jetcityimage

Introduction

2022 is as challenging as it is fascinating. The macro environment is extremely tricky as we’re dealing with a mix of high and persistent inflation, slowing economic growth, and a Federal Reserve eager to drain liquidity until inflation normalizes. In the midst of this, we see that railroads are still digesting the post-pandemic surge in demand, which came at a time of reduced labor and equipment investments. Hence, on top of everything else, railroads need to improve network fluidity while also incorporating risks of significantly lower volumes in the quarters ahead.

Norfolk Southern (NYSE:NSC) released its earnings earlier today (October 26). Not only is NSC one of my all-time favorite long-term investments, but I also added aggressively to my position in the past few weeks.

As an investor, I have to say that the challenges facing NSC are real. It’s truly a tough environment, and stock price weakness is justified. However, the company is handling these headwinds extremely well. The third quarter was a success, given the bigger picture, and I will remain a buyer at current prices.

So, let’s take a look at the details!

The Bigger Macro Picture

Norfolk Southern is one of America’s largest Class I railroads, which dominates the East with its only Class I competitor CSX Corporation (CSX). I discussed CSX earnings in this article.

Norfolk Southern

What makes Norfolk Southern unique is its intermodal exposure (trailers and containers). In its third quarter, the company shipped close to a million containers and trailers, generating 28% of its revenues.

I’m mentioning this because the economy is in a tricky spot. Unlike in the 2015/2016 manufacturing recession, weakness is now all over the place.

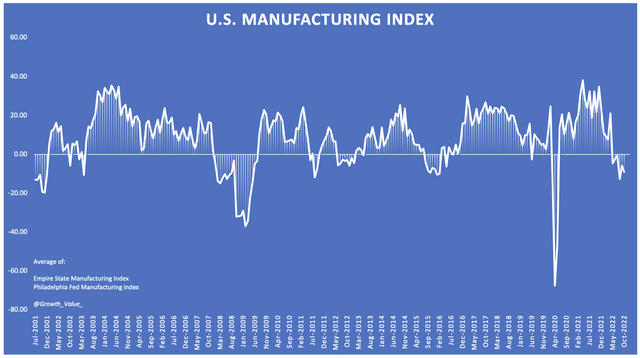

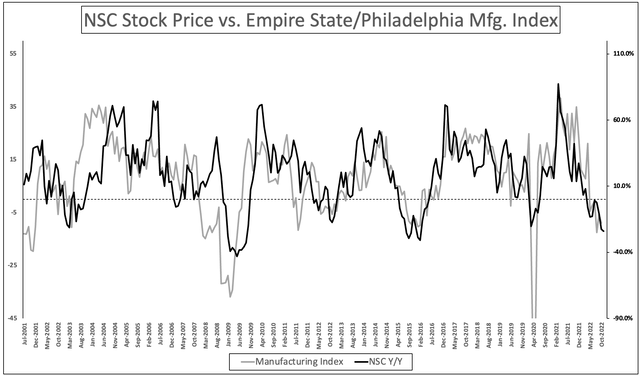

My updated manufacturing index, which consists of New York and Philadelphia Fed numbers shows that we are looking at industrial production contraction, after almost two years of very high business expectations.

Author

Earlier this month, Wells Fargo commented on the deterioration in US economic strength:

[…] while the U.S. economy has remained resilient thus far, tighter monetary policy is certainly starting to impact some key sectors. Industrial production regained its footing in September, but there are signs of slower growth ahead, while regional manufacturing surveys support this loss of momentum. Meanwhile, the real estate sector has been significantly affected by rising interest rates, with total housing starts falling 8.1% in September.

Bear in mind that all of this impacts railroads. Railroads are the backbone of US manufacturing as they ship basic materials to factories, semi-finished products to companies further down the supply chains and finished products to consumers.

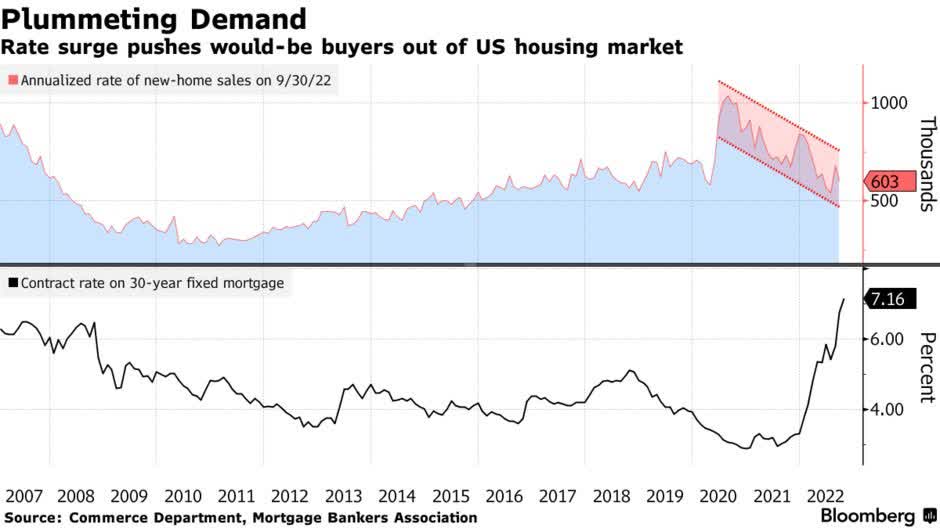

Add to this that housing is weakening as well.

Purchases of new single-family homes decreased 10.9% to a 603,000 annualized pace following an unexpected gain in August.

Bloomberg

This weakness hurts lumber shipments and everything related to one of the most capital-intensive industries in the world.

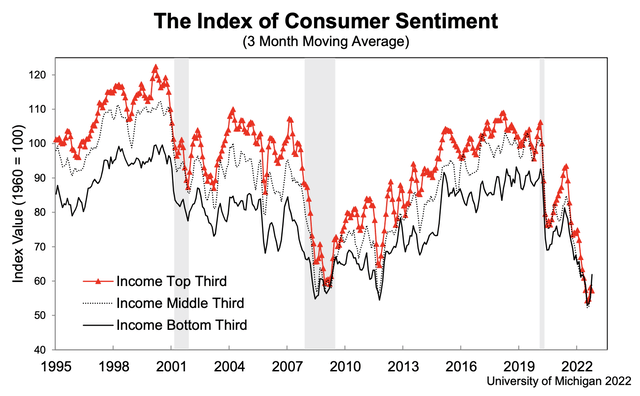

When adding high inflation, we get extremely low consumer confidence, which is terrible news in general, let alone for an economy with 68% consumer spending exposure (as a percentage of GDP).

University of Michigan

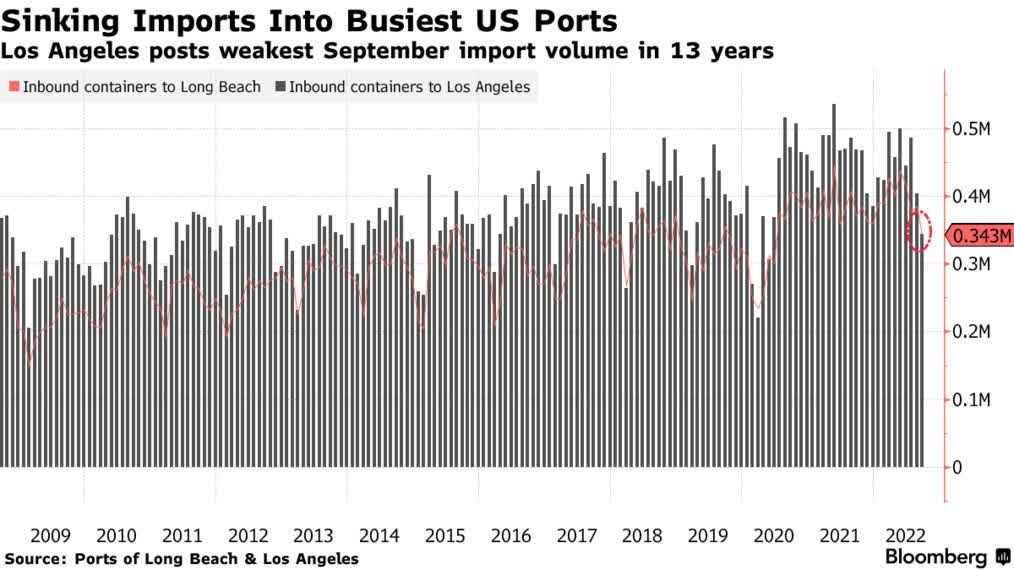

As I discussed in a recent Union Pacific (UNP) article, this is now hurting container demand. Import volumes are steadily declining as a lot of consumer products are imported.

Bloomberg

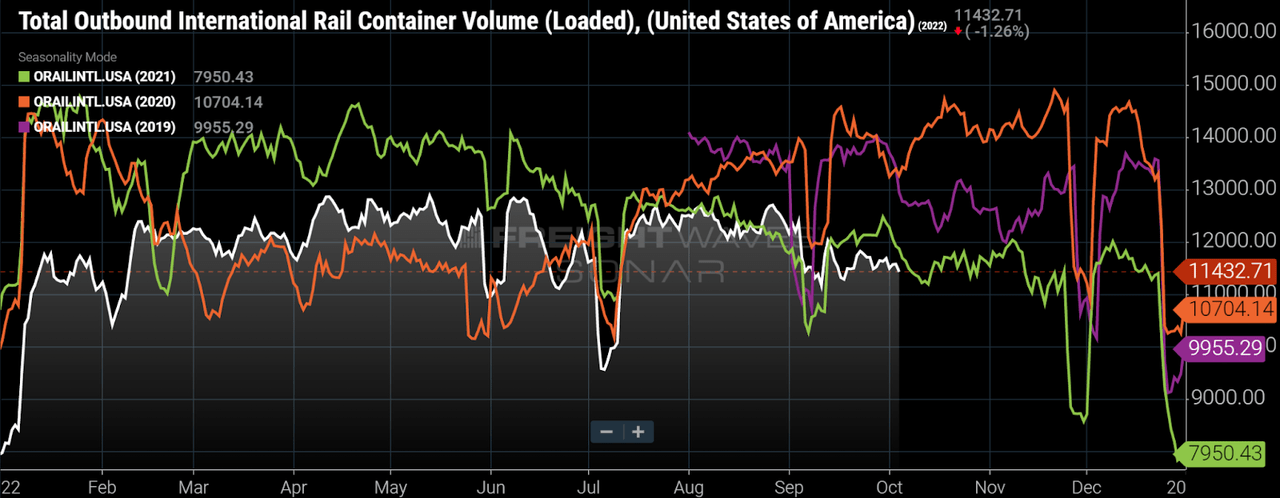

Unfortunately, outbound volumes aren’t much better as outbound rail container volumes are now below anything we’ve seen in the prior three years.

FreightWaves

In other words, railroads are still dealing with improving operations after a steep increase in post-pandemic shipments and, on top of that, declining shipments, which need to be managed accordingly to protect operating efficiencies.

While Norfolk is suffering, it did quite well.

Norfolk Southern Did Very Well In 3Q22

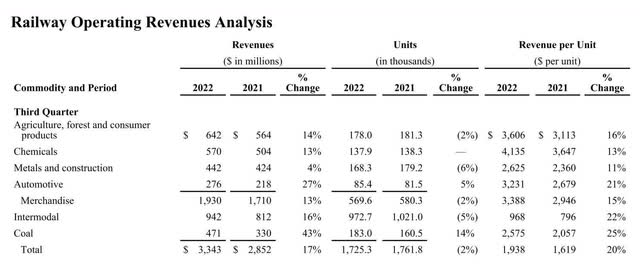

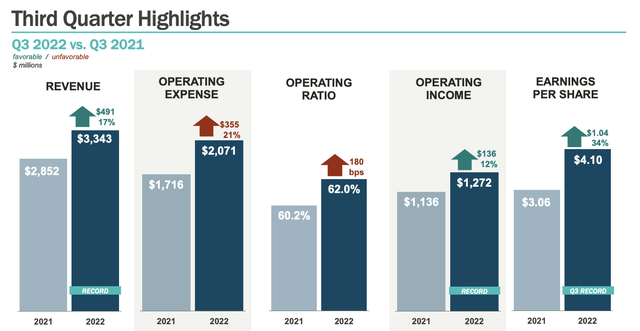

In its third quarter, the Atlanta-based railroad generated $3.3 billion in revenues. This is an improvement of 15.8% versus the prior-year quarter. It’s also $70 million higher than expected, which sounds good but means the results were roughly what analysts expected.

These revenues provided the company with fertile ground to generate $4.10 in GAAP EPS, which is $0.41 higher than expected.

As the table below shows, the company’s shipments confirm that the economy isn’t doing *that* well. Total shipments were down 2% to 1.7 million units. Only automotive and coal saw tailwinds, which makes sense. Automotive companies are benefiting from easing supply issues, allowing them to turn backlog into finished vehicles. Meanwhile, coal demand remains high as a result of the ongoing energy crisis, lower Russian exports, high natural gas prices, and everything related to that.

Norfolk Southern

The good news is that weakness in shipments was turned into strong revenue growth. Norfolk Southern achieved record revenues in merchandise, which was able to push total revenues into record territory as well.

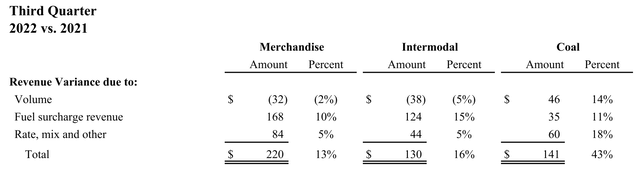

The tables below show the transition from volume to revenues. The biggest driver was fuel surcharges as a result of high energy prices. Rates, mix, and “others” added 5% to revenue growth in both merchandise and intermodal. Coal scored high in all three categories.

Norfolk Southern

Moreover, revenue per unit numbers were up 20% – on average. In this case, the company achieved record RPU results in every single category, which underlines its strength in an environment of slower volumes and aggressive inflation.

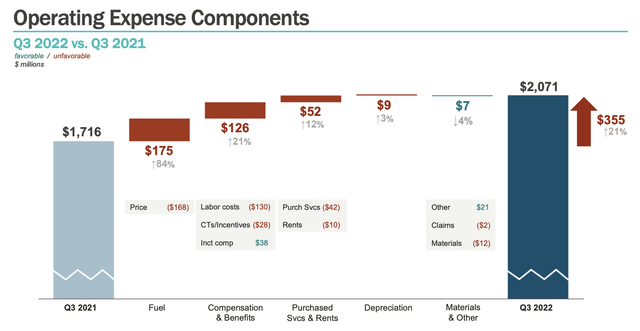

Speaking of inflation, the company’s operating costs soared by 21% to $2.1 billion. As fuel surcharges suggested, the biggest increase came from fuel as higher prices added $168 million to the fuel bill in 3Q22. Labor costs were $130 million, causing total compensation and benefits to soar by 21%.

Norfolk Southern

As the overview below shows, these numbers made it impossible for the company to improve its operating ratio. If you’re new to rails, the operating ratio measures how much it costs to operate the railroad, as a percentage of revenues. The lower, the better.

In the third quarter, the operating ratio rose by 180 basis points versus the third quarter of 2021. What’s interesting is that it did not prevent the company from growing operating income by 12% to $1.3 billion, a new all-time high. Moreover, the operating ratio would have been unchanged if it weren’t for 2022 wage accruals pertaining to prior periods. These wages added 270 basis points to the operating ratio. Core business improvements were a 50 basis points tailwind, which is extremely important to be aware of.

Norfolk Southern

Moving further down the company’s income statement, earnings per share rose by 34% as a result of 42% lower income tax expenses, and $2.3 billion in share buybacks this year, which lowered the number of shares outstanding.

So far, I have to say that I like the results – given the circumstances. The company was able to remain highly profitable despite headwinds, resulting in record results.

It also helps that the company’s network efficiencies are improving.

Hiring is going according to plan. The company has 950 conductor trainees. NSC now has 7,335 qualified train and engine employees, the highest number since 2Q21. It’s also the company’s target, which it reached one month earlier than expected. It’s also up from the low of a mere 6,937 in 1Q22.

In 3Q22, the company’s trains were faster. The average train speed was 19.1 mph, up from 15.5 in 2Q22. So far, in 4Q22, that number is 20.3. Total dwell hours are down to 24.5 in the first weeks of 4Q22, the lowest (the lower, the better) since 3Q21.

Moreover, with unchanged crew starts (yard & local), the company was able to lower dwell by 5% with 9% more cars per carload, which is another step in the right direction.

Total crew starts were up 1%. The number of active locomotives was up 3%. Volumes were down 2%. Normally, that’s not a great trend as the goal is to achieve higher volumes with flat (or lower) employment numbers. However, the company is rebuilding after the pandemic. So far, this is leading to record fuel efficiency and more network fluidity.

I like where this is headed.

What’s Next?

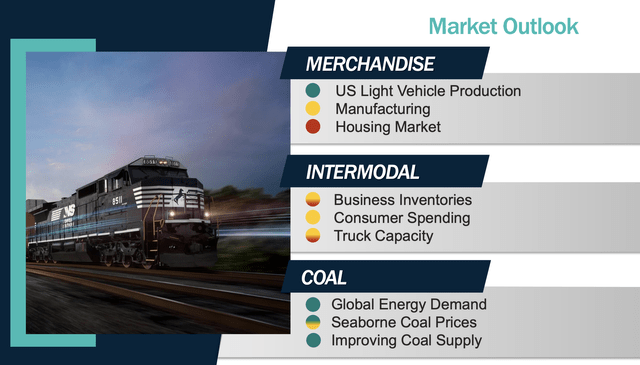

As expected, the company’s market outlook has gotten worse. As the colors below indicate, both merchandise and intermodal are now running into trouble as a result of slower expected manufacturing output, a significantly weakening housing market, and slower intermodal as imports, exports, and domestic shipments are weakening.

Norfolk Southern

According to the company:

As the Fed tightens interest rates, mortgage rates have increased to levels that are cooling the housing market. This reduced demand affects several of our merchandise as well as Intermodal markets. Overall, we expect merchandise volumes to be relatively flat in the fourth quarter with some upside potential as service continues to recover.

On intermodal, the company commented:

Within Intermodal, our expectation is for volume to be down slightly year-over-year with opportunities from easing terminal congestion and equipment supply being offset by expectations for weaker demand and a softening truck market.

So far, these comments and results perfectly follow the macro discussion we had in the first part of this article.

What’s interesting, but not unexpected, is that coal will remain a tailwind.

Coal still accounts for 14% of total revenues. Export demand will remain high as even “progressive” European countries are going back to coal to maintain somewhat elevated natural gas storage levels. It also helps that new supply is coming online while prices are expected to remain stable. That’s as close to a best-case scenario as it gets for transportation companies like NSC.

Valuation

Investors loved the company’s results, which I believe is justified. Despite headwinds, Norfolk Southern did very well. It handled the labor and congestion situations very efficiently and the company will continue to benefit from transportation “backlogs” and coal strength going forward.

That’s a reason to buy, despite a tough economic environment.

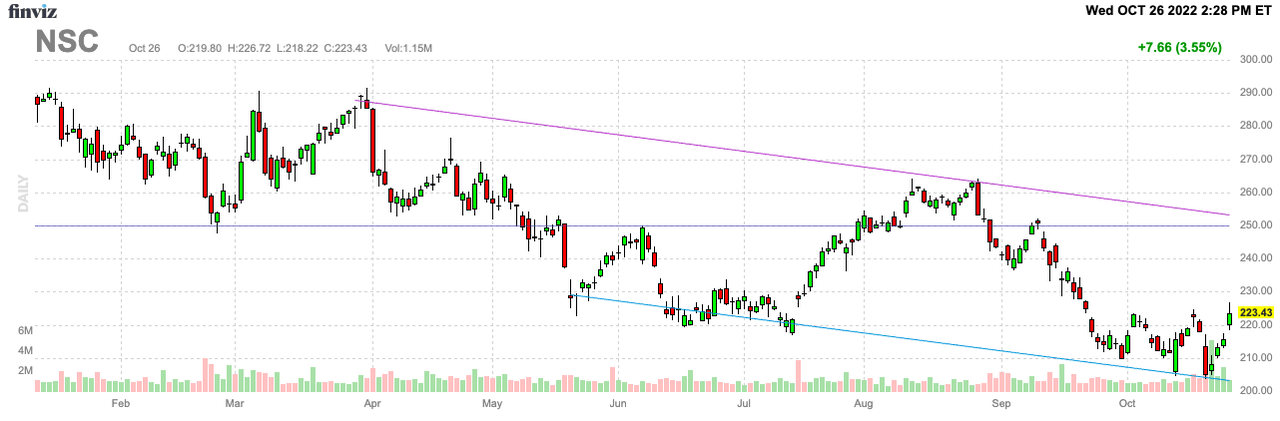

While I am writing this, the stock is up 3.5%.

FINVIZ

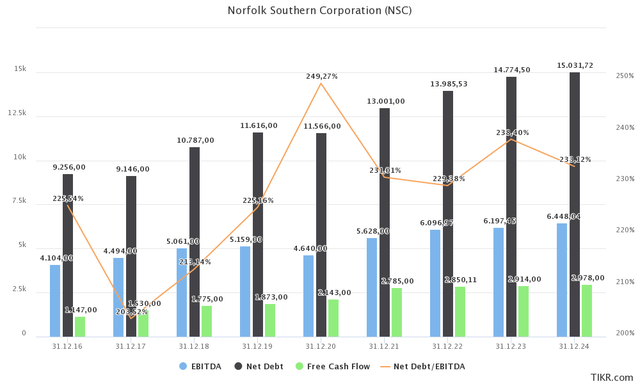

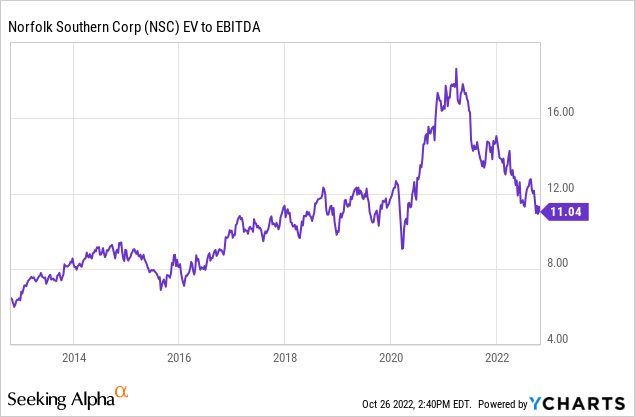

That said, Norfolk Southern is trading at 10.9x 2023E EBITDA. That’s based on its $67.9 billion enterprise value, consisting of its $52.5 billion market cap, $14.8 billion in 2023E net debt, and roughly $600 million in pension-related liabilities.

TIKR.com

Moreover, the company has an implied 2023 free cash flow yield of 5.5%, which supports its current 2.2% dividend yield, and buybacks, as the net debt load remains subdued below 2.4x EBITDA.

This valuation isn’t “deep value”, but it wouldn’t keep me from adding some long-term exposure if I hadn’t bought rather aggressively in the past few weeks.

As the stock is still 24% below its all-time high, the chart below shows that a lot of economic weakness has been priced in. The chart below uses the stock price performance of NSC and the manufacturing data I used in the first part of this article.

Author

Again, I cannot make the case that the stock market has bottomed. However, I can make the case that NSC is trading at an attractive valuation for long-term investors. Accumulating in sell-offs like the current one has been a great recipe for long-term wealth generation.

Takeaway

Norfolk Southern remains one of my favorite portfolio holdings. While macro and operating headwinds are vicious, the company is coping well. In its third quarter, it achieved its operating targets, hiring more people than expected, while increasing operating fluidity.

Moreover, while inflation and operating costs outperformed revenue growth, the company’s operating ratio breakdown shows a stellar operating performance. While the company won’t (almost certainly) be able to lower the OR below 62%, I believe that an upswing in volumes has the ability to push the ratio down to 55% in the 4-6 quarters ahead.

It also helps that the valuation has come down a lot as the NSC ticker is down 24% from its all-time high.

While it’s hard to make the case that stocks cannot possibly drop any lower, I think NSC offers opportunities for investors like myself.

I will remain a buyer at the current prices.

(Dis)agree? Let me know in the comments!

Be the first to comment