Olivier Le Moal

By Stephen Gardner

Silver and silver mining stocks have not been spared by the looming macro headwinds that have weighed on equity and fixed-income markets. Higher rates from the Federal Reserve Board tightening cycle have increased the opportunity cost of holding zero-yielding investments like gold and silver. The pace of Fed interest rate hikes compared to global central banks has bolstered strong dollar demand that has also weighed on precious metals. These factors have made silver speculators overly bearish, even in gold terms. The gold/silver ratio, the amount of silver needed to buy one ounce of gold, currently sits just above 83. This is higher than the long-term average of 65 since the 1970s. While there are current negative market forces weighing on silver, supply can’t keep up with strong demand, which makes us bullish on the commodity.

Supply/Demand Characteristics:

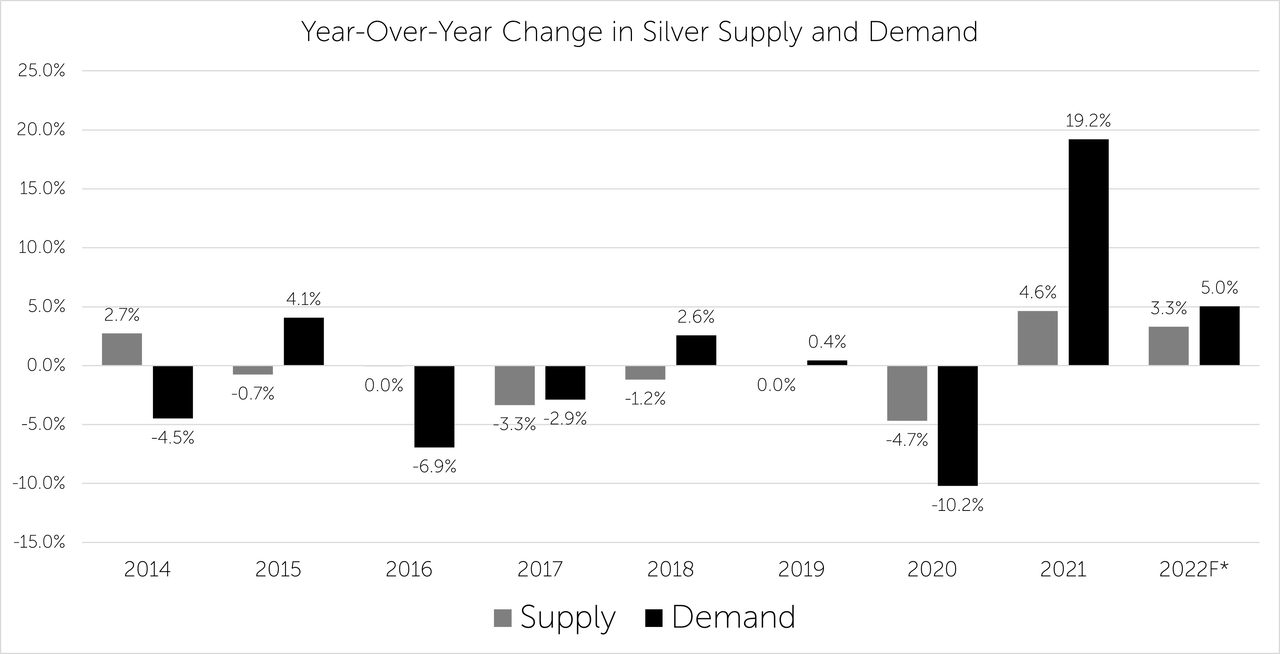

The supply-demand dynamic is the relationship that determines long-term pricing trends. While silver supply has recovered over the last two years since hitting a 10+ year low in 2020 due to coronavirus shutdowns, demand has since outpaced supply by a wide margin. The Silver Institute reported that in 2021 year-over-year demand increased by 19% versus a 5% increase in supply and so far in 2022 demand has outpaced supply by roughly 2%. Supply is currently constrained by the higher cost of fuel and production. Silver prices trading sideways to down in 2022 has only added to supply constraints because miners aren’t incentivized to expand production. This supply-demand imbalance has pushed premiums to purchase the metal to extreme highs. The premium to purchase an American Silver Eagle 1 oz coin, for example, can be as high as 63% above the spot price.

Material and statistics in this section were adapted in part from the Silver Institute’s World Silver Survey 2022. (SILVER SUPPLY & DEMAND – The Silver Institute)

Silver Use in Renewable Energy Transition:

The growing adoption of renewable energy applications like solar panels and electric vehicles (EVs) should only exacerbate the supply-demand imbalance over the long term. Nations across the globe continue to commit to a clean energy transition, providing subsidies and tax incentives. Sales of EVs doubled in 2021 from the previous year to a record 6.6 million and continued to grow in 2022 with 2 million sold in the first quarter alone. The global solar PV (photovoltaic) panels market revenue was $151.18B in 2021 and is expected to reach 292.32B by 2030 (8.6% Compound Annual Growth Rate).

Investment in Silver/Silver Miners:

The volatility in the equity market and macro headwinds have created a shift away from long-duration assets. Silver mining stocks are becoming more attractive for equity-like returns tied to a metal with favorable supply/demand fundamentals. Mining companies offer an alternative to investing in the metal itself and the storage/insurance costs of owning physical silver. If we see demand for safe-haven assets come back to the forefront amid inflationary and geopolitical concerns, the miners are expected to outperform the metal. The ETFMG Junior Silver Miners ETF (SILJ) offers a diversified way to gain exposure to silver mining companies.

Carefully consider the Fund’s investment objectives, risk factors, charges, and expenses before investing. This and additional information can be found in the Fund’s prospectus, which may be obtained by calling 1-844-ETF-MGRS (1-844-383-6477), or by visiting www.etfmg.com/SILJ. Read the prospectus carefully before investing.

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the Fund. Brokerage commissions will reduce returns. Narrowly focused investments typically exhibit higher volatility. Investments in foreign securities involve political, economic and currency risks, greater volatility and differences in accounting methods. These risks are greater for investments in emerging markets. The Fund is non-diversified, meaning it may concentrate its assets in fewer individual holdings than a diversified fund. Therefore, the Fund is more exposed to individual issuer volatility than a diversified fund. Funds that are less diversified across countries or geographic regions are generally riskier than more geographically diversified funds and risks associated with such countries or geographic regions may negatively affect a Fund. Investments in small-capitalization companies tend to have limited liquidity and greater price volatility than large-capitalization companies. The ETFMG Prime Junior Silver Miners ETF is subject to risks associated with the worldwide price of silver and the costs of extraction and production. Worldwide silver prices may fluctuate substantially over short periods of time, so the Fund’s share price may be more volatile. Several foreign countries have begun a process of privatizing certain entities and industries. Privatized entities may lose money or be renationalized. The Fund invests in some economies that are heavily dependent upon trading with key partners. Any reduction in this trading may cause an adverse impact on the economy in which the Fund invests. The Fund’s return may not match or achieve a high degree of correlation with the return of the Prime Junior Silver Miners & Explorers Index. To the extent the Fund utilizes a sampling approach, it may experience tracking error to a greater extent than if the Fund had sought to replicate the Prime Junior Silver Miners & Explorers Index. IOPV or indicative optimized portfolio value is an estimated intraday fair value of one share of an ETF determined by the last trade price of the fund’s underlying securities.

ETF Managers Group LLC is the investment adviser to the Fund.

The Fund is Distributed by ETFMG Financial, LLC, Member FINRA/SIPC. ETF Managers Group LLC and ETFMG Financial LLC are wholly owned subsidiaries of Exchange Traded Managers Group LLC (collectively, “ETFMG”). ETFMG is not affiliated with Prime Indexes.

The Fund is intended to be made available only to U.S. residents. Under no circumstances is any information provided on this website intended for distribution to or use by, or to be an offer to sell to or solicitation of an offer to buy the Fund or any investment product or service of, any person or entity in any jurisdiction or country, other than the United States, where such distribution, use, offer or solicitation would subject the Fund or its affiliates to any registration requirement or be unlawful under the securities laws of that jurisdiction or country.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment