DedMityay/iStock via Getty Images

In the market, it pays to keep your eye on the prize and not on the noise. But sometimes many moving parts create distractions and result in misjudgments. When this happens, opportunities spawn.

This is ostensibly the case of AZZ Inc. (NYSE:AZZ). The company entered into two transformative and highly accretive transactions in the past 6 months. With one deal closed and the other approaching consummation, AZZ is now entrenched in a business with improved margins, a market experiencing secular tailwinds, and an environment expected to last for the foreseeable future.

But the benefits from AZZ’s metamorphosis have apparently been lost by the market. The company is trading well-below peer multiples as well as its own historical average, and is also heavily discounted from its future cash flows. Inevitably, the market will realize this, and, when it does, AZZ stock could rise as much as +100%!

It is anticipated that once AZZ reports Q2 results in October, which will include a full quarter of acquisitive impacts, the market will begin to rerate its equity value. Thereafter, as management delivers on earnings and planned debt reduction, the stock should continue marching higher. Therefore, AZZ is currently a Buy with a price target of $68/sh.

The Company

AZZ is a North American value-added service provider in the steel and aluminum fabrication process. Services include metal coating and other solutions for steel and aluminum customers.

Operations are broken into three segments: 1) Metal Coatings; 2) Precoat Metals; and 3) Infrastructure Solutions. Metal Coatings (“AMC”) performs hot-dip galvanizing, a process where steel is submerged in molten zinc in order to reduce corrosion and increase durability over the metal’s lifetime. Precoat Metals (“Precoat”), AZZ’s $1.3b acquisition that closed in May, provides pre-painted coil metal coatings. Finally, Infrastructure Solutions (“AIS”) provides electrical engineering and manufacturing solutions to support industrial and electrical applications. AZZ decided in June to divest a 60% stake of AIS. The transaction, expected to close before year-end, will allow AZZ to deconsolidate AIS and account for the remaining interest under the equity method of accounting.

The Precoat acquisition and AIS divestiture boost AZZ’s margin profile and will be highly accretive to the bottom line. On a standalone basis, Precoat has a substantially greater margin profile than AIS. In FY’22 (February ’21 through February ’22), Precoat reported operating income of 16.8%, ~750 bps higher than AIS’ non-GAAP operating income of 9.3%. The higher margins would have resulted in a 54% uplift in AZZ’s FY’22 EPS on a pro forma basis. AZZ will continue to see these accretive benefits going forward.

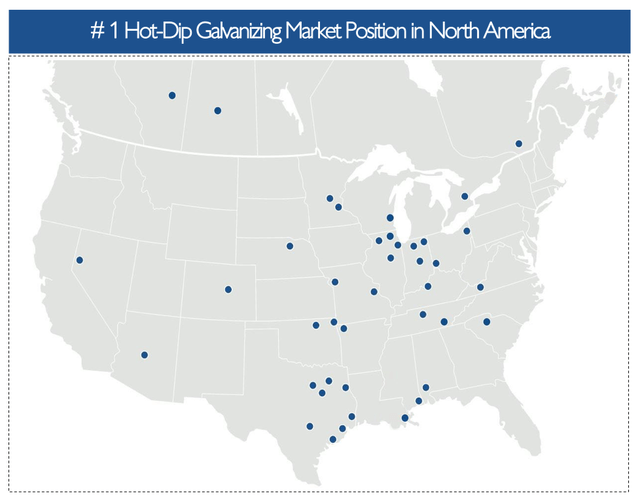

The acquisition also expands AZZ’s already well-established market leadership. Pre-acquisition, AZZ was head-and-shoulders above other hot-dip galvanizing competitors with a ~30% share of the U.S. market. By adding Precoat, AZZ has catapulted to the top of the fast-growing precoating market with a ~20% share. AZZ is now the dominant provider of both hot-dip galvanizing and prepaint solutions.

More importantly, AZZ’s market leadership is sustainable, in part, due to its unique geographic footprint. One of the most important factors in choosing a value-added service provider is proximity to the customer. This is because of the cost and complexity in transporting steel and aluminum products. Therefore, facilities close to customers have a tremendous competitive advantage. Currently, AZZ has an astonishing 41 hot-dip galvanizing facilities across the U.S. and Canada:

This dwarfs its closest competitor–Valmont Industries (VMI)– with only 19 hot-dip galvanizing facilities.

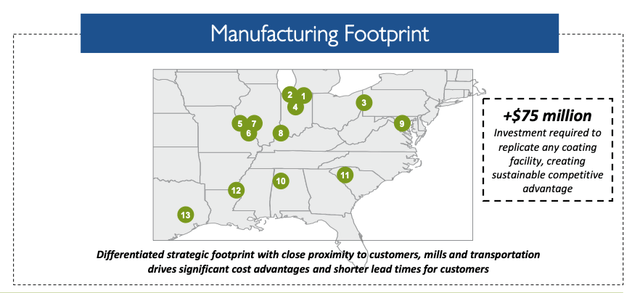

Meanwhile, Precoat brings 13 strategically located precoat facilities across the U.S. into AZZ’s real estate portfolio:

The Precoat facilities are particularly valuable because of the high upfront costs (+$75m) necessary to build a U.S. coating facility. Accordingly, AZZ is ideally positioned to maintain its market leadership going forward.

AZZ has several competitors in the U.S. metal coatings market. In addition to VMI, mentioned above, AZZ competes with Steel Dynamics Ltd. (STLD), an integrated steel producer and fabricator; Axalta Coating Systems Ltd. (AXTA), a provider of performance coatings for metals as well as other materials; and Cornerstone Building Brands, Inc. (formerly NYSE:CNR until it was acquired in July by a private equity firm). Then there are several private, independently-operated firms that compete directly within the steel and aluminum fabrication markets.

AZZ’s capital structure is composed of debt, preferred shares, and common stock. The Precoat acquisition doubled AZZ’s enterprise value. The acquisition cost $1.28b and was financed with a $1.3b term loan as well as $240m convertible notes that have since converted into 6% preferred shares. Presently, net debt is $1.2b (inclusive of leases and a $44.9m unfunded pension liability), $240m of preferred shares, and a ~$1.1b market cap. In total, AZZ’s enterprise value is ~$2.6b.

Compelling Drivers of Demand

The metal coatings market is experiencing strong secular demand trends, with tailwinds expected to persist for the foreseeable future. What is driving demand can be synthesized into two common themes–sustainability and security. From electric vehicles to renewable energy to sustainable packaging to energy efficient building materials to fortifying roads, bridges, and the electric grid; governments, businesses, and consumers alike are making investments in order to achieve lower emissions and create a sustainable and secure future.

The demand for sustainable packaging is one area of the coatings market undergoing secular growth. According to Science Advance, only 9% of the world’s plastic has been recycled to-date. Instead it ends up in landfills, oceans, and littering the environment. The desire to eliminate harmful outcomes is driving many manufacturers to transition to prepainted aluminum, which is endlessly recyclable and done so at twice the rate of plastic bottles. AZZ expects demand for precoated metal to grow at a 6.5% CAGR through 2026.

Another demand driver is government spending related to the recently enacted Inflation Reduction Act (“IRA”) and Infrastructure Investment and Jobs Act (“IIJA”). In total, the bills combine for ~$920b in infrastructure and climate-related investments over the next 5 to 10 years. These bills will drive significant demand across AZZ’s business. For example, AZZ is the #1 provider of precoating solutions to HVAC customers. Just one of the numerous tax credits under the IRA allows a qualifying homeowners to receive as much as an $8,000 rebate off the price of a heat pump. This Old House estimates a heat pump costs anywhere between $1,000 and $6,000 (excluding labor). In other words, the IRA will allow some households to receive a heat pump for free! This tax incentive, and others like it, is going to make it difficult for AZZ and downstream suppliers to keep up.

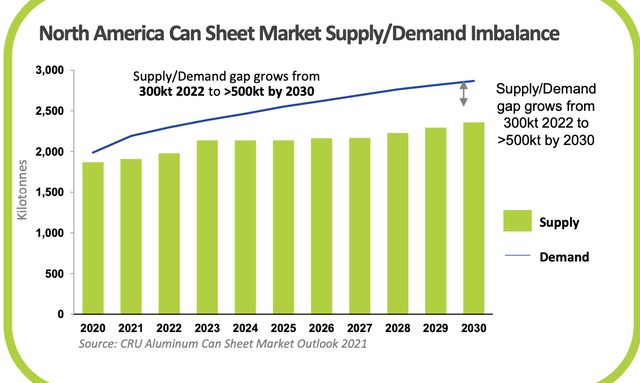

In fact, under capacity is already an issue facing the industry. STLD stated in its most recent conference call, “[W]e see a very clear gap in the supply and demand” when asked about its investment decision to build additional U.S. galvanizing and coating capacity. Despite new capacity, industry participants do not believe the gap will abate anytime soon. Hindalco (OTCPK:HNDNF), the world’s largest flat-rolled aluminum producer and 4th largest U.S. precoat metal producer, expects the North American capacity gap to grow from 200kt currently to 500kt by 2030:

Hindalco Investor Presentation

AZZ forecasts that imbalance will require ~14 new processing and coating lines to meet demand through 2026.

Given the compelling demand drivers coupled with increasing supply constraints, AZZ is poised to generate reliable mid-single digit (4%-6%) growth in the coming years.

Valuation

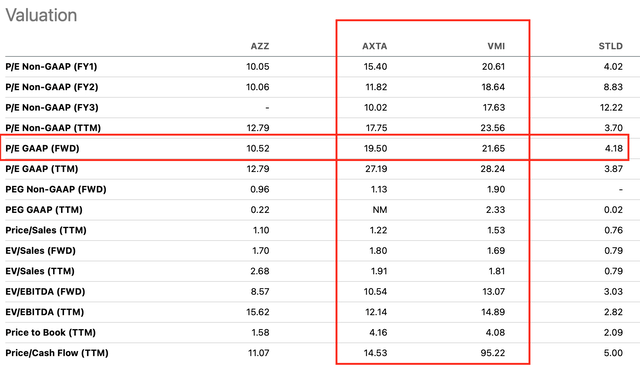

Based on the future demand picture, AZZ presents an attractive investment opportunity given its current forward P/E multiple relative to peers. The company currently trades ~10.5x FWD P/E, compared to an average 20x for VMI and AXTA (although a competitor, STLD was excluded from the average as it is largely a steel producer with fundamentally different valuation metrics. Including STLD, the average FWD P/E for comps would be 15x):

AZZ Peer Tab – Customized (Seeking Alpha)

If it were to rerate in-line with peers, AZZ’s est. FY’23 $4.37 EPS implies a share price of ~$89/sh, a 100%+ upside. Even if AZZ did not move in-line with peers but reverted to its 17x historical average p/e, the company would trade at ~$74/sh, ~70% higher than today’s price! The market is obviously not considering the accretive effects of AZZ’s recent transactions.

AZZ is also undervalued by a wide margin using an intrinsic value approach. Below are conservative assumptions used to discover AZZ’s base case intrinsic value:

- 4.1x net leverage at FY’23 year-end

- AZZ maintains common dividend, pays preferred coupon in cash

- Free cash used to paydown debt to 2.5x with debt pegged thereafter

- Blended revenue growth (organic and inorganic) of 5.1%

- 20.6% EBITDA margin with 22% incremental improvement in FY’24+

- Capex at 4.5% of revenues

- 6% WACC (inclusive of tax shield benefit)

- Exit multiple – 8.5x FY’32 EBITDA.

These assumptions imply a $68/sh equity value, which is ~56% higher than today’s market quotation.

Based on the foregoing, AZZ is trading at a substantial discount and therefore is an attractive equity investment.

Risks

The chief risk in owning AZZ is its leverage. The company went from a debt-to-equity ratio of 34% before the Precoat acquisition to 234% after. AZZ currently has a net leverage ratio (ST & LT debt / adj. EBITDA) of ~4.2x. Its ~$1.3b term loan with a floating rate of 4.25%+SOFR is a significant concern considering the sharply rising interest rate environment. Fortunately, AZZ’s promising revenue outlook and improved operating margins (est. FY’23 of 15%) will provide ample liquidity to quickly reduce leverage. AZZ’s goal is to achieve net leverage between 2.5x and 3.0x by year-end FY’24. Management already committed to use the $228m of anticipated AIS divestiture proceeds to reduce leverage and is keen on using additional free cash to further reduce leverage. Q2 earnings will be investors’ first chance to see whether the goal is realistic.

Following close behind leverage is executional risk. Pre-Covid-19, AZZ went through a span of poor execution leading to missed guidance, misstated financials, and asset impairments. While those issues are largely in the review mirror, and the company has since replaced its CFO, there remains uncertainty whether current leadership can effectively steward the company. Management, however, believes it will be successful and has put its money on the line as evidence. Earlier this month, AZZ’s CEO purchased 5,000 shares (~$212k) of company stock in the open market.

Competition is also a risk. STLD recently announced it is spending $500m to add galvanizing and coating lines in two locations, and another $2.2b on a greenfield aluminum flat-rolled mill with value added lines. Nucor (NUE) is spending $238m to integrate is own galvanizing and prepainting lines. While large dollar investment like these are limited to a few players, it is a sign that the competitive pressure is heating up and that AZZ will have to continue fighting if it wants to remain on top.

Two final concerns are inflation and economic recession. AZZ’s largest input cost is Zinc, which is widely available (the 24th most abundant element in Earth’s crust) but prices can be volatile especially during inflationary periods. Also, a slowdown in the construction, industrial, energy, or transportation markets could stunt the company’s growth and jeopardize its ability to service its debt. Fortunately, ~75% of AZZ’s operating costs are variable, allowing for tremendous flexibility to preserve margins and fulfill its servicing obligation in the event of a downturn.

Conclusion

AZZ will soon have its opportunity to refocus investors away from the distractions and back on the prize. When it does, the stock will climb–substantially. Therefore, AZZ should be seriously considered by long equity investors.

Be the first to comment