Pgiam/iStock via Getty Images

While it would seem for now that the macro picture is getting clearer with GDP contracting two quarters in a row (mild recession), consumer sentiment weakening based on all of the earnings reports our team has scoured, and the Fed possibly slowing its pace of hikes, markets are finding some footing that last few weeks. That said, we are not out of the woods yet. The best trades right now have been the ones panning out in about a quarter or so, while some of the more volatile ones have played out in weeks. Today we are highlighting a name that we think moves from the $20s into the $30s. It has moderate growth and good value. That is a combination that has worked for us. It is pretty low beta, but we would like to buy two lots, and look to jettison over $31 for a nice 10-15% gain. The name in question is TriMas Corporation (NASDAQ:TRS).

Who is TriMas?

We are sure that is not a household name for many of you. So for likely all of our readers that are unfamiliar with this company, TriMas manufactures a diverse set of products primarily for the consumer products, aerospace and industrial markets through three segments. These are the TriMas Packaging, TriMas Aerospace, and Specialty Products groups. Let us share with you the company description of each group.

TriMas Packaging consists primarily of the “Rieke, Affaba & Ferrari, Taplas, Rapak, Plastic Srl, Intertech and Omega brands. This division develops and manufactures specialty dispensing and closure products for the applications of beauty & personal care, food & beverage, pharmaceutical & nutraceutical, industrial and home care” markets.

TriMas website

It also makes dispensing products include “foamer pumps, lotion pumps, fine mist sprayers, trigger sprayers, beverage dispensers and flip-top caps, among others. Closures include packaged food lids, child resistant caps, tube, jar and pail closures, and a variety of industrial related products”, such as drum closures. Rieke also has a full line of lock-down dispensers. The products enjoy strong demand even in recession.

TriMas Aerospace, which is comprised of “Monogram Aerospace Fasteners, Allfast Fastening Systems, Mac Fasteners, Martinic Engineering, RSA Engineered Products and TFI Aerospace brands, designs, qualifies and manufactures precision fasteners, air ducting products and precision machined components” for a few customers. These include commercial aircraft companies, distributors, suppliers and of course, the U.S. military.

TriMas Aerospace

TriMas Aerospace’s products include highly engineered “fastener solutions for composite and metallic aircraft structural applications including customer-qualified blind bolts, solid and blind rivets, temporary fasteners, collars and standard fasteners”.

This division also makes air ducting products including systems and connectors used for anti-icing needs and other aerospace applications.

Finally there is the Specialty Products segment which is comprised of the Norris Cylinder and Arrow Engine brands.

TriMas speciality brands

Norris Cylinder designs and manufactures a full range of “highly-engineered high-pressure and low-pressure steel cylinders used for the transportation, storage and dispensing of compressed gases”. Arrow Engine develops and manufactures a variety of natural gas powered engines and gas compressors for use within the oil and gas markets.

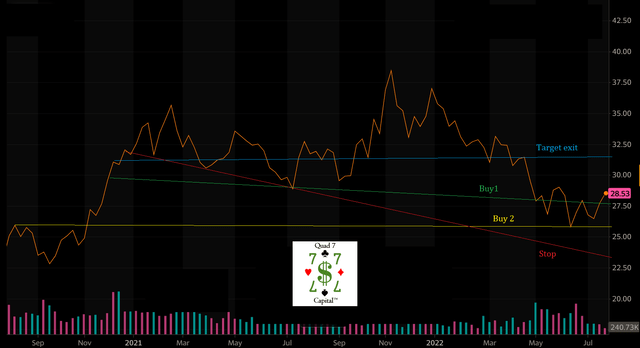

Stock trading

So now you have a solid foundation of the operations. The stock has ebbed and flowed, and has pulled back heavily with the overall market. We like a buy in the $20s:

BAD BEAT Investing

The play

Target entry 1: $28.75-$28.95 (20% of position)

Target entry 1: $27.75-$28.00 (30% of position)

Target entry 2: $25.40-$25.60 (50% of position)

Stop loss: $23

Target exit: $31.50-$32.00

Discussion

The stock is not wild, but if the market moves lower, we can get our second leg. I like management here, and performance is solid.

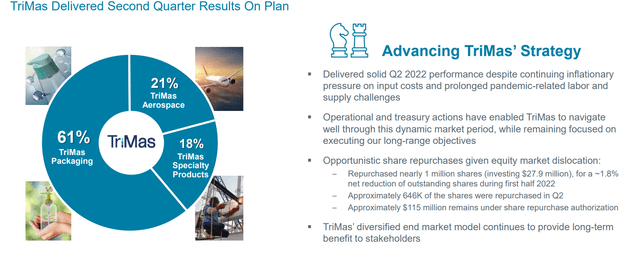

TriMas Q2 slides

They are growing and have great value. They just reported a decent Q2.

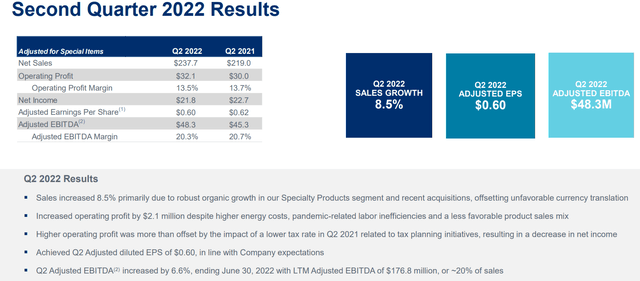

Top line growth evident

TriMas reported Q2 2022 net sales of $237.7 million, an increase of 8.5% vs. the $219.0 million in Q2 2021, primarily as a result of increased demand in TriMas’ Specialty Products group and acquisition-related sales. Currency exchange however weighed a good amount.

TriMas Q2 Slides

Not only are sales growing steadily, the company is profitable, and growing said profit. The company reported operating profit of $29.9 million in Q2, an increase of 16.8% vs. the $25.6 million in Q2 2021. Now, if we adjust for some items that were associated with the realignment and acquisition-related transaction costs, adjusted operating profit was $32.1 million, an increase of 7.2% compared to $30.0 million last year. Not bad.

This more than offset a poor product sales mix. It also offset the pain from continuing inflationary pressure on input costs. The biggest areas hit by inflation were energy, freight and certain commodity costs. There was also some production inefficiencies from prolonged pandemic-related labor challenges and supply chain constraints that these big gains on sales helped with.

Solid growth in income

Look at this growth. TriMas saw Q2 net income of $19.9 million, or $0.47 per share. That is solid growth when compared to the net income of $11.8 million, or $0.27 per share, for Q2 2021. However, making adjustments again, net income stalled, so that is one concern, but management indicates this is short-term. Adjusted income was $21.8 million, a slight decrease compared to $22.7 million last year while EPS was $0.60 compared to $0.62 a year ago. That said, this was in line with estimates. EBITDA was strong too, and the company is focused on maintaining a good balance sheet.

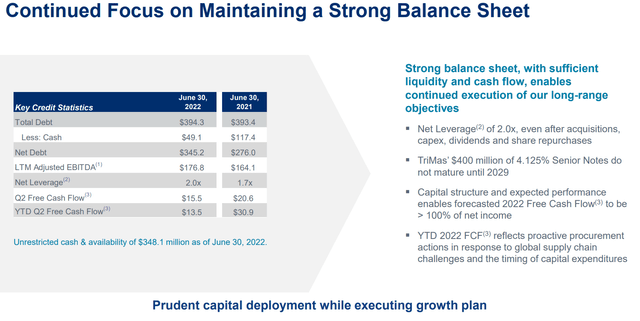

Good balance sheet

TriMas Q2 slides

The balance sheet is healthy. The company has a small debt load, and superb cash flow metrics. We like what we see here, with most debt stemming from acquisition costs. 2022 free cash flow is expected to be 100% or more of net income. Strong. The company expects to earning a solid $2.25 to $2.35 this year. At $29 a share, this is a valuation of 12.6X FWD EPS. That is attractive, with a price to sales of 1.4 and EV/sales of 1.83. The company also pays a small dividend.

Final thoughts

I think you let the stock come down and buy it up, and look to sell for profit in the 30s. This is a fine company, and one that we think can be traded into the next round of weakness.

Be the first to comment