Noam Galai/Getty Images Entertainment

Investment Thesis

UiPath Inc. (NYSE:PATH) stock price has continued to intrigue us. We argued in our previous article that PATH stock seemed to be in the buy zone. However, we also cautioned that the stock appears to be in a secular downtrend, as it continued to take out lower lows.

Notably, its FQ4 report card has helped that trend to continue. Furthermore, it was a card filled with several headwinds, and we think some seemed structural. Furthermore, its closest peer Blue Prism (OTCPK:BPRMF), continues to trade at a discount to PATH stock, further complicating its growth premium. In addition, the Street average price targets (PTs) have also been consistently revised downwards. Therefore, even the best and brightest on the Street couldn’t determine why the market didn’t concur with its optimism.

But, the writing has always been on the wall for a while. We simply didn’t see it. PATH is deeply unprofitable. And, if you cannot translate those tremendous topline growth to sustainable GAAP operating profits, the market will continue to punish UiPath investors. Until PATH learns how to be profitable, we encourage investors to learn to respect the secular downtrend.

As such, we revise our rating from Buy to Hold on PATH stock.

European Exposure & Investments Guidance Could Add To Headwinds

UiPath telegraphed that it has pretty meaningful exposure in Europe. Notably, 30% of its business is exposed to Europe, including Russia and Ukraine. As a result, the company revised its ARR guidance for FY23, given its exposure.

Therefore, we think the company’s headwind is structural. Nonetheless, the company was confident that it could still leverage the secular digitization drivers despite these headwinds. But, we believe that means UiPath might need to invest more moving forward. As such, the company’s guidance also incorporated a pretty significant investment cadence. UiPath justified its cadence as it suggested its confidence in its expansion plans. CFO Ashim Gupta articulated (edited):

We are committed to expanding like this is for the long term. So when you think about our margin rates long-term, I would say we’ve already been expanding.

If you look back on our trajectory of the last 3 to 5 years, we look for that trajectory to continue. And frankly, as we accelerate scale, that being said, we are constantly going to evaluate the balance of profitability and growth.

We’ve reiterated we feel like we’re in a large and early-growing market. We’re going to make investments. We’re not going to be shy about it. And we’re going to be good stewards of that capital and measure the right returns and have the right hurdle rates internally for it. (UiPath’s FQ4’21 earnings call)

But, Where Were The Profits?

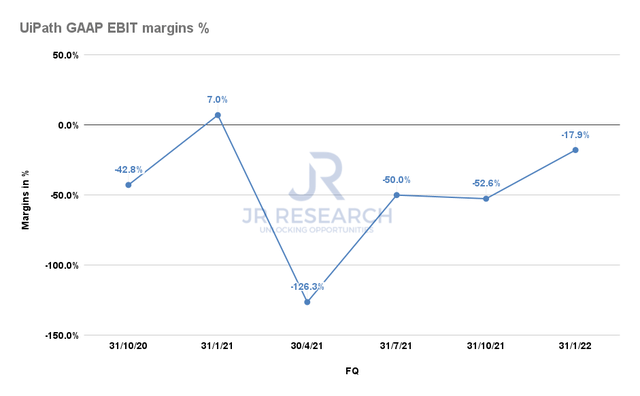

UiPath GAAP EBIT margins % (S&P Capital IQ)

UiPath reported revenue of $289.7M in FQ4, up 39.4%. FY22 revenue was $892.3M, up 46.8%. Therefore, UiPath’s revenue growth has also slowed down as it scales. However, we have to credit UiPath for moving towards profitability as its GAAP EBIT margins have improved markedly. Nonetheless, it’s still unprofitable, and its FCF margins also looked weak.

Furthermore, its FCF margins fell from 4.5% in FY21 to -7.2% in FY22. Therefore, we aren’t convinced whether the company’s financial position could be worsened further by the headwinds discussed above. Cowen also wasn’t optimistic on its earnings commentary. It added (edited): “UiPath posted a broadly solid Q4, beating the Street, but its 2023 outlook was disappointing. Management’s broadly bullish commentary doesn’t translate to 2023 upside.”

Several analysts also downgraded the stock as they weren’t confident about management’s guidance. The problem was these analysts have been too optimistic. We also previously held a Hold rating given its growth premium but revised it to Buy in February as the market fell broadly.

However, while the Invesco QQQ ETF (QQQ) has already emerged from its February/March bottom, PATH stock remains mired in a lower low.

We believe that the current environment doesn’t bode well for highly speculative stocks like UiPath. We struggle to find any near-term catalysts due to its unprofitable business model, heavy investments, and structural headwinds.

Is PATH Stock A Buy, Sell, Or Hold?

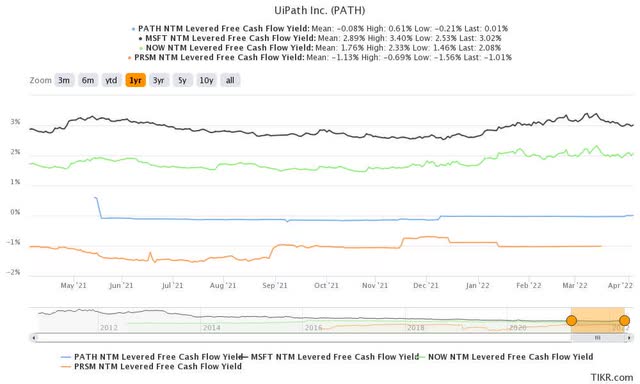

PATH stock NTM FCF yield % (TIKR)

UiPath continues to believe in its long-term strategy. Management believes that it’s the clear leader in its field. It also doesn’t consider its nearest competitors as significant threats in the near term. CEO Daniel Dines articulated (edited):

We are not seeing really any increase in the competition. On the contrary, we are seeing less competitive pressure in the deals.

And in terms of our traditional specialized competitors, we are really seeing less and less of them.

We are replacing Blue Prism and Automation Anywhere in many customers. And speaking about the new entrants like Microsoft (MSFT) and ServiceNow (NOW), we are not seeing them that much. – UiPath

But, we have always been a little more reticent about investing in the pure-play RPA players. ServiceNow and Microsoft have much broader businesses. Notably, both are FCF profitable and can dedicate significant resources to compete against UiPath and Blue Prism. Investors would be remiss to rule out what the King of SaaS Microsoft has in mind.

You will get our gist if you consider the FCF yields for UiPath and Blue Prism. For UiPath, it’s an unprofitable business, slowing growth, facing structural headwinds, and offering a 0.01% NTM FCF yield.

Given the recent tech bear market, we believe there are plenty of better options in the tech and growth space.

Therefore, we revise our rating from Buy to Hold on PATH stock.

Be the first to comment