peterschreiber.media

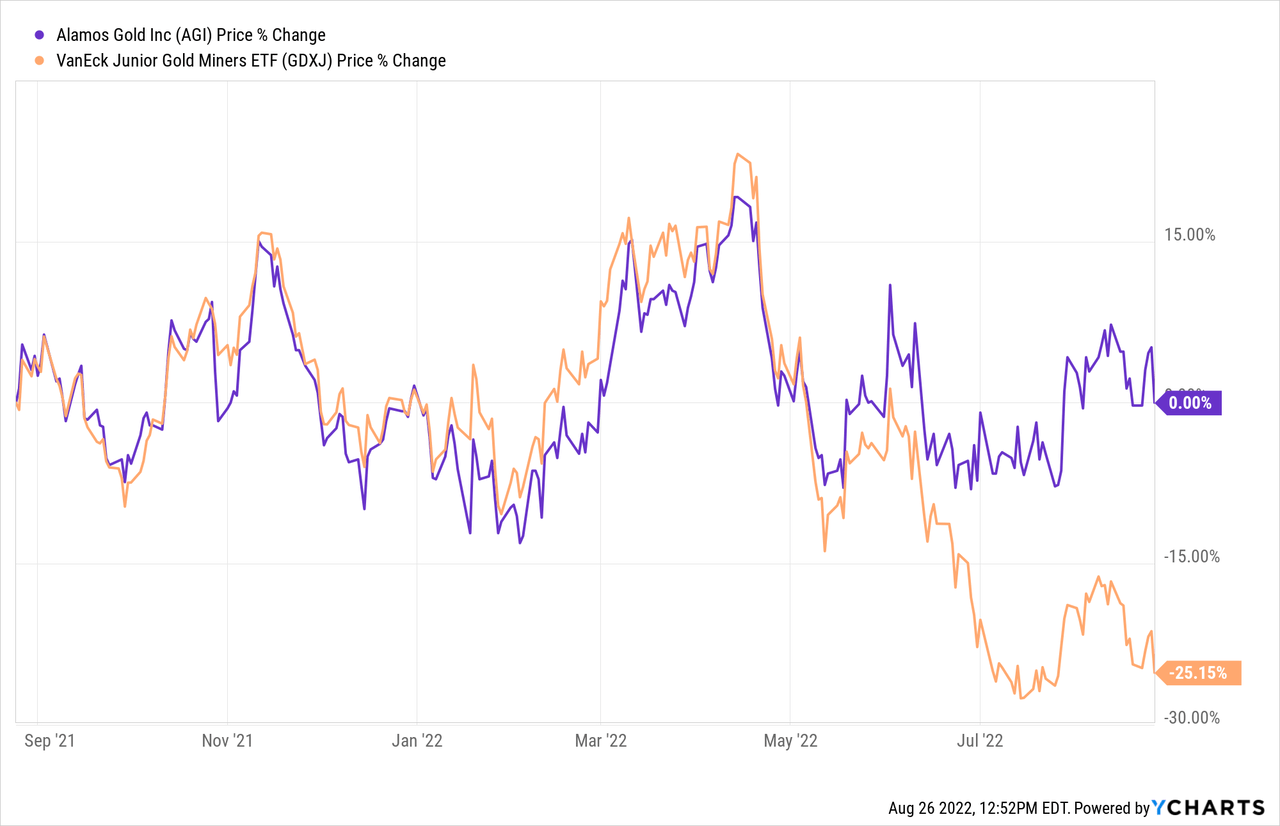

Alamos Gold (NYSE:AGI) has gone through a lull for the past few quarters with Mulatos barely generating free cash flow due to the transition to the La Yaqui Grande pit, and the Island gold mine under-performing in Q1 due to handling issues caused by exceptionally cold weather in January. Nevertheless, shares have outperformed peers (GDXJ) over the summer months thanks to a couple of strategically timed news releases just before the holiday season: on June 20, the company announced the completion of construction and initial production at La Yaqui Grande, followed only a week later by the release of results for a Phase 3+ expansion study for the Island gold mine. Judging from the chart below these two news releases have worked their magic on the share price, and the subsequent release of Q2 results seems to have reinforced the market’s positive outlook on this mid-tier gold miner.

We have studied Q2 results (financials, MD&A), listened to the earnings call, and updated our charts. Here is our take and current investment thesis for Alamos Gold.

Operations

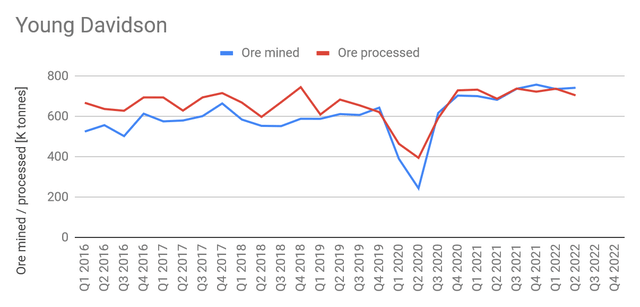

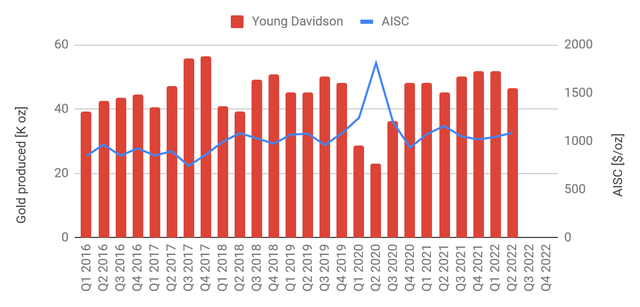

The Young Davidson mine delivered yet another solid quarter, reaping the benefits of the lower mine expansion. The mine exceeded design mining rates for the fourth quarter in a row, while mill throughput and consequently gold output was logged at slightly less than average due to planned downtime facilitating a liner change. Costs remained steady for another quarter despite production coming in at the lower end of the usual range.

Young Davidson – ore mined & processed (Company filings & author’s data base)

Young Davidson – gold produced & AISC (Company filings & author’s data base)

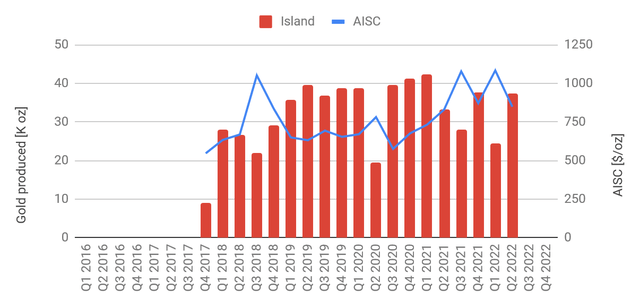

Challenges experienced in Q1 at the Island gold mine did not recur and the mine delivered another strong quarter in terms of gold output as well as cost.

The company has updated its plans for the Phase III expansion of this mine based on the latest resource estimate. Here is how CEO Mr John McCluskey summarized the results of the latest study:

Following the completion of the shaft in 2026, production is expected to more than double from current levels to average 287,000 ounces of gold per year with all-in sustaining costs dropping to $576 through the larger expansion … all contributing to a significantly more valuable operation with a $1.8 billion valuation at current gold prices.

In this context, it’s worth noting that this mine is currently carried at just over $1B book value, i.e. significantly less than the value documented in the latest study.

We expect operations to continue at the present clip going forward, ensuring self-funding of the so-called Phase III+ expansion at the Island gold mine.

Island gold mine – gold produced & AISC (Company filings & author’s data base)

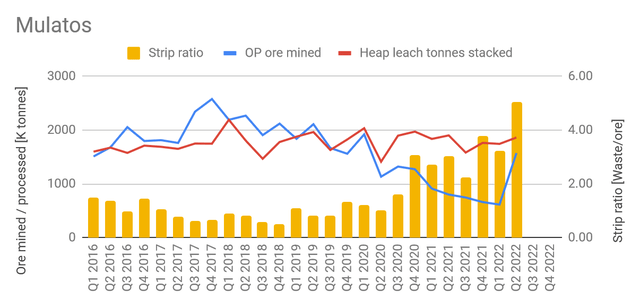

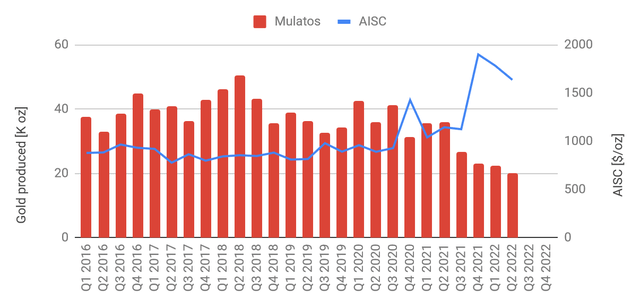

This leads us to the Mulatos mine complex where the La Yaqui Grande mine has finally started operations, and has contributed just over 20% of the total ore mined at Mulatos in Q2, with the remainder sourced from the El Salto pit. Nevertheless, this relatively small contribution from the La Yaqui Grande pit already left its mark on our charts.

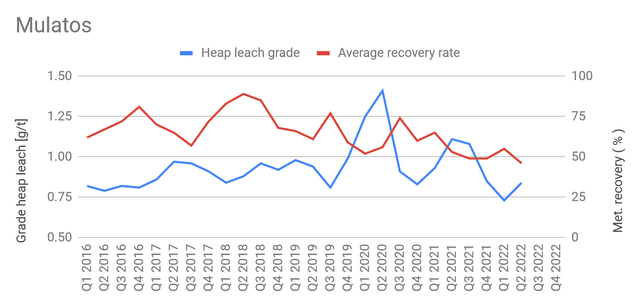

The consolidated strip ratio increased sharply due to waste mining at La Yaqui Grande. Open Pit ore mined also increased sharply, while tonnes stacked trended up but to a much lesser degree. We expect “tonnes stacked” to catch up with “ore mined” in the coming months, and at the same time we should also see grades on the pad trending higher. Concurrently we expect recovery rates to improve as production moves from the stockpiles and the dying pits to the new ore source and leaching settles into a steady state at the new pad.

All done and dusted we expect to see the full benefit of the high-grade ore from La Yaqui Grande around year-end. The charts below certainly show the green shoots of the rebound at Mulatos investors had been longing for, but will require confirmation in the second half of this year.

Mulatos – mine balance (Company filings & author’s data base)

Mulatos – heap leach stats (Company filings & author’s data base)

Mulatos – gold produced & AISC (Company filings & author’s data base)

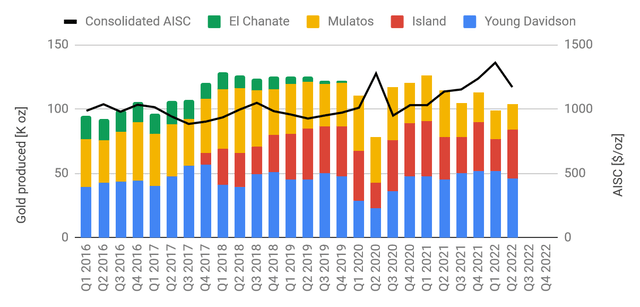

On a consolidated basis, Q2 production topped the 100Koz line — still at the lower end of the range but up from Q1. And if La Yaqui Grande lives up to expectations then we should see the bars in the chart below trending up to 110-115Koz in H2.

Consolidated production & AISC (Company filings & author’s data base)

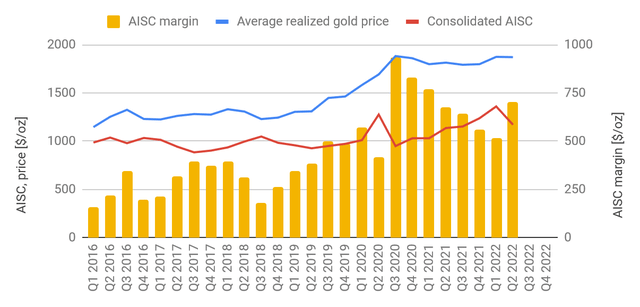

All-in sustaining costs have declined again from the Q1 peak, and margins have increased above $700/oz again. And that’s quite an achievement in the current environment where cost inflation takes center stage in earnings calls with most peers.

Margins (Company filings & author’s data base)

Financials

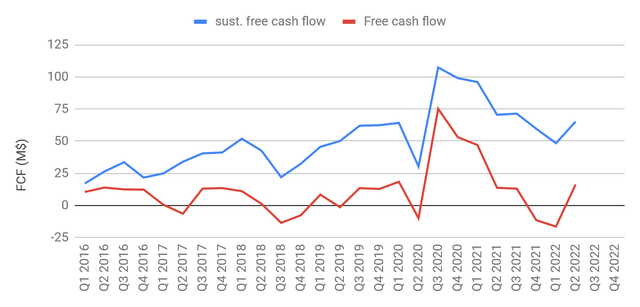

The company’s top line has been benefitting from the strong gold price in recent quarters, and the mentioned cost control has supported Alamos Gold’s ability to generate free cash flow before growth capital spending as indicated by the blue line in the chart below. This free cash flow from ongoing operations has been spent mostly for organic growth projects keeping free cash flow (red line in the chart below) around the Zero line. Capital spending with regards to La Yaqui Grande is coming to an end now, and we should see the red line move up towards the blue line in the coming quarters.

FCF (Company filings & author’s data base)

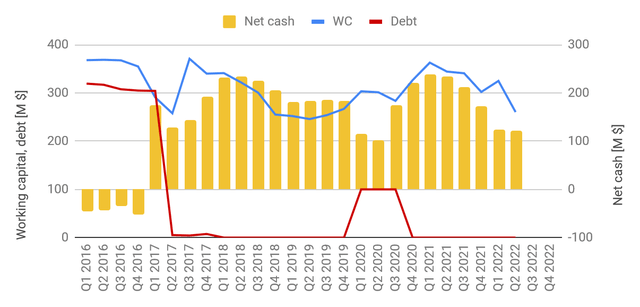

The balance sheet is still in good shape. The credit facility remains undrawn, and working capital as well as the net cash position were reported above the $100M mark at quarter end. Clearly, this company is in good shape with Mulatos and Young Davidson both set up to generate plenty of free cash flow, and Island Gold paying its own way with regards to the expansion plans.

Balance sheet (Company filings & author’s data base)

Summary & Investment Thesis

Alamos Gold has almost completed its latest organic growth project and is poised to generate substantial amounts of free cash flow for the foreseeable future. The completion and ongoing ramp-up of production from the La Yaqui Grande pit should turn Mulatos back into the cash cow investors have learned to appreciate before the transition. And the Island gold mine will drive growth going forward and management has made it clear that it will also get priority in terms of capital allocation, while the Lynn Lake project will continue to play second fiddle. Alamos Gold has been able to control costs better than most peers, and with increasing production at Mulatos even a cost reduction on a consolidated basis seems plausible going into 2023.

The balance sheet hasn’t suffered much at all from capital spending at Mulatos and remains one of the strongest among mid-tier gold miners, boasting no debt and more than $100M in cash.

Alamos Gold has bucked the general down-trend among gold miners and has out-performed peers over the summer months. We continue to be impressed by this company’s ability to deliver on organic capital programs, and its ability to control costs.

We believe that cash flow multiples are presently the most appropriate tools for mid-tier gold miner valuations. We prefer to use sustaining cash flow for this purpose as this nets out the effects of capital programs and bases the valuation on the strength of ongoing operations. At the time of writing, Alamo’s shares were trading around the $7.60 mark, which translates into a sustaining free cash flow multiple of just over 12 based on trailing quarters. Looking forward we see the multiple dropping to around 10 once the benefits of the La Yaqui Grande transition manifest themselves on the cash flow statement. That’s a very attractive valuation, and compares very favorably to peers routinely trading at multiples well above 15.

Furthermore, we note that at a $7.60 share price the company is trading at 0.9xNAV, and if we factor in the latest technical report on the Island gold mine the multiple drops to 0.7. Both these measures – again indicating a highly attractive market valuation.

Bottom line: Alamos Gold is our top pick among mid-tier gold miners. Management has an impressive track record of adding value to an already attractive portfolio. The company is set to generate solid free cash flow for the foreseeable future, and it is well-positioned to act on M&A opportunities by virtue of its solid balance sheet. And last, but certainly not least, the company is currently trading at a very attractive valuation. BUY Alamos.

Be the first to comment