Wolterk

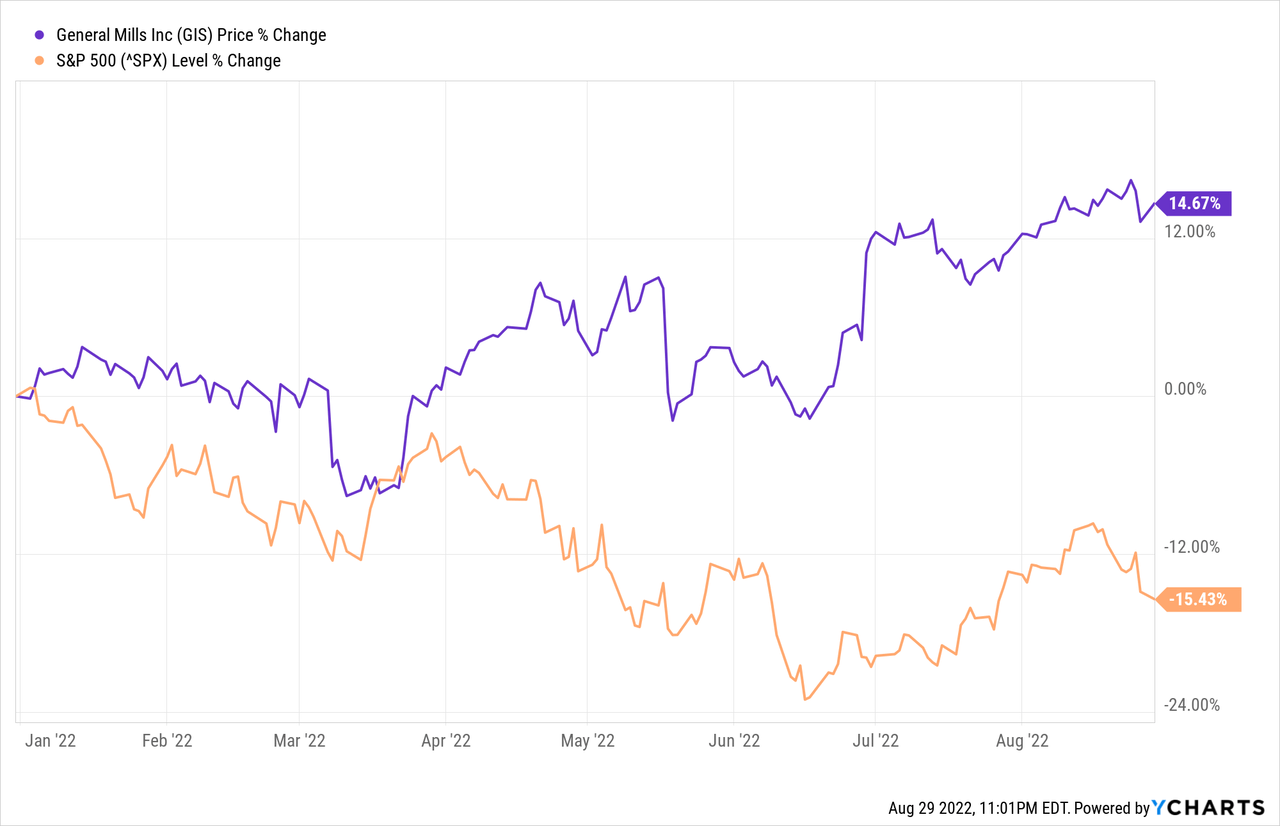

In my last article, I rated General Mills (NYSE:GIS) as a hold and considered it as a solid investment, but not really as an extreme bargain or a stock that is a screaming buy. Now, about half a year later, I must admit that I am pleasantly surprised by the outperformance of General Mills compared to the S&P 500 (SPY). While the S&P 500 lost about 15.4% year-to-date, General Mills increased about 14.7% in value since the beginning of 2022 (not including dividends).

This is making General Mills one of the companies in the top 10% of the S&P 500 when looking at the top performance YTD. In my last article, I concluded:

General Mills is a solid investment in my opinion and a classical “sleep well stock”. The company is paying a solid dividend and is a recession-proof business. And when looking at the performance in the last decades, it always performed better than the overall market during recessions and bear markets. And as I am expecting an extreme bear market in the years to come, General Mills might be a good pick – although we could maybe find better investments.

Let’s look at the company and stock once again and determine if we can still find better investments and what to do now about General Mills.

Annual Results

We can start by looking at the performance in the last fiscal year (fiscal 2022 ended on May 29, 2022, for General Mills). Net sales increased from $18,127 million in fiscal 2021 to $18,993 million in fiscal 2022 – an increase of 4.8% year-over-year. Operating income increased 10.5% year-over-year from $3,145 in the last fiscal year to $3,476 million in fiscal 2022. And finally, diluted earnings per share increased from $3.78 in fiscal 2021 to $4.42 in fiscal 2022 – resulting in an increase of 16.9% year-over-year.

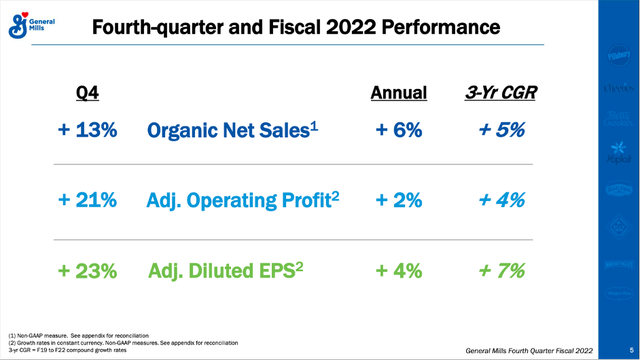

General Mills Q4/22 Presentation

When looking at adjusted, non-GAAP results, we see high growth rates for the fourth quarter of fiscal 2022, but only mediocre annual growth rates. Additionally, we can look at the four different segments and can identify two segments which were responsible for growth in fiscal 2022. On the one hand, “Pet” generated a revenue of $2,259 million resulting in a growth rate of 30% YoY with operating profit increasing 13% compared to fiscal 2021. On the other hand, “North America Foodservice” could grow 24% year-over-year to $1,846 million in revenue while operating profit increased 26% for the segment. And while these two segments contributed to growth, “International” saw declining revenue (9% year-over-year decline to $3,316 million) and a declining operating profit (2% YoY decline).

Recession

In my last article about General Mills, I already mentioned that General Mills can be seen as rather resilient in case of a recession. In this article, we will look at the topic once again and analyze how General Mills performed during recessions in the past four quarters.

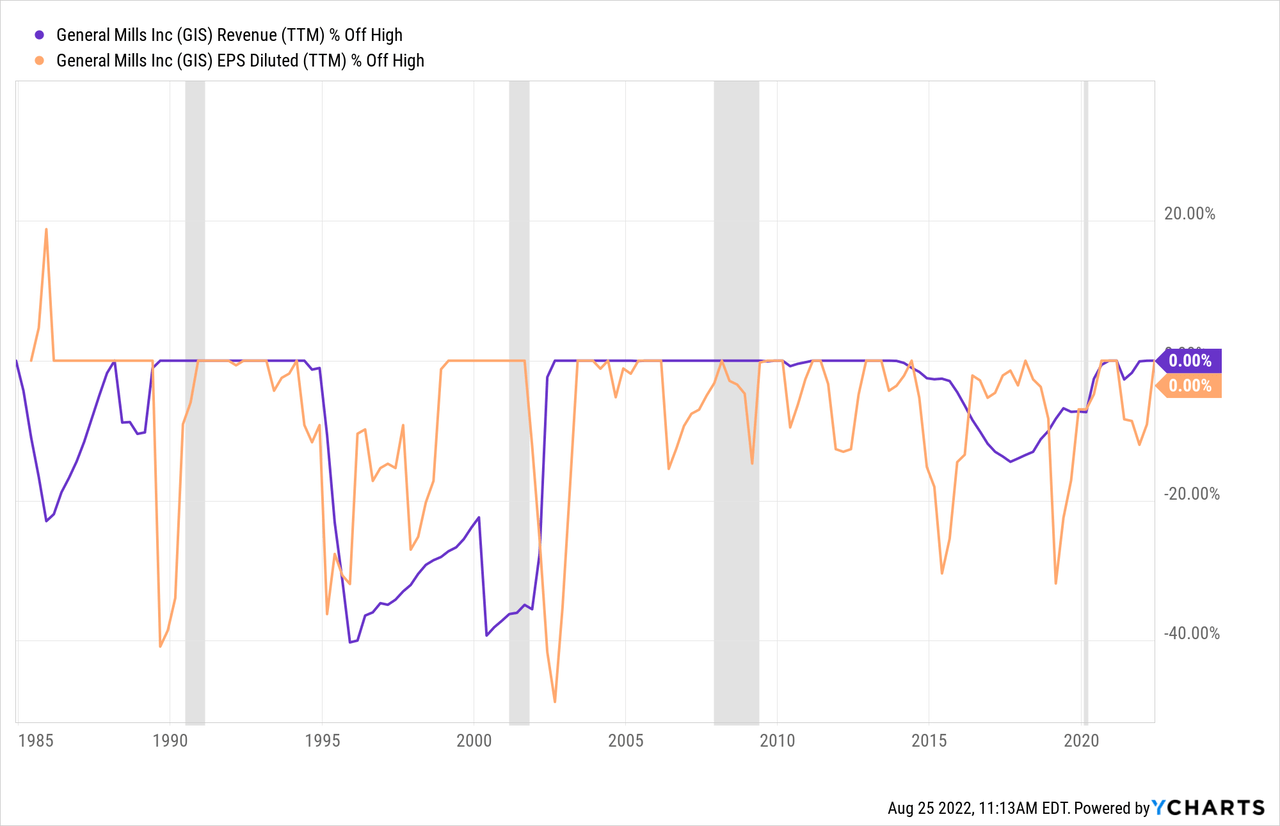

When looking at the last four decades, we certainly are seeing declining revenue as well as declining earnings per share. However, when trying to make connections between a recession and declining revenue and/or declining earnings per share it gets more difficult. Revenue was declining a few times for General Mills in the last four decades, but there doesn’t seem to be a connection to any recession as revenue declined in the years between recessions and obviously without any real connection to these recessions.

When looking at earnings per share the picture is a little different. We see earnings per share declining several times and some of these declines can be connected to recessions. But we also must acknowledge that earnings per share declined several times without a clear connection to any recession. It seems safe to say that General Mills seems to be pretty resilient to recessions and especially revenue was hardly affected by recessions in the past few decades. Earnings per share on the other hand was reacting to recessions but in most cases the reaction was rather moderate.

And General Mills being rather resilient to a recession is not surprising as the company is selling mostly essential, everyday products. And consumers must purchase these products in all economic conditions as people need to drink and eat during booms as well as during recessions. However, General Mills is selling branded products that are usually more expensive and in economic downturns consumers might switch to non-branded products which are cheaper. With disposable income being lower, consumers might try to save money by moving away from the more expensive branded products.

While this is a risk we must keep in mind, we should also not ignore that these products are making up just a fraction of the overall monthly spendings and when people are trying to save money, they will cut down spending somewhere else: they might postpone buying a new car, using their smartphone a year longer and stop eating at expensive restaurants. Switching from branded products to non-brand products might save only a few dollars (or even less) and in my opinion most customers will try to save money in different ways.

Positioning The Portfolio For Growth

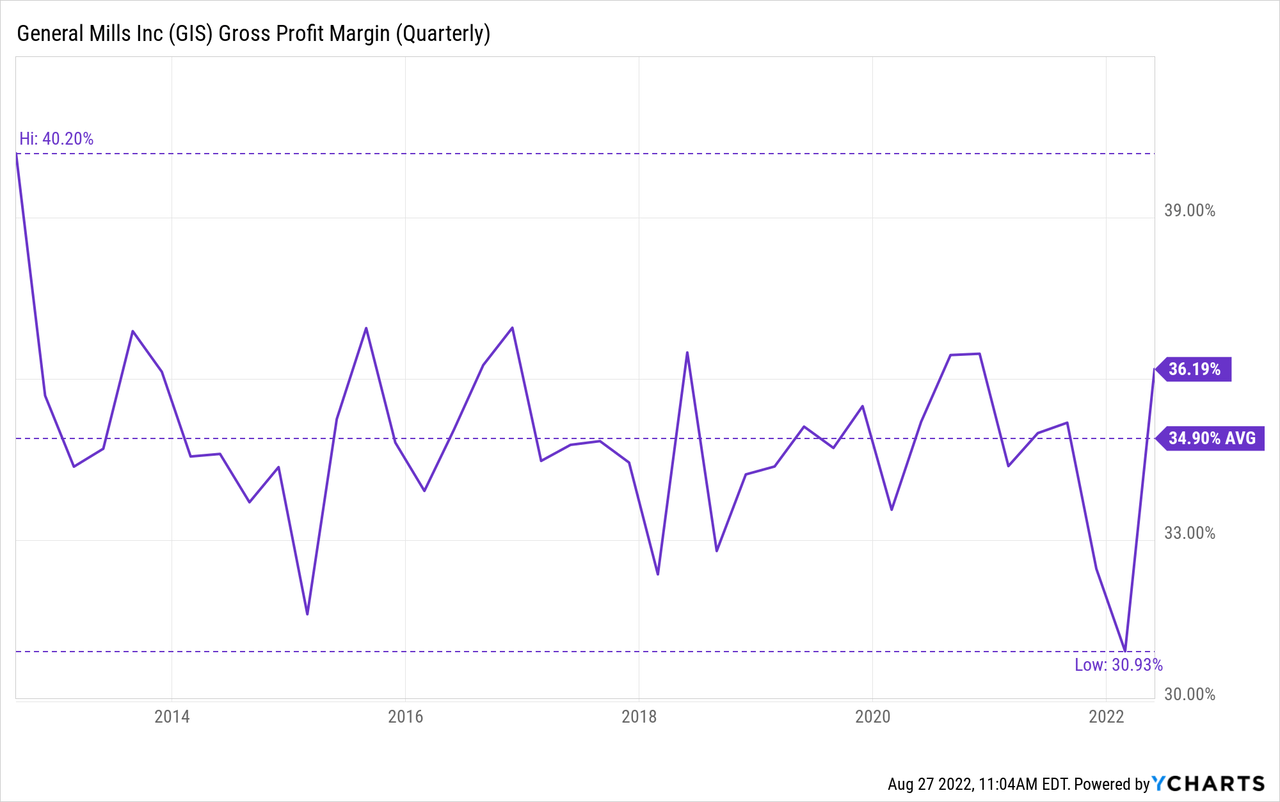

Other contributors and analysts are seeing General Mills as a company with little or no pricing power, but in my opinion the picture is different. General Mills has pricing power and should therefore be able to offset inflation. One strong hint for the company’s pricing power is the stable gross margin. Of course, there are single quarters with a lower gross margin, but over time the gross margin is pretty stable around 35%.

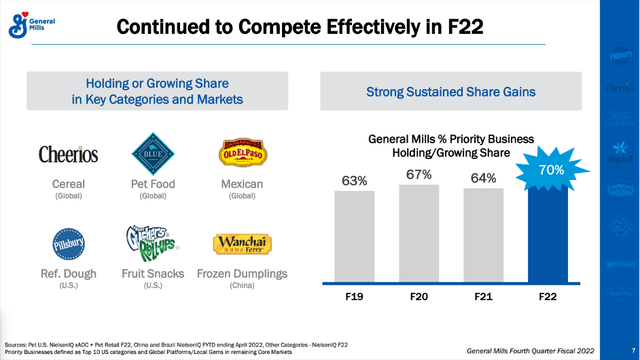

General Mills has several well-known brands and companies are usually able to increase prices slightly above inflation for these branded products without losing customers. And it is also a good sign, that General Mills is holding or growing market shares in key categories and markets – another strong sign for a stable business with pricing power.

General Mills Q4/22 Presentation

And when looking at the fourth quarter of fiscal 2022 we see organic price/mix contributing 14% to top line growth, which is higher than inflation and a good sign that General Mills has enough pricing power to fight inflation.

General Mills Q4/22 Presentation

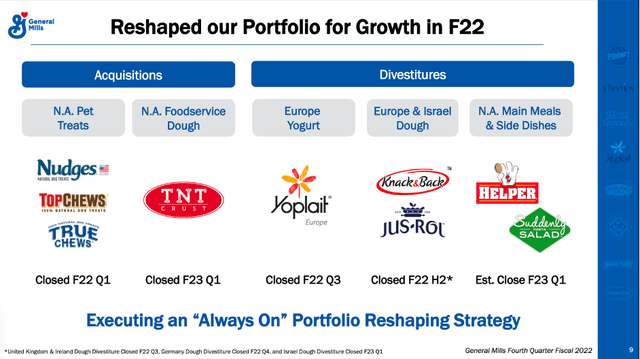

General Mills is also trying to reshape the portfolio and in fiscal 2022, it made several acquisitions. Three of them already closed in the first quarter of fiscal 2022, while another acquisition is expected to close in Q1/23. Aside from making acquisitions, General Mills also made several divestures to better position its portfolio for growth.

Dividend

In June 2022, General Mills announced another dividend increase and the company raised the dividend from previously $0.51 to a current quarterly dividend of $0.54. We can also claim that General Mills is increasing its dividend regularly, but unlike many other businesses the company is not increasing its dividend annually. Before General Mills increased the dividend in June 2022, the company paid the same dividend for seven consecutive quarters. Nevertheless, General Mills can be seen as a stable dividend payer, it is just not increasing the dividend every single year. Hence, General Mills is not a dividend aristocrat but paying a dividend without interruption for 120 years.

Right now, General Mills has a dividend yield of 2.75%. And when comparing the annual dividend of $2.16 to the earnings per share of $4.42 in fiscal 2022, we get a payout ratio of 49% for General Mills and therefore the current dividend can be seen as stable, and we don’t have to worry.

Intrinsic Value Calculation

In my last article, I rated the stock as a “Hold” and in the almost six months that passed, the stock increased about 22%. And we must ask the question if General Mills is a good investment right now as a stock price increasing about 20% to 25% in just six months is not justified by fundamentals.

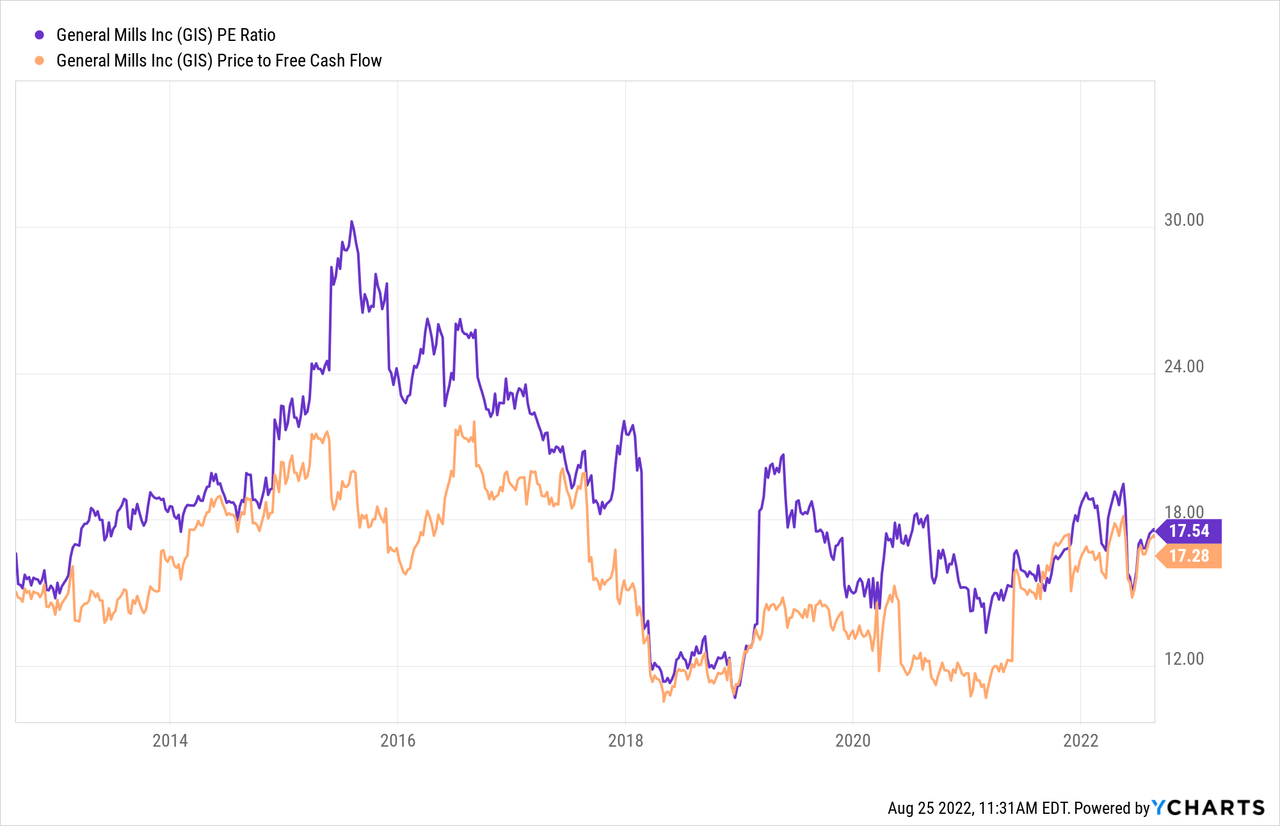

On the other hand, General Mills is trading for 17 times earnings as well as 17 times free cash flow and these seem like reasonable valuation multiples for a business that might be able to grow in the mid-single digits.

Additionally, we can use a discount cash flow calculation to determine an intrinsic value for the stock. As basis we can use the free cash flow of the last four quarters, which was $2,747 million. And I would assume growth rates of 5% once again – similar to my last article.

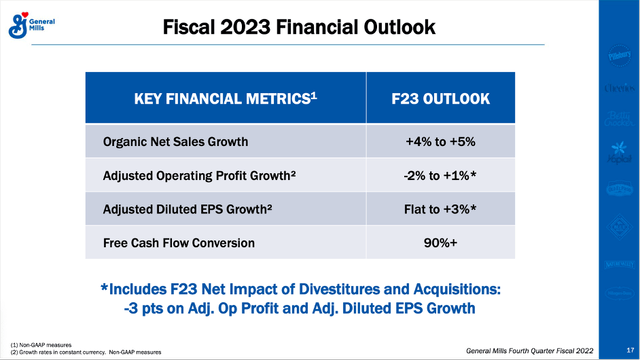

General Mills Q4/22 Presentation

5% growth is more or less in line with the fiscal 2023 financial outlook. These assumptions are also in line with analysts’ assumptions for the next few years. From now till fiscal 2023 analysts are expecting earnings per share to grow with a CAGR of 5.93%.

When calculating with these assumptions and assume 10% discount rate as well as 611 million outstanding shares, we get an intrinsic value of $89.92 for General Mills. In my last article, I calculated an intrinsic value of $83. With the stock trading for $77, we can rate the stock as a “Hold” once again. I consider the stock still a solid investment, but once again I don’t see General Mills as a bargain.

Conclusion

In my opinion, General Mills is still a “sleep-well” stock and solid investment that is paying solid dividends. I would also describe General Mills as a solid pick for the quarters to come as the company might be able to withstand a recession reasonably. I don’t expect General Mills to continue its current outperformance versus the overall stock market, but chances are high for General Mills to keep revenue (and earnings per share) more or less stable, and the stock could perform better than the overall market in the coming quarters.

Be the first to comment