recep-bg/E+ via Getty Images

Author’s Note: This is the free version of a premium article posted on iREIT on Alpha on 20th of June 2022.

Dear Subscribers/readers,

My investment in Orange (NYSE:ORAN) has, inclusive of dividends and FX performed positively in a market that has otherwise been marked by significant downturns and troubles.

When a company manages to eke out gains, even small ones, in a market where most stocks seem down by 15-40%, that is a “win” in itself. And it was all about buying Orange at what turned out to be a superb undervaluation. Since I bought the company, we’ve seen fundamental improvements to the company’s prospects. These improvements can be considered relevant even beyond the current environment we’re in.

Let me show you.

Orange – An Update

Orange has long been a tale of answering the question; “When will things finally turn around?”

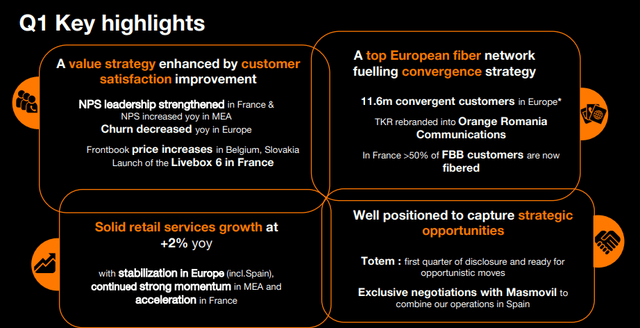

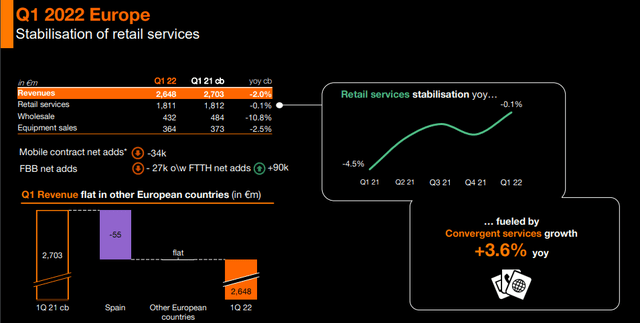

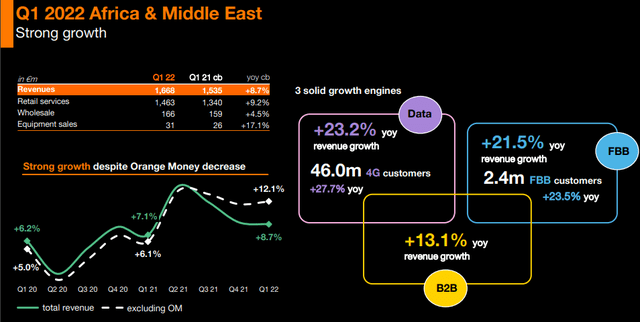

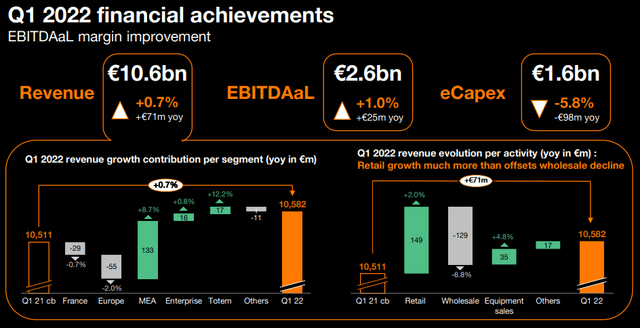

My answer to that question is that this is happening as we speak. For the past two years, we’ve seen something of an inflection point in revenue and EBITDA growth, with Orange becoming more of a solid fixed player and with fixed incomes leading the charge together with TV. This is continuing, in the latest 1Q22 report. 1Q22 reported in line with expectations with an EBITDA growth of 2.5-3% for the full year, while CapEx, as expected, will start to step down and normalize – in this year, by around 5%, impressive enough.

Revenues and EBITDAaL for the quarter were up slightly, while CapEx was already showing that 5% decrease, with a 5.6% decrease in 1Q22 alone. This allowed for a very impressive EBITDA less CapEx increase of no less than 14% YoY.

Orange Presentation (Orange IR)

These numbers were not expected by many, it seems, but analysts, including myself, were expecting this. That’s part of why I’ve been adding Orange. When it comes to the company’s dividends, this is also a point worth making – that the dividend, stuck at €0.7/share for 2022, will be able to slowly start to increase in 2023. To make it clear, my yield on cost here is over 8% on the company, and this will rise once the company starts bumping up that dividend.

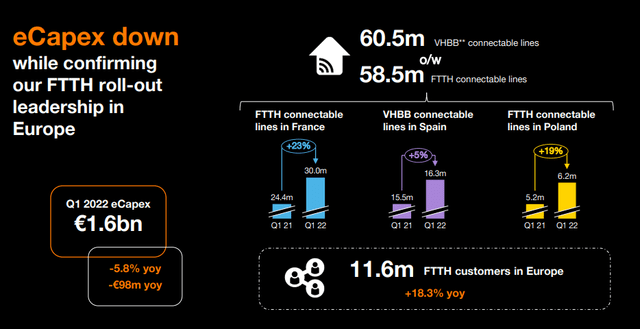

The reason for this outperformance in EBITDAaL was in large part due to fundamental outperformance but also effects like favorable comps linked to the employee shareholding program, which weighed heavily on results last quarter. On 31 March 2022, Orange had 58.5M households connectable to FTTH worldwide (an increase of 17.7% YoY). In France, the FTTH customer base rose by 23% – again, very impressive numbers.

My main point when it comes to Orange is that I expect this company, regardless of current macro, to enter a very favorable cycle over the next few years. We’re likely to see significant growth in company operational and free cash flow with EBITDA growing by 2-3% in 2022, and beyond in 2023-2025. Fiber is the core here, with more than 53% of new fiber customers belonging to this group. In early 2022, Orange France signed its 6th millionth fiber customer – the CapEx the company has put to work over the course of several years will now start to pay off, and the convergent effects here should see improvement to the company’s bottom line.

These things will, as I see it, drive EBITDA growth for the foreseeable few years.

The favorable cycle will be further influenced by the decrease in CapEx, which has only begun. With 28.8M households connectable to FTTH at the end of 2021 (corresponding to an impressive 85% coverage), we can now say that France, unlike Germany or the UK which are still far from it, is covered in FTTH. Orange is indeed the uncontested European fiber optic leader with a vast network of over 58.5M connectable households across the group’s footprint. This means that Orange can wind down the CapEx that other operators still have to spend in order to reach the same coverage.

Orange is, as they say, ahead of the curve here. With a forecast of the company’s EBITDA less CapEx growing significantly going forward, we can expect Orange to advance going forward. The only pity here is the fact that Orange chose to remain that dividend at €0.7 for another year, despite really having the ability to push the envelope here.

Orange Presentation (Orange IR)

Combine this with the fact that the company is significantly undervalued on an EBITDA basis, and we can see that the market is continuing to severely underestimate Orange as an investment – there’s only one thing to do in response to something like that, as I see it.

Don’t forget also, that Orange combined their operations with MasMovil in Spain. The combined player will take some of the stress of Orange’s Spanish operations due to size, with the entity being the second-largest Spanish telco with revenues of €7.5B, compared to over €12B for Telefonica. €450M worth of synergies is expected, as well as a combined EBITDAaL of €2.2B on that €7.5B worth of revenues.

Orange Presentation (Orange IR)

MasMovil is an impressive shop. Since the company came on the market after its purchase of Yoigo from Telia (OTCPK:TLSNY). Spanish consumers began to reorient themselves toward budget plans, which became more excessive during COVID-19. MasMovil has increased its fiber and ADSL customer base, grabbing most of the gross growth of the Spanish market and stealing from its competitors. Note MasMovil has wholesale agreements with Orange, Vodafone, and Telefonica for the rest of Spain

Note, in the same period, the three main players (Telefonica, Orange, and Vodafone) have barely increased their fixed customer base, although they have better quality customers with better ARPUs.

This coincided with the departure of the company’s CEO Stephane Richard. It’s a great deal, as I see it, and it should deliver value to Orange.

Orange – The Valuation

I’ve talked extensively about Orange’s valuation before – so let me do it again and really hammer this stuff home. The telecom sector offers probably one of the best visibilities in dividends for the next ten years, a point that is worth considering even in this market environment. By investing in qualitative telcos, you’re “parking” money in electronic communications infrastructure – plays that typically have some sort of inflation protection or indexing, either directly or indirectly, much like we’ve seen companies like Verizon doing by upping their prices across the board.

When telcos have finally completed the deployment of their fixed ultra-fast broadband networks (fiber or upgraded cable), they will control the primary access to all of the services that people now rely on. That is really what you’re investing in here.

On the back of significant EBITDAaL increases, I’m forecasting a significant earnings growth that influences the DCF, but the undervaluation is present across every single other perspective as well. Let’s run through them one by one.

Orange presentation (Orange IR)

I forecast EBITDA to remain the same in terms of growth – for the most part (single-digit increase) – but the significant thing here is the company’s 3-5% CapEx decline that’s already begun. The net effect here is more profit. Based on a WACC of 6% and an average cost of debt north of 3.3%, we still get an implied EV/share of €20/share, which is almost double the current, €11/share price. So much for DCF – and we require some care here.

What about other analysts? Other analysts do consider Orange undervalued, but the range can be somewhat different. Based on a range of €8.3 as a low and €16 as a high, the average from 21 analysts calls for a valuation of €12.5/share. I view this as conservative to where the company could go, but I do think it’s also an accurate, conservative upside. 13 out of 21 analysts consider the company either a “BUY” or an “Outperform” at this valuation. S&P Global gives the company a 14% undervaluation. Equity analysts like Alpha value, go up to 50% undervaluation.

Me? Somewhere in between, much like my last article. I’d say Orange is worth €14/share, and consider the company undervalued here with a significant upside. Given a 70-cent dividend, this company has a yield of 6.5% – on par with Vodafone and some others – but more upside than most, in case this is realized.

Remember – Orange is actually ahead of the curve. That’s why you might want this company on your side.

Thesis

This brings us to the current ORA thesis. There’s also the ADR ORAN – you can invest in either. They’re both very liquid. In the case of orange, I actually use the ADR for investing, as it grants some broker-related advantages above the Paris listing.

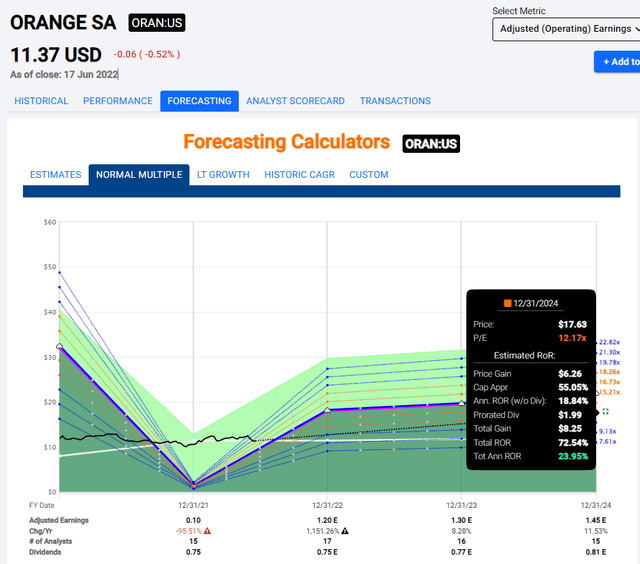

This is the 12.5X 2024E Upside to the current forecasts, which I consider to be accurate.

Orange Upside (F.A.S.T graphs)

This is why the company continues to be a heavy telco investment for me – and why I don’t mind pushing the envelope and expanding my stake to 3-4% of my TPV if I can find the capital to do so. Currently, I’m all about the careful and consistent deploying of capital into undervalued opportunities. There are plenty of those opportunities on the market today.

This is one of the major ones.

Orange is a “BUY” with these targets.

Be the first to comment