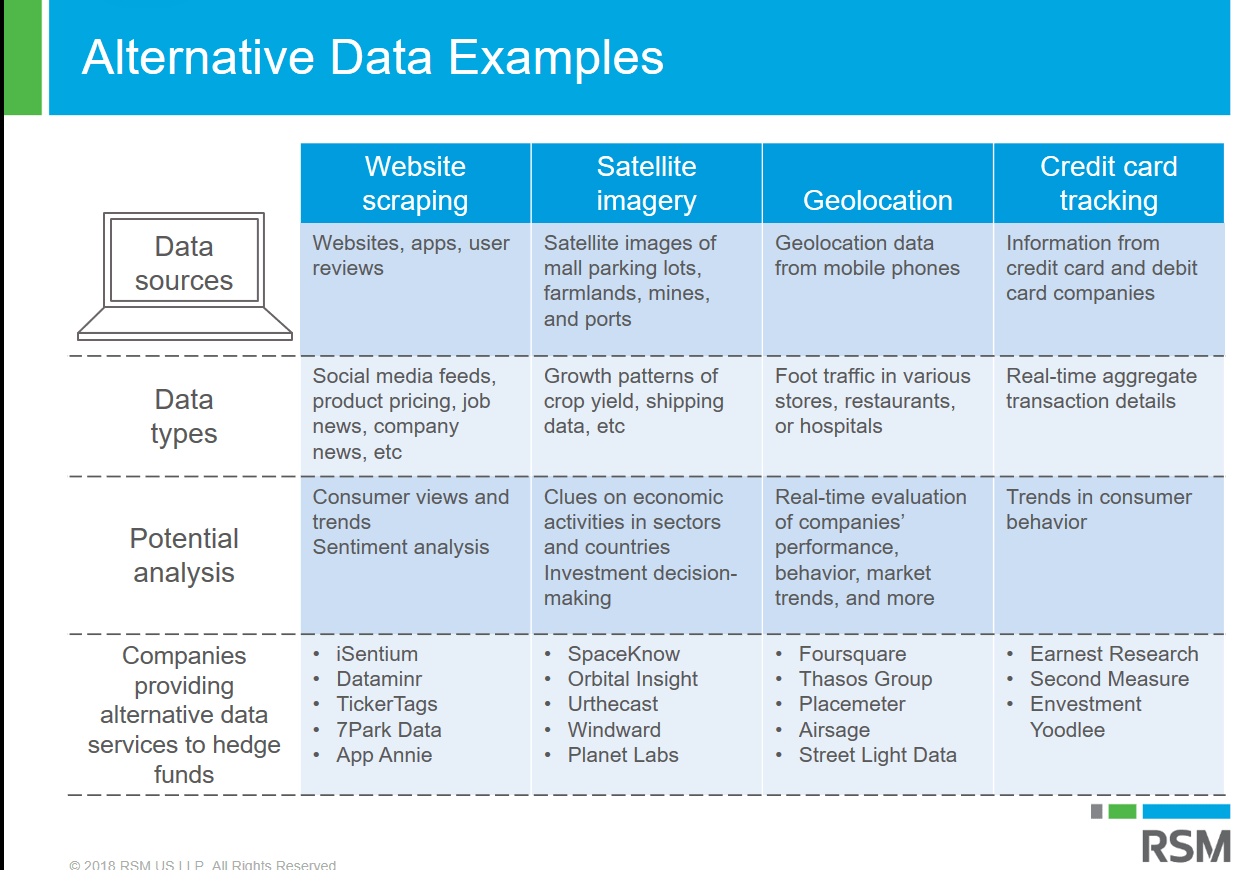

The video above is a good overview of the open baking landscape. Open banking is all about making it easy for consumers to access and share their transaction history if they choose to give consent to a regulated third party so that they can find better financial products. Since someone’s actual spending history can be used in determining which specific financial product is most suitable to their needs in this open banking paradigm, it’s easier for lenders to approve worthy borrowers more confidently, creating a more inclusive lending environment that takes into account alternative data points. Alternative data points, specifically those within the transaction (i.e., credit card tracking) are one way for lenders to analyze a potential borrower’s account balances, payment history, and transactions in order to offer a unique financial service that’s more competitive and ultimately better for consumers.

The Real Economy Blog

Open banking is a secure technology – that’s the APIs – that allows a consumer or SME (small and medium-sized enterprises)to safely share their transaction data with an authorized third-party. It also enables that consumer or SME to instruct that third party to send a payment from their account should they want to. – Imran Gulamhuseinwala, Why Open Banking is the Future of Fintech

Now that we understand the open banking landscape, let’s dive into some of the innovative companies that are making this possible.

Plaid: The Flow Of Data

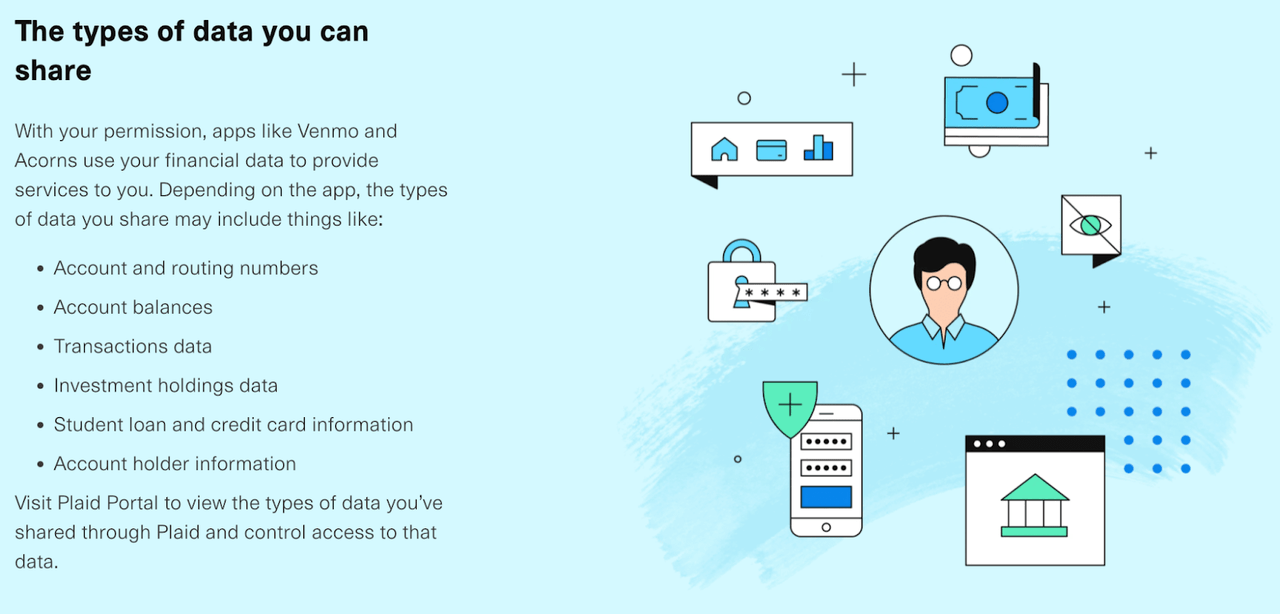

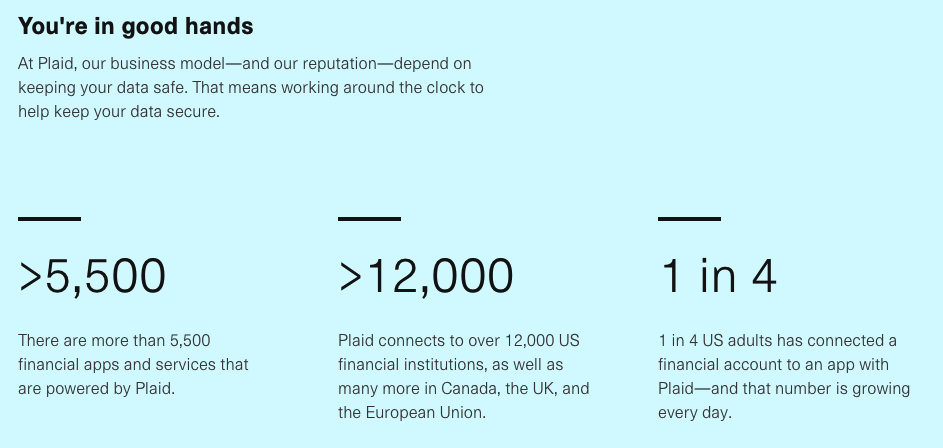

Plaid is at the heart of open banking. Plaid plays a role as a consumer-facing component as it is the bridge between fintechs and financial institutions. More than 5,500 financial apps and services are supported by Plaid, while it also connects to more than 12,000 financial institutions. Plaid is a gateway that makes it easy for consumers to securely connect their financial accounts across many financial institutions with apps and services that the consumer approves.

Plaid

Plaid plays an important role because it sits between the financial institutions and the up-and-coming fintechs as Plaid is the gateway between the data that flows between these organizations (transaction history, account balances, etc.). Plaid provides the verification and bank account linking services, while Plaid Auth enables instant account verification. Plaid scrapes for all the financial account information ranging from the address, name, phone, and

email associated with a connected financial account which enables apps and services to leverage this information in the KYC (Know-Your-Customer) process.

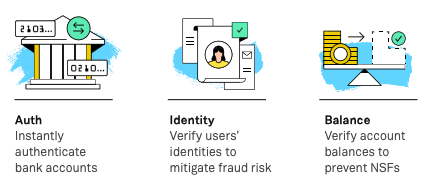

Plaid ACH Whitepaper

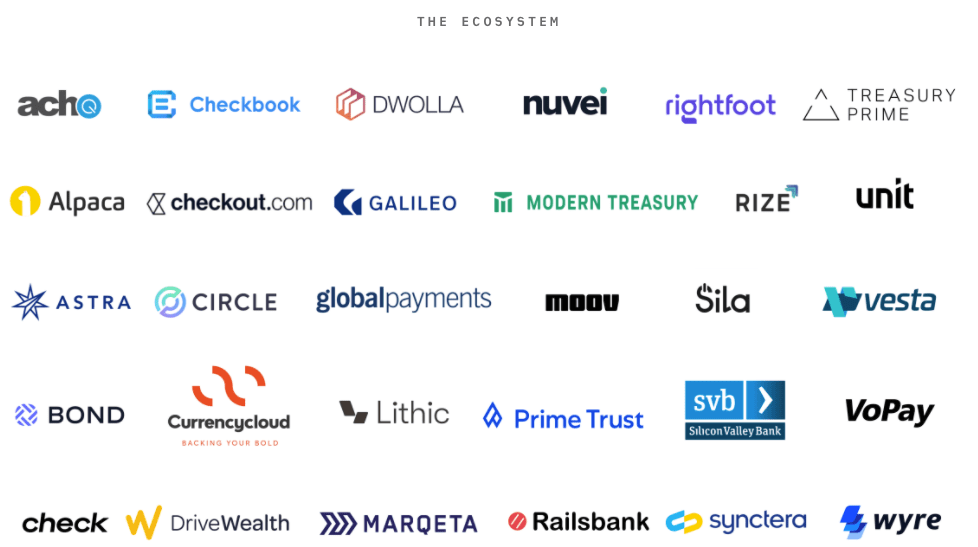

Plaid only links apps and services to financial accounts rather than actually processing payment transfers. Plaid is building a payments partner ecosystem that includes over 50 partnered payment and tech providers to process ACH payments and streamline the flow of payments to optimize digital banking experiences.

Plaid Partner Ecosystem

Plaid Payment Partner Ecosystem | Plaid

Plaid’s payment processing partners extend the utility of Plaid’s solutions as it makes it easy for Plaid’s customers to leverage Plaid’s API with other unique processing solutions.

Plaid

Plaid has a strong global presence and plays a critical role acting as the gateway between financial institutions and fintechs while Plaid directly touches the consumer, which makes Plaid extremely important to open banking as Plaid has a relationship with the consumer. Plaid is critical for enabling the flow of data between legacy institutions and the new innovators, while Plaid isn’t the party that actually moves money and controls the flow of funds.

The Flow Of Funds

Open banking and the data available in each transaction allow for embedded finance tools to become intelligent and provide consumers more value, while also enabling companies to protect themselves from bad actors who may not appear as bad actors without the data from sources like Plaid. However, when it comes to moving money, it is not as easy as just moving data with the required consent.

Traditionally, money is exchanged through card networks or through ACH (automated clearing house). However, it’s important to point out that the card networks are just the middlemen between two banks who act on behalf of the consumer’s bank (the issuing bank) and the merchant’s bank (the acquiring bank). Visa and Mastercard are essentially the toll booth between the two banks in a transaction and they play the role of the messenger between the two banks. The alternative data and information the banks see from their customers (account balances, merchants’ stock-keeping units, etc.) aren’t exchanged when the card networks process a transaction. So, the data that Plaid can see is not transferred through a credit card transaction, which means it can’t be leveraged into embedded finance tools that offer value for merchants, consumers, and the companies offering the embedded finance services.

In my previous note, Buy Now, Pay Later (BNPL) Is Disrupting The Consumer Credit Ecosystem, I broke down the card networks in-depth and why alternative data, specially SKUs, is important when offering financial services.

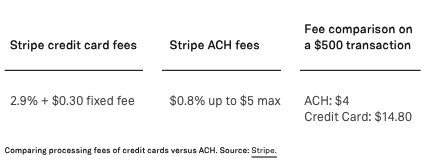

Plaid ACH Whitepaper

Credit card fees are significantly higher than ACH fees while the fees are paid by the merchant accepting the payment.

The Acquirers

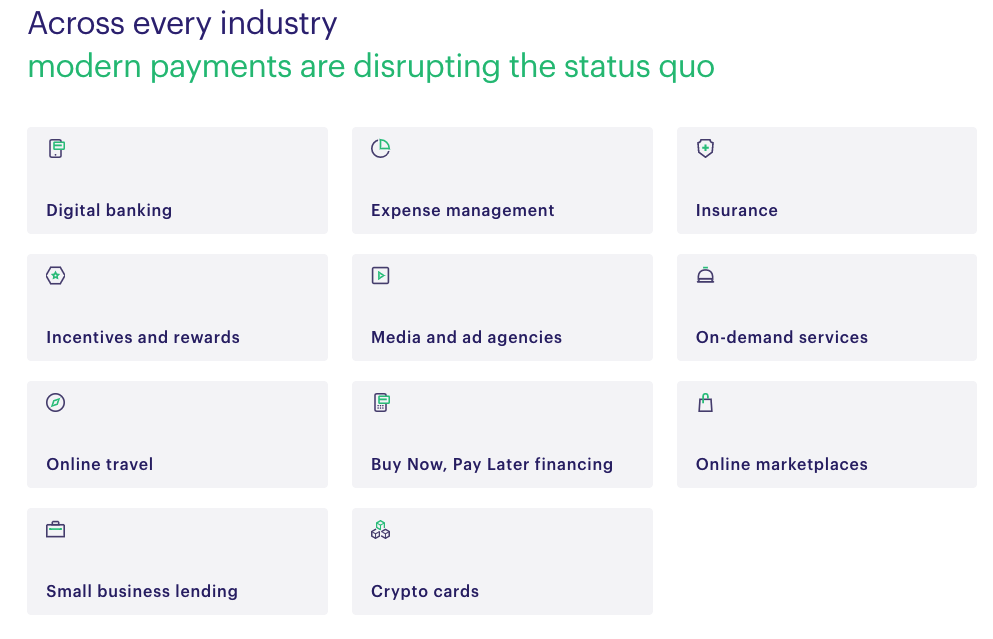

There’s innovation taking place on the acquiring side of the transaction as companies like Adyen (OTCPK:ADYEY) and Stripe (STRIP)enable online merchants to accept payments and offer a full banking stack for merchants to process their sales through an API. These companies are evolving the way in which merchants accept payments and leverage their data from the goods or services they sell. Stripe and Adyen provide the infrastructure for merchants to use this alternative data as a relevant source in operating their customers’ businesses. These companies are building the global infrastructure for merchants to better operate their banking stack. Companies like PayPal (PYPL) also offer an acquiring solution for online merchants to integrate account-to-account payments, while Block’s (SQ) Square Sellers ecosystem plays the role of the acquirer for its millions of merchants that use Square terminals to accept payments. Braintree is a subsidiary of PayPal and offers some of the same components as Stripe as it enables merchants to process customers’ credit and debit card transactions as well as other forms of payments, whether from digital wallets or apps like Venmo.

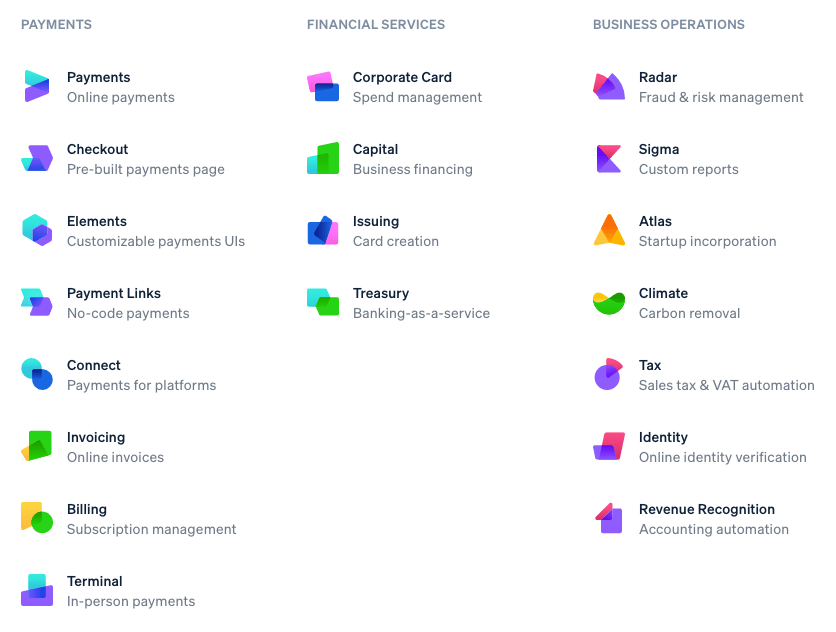

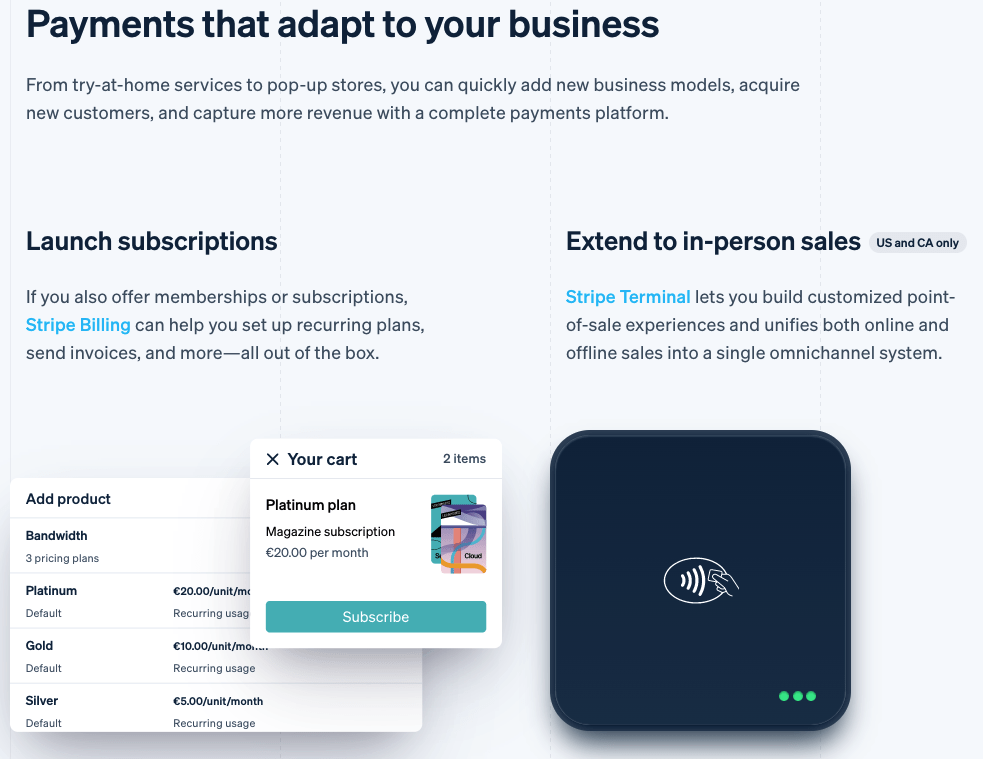

Zooming in on Stripe

Stripe was last valued at $95B and is the “payments infrastructure for the internet”. Stripe enables merchants to leverage internal data ((SKUs)) as well as other alternative data points to better understand their customers. Stripe uses its visibility into merchants’ flow of payments to offer a variety of embedded financial services and valuable insights through its platform.

Stripe

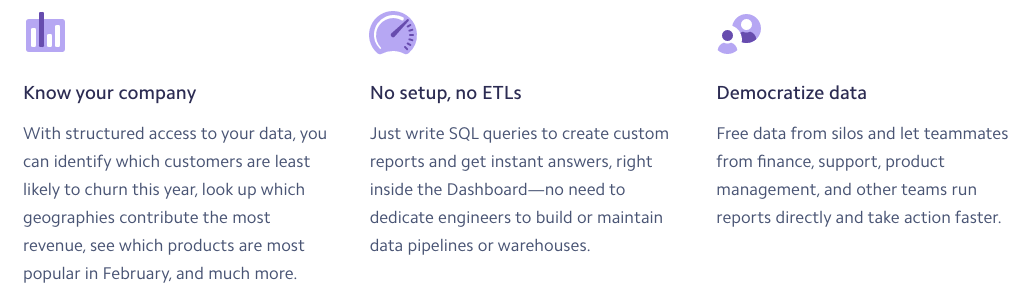

Stripe Sigma

Stripe supports payments in more than 135 currencies and also enables merchants to accept payments in cryptocurrencies and through ACH. Stripe offers merchants an extremely valuable component of their business, the ability to generate sales, which gives Stripe a strong moat when it comes to offering embedded financial services to merchants, for either their customers or employers.

Stripe is essentially an operating system for commerce and also has a strong developer-first culture. Stripe is at the heart of the transaction for many online commerce companies ranging from Amazon to Shopify to Klarna, and Stripe has a lot to offer when it comes to helping merchants pair transactional data with alternative data points while it recently entered new categories like issuing and offline payments.

Plaid

As it becomes increasingly more valuable for financial service providers to leverage the data available from merchants relating to specific SKUs and product manufacturers, having full control of one’s banking stack will enable data from merchants to easily flow to the necessary parties. This will enable merchants to process more sales and better engage their customers as they look to leverage the data from each transaction with information from other services like Plaid to offer consumers better services. This results in merchants driving better retention and reaching new customers as they stand to benefit from consumers willing to spend more, all while the merchant can optimize their go-to-market approach and lower their cost structure since they have better insights on their customer base. Merchants also benefit when customers pay through ACH.

Plaid

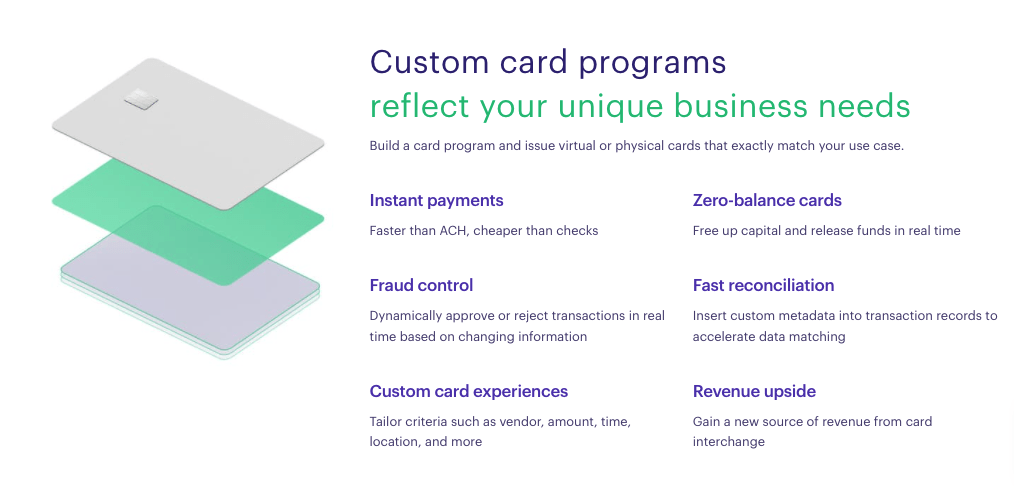

The Issuers

On the opposite side of the spectrum from the acquirers are the issuers. There are infrastructure companies like Marqeta (MQ), Galileo (SOFI), and Lithic that enable companies to issue physical and digital payment products. Traditionally, only banks could enter the Visa and Mastercard rails to send money between the networks; however, these infrastructure players enable companies like Square, DoorDash, and Coinbase to offer payment products where they are in control of approving transactions within the card networks. These infrastructure players have an important role because it is the issuers who deny or accept payment and move the money to the acquiring bank on behalf of a consumer. While there is a great amount of data from merchants to leverage, there are also many alternative data points that are generated when someone makes a payment.

Card issuers like Marqeta typically see a larger part of the payments ecosystem than merchant acquirers, giving us a significant opportunity to use data to improve consumer experiences, for instance helping our customers make proactive recommendations to help their cardholders save money, or protect them from fraud. I think we’ll see payments become an even bigger part of how brands engage with their customers, with new incentives and rewards that can be customized based on data.” – Randy Kern

Marqeta

Marqeta is the leader in modern card issuing and it supports many components of the open banking ecosystem as it already has strong relationships with Plaid. Marqeta is becoming the standard for modern card issuing in many verticals as financial institutions like Citi and JP Morgan turn to Marqeta’s modern card issuing platform, while Marqeta also has strong ties to the BNPL and expense management verticals.

Marqeta

Marqeta is a part of the Plaid payment ecosystem, which incorporates nearly 50 payment, tech, and BaaS platforms. Last quarter, Marqeta announced another partnership with Plaid that enables Plaid’s technology to simply integrate with the Marqeta Platform so Marqeta customers can get the benefits of Plaid’s API.

This partnership will simplify ACH transfers, allowing customers to seamlessly and securely authenticate their bank accounts and fund their accounts to power more immediate card shopping. As a result, developers building on the Marqeta platform can quickly and easily authenticate users’ bank accounts versus the traditional cumbersome ACH process. Plaid works with over 12,000 financial institutions. This scale, combined with its commitment to information security, makes them a perfect partner for Marqeta.” – Eric Sager, COO at Plaid

The partnership is exciting for both Marqeta and Plaid as Plaid will leverage Marqeta’s ability to move money while Marqeta’s customers will have easy access to Plaid’s APIs. Plaid makes it easier for Marqeta’s customers to shorten their go-to-market approach by leveraging Plaid’s API so end-users can fund their accounts with their bank account username and password, compared to inputting an ABA routing number for ACH transactions. This makes it incredibly simple for Marqeta’s customers to fund their accounts which leads to outflows, which are processed by Marqeta and are Marqeta’s predominant source of revenue.

As merchants look to shift away from processing credit cards due to higher interchange rates, Marqeta is uniquely positioned to process ACH payments and offer its customers the benefits of Plaid’s APIs in the form of a physical or digital payment solution.

Now that companies don’t need to be a bank in order to issue cards within the Visa and Mastercard networks, it enables companies to leverage alternative data in their underwriting to provide consumers with better services that are more inclusive. As more and more companies look for innovative ways to lower the costs of transactions and leverage new technologies that enable issuers to utilize data from consumers and merchants, the services issuers provide will evolve from the issuance of cardholder debt to the value they create for consumers and merchants.

How To Invest In Open Banking?

Plaid and Stripe are private companies and are expected to enter the public markets sometime over the coming years. On the other hand, Marqeta is a public company and has a lower valuation than both Plaid and Stripe. Marqeta’s market cap is $6B with an enterprise value of $4.3B. Plaid’s latest valuation was for $13.4B in April of last year, while annualized revenue had reached $170M by the end of 2020, better than 60% annualized growth. Stripe’s latest valuation was for $95B around the same time while Stripe’s revenue increased from $2B in 2019 to $7B in 2020, as Stripe was a beneficiary of the increase in eCommerce due to the pandemic. Marqeta recently announced its Q4 and 2021 results, a strong year generating $517M in revenue, good for 71% growth.

At Beating The Market, we are investing in open banking, specifically, the infrastructure of open banking, as it relates to the movement of money and modern card issuing through investing in Marqeta. While the private markets may have cooled down as late, Marqeta is still trading at a discount compared to Plaid and Stripe’s private valuations. Marqeta is poised to be at the heart of moving money as it enables machine learning and blockchain applications to connect to the current underlying payments infrastructure. Marqeta also grows with its customers as Marqeta saw BNPL volume increase by 50% sequentially last quarter.

Marqeta is essential to enable the transfer of money and essential for its customers like Affirm. Marqeta is the operating system that fintech applications leverage to connect their payment solutions to the underlying payments infrastructure and utilize data from a variety of sources, whether from the consumer or product manufacturer.” – Author’s Previous Marqeta Note, The Power Of Pay

For more on Marqeta’s latest quarter check out my note here. Marqeta is a great way to play the open banking trend because of its wide range of customers and its ability to grow alongside them as well as its strong ties to Plaid.

Concluding Thoughts

There’s a lot of innovation taking place within open banking, specifically payments, with a large emphasis on using data to drive better and more inclusive financial services which help drive better outcomes for the overall economy. In order for this to work, consumers will need to feel comfortable giving companies like Plaid permission to access their bank accounts or other regulated third parties access to alternative data to offer smarter embedded finance tools. In this note, we highlighted the foundational layers of the open banking ecosystem, illustrating how open banking is eating away at the traditional consumer credit ecosystem, through analyzing an immense amount of data.

In future articles, I plan to break down how the applications of open baking will transform the way in which people store money, move money, and access money (i.e., obtain credit). As the flow of data becomes more easily permissible and companies innovate the flow of funds through using ACH or even alternative blockchain protocols like the Lightning network, there will be many opportunities for companies to increase the economics of transactions for both merchants and consumers. In my next open banking article, I will focus on the applications that merchants and fintechs will offer to capitalize on these open banking trends to ultimately enable more people to enter the economy, whether companies offering employers embedded financial services or BNPLs using alternative data to strengthen their underwriting. The evolution of understanding alternative data within every transaction and every consumer will enable companies to offer more inclusive services to consumers while Marqeta, Plaid, and Stripe will be three important players to watch in this open banking paradigm.

Be the first to comment