mesut zengin

Although most investors seem to focus on investing in companies that are large players with diversified offerings, there is a certain appeal to acquiring stock in niche product and/or service providers. One really interesting example can be seen by looking at Traeger (NYSE:COOK), a company that focuses on producing and selling grills to its customers. But these aren’t just any grills. The company specializes in what it calls a wood pellet grill that utilizes natural hardwoods in order to grill, smoke, or otherwise cook the food in question. This compares to the traditional gas, charcoal, and even electric grills that are out there. Despite the interesting space in the market that the company plays in, the firm is showing some signs of weakness right now. Normally, when the share price of a company declines as much as Traeger’s has in recent months, I would be tempted to pull the trigger and buy some shares. But I only do that when the fundamental condition of the enterprise does not materially worsen as it has in this case. In all, this has led me to retain my ‘hold’ rating on the company for now.

Not a pleasant few months

Back in May of this year, I wrote an article about Traeger wherein I acknowledged that the fundamental performance of the company had been cooling down. This followed an attractive track record for growth in prior years and even came at a time when revenue was expected to continue climbing through 2022. However, bottom line performance was already showing signs of weakness. I did say that a return to normalcy could prove bullish for investors. But until we see signs of that, buying in may not be the best idea. At that point in time, I ended up rating the company a ‘hold’, reflecting my belief that its returns would more or less match the broader market for the foreseeable future. However, I have so far been mistaken on that. While the S&P 500 has increased by 6.4%, shares of Traeger have declined by 34.2%.

At first glance, seeing a ‘hold’ prospect plunging by such a significant amount may make it seem like now is the time to buy. However, that only applies in cases where the fundamental condition of the company does not materially worsen. And materially worsen is exactly what we have seen recently. To see what I mean, we need only cover the second quarter of the company’s 2022 fiscal year. This is the only quarter for which new data is available that was not available when I last wrote about the firm. During that quarter, revenue for the company came in at $200.3 million. That’s down slightly from the $213 million reported the same time one year earlier. This 6% decline year over year was driven by lower unit volume for grills and consumables. However, it was offset to some degree by higher selling prices for the company’s products. On the accessories side of things, revenue for the business benefited from additional sales associated with the company’s acquisition of Apption Labs back in July 2021. That helped to bring revenue for that category up by 157.2% this year relative to last year. But consumables revenue rose by just 2.2% while revenue associated with grills plunged 24.6%.

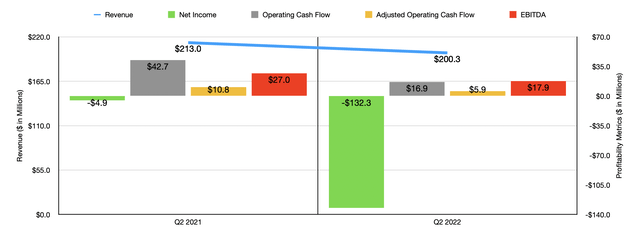

If all we were dealing with was a 6% decline in sales, I wouldn’t be too worried. Instead, we’re dealing with that and a plunge in profitability caused by margin contraction. In the latest quarter, the company generated a net loss of $132.3 million. That compares to the $4.9 million loss achieved the same quarter one year earlier. There were a couple of key factors here that impacted the company in a negative light. For instance, the firm’s gross profit margin dropped from 39.1% to 36.7%, with a shift in product mix relating to the grills category, increased shipping costs, and other related activities more than offsetting the increased selling prices of the products the company produces. General and administrative costs, meanwhile, rose from 11.6% of sales to 14.4%. This was driven, in turn, by higher equity-based compensation expenses and higher personnel-related expenses thanks to the aforementioned acquisition the company made. This decline in net income also impacted other profitability metrics. Operating cash flow, for instance, came in during the quarter to $16.9 million. That compares to the $42.7 million generated one year earlier. If we adjust for changes in working capital, it would have gone from $10.8 million to $5.9 million. And over that same window of time, EBITDA for the company also worsened, dropping from $27 million to $17.9 million.

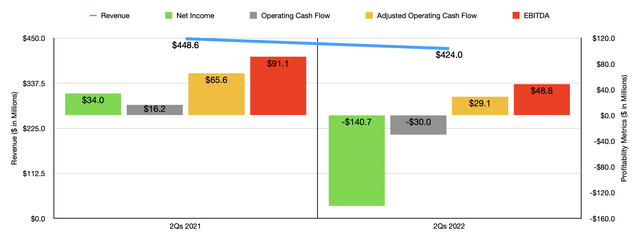

As you can see in the chart above, this weakness on both the top and bottom lines was instrumental in pushing year-over-year results for the first six months of the 2022 fiscal year down considerably. On top of that, management expects this weakness to continue. At present, they are forecasting revenue of between $640 million and $660 million for the year. Their prior guidance was for revenue of between $800 million and $850 million. This wasn’t the only guidance-related item that was downgraded. The company also said that EBITDA should come in at between $35 million and $45 million for the year. Prior guidance was for this to be between $70 million and $80 million. If we apply similar assumptions to the company’s adjusted operating cash flow, then that metric might be around $20.9 million for the year.

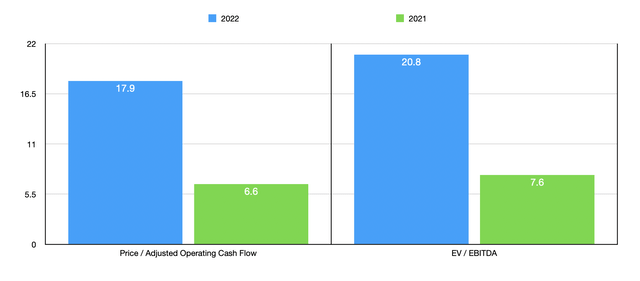

Using this data, we can see that the firm is trading at a forward price to adjusted operating cash flow multiple of 17.9. That compares to the 6.6 multiple that we get using 2021 results. The EV to EBITDA multiple of the company, meanwhile, should be 20.8. If we were to use our 2021 figures again, this multiple would come in at 7.6. As part of my analysis, I did also try and look at other similar firms. The sad truth is that there aren’t very many good companies to compare this to. I did identify four firms that were worth a look. On a price-to-operating cash flow basis, only one of the four companies had a positive result, with a multiple of 19.5. In this case, Traeger was cheaper. Using the EV to EBITDA approach, the range of the four firms was between 8.2 and 41.8. In this scenario, two of the four companies were cheaper than our prospect.

| Company | Price/Operating Cash Flow | EV/EBITDA |

| Traeger | 17.9 | 20.8 |

| Weber (WEBR) | N/A | 41.8 |

| iRobot Corp. (IRBT) | N/A | 39.3 |

| Helen of Troy (HELE) | 19.5 | 12.2 |

| Cricut (CRCT) | N/A | 8.2 |

Takeaway

At this point in time, I’m still intrigued, operationally speaking, by Traeger. But that’s where my interest ends. While the company may be an intriguing prospect, It is going through a rather difficult time at this moment. This is especially true when we talk about its bottom line results. If the company does return to the kind of performance it achieved in prior years, it could offer a nice bit of potential upside. But at the same time, the absence of a timely return to normalcy does make the stock look closer to fairly valued. And for this reason, I have decided to retain my ‘hold’ Rating on the firm for now.

Be the first to comment