efenzi/E+ via Getty Images

Investment Overview

Having recently updated on progress at MindMed (MNMD) – a company developing “”pharmaceutically optimized drug products derived from the psychedelic and empathogen drug classes,” I thought I would provide a complementary update on progress at Compass Pathways (NASDAQ:CMPS), a London-based firm attempting to bring its COMP360 psilocybin therapy to a market of ~100 million people with Treatment Resistant Depression (“TRD”).

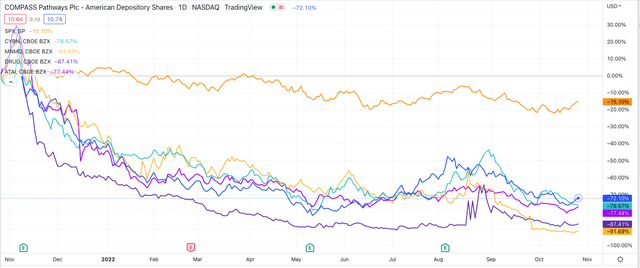

When covering MindMed I shared a screenshot taken from TradingView charting the share price performance of several of the most prominent companies working with psychedelic drugs and mental health. I’m sharing an updated chart below.

Share price performance of selected companies developing psychedelic drugs. (TradingView)

Although there’s increasing mainstream awareness of psychedelic drugs – from MDMA, to ketamine, to LSD and psilocybin – the ingredient found in “magic mushrooms,” and how they may be used to treat people with mental health conditions – from schizophrenia, to Post Traumatic Stress Disorder (“PTSD'”), to treatment resistant depression and anorexia nervosa – from an investor’s perspective, it’s important to understand that these companies valuations have been plummeting.

The share prices of Canada based Cybin (CYBN), Berlin, Germany,-based ATAI Life Sciences and MindMed, based in New York, are down by respectively 76%, 78%, and 92% across the past 12 months, whilst Compass’ share price has fallen by 72%.

When I covered Compass in September 2021, its market cap valuation was >$1.4bn – today it is just over $440m, which speaks to the fact that the market is simply not buying the psychedelics / mental health story at the present time.

Although numerous studies going all the way back to the ’50’s and ’60’s have been able to establish links between psychedelics and improved mental health outcomes, and the FDA has even approved Johnson & Johnson’s ketamine based nasal spray for TRD, there are major hurdles that need to be cleared before companies like Compass can begin to resemble bona fide investment opportunities.

Patent protection is one such hurdle. Whether it’s possible to establish a patent for a naturally occurring substance is a hotly-debated subject – some believe patenting psychedelics is the only way to encourage innovation and provide R&D funding, while others believe it’s exploiting practices used by indigenous peoples in healing and religious ceremonies for centuries.

The fact that both the US Food and Drug Agency (“FDA”) and Drug Enforcement Agency (“DEA”) categorise psychedelics as “Schedule 1” drugs – meaning they’re classified as having high potential for abuse, no accepted medical use and cannot be prescribed marketed or sold in the US – is another major problem faced by thee companies.

A third problem is establishing that a drug indicated for depressive conditions is both safe and effective. Depressive conditions can be complex and hard to diagnose, improvements in condition hard to track, and assessments objective. Time also is an important factor – does a therapy only work while it’s being administered, or for a short time after, before the effect wears off and the patient’s condition worsens.

It’s safe to say that none of the listed psychedelics companies have been to satisfactorily resolve any of these issues – if they had, their share prices would likely be rising, not falling, as demand among patients and physicians for psychedelic treatments likely supports a multi-billion dollar industry, and a successful formulation could become a blockbuster (asset generating >$1bn per annum revenue) drug.

The currently-listed psychedelics companies are dogged by other issues also, such as funding concerns, boardroom shenanigans, difficulties transporting their product, arranging clinical trials, establishing trial protocols, and all in the face of hostility from big pharma, which views psychedelics as an industry of little value given the patent and regulatory issues.

Compass is probably the company most likely to overcome the challenges faced by a psychedelic drug developer based on its management, stability, and progress / body of work, and is therefore the least speculative bet for investors looking for opportunities within the psychedelics field.

Investors are paying a premium for this stability and progress – the other three companies mentioned are much cheaper to buy – but in this post I will update on where Compass finds itself today, and why it may just have a shot at success.

Compass Today

Compass IPO’d in September 2020, raising $147m at $17 per share, so the stock is only trading at a 35%-40% discount to its listing price, which is not too bad based on current biotech bear market standards.

The fact that Peter Thiel and German film producer and serial investor Christian Angermayer were investors gave the company publicity and helped the share price quickly rise to $58, but since then has generally been in decline, barring a surge to $49 in November 2021, when Compass announced that its phase IIb study of COMP360 psilocybin therapy for treatment-resistant depression has reached the primary endpoint for the highest 25mg dose.

That remains the high water mark for the company study-wise, but the company also has been steadily growing and now numbers ~120 staff, with a new CEO appointed shortly before Q222 earnings were announced in the shape of Kabir Nath – formerly Senior Managing Director of Global Pharmaceuticals at Otsuka Pharmaceutical Co, and President and CEO of its North America Pharmaceutical Business.

The appointment of a pharma industry veteran as CEO seems like a coup for Compass as it suggests senior management and investors genuinely believes it can win approval for COMP-360 and perhaps even overturn psilocybin’s Schedule 1 drug status, opening up a multi-billion market in which it would have a significant first mover advantage.

COMP360 psilocybin therapy contains 3 elements – the drug itself, a “synthetic, high-purity polymorphic crystalline formulation of psilocybin,” psychological support “from registered and trained mental health professionals” and Digital Tools, i.e. a patient app, therapist portal and AI-driven analytics platform.

That may sound complex but it’s one way of circumventing patent issues – the entire process is patented as opposed to just the drug. In fact, Compass has won five patents in relation to COMP 360, but these have been challenged in court by a not-for-profit, Freedom to Operate, who view Compass’ patents as an attempt to take control of a product that’s naturally occurring and therefore not patentable, and earn license fees from other companies engaged in similar work. There’s an argument that winning the battle for psychedelics is in fact the entire game, thanks to the licensing fees that would be chargeable.

Compass remains reasonably well funded, with a current cash position of ~$200m, although comprehensive loss for 1H22 stood at >$65m.

The Phase 2b Success – Compass’ Attempt To Establish Proof-of-Concept

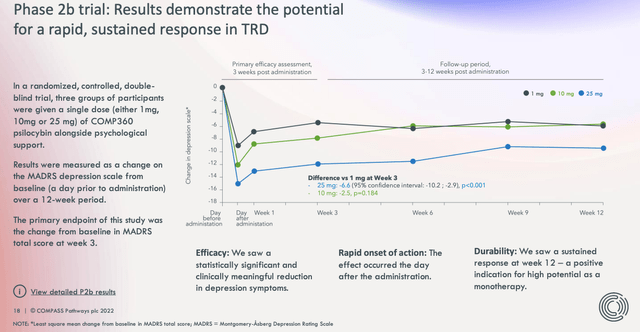

To return to more mundane matters, as we can see in the slide (from a Compass investor presentation) the Phase 2b study was able to meet its endpoint.

Phase 2b study results (investor presentation)

Compass was able to announce a “statistically significant and clinically meaningful reduction in depression symptoms” in patients at Week 3, and encouragingly, by Week 12 the response was still in evidence.

Sustained responders – those who recorded a ≥50% change in MADRS total score from baseline) at weeks 3 and 12 – also saw improvements in quality of life and in PANSS positive effect total score.

From a safety perspective, although treatment emergent adverse effects (“TEAEs”) were observed in all groups i.e. the 25mg dose, 10mg dose, and 1mg dose, such as suicidal ideation and intentional self-injury, Compass said all patients who experienced these events during the therapy had admitted to suicidal thoughts prior to the trial, and concluded:

Case-by-case analysis of safety data found no evidence to suggest a causal relationship between these TEAEs and administration of COMP360 psilocybin.

To summarize the results, we can say that the results were broadly encouraging, but equally that they likely throw up as many questions as answers. Was the sample size of 233 patients large enough? Which aspect of the therapy was most effective? Could it be that the presence of the professional mental health counselor was more important than the drug? How long does the positive effect persist / are there longer term safety issues not yet discovered?

These are the types of questions Compass will presumably attempt to answer with its Phase 3 trial design.

The Phase 3 Study – Compass Looks To Double Down and Show Longer-Term Safety

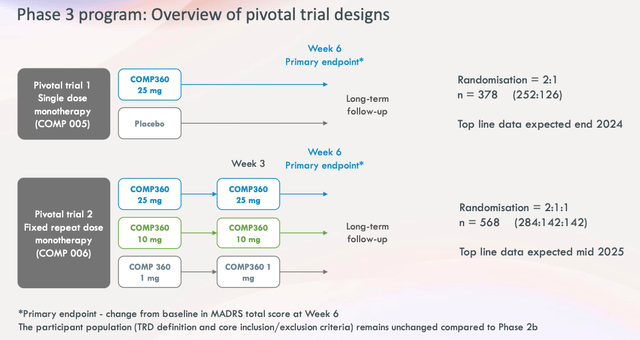

After completing its end-of-phase 2 meeting with the FDA, Compass has now designed its – presumably pivotal – Phase 3 study.

Phase 3 trial design (presentation)

As we can see above, in the Phase 3 design there are two separate studies. The first is split into COMP 360 25mg dose and placebo, with a primary endpoint of change from baseline in MADRS total score at Week 6, followed by long-term follow-up. The second evaluates the 3 different dosages again, with the same endpoint, and long-term follow-up.

In total the trial will enroll nearly 950 patients, with top line data expected from part 1 in late 2024, and from part 2 in mid 2025. The study will use sites in the US, Europe, and Canada. To summarize, the study may well answer questions around longer-term safety, has a much larger patient population, a placebo arm and a method of administration that is presumably becoming more and more attuned to patients.

These are certainly encouraging signals, as is the potential market opportunity.

Treatment Resistant Depression Market

Treating Depressive conditions is big business – AbbVie’s Vraylar, for example, approved to treat schizophrenia and bipolar, earned >$1.7bn of revenues in 2021, whilst Bristol Myers Squibb’s Abilify earned >$7bn per annum prior to generic competition being permitted – but at the same time the scale of the unmet need in these markets is substantial.

That’s because nobody knows precisely what drugs may work for different patients, and also because most drugs show limited efficacy only, and may not have any effect whatsoever on a large proportion of patients.

Treatment Resistant Depression is a ~100m patient market, Compass estimates, comprised of ~30% of 320m people suffering with depression who have not been helped by first or second line treatments.

Compass’ revenue model is based on delivering COMP360 to treatment centers, and offering training and site activation services, and digital solutions. Compass hopes it will be able to secure reimbursement and also is looking to licensing for its training techniques and digital monitoring.

Here again is where things begin to get murky for Compass. If approved, will Compass be able to be able to claim patent protection for providing a naturally occurring drug? And what price could it charge? What’s stopping another company rapidly gaining approval for the exact same procedure, tweaking a few elements to ensure there is no patent infringement?

Conclusion – Compass Has Red Queen Syndrome But Likely Remains The Pick Of The Bunch

“Red Queen” syndrome is a condition named after the Queen of Hearts in Lewis Carroll’s Through the Looking Glass, who tells Alice:

Now, here, you see, it takes all the running you can do, to keep in the same place.

The syndrome is associated with evolution and the nature of competition in business, but in the case of Compass, I use it in the sense that no matter how hard or fast the company runs, it still finds itself facing an identical problem that will not go away.

I’m referring to the twin issues of how to protect an asset that basically belongs to everyone and cannot therefore be patented, and how to persuade the authorities to reschedule psilocybin as a Schedule 2, 3 or 4 drug, as opposed to Schedule 1.

Both present complications that seem insurmountable, but also could be viewed as opportunities. On the one hand, if Compass wins approval for COMP 360 based on a positive Phase 3, it may be good news for the company, but what’s stopping hundreds of other companies completing similar studies and entering the market? The profits of the business would soon dry up in that scenario.

On the other hand, Compass could become like a franchise vendor, allowing other companies to license its approach and buy their product from Compass, but would this be permitted? It would be a highly controversial and unpopular move.

Compass does have some influential people fighting its corner and by comparison with some of its rivals, it’s making serene progress, but it still seems entirely unclear as to whether its business can ever earn revenues in the manner intended.

Some people have suggested that Lewis Carroll was under the influence of psychedelic drugs when he wrote his Alice stories in the 1860s. In fact, the psychedelic drug legalization debate has been around just as long, without ever becoming close to being resolved.

That would be my fear with Compass, that no matter how the Phase 3 trial turns out, it’s not sufficiently correlated with a coherent business plan for the company to succeed as a company, no matter what it may or may not do for the psychadelic debate in general.

Be the first to comment