oatawa/iStock via Getty Images

Global-e Online Ltd. (NASDAQ:GLBE) is a $3 billion market cap internet & direct marketing retail company in the consumer discretionary sector. According to Fidelity Investments, the company and its subsidiaries provide “a platform to enable and accelerate direct-to-consumer cross-border e-commerce in Israel, the United Kingdom, the United States, and internationally. Its platform enables international shoppers to buy online and merchants to sell from, and to, worldwide. Global-e Online Ltd. was incorporated in 2013 and is headquartered in Petah Tikva, Israel.”

The stock has endured a wild ride since its IPO last year. The $25 IPO price, according to Nasdaq.com, was a launch pad for a surge to above $83 last September after trading began just 13 months ago. The stock has fully round-tripped… and then some. Shares currently trade under $20 but may have found a floor. I’ll detail that later.

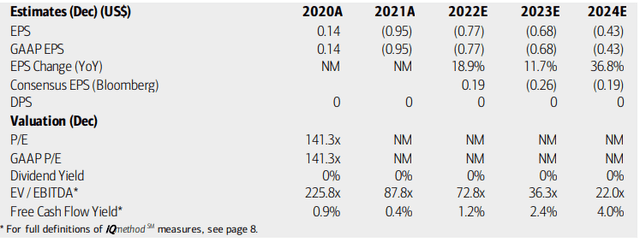

Fundamentally, GLBE features negative earnings per share looking out to next year and 2024. The company does not pay a dividend and its free cash flow yield is paltry. Moreover, its enterprise value to EBITDA ratio is sky-high around 70x right now, though analysts at Bank of America Global Research expect that to drop in the coming two years.

Global-e Earnings Estimates & Valuation

The upshot is that Global-e is expanding its U.S. presence. BofA notes that the company acquired Borderfree, a subsidiary of Pitney Bowes for $100 million in an all-cash deal. That’s the second big acquisition already in 2022 – Global-e bought Flow Commerce in January for $500 million. Amid these acquisitions, execution risks are high. Still, BofA places a $30 price target on its shares based on an EV/gross multiple valuation. They cite risks from the deals, tough pandemic comps, and continued supply chain issues, among others.

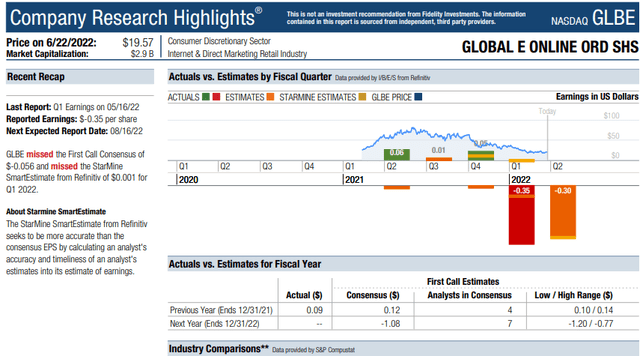

The stock recently reported a $0.35 per share loss in its Q1 2022 earnings report, below analyst expectations of $-0.056, according to First Call Consensus.

Global-e Research Highlights: Earnings Miss

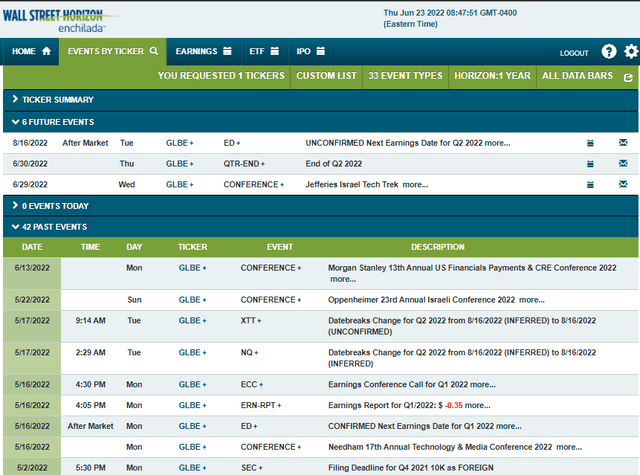

Looking ahead, the corporate event calendar is somewhat light for GLBE. There was a technology conference slated for later this month, but after digging, I found that Jefferies moved that event to September. So keep your eye out for potential market-moving news at that event in three months. The next earnings date is unconfirmed for August 16 AMC, according to data provider Wall Street Horizon.

Corporate Events: Q2 Earnings Date & Jefferies Conference

The Technical Take

Turning to the charts, something I specialize in, it doesn’t take words to tell how bad the story has been. The drawdown off the 2021 peak is more than 75%. Making the drop even harsher is that it traded in a range from about $50 to above $80 for just about the entire second half of last year. There are many so-called “dead bodies” in that range. That is tough long-term resistance.

Near-term, however, I see a tradable bottom. There’s support in the $15.87-16.80 range. That area, tested three times since early May, continues to hold. I’d like to see GLBE climb above $24 to confirm that low – also keep in mind the psychologically-important IPO price is just above that. If we do breakout above the mid-$20s a longer-term target to the prior range-base in the upper $40s could be in-play.

GLBE Since Its IPO: Support Zone With Resistance Levels

The Bottom Line

GLBE is another sad IPO story of 2021. Free cash flow is weak, and the valuation is still expensive. It’s not all doom and gloom, though. I see support on the chart. The bulls might be gathering steam below the IPO price right now. A swing long trade here with a stop under the May low makes sense to me.

Be the first to comment