Rafael_Wiedenmeier

American industrial conglomerate General Electric (NYSE:GE) released its third-quarter earnings on Tuesday morning.

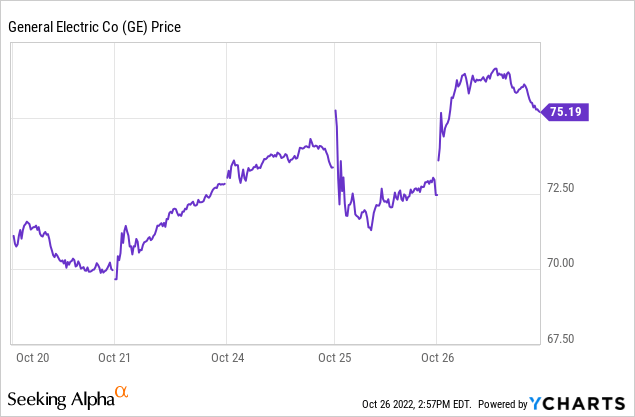

This was not an earnings report that dramatically changed the state of play for GE stock:

Heading into the Q3 earnings report, GE stock had advanced from $70 to $74 over the prior week. Shares initially moved higher on the Q3 numbers but sold back off immediately at the start of trade on Tuesday. Ultimately, shares ended up off less than a percent for the day.

And now, GE shares are higher in Wednesday trading amid a rally in many industrial sector stocks. All that to say that the earnings report certainly didn’t derail GE’s broader uptrend, but it’s hardly a game changer on its own either.

Why is that? Overall numbers were mixed, with several signs of strength but one division continuing to perform terribly. On top of that, GE is still quite far from finishing its planned spin-offs and corporate restructuring, which means that investors still have to wait to see how the company will perform once this streamlining process is complete.

Mostly Good Results

GE’s headline earnings numbers missed expectations. Adjusted earnings of 35 cents per share came up well short of the 49 cents that analysts had been looking for. Furthermore, the company trimmed its full-year earnings guidance in conjunction with the quarterly results.

It’d be easy to look at the headline figures and assume the worst. Under the surface, however, there was more good than bad. The company’s revenues exceeded expectations, and GE maintained its sales guidance going forward. While there are issues with profit margins for the time being, demand for GE’s products remains strong despite the uneven economic outlook at the moment.

This was particularly true on the aerospace and aviation side of the business, where GE reported an encouraging 24% jump in revenue. This was particularly driven by higher service revenue, which is positive news given the favorable margin profile from that line of business.

That said, engine sales also were up significantly. In the past, GE has at times seen margin issues on hardware sales; the fact that it was able to post this much additional profit margin growth speaks to a robust recovery in aviation rather than just product mix toward more attractive servicing work.

Notably, GE pulled off this 24% growth in aviation revenues even as military sales declined slightly. Given current geopolitical developments, it wouldn’t be surprising if military sales pick up steam in coming quarters as well, which would add further momentum to this already surging business.

And, it’s worth remembering, the new GE will be its aviation business as the company is spinning off healthcare in early 2023 and the power business in 2024. As GE is becoming an aviation-focused business, investors should be cheered by the particularly strong results from this segment right now.

Wind Is A Big Headache

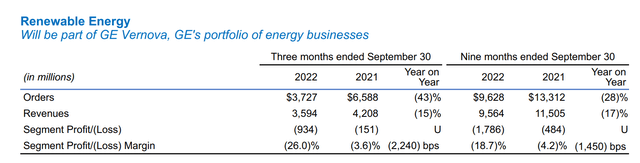

Why weren’t GE’s Q3 earnings stronger? While several divisions met or exceeded expectations, the renewable energy segment continues to be an anchor on GE’s overall outlook:

GE Renewables Results (Company report)

For the quarter, GE Renewable Energy saw orders plunge by 43% while revenues slumped by 15%. The company’s operating loss dramatically widened as the segment’s operating margin fell by more than 2,200 basis points. This wasn’t just a Q3 event, either. Renewables’ year-to-date results also have been bleak.

GE blamed the big decline in activity on the lapsing of the former production tax credits for the wind industry. In addition, GE was more selective in which new contracts it would accept in the renewable segment going forward. Over time, it makes sense to cull less profitable contracts and focus on higher value-add opportunities. However, it certainly adds to the near-term earnings hit. Warranty-related expenses also increased.

Earnings Expected To Recover, But Spin-Offs Complicate Things

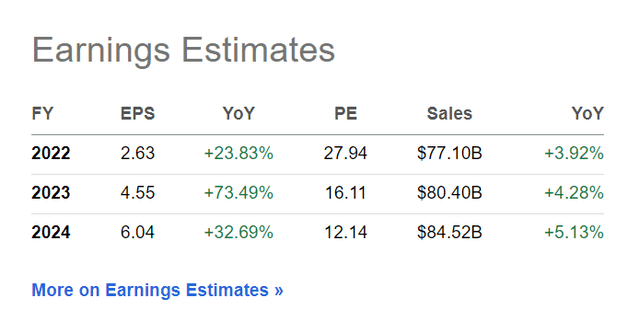

Coming into GE’s Q3 2022 numbers, analysts were forecasting $2.63 of full-year earnings for this year:

GE earnings forecasts (Seeking Alpha)

Going forward, analysts see that jumping to $4.55 per share for 2023 and $6.04 for 2024. In theory, this would make GE quite the bargain stock as shares would be at just 16x and 12x forecasted 2023 and 2024 earnings, respectively.

The thing is that, in theory, GE should already be quite profitable. As you can see, analysts aren’t expecting any huge leap in revenues going forward, with top-line growth being in the mid-single digits. Rather, GE is supposed to benefit from strongly improving profit margins as CEO Larry Culp’s operational improvements really take hold at GE.

However, it’s hard to say just how much earnings improvement GE will actually see. The Renewables division, for example, is now unlikely to return to segment profitability until at least given 2024 given the additional strain in that sector.

And, more broadly, it’s really hard to judge where earnings will be going forward thanks to the upcoming spin-offs. Until we see what the remaining GE looks like along with operating numbers for the newly spun-off units, it’s hard to get a sense of exactly where valuations should be, either for each individual GE business segment or the overall corporate parent.

GE Stock’s Bottom Line

At the end of the day, GE remains a bet on Culp’s ability to improve the company’s operations and allocate capital responsibly. There are some hints from the quarterly results and associated conference call that this transformation is going well. GE is getting more production and efficiency out of its servicing operations, for example.

However, this is not going to be an easy story to quantify until after the spin-offs. There are simply too many moving parts with both the healthcare and energy businesses set to depart. Meanwhile, aviation numbers remain volatile as the industry recovers from the effects of the pandemic and Boeing’s (BA) safety issues.

Based on what analysts are forecasting and also what Culp achieved in the past with Danaher (DHR), today’s valuation for GE seems rather undemanding. And there are long-term tailwinds here too with the United States’ improving position geopolitically. That’s particularly true in light of a renewed push toward manufacturing in North America and the country’s cheaper energy prices as compared to Europe and Asia.

For investors willing to stick with GE through 2024 and give Culp time to keep executing on the plan, there’s a lot to like here. But let’s not get too excited in the short run. There are a ton of moving parts to deal with between now and when new GE is fully up and running in a couple of years. And, in the interim, the company still has to deal with a sluggish renewable power division along with the broader struggles that a slowing economy will cause.

All that to say that GE remains a favorable risk/reward for longer-term investors. That said, there’s a high degree of uncertainty on what GE’s next 12 months will look like, and investors should be prepared for more volatility before things improve.

Be the first to comment