Bet_Noire

The Macroeconomic Situation Does Not Favor the Aluminum Industry

Aluminum is a material widely used in various industries such as infrastructure, construction, electrical and electronics, healthcare, metallurgy, automotive, packaging, etc.

Recently, some negative factors weighing on aluminum demand, such as issues with global supply chains and the risk of an economic recession, as well as headwinds from a fall in the price of the metal in futures markets, have discouraged investment in aluminum.

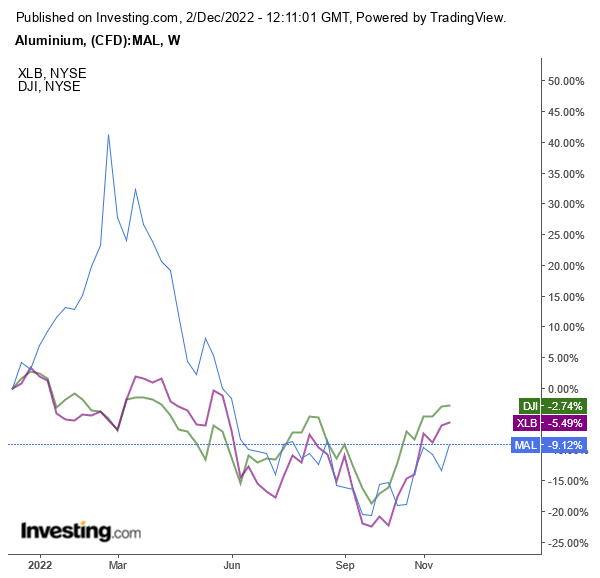

As charted by Investing.com, the price of the metal, traded via aluminum (MAL3) contract futures, has fallen more than 9% over the past year, underperforming the broader basic materials sector and the US stock market as a whole.

As a benchmark to measure the performance of the basic materials sector and the overall US stock market over the past year, the Materials Select Sector SPDR Fund (^XLB) is down 5.49%, while the Dow Jones Industrial Average (DJI) is down 2.74%.

Source: Investing.com

Amid deteriorating aluminum fundamentals, US-listed shares of aluminum product manufacturers have also not fared well over the past year, while the outlook for the foreseeable future is not better than what we have already seen.

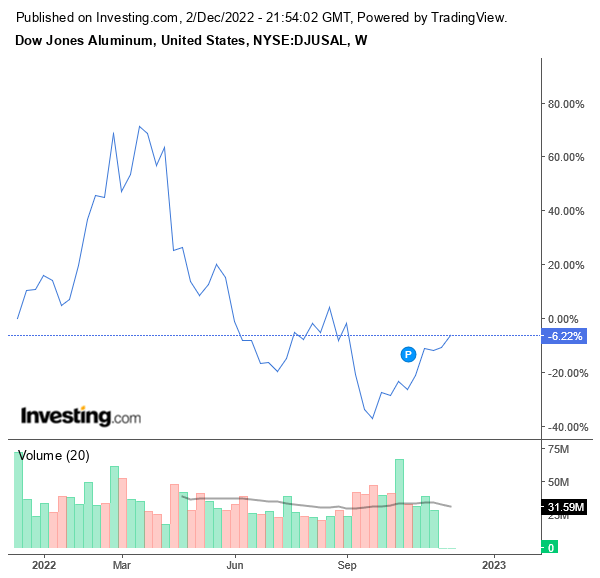

As a benchmark for US-listed aluminum stocks, the chart below from Investing.com shows that the Dow Jones U.S. Aluminum Index (^DJUSAL) is down 6.22% over the past year.

Source: Investing.com

The ongoing headwinds weighing on demand for the metal and the expected additional downward pressure on the price will not be ideal for US-listed aluminum stocks, so investors may want to consider the possibility of trimming their positions in some of them.

Century Aluminum Company (NASDAQ:CENX) shares appear to be heavily exposed to the negative factors mentioned above, which is a concern as the operation is unlikely to produce better results than the third quarter of 2022, which in general was not good. The company that wants to strengthen its financial position will have to wait for a better moment.

Century Aluminum Company in the Aluminum Industry

Based in Chicago, [Illinois], Century Aluminum Company operates in the aluminum production industry, supplying standard and value-added primary aluminum-based products throughout the United States and Iceland.

Century Aluminum Company also owns and continuously operates a carbon anode manufacturing facility in The Netherlands.

Century Aluminum Company Stock Performance Year to Date

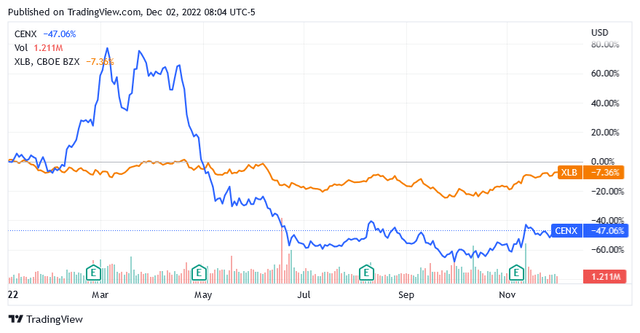

Following the metal’s downtrend, Century Aluminum Company shares have underperformed year to date, shedding more than 47% while trailing the Materials Select Sector SPDR Fund (XLB) by a wide margin.

The next 12 months will not pave the way for a share price recovery as expectations for the aluminum price are not rosy, while the company’s Q3 2022 earnings report shows signs of negative trends in shipment volumes, which may also extend into 2023.

The expected decline in aluminum prices and supplies will continue to impact sales and margins, increasing the likelihood that the shares will not trade much higher than current levels, or ultimately result in even worse valuations.

Regarding future aluminum prices, analysts have issued a 12-month price target of $2,127.90 per tonne, reflecting a nearly 14% loss compared to the price at the time of this writing.

Century Aluminum Company Third Quarter 2022 Earnings Report and Factors Affecting Demand for Aluminum Products

Long-term trends for standard products and value-added aluminum products will certainly benefit Century Aluminum Company’s business, but the near future should keep on presenting a number of challenges.

Creating value for shareholders won’t be easy over the next few quarters.

The company has reduced aluminum production at its manufacturing facility, resulting in a sharp 19% quarter-over-quarter decline in aluminum product shipment volume to 173,725 tons in the third quarter of 2022.

The decision to reduce plant production capacity is part of a broader business plan that Century Aluminum Company intends to implement to pursue significant cost savings. This means that the coming quarters will likely be consistent with Q3 2022 in terms of reduced shipments.

The company’s plan points to lower demand for its aluminum products in 2023, as well as a drop in the price.

Due to the application by the Chinese authorities of harsh ‘zero-tolerance’ measures against Covid-19, which is causing frustration and anger among the people, the economy of the world’s first aluminum consumer continues to practically suffer from the pandemic.

Dr. Wang Zhe, an economist at Caixin Insight, therefore, suggests that the Chinese government should introduce additional fiscal packages and monetary policy measures to sustain consumption while boosting incomes.

The Chinese economy was already severely affected by the crisis in the real estate sector, which absorbs the demand for aluminum much more than many other sectors.

In addition, a global recession because of aggressive monetary policies around the world aimed at curbing runaway inflation could seriously affect aluminum demand.

The reduction in the shipment volumes coupled with a nearly 14% quarter-on-quarter decrease in the average realized aluminum price to $2,636 per ton led to a worsening in net sales from $856.6 million in the second quarter of 2022 to $637.2 million in the third quarter of 2022.

Rising energy costs also impacted the company’s ability to generate profits in the third quarter and the company reported a sharply negative turn in adjusted net income and adjusted EBITDA.

Adjusted net income was a net loss of $34.2 million [vs. a net profit of $30.4 million in the previous quarter], while Adjusted EBITDA was negative at $35.9 million [vs. positive $86.6 million in the previous quarter].

Century Aluminum Company has implemented hedging strategies through ad hoc agreements with an Icelandic utility to try to limit the company’s exposure to the effects of severe energy market volatility.

However, these hedging strategies will soon be put to the test when the next headwind comes just as strong and from all directions.

In addition to the expected lower prices and sales volumes of aluminum, energy costs will continue to impact earnings with their increases because of the global turmoil due to the war in Ukraine and other geopolitical tensions.

The Financial Condition of Century Aluminum Company

The coming months will be extremely challenging for Century Aluminum Company’s business and for its balance sheet, which the company has financially strengthened a little bit as a precaution by receiving an additional $90 million line of credit backed by certain assets.

As of the third quarter of 2022, the balance sheet reported net debt of $446.4 million, which required approximately $28 million of annual interest payments, fully offset by operating income of $94.2 million, among other things.

Annual operating income divided by annual interest expense gives an interest coverage ratio of 3.4, which is higher than the 1.5 that investors consider the minimum acceptable level for a company to meet its financial obligations ahead of schedule.

Financial health could be better, as an Altman Z-Score of 1.41 suggests the balance sheet is in distress areas, implying a significant risk of bankruptcy. In terms of this ratio, Century Aluminum Company lags behind all of its direct competitors.

The Stock Valuation: Low Stock Price Does Not Mean that Shares Will Rebound

Over the past year, Century Aluminum Company (CENX) shares have plummeted and are now trading low compared to some technical indicators.

At the time of writing, the share price was $8.85 with a market cap of $823.04 million and a 52-week range of $5.27 to $30.36.

Stock prices are looking low as they are trading in the first half of the 52-week range and well below the middle of the range. Shares are also trading well below the long-term trend of the 200-day simple moving average of $12.66.

However, such comparisons do not justify a buying approach on this stock.

Instead, investors should consider reducing their positions in this stock. The expected decrease in demand and prices for aluminum and expensive energy will weigh on the company’s sales and earnings.

Shares are on track to test lower levels or, at best, move sideways from current prices, but recovery is unlikely.

For a recovery, aluminum prices should rise in tandem with corporate production, provided hedging strategies to control costs play their part.

However, with a recession looming and the Chinese economy still grappling with the Covid-19 pandemic, there is very little room for optimism about near-term growth opportunities in the aluminum industry.

In addition, Century Aluminum Company operates in a very competitive environment with many other players including major international manufacturers.

Wall Street Recommendation Ratings and Average Target Price

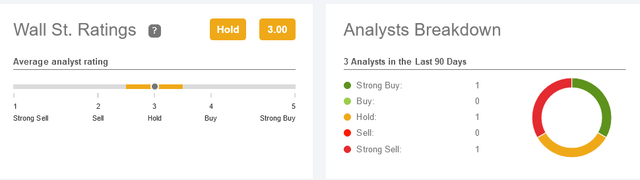

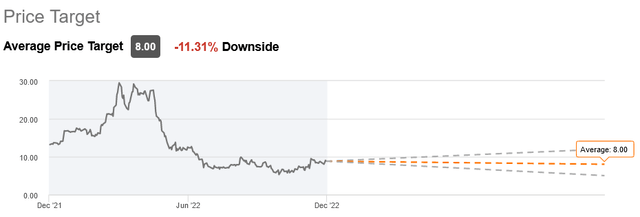

On Wall Street, analysts have issued a Strong Buy rating, a Hold rating, and a Strong Sell rating for Hold’s medium recommend rating.

Analysts have issued price targets averaging $8 per share, reflecting an 11.3% decline from low levels.

Conclusion

Shares of Century Aluminum Company could fall further after last year’s slump on the gloomy outlook for the aluminum industry.

Investors should consider reducing their positions in this stock.

Be the first to comment