Olemedia

FREYR, The God of Prosperity

FREYR Battery (NYSE:FREY) (“Freyr”) is a rare $1 billion+ market cap company that has yet to even come close to production. Investors applaud the company’s organization and extensive relationships across the U.S., Europe, and Asia, and certainly are believing in the company’s lofty intermediate-term production goals. The question remains: will the company reach those goals, and if they do, how will the share price react along the way?

Unfortunately, the recent rise on the back of an upgrade by Goldman Sachs has left little wiggle room for issues on the way towards full operation. This does not take away from the benefits of the company, but as seen across the market, the highest quality names suffer from valuation issues.

With construction now commencing in Norway at their flagship facility, and recent announcements for additional facilities in the U.S., investors have little worry about Freyr’s scale. In total, the company expects up to 43 GWh of production by 2025, the year their first factories are set to open. By 2028, expectations reach up to a significant 83 GWh.

Freyr Website

To provide some scope, Tesla’s (TSLA) and Panasonic’s (OTCPK:PCRFF, OTCPK:PCRFY) battery factory in Nevada currently produces approximately 39 GWh per year, with an increase of 10% to 43 GWh slated for this year. It is also far higher than the former world’s largest EV battery factory owned by #1 EV manufacturer BYD (OTCPK:BYDDF, OTCPK:BYDDY) (by volume). In 2018, that facility was expected to meet 24 GWh of production per year, with the company attempting to reach a total of 60 GWh of production by 2020 (BYD has increased their pace to ~250 GW as of mid-2022).

Business Update

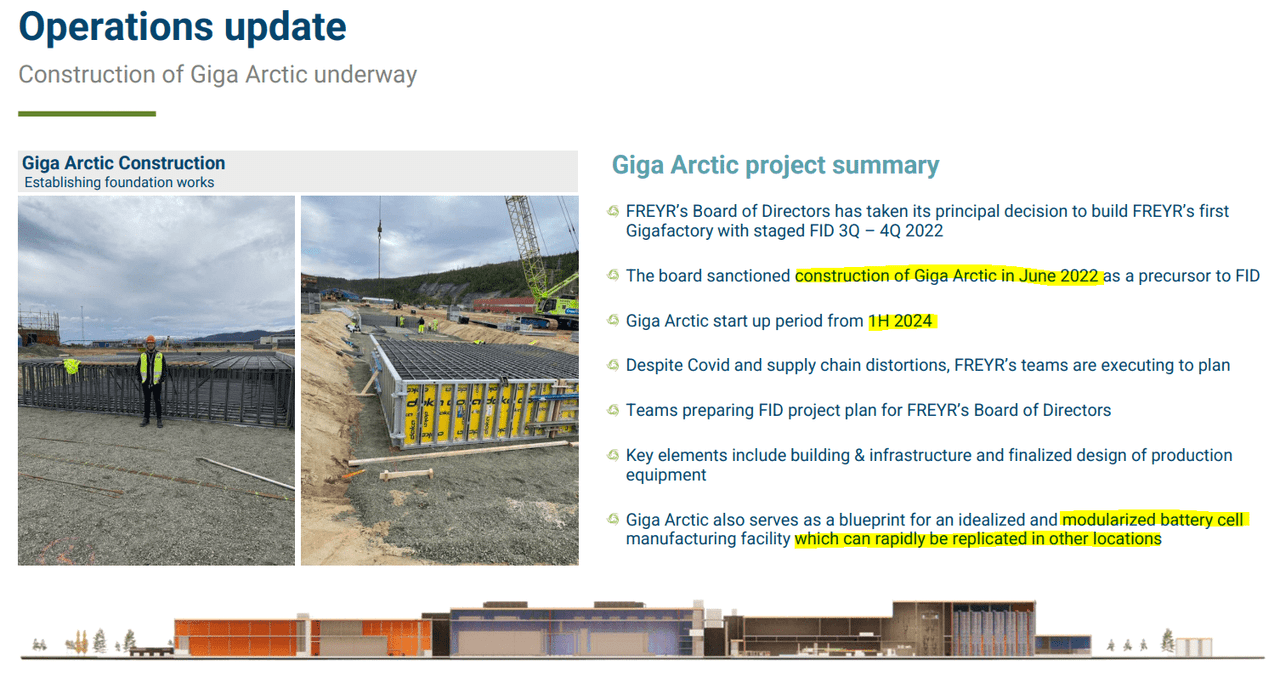

I will come back to these points when discussing appropriate valuation expectations. It is good to see that Freyr expects significant market share within just a few years. For the moment, I will highlight the current operational status. First, and perhaps most importantly, Freyr expects the completion of their initial customer qualification plant (CQP) by the end of 2022. The CQP will simulate the completed Giga Artic factory in scale but will be used to initially test the production process with customers’ careful guidance. Depending on the progress, Freyr expects to initiate the beginning of construction of their flagship Giga Arctic facility.

With an anticipated opening period in the first half of 2024, Freyr is not very close to establishing full production. This will allow competitors Tesla/Panasonic, BYD/CATL, and LG to continue their already established ramp ups in production. However, Freyr expects the Giga Arctic facility will be just the first such facility and will reach their 2028 production goals with modularized ramp ups and expansions. This includes a recently announced facility in the Boston area to reach the U.S. market efficiently. The key to the rapid expansion progress is one key partnership with battery tech developers 24M, a secretive firm spun out of MIT research.

Freyr Investor Presentation

Who is 24M?

Freyr is not developing their own battery manufacture process, and instead, is licensing the production technology established by a MIT research group, now a private company. Based on a novel, high-efficiency lithium-ion platform, Freyr expects that licensing is far more financially viable than researching their own platform. No untested zinc platform here (I’m looking at you Eos Energy (EOSE)). While 24M was founded by some leading researchers in lithium-ion and business development, some risk can be applied to the relationship between 24M and Freyr.

As a small private company, information on 24M is scant. While the technological benefits may be there, I worry about the financial side. Co-founders Wilder and Chiang (link to a good interview) certainly seem like they can create a viable opportunity, current CEO Ota has a small stain on his reputation to consider. Ota used to work for EnerDel, a developer of battery solutions way back in the 2000s, but unfortunately, the parent organization Ener1 went bankrupt by 2012. Ota is not alone, A123 Systems, founded by Chiang, has also had bankruptcy issues.

Thankfully, the issues seem to revolve around economics post-GFC and lackluster EV growth in the early part of the decade, rather than the technology itself, but negative stigma may remain (I also do not know if Ota was involved by that time). Fret not, EnerDel is still alive and kicking, and was recently purchased by a private construction firm PLH LLC, highlighting the longevity of the subsidiary. Meanwhile, Chiang’s A123 is now owned by Chinese auto parts conglomerate Wanxiang.

24M Website 24M Website

Unfortunately, having a strong tech platform is not all that matters. From Freyr’s perspective, it is important that they have the right deal established. As the in-house production systems will not be proprietary, funds will be partially flowing to 24M. While it is unknown how large these fees will be, perhaps it will pay off more than R&D expenses in the long run.

However, issues in regards to the license may return in the form of litigation or termination of contracts, and this may wreak havoc on the stock. It is not like patent issues are a rare occurrence, and all this partnership does is add risk that simmers beneath the surface. However, due to the significant number of partnerships now formed (see image below), 24M has a lot more to lose in the event of abuse or mistrust.

24M Website

Financials

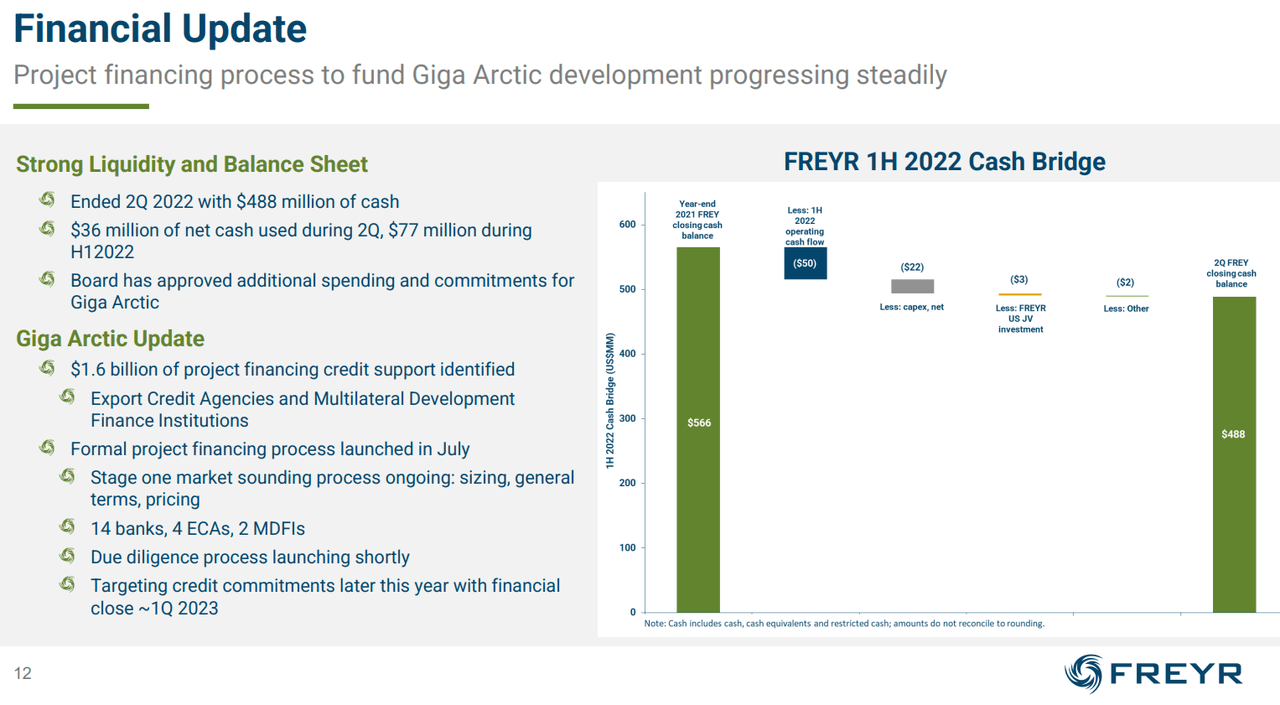

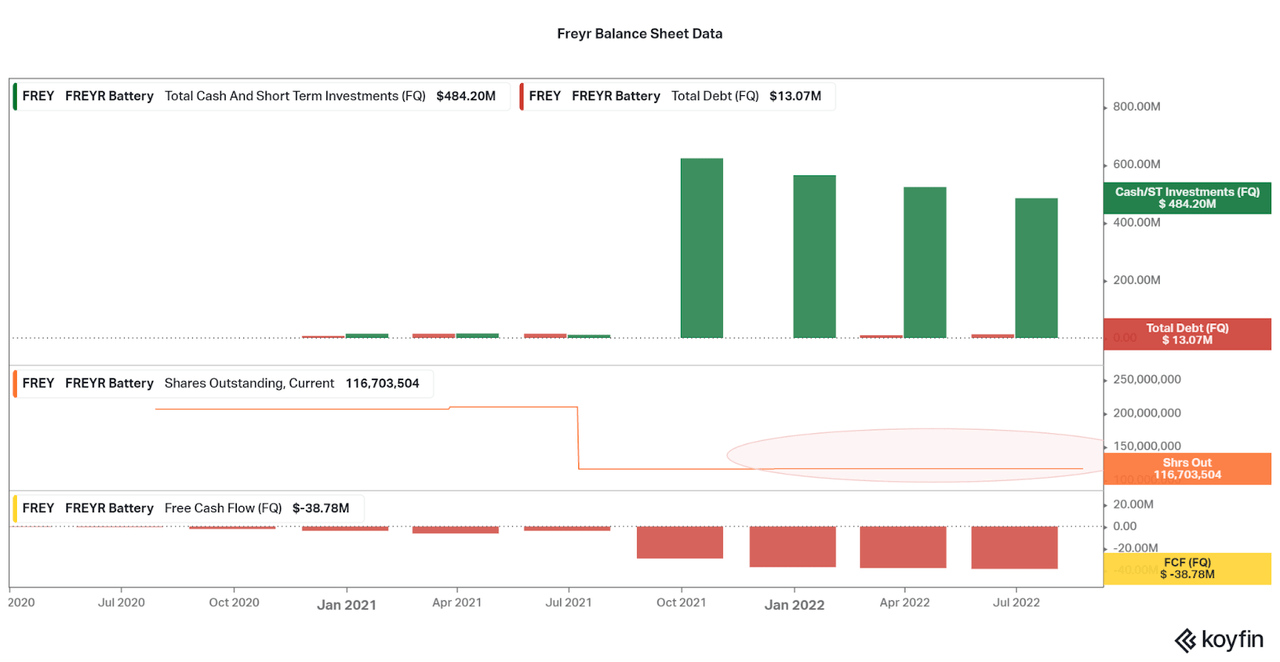

The last key aspect of Freyr is financing for their lofty goals. Currently, the company is sitting on $490 million in cash, but the factories are expected to cost well into the billions. Yearly losses are also approaching $100 million, leading to a 4-year steady state runway. To fund the growth of the business, Freyr has been busy marketing and establishing connections with banks and developers, including the Norwegian government, who have pledged up to $400 million in grants and loans.

Altogether, Freyr expects to be able to acquire $1.6 billion in total funding over the next few years and this should be enough to finalize the initial operations. Then, revenues should be able to drive debt reduction and future growth. However, it is unknown how much of this will be debt compared to further dilution, as the current market cap of almost $1.5 billion is certainly worth leveraging. Since shares have not been issued since the IPO in 2021, I would not be surprised to see a prospectus soon, and perhaps that may lead to an opportunity.

Freyr Investor Presentation Koyfin

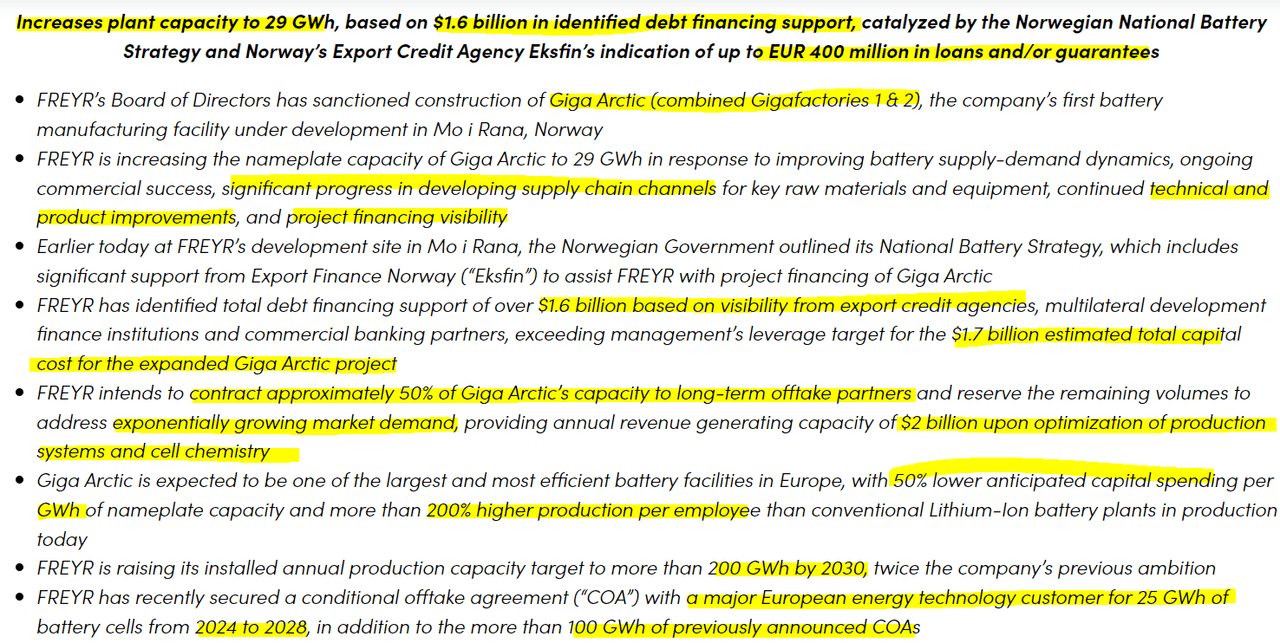

A recent press release announcing the inauguration of construction at the Giga Arctic facility summarizes the current opportunity well. Well, the information provided, investors have a very clear image of the next few years, even as production has yet to commence. Feel free to read the highlights in the image below, but the major points are as follows.

-

$1.6 billion in identified debt financing support, no notes on further dilution, and an estimated $1.7 billion total cost for Giga Arctic. Don’t forget the $480 million in current cash.

-

Current finance partners include major banks, development firms, and government entities, including the local Norwegian government. This is far greater in magnitude and quality than early state peers such as ESS Tech (GWH) or Eos Energy.

-

Due to a magnitude of positive business environment factors, management has increased their growth expectations two-fold in just a few years, to a new 2030 goal of 200 GWh.

-

Due to the 24M platform and in-house expertise, the company expects to be more profitable than peers. Management also expects $2 billion in annual revenues, but when is unknown.

-

Thankfully, investors have some hope that production will actually be sold, as offtake partners are already being established with long-term contracts.

Freyr Press Release

Valuation

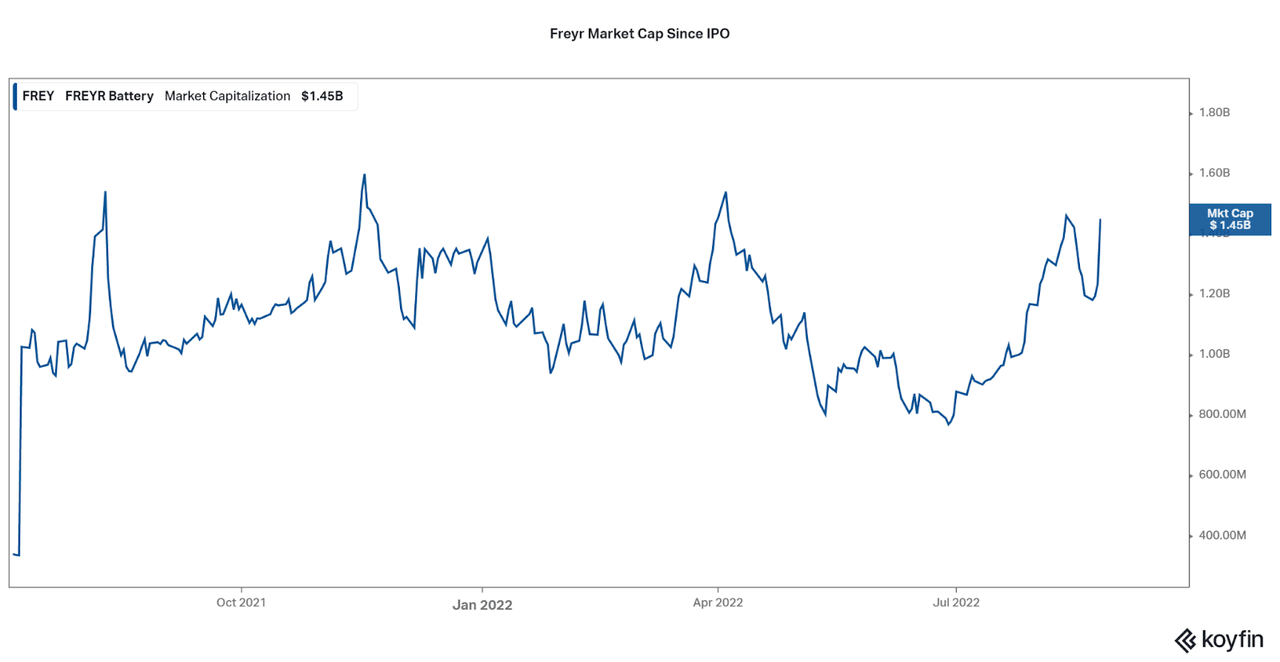

Well, it all sounds great, but this inherently led to the current $1.5 billion market cap. Even considering the recent bull run since late June, investors have only been able to capitalize on the lowest of $750 million at the lowest point. Now that was certainly the right time to buy, but I now have reservations. If you are followers of my work, you would know that I recommend staggered investments, and so, if you were familiar with the company before, your average share price may be equal to less than $1 billion in market value.

Koyfin

However, due to Freyr’s publicity and scope, the company has failed to draw down meaningfully even as others around them have collapsed. Therefore, it is important to consider what can go wrong, and how far can the shares fall if an issue arises. So let’s begin to discuss the current valuation in depth.

At current prices, investors expect the success of Giga Arctic, and within a short period of time. Or, they expect that the company will be able to smoothly expand production worldwide for many years to come. No room for intermediate-term investors here. Then, when scale is achieved, there is little to look forward to in terms of valuation. Just take LG, Panasonic, Toshiba, or BYD as examples: all trade at less than a 3.0x P/S, most under 1.0x. Although, you can mostly blame the other revenue segments for the low valuation. P/S aside, just remember that it will take at least 10 years before Freyr is on par with these far larger peers.

If we do a reverse NPV, current sentiment values Freyr’s current future cash flows at around $3.5- $4.5 billion, depending on the discount rate (10% or 15%) over the next 8 years. This would be double the company’s current expectations of $2 billion in revenues upon optimization of Giga Arctic. Also, it does not even take into consideration profitability, even when Freyr claims they will be one the most profitable battery makers.

Considering 24M is licensing to over 5 other peers, I would say the benefits are limited. Based on the trading pattern so far, I would say any price under $1 billion market cap is optimal for timers, but since we cannot predict the future, recurring investments will likely outperform any timing.

Conclusion

So, like usually, I find myself at an impasse with these speculative companies. While there are cheap ones with many tangible risks, there are those like Freyr who know all the right things to say. However, all remain unproven. This stresses the importance of three things: diversification (don’t put all your eggs in one basket), recurring investments (don’t try to time the market), and time in the market (speculative bets take time to work out and thrive).

Therefore, there is never a rush to get into a holding and no fear of missing out because volatility may prove you did not miss anything. I believe this will be the case with Freyr, but I also feel Freyr is on the shortlist for the highest probability to succeed out of a large speculative field. Do you agree? Feel free to share your thoughts in the comments.

Thanks for reading.

Be the first to comment