M_a_y_a/E+ via Getty Images

Investment Thesis

For Spok Holdings (NASDAQ:SPOK), much has happened over the last several months that should give investors confidence that the shares are undervalued, pay a sustainable head-turning dividend yield, and the company may be close to selling.

Like all good value stocks, SPOK doesn’t look attractive at face value and needs some work to uncover the value of the business. For instance, the company’s earnings and cash flow are not all that appetizing. Though, recent moves by management should soon unmask the earnings power of the business. For instance, net income fell from $80 million in 2015 to a loss of $22 million in 2021.

The declines in earnings were primarily due to the company’s investment in cloud-based software service, Spok Go. The additional investment cut into the profits of the two high margin segments. The stock has suffered since then.

Management created the Spok Go platform as the next generation for the company’s software segment. Delays and cost overruns cost the company $20 million per year. When Spok Go finally went to market in late 2019, customers were unreceptive. Spok was able to secure a few contracts from new customers, but their enviable customer list was lukewarm to Spok Go. Not to mention the onset of the COVID pandemic in early 2020, which hurt the cause further.

The company’s future started to change in September 2021 when activist investors Acacia Research and Starboard Value LP disclosed a 6.5% stake in the company along with a bid of $10.75 for the remaining shares. In response, Spok’s board issued a press release announcing that it had received multiple expressions of interest to buy the company and also initiated a limited-term poison pill. The press release also mentioned that the board had invited Acacia to participate in the strategic review process.

After postponing its October 21 Investor Day and five months of waiting for the strategic review results, Spok finally disclosed a new strategic business plan on February 22. The plan noted that the company would make some dramatic changes to increase value to shareholders. Most surprising, the company will discontinue its Spok Go platform and its associated costs. In addition, the board approved a 150% increase to its quarterly dividend to $1.25 per year and initiated a $10 million share repurchase plan.

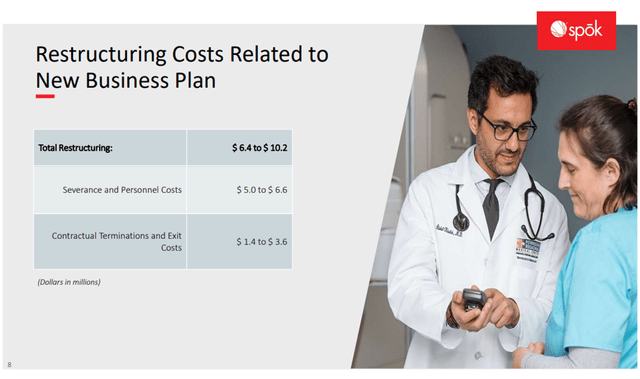

A further examination of SEC filings reveals that the company plans to reduce its headcount by 175 employees. According to the ensuing investor presentation, the cost-cutting will result in $6.4 million to $10.2 million in one-time payments.

Company Website

Source: Investor Presentation

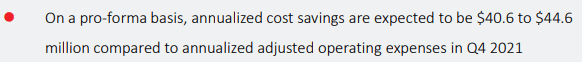

The presentation also noted that these measures would save the company $40.6 million to $44.6 million annually compared to Q4 21. Almost all the saving should go straight to the cash flow statement.

Company Website

Source: Investor Presentation

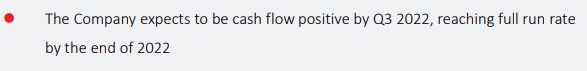

Management expects Q3 to be cash flow positive and Q4 to be full run-rate free cash flow. Most of the savings will come via the 175 employees being let go. Because Spok made the announcement publicly, the affected employees were notified immediately in February. According to the WARN Act, Spok must give employees of such a large layoff 60 days’ notice. So, one-time severance costs will run into the second-quarter financials. One-time costs for contractual and exit costs should run into the second and third quarters.

Compnay Website

Source: Investor Presentation

Most of the reduction in headcount will come from R&D staff. Spok’s R&D department oversees product development for the software segment. With the Spok Go platform off the table, there is ample room for reduction without disrupting the business. Further, the contact center product is legacy software. The R&D staff updates and enhances the software at the user’s request. There is little need for significant advancements in the software from the R&D department.

Of course, what management does with the additional capital is of the utmost importance. In the future, the company will have the extra cash flow to support the dividend and buybacks announced in the new business plan. In addition, the balance sheet contained nearly $60 million and no debt, which is more than adequate to get them through the near-term transition and $10 million repurchase program.

Looking ahead, Spok will likely use cash on hand to repurchase shares. If they can buy shares at the current price of ~$8, they’ll reduce the share count from ~19 million to ~17.75 million (or 6.5% of shares). The dividend payout will amount to ~$23 million, depending on the timing of buybacks.

When the calendar finally rolls around to 2023, cash on the balance sheet may be reduced to ~$27 million ($60m – $10m buybacks – $23m dividend). A very desirable balance sheet condition. At that time, the company should be generating operating cash flow to maintain the dividend.

After the company announced its strategic business plan, shares sold off significantly from ~$10 to its current ~$8 level. Shareholders may have thought the strategic plan indicated that Acacia’s $10.75 was off the table and sold the stock. Though, it is not. Whatever the reason, the stock’s dividend yield is now an eye-popping 15%+!

Company Overview

Spok Holdings is a healthcare communications company that does business with almost all the largest adult hospitals in the United States. The stock is paying a 15%+ dividend yield and the company is currently fielding takeover bids.

The company operates in two distinct segments, though many customers pay for both services. The company’s software segment operates contact center operations for hospitals. The software provides on-call scheduling, routes patient, doctor, nurse, and staff communication, and makes code calls quickly and accurately.

The wireless segment provides pager services (yes, doctors still use pagers). The wireless segment operates on its own data frequency, ensuring doctors and nurses will receive messages while on call or in an emergency. Pager numbers are not transferable like smartphones. Though, the paging business is slowly going the way of the more convenient smartphone. Pager users are not inclined to rebuild their contact network with a new device or risk cellular signal fault.

Catalysts

The most immediate catalyst is a potential purchase of the company. Acacia and Starboard announced their $10.75 bid in September of 2021. It’s been over six months since the announcement and zero news since then. There is no indication that the company has given up on selling the company.

Interestingly, B. Riley offered the company $12 per share during the pandemic selloff. The board quickly rebuffed the offer due to the circumstances.

Spok’s software business is mature, and growth is hard to come by. In addition, the pandemic caused hospital customers to close their doors to vendors like Spok making new sales very difficult. Management believes that hospitals have fully reopened their doors and are now open to sales meetings. The sales cycle for Spok software is 6-18 months. So, it’s not out of the question that the software business returns to growth over the next few years as Spok finally meets pent-up demand.

Risks

The company is better off privately held, in my opinion. I say this because there is a risk that the stock price could stagnate for years or even dwindle as the wireless segment dies a slow death over the next couple of decades. That’s why the company needs to pay out cash flow in dividends as if it were a private business.

Slow declines in the wireless business are understandable. Revenue has been on the decline for the last several years. The software business had changed in revenue recognition before the pandemic, which closed hospital doors to vendors like Spok. The company guided to a revenue decline in the software business in 2022, but management believes they can stabilize or even return to growth beyond 2023. If they can’t stabilize software sales, they’ll have two declining businesses, and the stock could tank.

Valuation

After Spok completes its cost-cutting initiatives, the company will have two cash generative annuity-like businesses. The present value of cash flow would make sense. Management indicates that operating margins for the wireless business are over 30%. However, revenues have declined roughly 7% on average over the last few years. Wireless revenue in 2021 was $78.8 million. A 30% operating margin generates a cash flow of $23.6 million. If we assume a 7% decline for 20 years and a 10% discount rate, the present value of cash flow is ~$6.30 per share.

In a press release announcing Q1 2020 results, management valued the wireless business at $6.50 per share.

our valuable wireless business that remains a critical tool for hospitals and emergency response and that we conservatively expect will generate significant cash flow over a projected useful life of thirty years with a discounted present value, based on prevailing discount rates for the business, of approximately $6.50 per share

Assuming the software business makes a modest 8% operating margin or $5 million per year for the same 20 years and discount cash flow at 10%, the present value is ~$2.25 per share.

$60 million in cash and no debt fetches another $3.00+ per share

The three parts sum to $11.55 per share ($6.30 + $2.25 + $3.00). The valuation is a 44% premium to shares currently at ~$8. Until the market realizes the value, shareholders pocket a 15%+ dividend yield.

Not mentioned in the valuation is over $210 million in federal and state net operating losses (NOLs). A financial buyer may value the NOLs higher than the market.

Actionable Conclusion

Spok shares are great for long-term conservative investors or dividend seekers.

The board has rejected the $12 bid from B. Riley, and the $10.75 bid from the Acacia/Starboard group appears to be a starting minimum bid for current bidders. Though it’s not wise to count on a sale when you invest in a business, the current environment makes the possibility naive to ignore. We are experiencing historically high flows into private equity who crave cash flow and NOLs, and the company has a ‘For Sale sign in the front yard.

Given the critical nature of its services and huge entrenched customer list, I believe the company has legs for a couple of decades. If a sale never materializes, shareholders collect a hefty dividend. If that is the case, shareholders will likely get their $8 back in dividends. Not a bad proposition. Even in the worst-case scenario.

Be the first to comment