Medvedkov/iStock via Getty Images Frontline Ltd. logo (Frontline Ltd.)

Investment thesis

The share price of Frontline Ltd. (NYSE:FRO) keeps improving and has been a good place to be invested since we upgraded it from a Hold to a Buy on the 1st of June. As usual, we did not foresee the bottom of the market, but the positive trend we saw was based on fundamentals.

As their business, which to a high degree relies on spot freight rates, can at times be very volatile it would be wise for shareholders to keep a close eye on potential changes to the spot market and what one can predict about the medium terms of 6 to 18 months out.

This article shall do that and give some guidance as to what we think Q3, which is coming out on 30th November, will look like.

Q3 Earnings capability

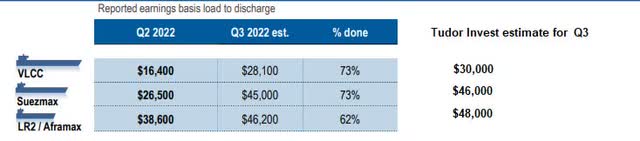

If we base our estimate on FRO’s 2nd Quarter earnings and extrapolate this using data we have on the general market time charter equivalent earnings or VLCC, Suezmax and LR2 vessels have earned in Q3 we hope to get not too far off what FRO will deliver.

Let us first explain that there is a huge difference in earnings between a non-scrubber-fitted vessel and one with a scrubber.

For vessels that are not fitted with scrubbers, they need to buy much more expensive fuel with low sulfur content. This is priced as Marine Gas Oil which in early July cost USD 1,288 per ton. Scrubber-fitted vessels can burn 380 CST fuel which at that time cost USD 589 per ton. In other words, the spread was as much as USD 699

As a result of this, in the first week of the third quarter, shipbrokers Fearnley in Oslo stated in their weekly market report that non-scrubber-fitted vessels would barely break even on a voyage from MEG to Asia. Bear in mind brokers calculate, as they should do, returns on round voyages which include a ballast from Asia to the Middle East.

On the 7th of July, the rate for a VLCC from MEG to Singapore was estimated at WS 56.5

Non-scrubber vessels would earn close to zero, but scrubber-fitted vessels would earn an estimated USD 26,500 per day.

For clarity purposes, the way FRO, and other publicly listed companies present their average time charter equivalent earnings is based on vessels from load to discharge ports only. They do not calculate the earnings on a round voyage basis. This means that close to half the time, when ships are ballasting, they have zero earnings. Over a year this works out to not much difference, but on a quarter-to-quarter basis, there could be periods where more ships are having an uneven distribution of days earning or not earning money.

FRO – earnings forecast for Q3 of 2022 (Frontline Ltd & Tudor Invest )

Operational EBITDA for Q3 should nearly double in Q3 from Q2. Assuming that interest expenses, which were USD 18.9 million only increases to USD 20 million after the inclusion of the two additional VLCC they took delivery of, we should see net earnings go from USD 47 million to USD 90 million in Q3.

In addition, come other non-operational items such as gains on derivatives, results from associated companies, and mark-to-market losses, if any, on marketable securities. In Q2 this worked out to an additional profit of USD 2.1 million.

It is hard to put a number on this, but Q2 had a considerable loss on the value of marketable securities of USD 12 million which I do not think we will see again. Hence the profit here is more likely somewhat higher than the USD 2.1 million in Q2.

We can use adjusted earnings of USD 94 million which translates to an EPS of 0.457 for Q3 of 2022 based on the 205.26 million shares outstanding.

Now, let us look at cash flow generation.

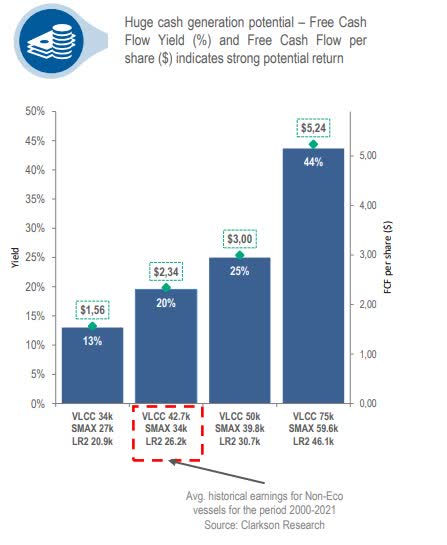

Frontline – cash flow generation potential (FRO Q2 2022 Presentation)

The numbers marked in red are quite achievable in the coming quarters.

If free cash flow per share will be USD 2.34 per year or USD 0.585 per quarter, we know from history that dividends will be close to this level. It is certainly going to be a lot higher than the USD 0.15 distributed in Q2. The recent increases in the share price seem to be confirming this too.

At the risk of being wrong, we shall stick our neck out and predict a dividend of USD 0.25 per share in Q3.

Business development

As we stated in our investment thesis, FRO relies heavily on the spot market.

However, in August this year, they fixed one of their LR2/Aframax tanker to a Charterer for a 3-year time charter, at a daily base rate of USD 31,500. It is a good hedge against any potential slowdown in the market. It is not much coverage, but it seems prudent to try to put away some VLCC tonnage too in a hot market.

The good news is that the oil majors, which typically shun away from committing to tonnage for the long term, are now willing to look at fixing in some tonnage for 3 to 5 years.

The fundamentals for their vessels do look very promising going forward.

On one hand, we got changes to trading patterns which is adding tons/miles to existing demand.

The demand has been strong in Q3 but there are understandable concerns about demand going forward should a recession be deeper and last longer than earlier projections.

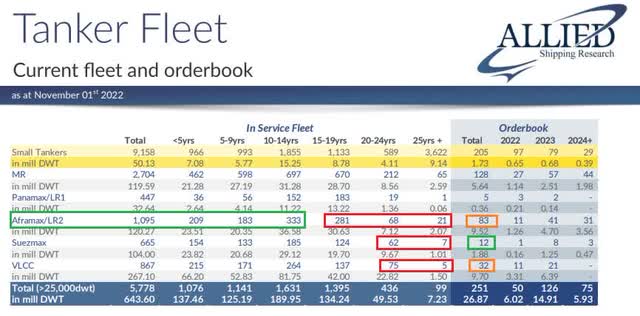

As always, the supply equation is more clear since we know the present fleet and what will come in the next couple of years.

Tanker fleet and New buildings on order (Allied Shipbrokers)

Risks to the thesis

Earnings for the maritime sector for those that rely heavily on the spot market are going to remain cyclical with risks of a long period where earnings do not cover all the costs.

Apart from this, FRO’s main shareholder has always used large doses of financial leverage to build the size of the companies.

Fortunately, their average finance expenses in Q2 were quite competitive at 3.3%

As of June 30, 2022, FRO’s outstanding debt, which was at variable interest rates, net of the amount subject to interest rate swap agreements, was USD 1,591 million.

Based on this, a one percentage point increase in annual interest rates would increase its annual interest expense by approximately $15.9 million, excluding the effects of capitalization of interest.

Should a “perfect storm” of higher interest rates and much lower earnings again take place, FRO could face difficulty in servicing the debt. This is a risk worth bearing in mind.

Conclusion

The market is telling us that investors think that better days are yet to come. This is already reflected in the present share price.

Frontline share price development (SA)

Therefore, the sixty-four thousand dollar question is would I still buy it here at this level?

As investors, we are generally quite risk-averse. Sure, six months ago, it was easy to be quite bullish on this sector. The “easy money” has been made. From here on, it leaves investors in our opinion with a slimmer margin of safety

As such, we would rerate FRO to a Hold here.

Be the first to comment