LordHenriVoton

Thesis

The PCM Fund (NYSE:PCM) is a fixed income CEF from Pimco. The fund is on the small side, with under $100 mm in unleveraged assets, and is mostly composed of mortgage debt now (both agency and non-agency). The fund employs a significant amount of leverage, which currently sits at 50%. The main distinctive feature of this fund is its extremely high premium, that tends to compete with PTY’s levels. Back in the beginning of October the fund’s premium was “only” 9%. It has now rallied in excess of 25%.

Despite a solid build and a robust 2023 in front of it, this vehicle does not warrant a market price which is 25% in excess of its net asset value. While the fund undoubtedly benefits from an exquisite management team and expected annual returns around 10%, it does expose a significant beta to market risk-on / risk-off environment. Think of the risks embedded in PCM’s pricing stemming from 2 factors:

- Risk/Rewards of the underlying collateral

- Risk associated with a high premium and its performance in a market sell-off

While not much has changed in respect to the underlying collateral (we will detail a bit further below), the premium for the fund is subject to a sudden collapse in another risk-off scenario. On the holdings side (which we detail below) we are witnessing a stagnating housing market which is currently frozen since buyer interest does not align with seller pricing. A drop in prices is next, which will have some minor negative implications on the collateral. Most of the rates move and CPR increases are priced in though.

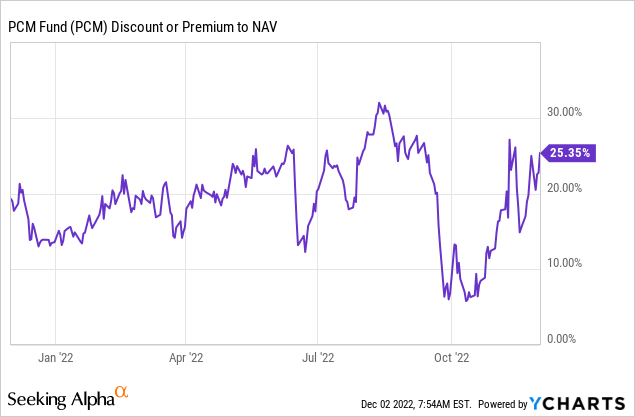

We can see from the “Premium/Discount to NAV” section below how the fund’s premium to NAV has fluctuated with the risk-on / risk-off moves this year. During the June sell-off the premium collapsed by 10%, while the September market risk environment saw a 20% move down in the premium to NAV. These are huge moves! They can represent the dividend payments for one or two entire years. A retail investor needs to be very careful regarding entry points in a CEF that exhibits large premiums with large betas to market moves. It can make the difference between a 10% annualized return and a 3% annualized return (if you buy at peak premium).

We believe we are experiencing another bear market rally currently. While indeed rates have come down a bit in the past two weeks, PCM’s premium to NAV will not be spared during the next leg down in this bear market. Fundamentals are deteriorating and we need to see a capitulation in risk. We have not seen one yet. Expect another significant move down in the PCM premium when that happens, towards its long term level of 10%. Active retail investors can use this opportunity to lighten up on some risk in light of picking the shares back up at a much lower premium to NAV. New investors should not allocate capital to PCM here. It is too expensive at these levels.

Premium/Discount to NAV

The fund is back at premium levels exceeding 25%:

We can see from the above graph, courtesy of YCharts, that the CEF tends to lose anywhere from 10% to 15% during risk-off environments such as the ones experienced in June and September. Expect more of the same. Such a high level of premium is unsustainable now in today’s environment plastered with uncertainties.

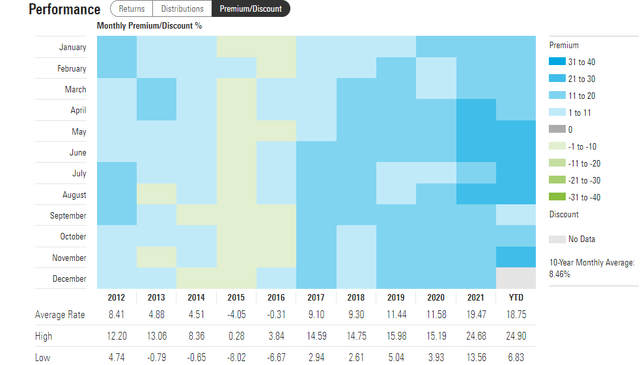

The average, long term fund premium is closer to 10%:

Premium / Discount to NAV (Morningstar)

Do expect history to repeat itself and the fund to navigate towards that level. We only saw consistent premiums to NAV in excess of 10% during the zero rates environment that characterized 2021.

PCM Holdings

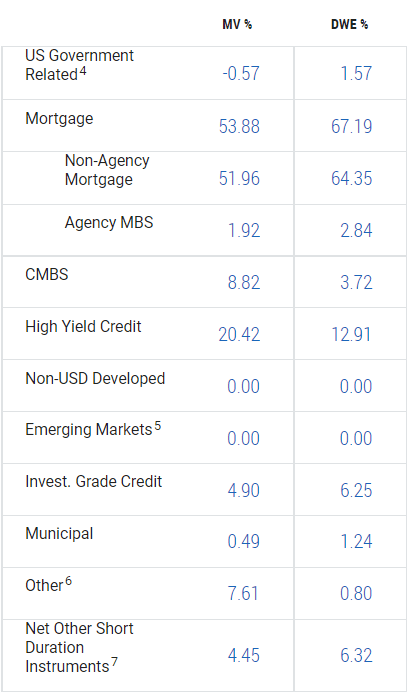

The CEF is a high yield fixed income one, being overweight Non-Agency Mortgages and junk bonds:

Holdings (Fund Website)

Mortgages represent more than 67% of the fund on a duration weighted basis, with the non-agency bucket representing the bulk of the exposure.

Non-Agency Mortgages are bonds which do not have a government guarantee, and thus are subject to credit risk. Non-agency MBS are often based on pools of borrowers who couldn’t meet agency standards. Private entities, such as banks, are able to issue mortgage-backed securities based on pooled mortgages.

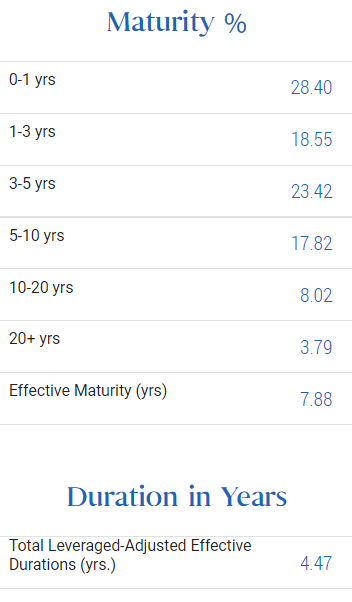

The fund runs a fairly conservative duration of 4.4 years:

Maturity Profile (Fund Website)

An investor needs to remember that a slowdown in the housing market has a two-pronged effect on mortgage bonds: on one hand the credit risk is higher as house prices come down, and at the same time bond durations tend to increase because of a slow-down in pre-payment rates.

Conclusion

PCM is a fixed income CEF from Pimco. The fund is on the small side (sub $100 mm AUM) and has a high leverage ratio of 50%. PCM is now overweight mortgages (both agency and non-agency) and we expect it to have a robust long term performance via its collateral composition. The fund however has traded with a premium to NAV, premium which has jumped to an unsustainable level of 25% now. Long term the fund has shown its premium levels fluctuate around 10%, with only 2021 and zero rates moving that number to a 20% level. We believe we are experiencing another bear market rally currently. While indeed rates have come down a bit in the past two weeks, PCM’s premium to NAV will not be spared during the next leg down in this bear market. Expect the premium to be slashed by 15% when the next risk-off event occurs in the near future. Active retail investors can use this opportunity to lighten up on some risk in light of picking the shares again at a much lower premium to NAV. New investors should not allocate capital to PCM here. It is too expensive at these levels.

Be the first to comment