Alex Wong/Getty Images News

Back in 2015, Berkshire Hathaway (BRK.A) (BRK.B) closed a merger of two major food producing companies, Kraft and Heinz. The new company, Kraft Heinz (NASDAQ:KHC) quickly reached a $90 share price, and its dividend topped out at $2.68 per year. Then the bottom fell out of the stock, and the company cut its dividend by more than a dollar in 2018.

As I noted in a previous article near the end of last year, Warren Buffett admitted he’d overpaid for KHC. If one of the greatest investors of all time made a mistake in this investment, everyday investors also lost out. However, with lower valuations and a lower dividend, those who have invested in recent months have fared better. At the beginning of the year, it looked like a good investment. Those who bought at that time actually have fared better than the market as a whole, but some of the company’s recent numbers related to sales and cash flow might provide some concern.

Current Valuation

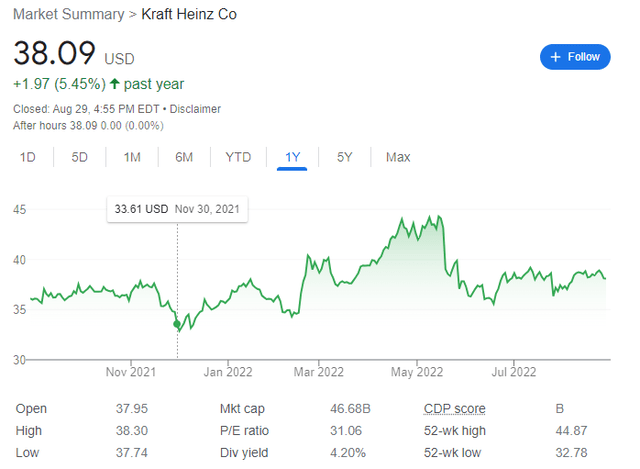

KHC’s stock is currently trading at $38.09 (as of the market close on August 29, 2022). The company’s most recent quarterly report shows GAAP income of $0.21 per share. This leads to a P/E ratio of nearly 31, which is pretty pricey. However, the actual normalized earnings came in at $0.70, which drops the P/E ratio to 13.91. This is actually a solid valuation that would indicate that KHC might be a good option at the present price.

Kraft Heinz has performed well over the past year when looking at only the price. Over the last twelve months, investors have seen a 5.45% increase in the value of their shares without counting for any dividend reinvestment. This is much better than the return of the S&P 500 as a whole, which is down 11% over the same period.

Kraft Heinz has a stable of brands that are well-known throughout the US and the world. From the company’s namesake ketchup and cheese to brands like Oscar Meyer and Ore-Ida, KHC has brands that bring in billions every year. Many of these brands have customer loyalty, although the recent run-up in inflation might cut into that loyalty on the margin.

Sales

Indeed, there might already be evidence that KHC is facing pricing pressure. Net sales actually dropped over the past 12 months. For the quarter ending June 25, 2022, net sales were $6.554 billion. This was a decline from $6.615 billion for the same quarter a year prior. With top-line inflation running 9.1% between June 2021 and June 2022, one might expect a company with pricing power to see sales increase by a similar amount. Indeed, inflation in food prices was 10.4% over the same period. Yet, KHC actually saw a decrease of 0.9% in sales. For the past six months, the number is even worse, with Kraft Heinz seeing a 3.2% decline in sales. This might indicate that people who are feeling the pinch from inflation are switching over to house brands sold at major retailers like Walmart (WMT) or Kroger (KR).

Another number that might give a bit of pause to some investors is the decline in cash available to the company. Free cash flow declined by 78% from the previous year, although the quarterly report notes higher cash tax payments from divestitures during the year. At the end of the quarter ending in June 2021, KHC had $3.942 billion on hand. This year, the number was down to $1.519 billion. The slightly lower sales are likely not tied to divestitures, but are more likely due to lower volumes.

Dividends

KHC has paid a dividend since the merger. However, its investors have already experienced a dividend cut. Some dividend investors decide to sell when there’s a cut and refuse to buy back in until there is a new record of dividend growth. Kraft Heinz would not qualify in this regard. However, the company’s dividend is $1.60 per share on a share price of $38. This is a dividend yield of 4.2%, which is pretty healthy when compared to many dividend-paying stocks or index funds. Based upon the non-GAAP earnings, this is a payout ratio of just north of 58%, which should be quite sustainable in the immediate term, although this might change if revenue continues to stagnate.

Those seeking relatively high yields might find KHC ticks that box. There is no dividend growth, as the company has kept the dividend at $0.40 per quarter since its 2019 cut from $0.625 per quarter. However, the dividend has remained stable for nearly four years, and, as noted above, it appears sustainable for the near term.

Conclusion

KHC is a popular company with many well-known brands. It’s done a good job of maintaining its current dividend in recent years after a cut that went into effect with the first payment in 2019. The payout ratio is sustainable right now, but slightly lower sales numbers in an inflationary environment are a bit concerning. One might expect to see sales increase on a year-over-year basis, especially for a company like Kraft Heinz, which should have quite a bit of pricing power because of the popular brands in its stable. Those who are chasing yield might find the stock’s valuation and dividend attractive, but it might be worth the effort to watch sales numbers in coming quarters to see if this is a trend that might erode the company’s profitability in the longer term. Should sales continue declining, a preemptive sale might be a good idea.

Be the first to comment