Gingagi/iStock via Getty Images

On August 15th, Sorrento Therapeutics (NASDAQ:SRNE) released its Q2-2022 results and the stock lost almost 23% in the following two days of trading with results being worse than expected. In this article, I will provide a review of the Q2-2022 results, and I will support my HOLD recommendation. This is not my first article on Sorrento Therapeutics: here you can find my previous analysis of the FY2021 results.

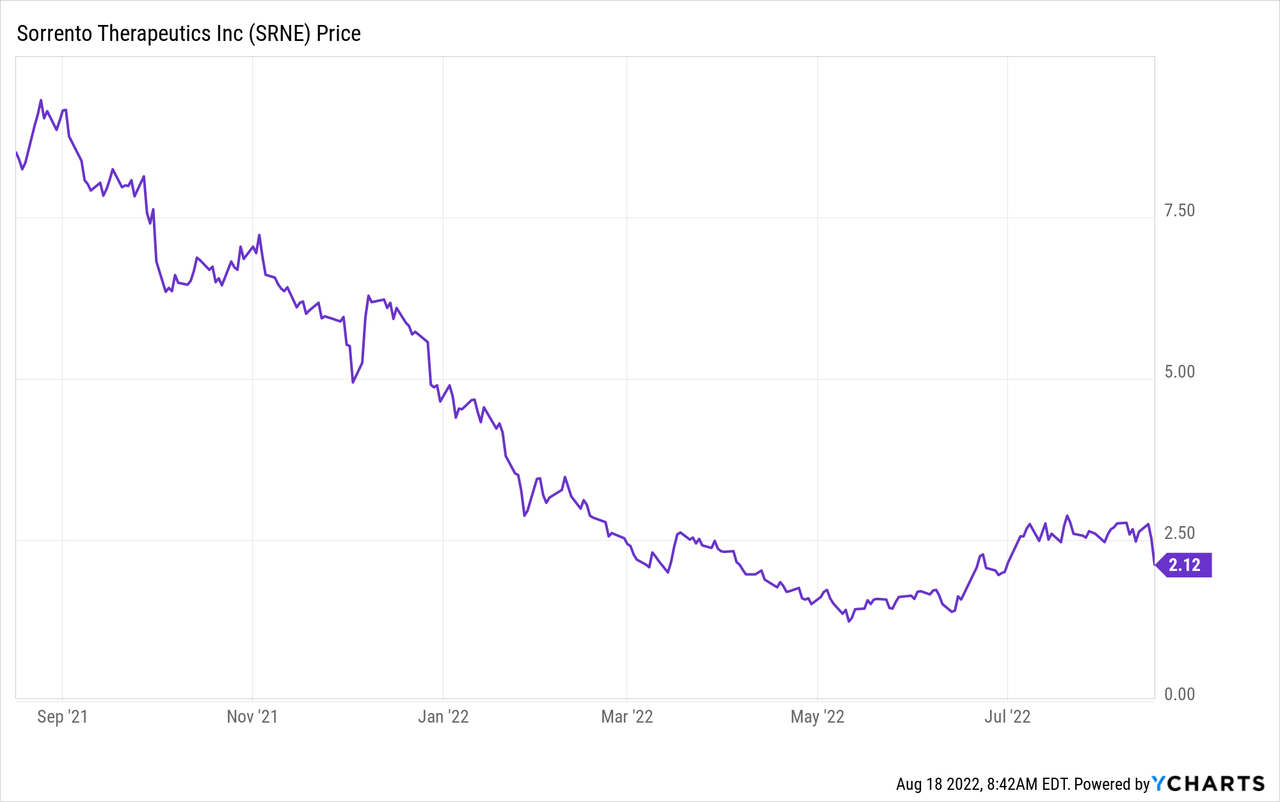

Stock Performance

Sorrento Therapeutics is currently trading at $2.12/share, equivalent to a market cap of $806M, and it is down 54% year-to-date and down 75% year-on-year. If we look at the performance of the last 52 weeks, one can see that the stock has been constantly losing value until it stabilized in a range between $2 and $3 per share. The 52-week minimum is $1.24/share (May 11th, 2022) while the 52-week maximum is $9.32/share, recorded almost one year ago, on August 25th, 2021.

Financials

Total revenues for the quarter dropped by 15% year-on-year (or $2.1M) from $13.5M in Q2-2021 to $11.4M in this last quarter. The drop in sales is mostly explained by the reduction of service revenues for the Sorrento Therapeutics segment due to lower contract manufacturing versus the prior year. Service revenues ($2.8M) accounted for 25% of total sales (versus 42% in Q2-2021) while product revenues were $8.5M and accounted for 75% of the total.

It is worth spending a few words on revenues generated by the COVISTIX, Sorrento’s antigen test for the detection of COVID-19: in the first six months of 2022, Sorrento generated $3.2M sales from the COVISTIX, but these sales were all concentrated in Q1-2022. Apparently, in Q2-2022 no sales were generated from this product that, according to previous reports, should have played a relevant role in generating cash flows to support Sorrento’s future growth.

Despite decreasing revenues, total operating expenses increased by 14% year-on-year, going from $114M in Q2-2021 to $130M in Q2-2022. The largest organic cost items are R&D, which dropped 11% year-on-year to $48M, and SG&A, which decreased by 4% from $50M to $48M. However, these cost reductions were more than offset by a $91M non-recurring loss on impairment of intangible assets due to the impairment of IPR&D assets (associated with Abivertinib) acquired from ACEA in June 2021.

Overall, Sorrento Therapeutics reported a quarterly net loss of $219M, 30% worse than the $166M loss of Q2-2021.

Moving to the cash flow statement for the first six months of the year, cash flow from operations was obviously negative at -$164M, about 30% worse than Q2-2021 (-$126M). Cash flow from investing was negative at -$15M, with Sorrento carrying out some investments for purchasing new equipment and paying a cash consideration to Virex Health for the acquisition announced in February 2022. The company added $215M in financing as a result of several operations: on one side, Sorrento repaid $111M of debt (notes and bridge loan); on the other, the Company carried out an equity offering that raised $268M. Net debt stands at $36M, with total debt of $107M and cash on the balance sheet of $70M.

Distribution Agreement With CH Trading Group For ZTlido

On August 17th, 2022, Sorrento Therapeutics announced a new distribution agreement for ZTlido, the flagship product that was first marketed in October 2018 as lidocaine topical medicine for the relief of pain caused by post-herpetic neuralgia. The new distribution agreement was stipulated with CH Trading Group – an import/export operator – and aims at marketing the ZTlido in the Middle East and North Africa, geographical areas where today the ZTlido is still not available. The deal is quite important because it will enable Sorrento Therapeutics to potentially increase the revenue stream generated from ZTlido while sales from COVISTIX are lagging behind.

Commercialization Agreement With ROMEG Therapeutics For Gloperba

On June 14th, 2022, Sorrento Therapeutics announced a new license and commercialization agreement with ROMEG Therapeutics for the exclusive right to distribute in the United States Gloperba, an oral liquid colchicine-based treatment for people suffering from gout. Sorrento will pay an upfront consideration of $2M plus additional milestones-linked payments up to $13M and some royalties based on the annual Gloperba sales. The strategic rationale behind the deal is to expand Sorrento’s business in new areas and generate additional revenue streams: leveraging the current distribution channels already in place, Sorrento wants to enter the gout treatment market that is projected to be worth up to $8bn in 2025 with a compounded annual growth of ca 16%.

Valuation

To factor in the impact of the recent news, I developed a DCF model that derives a potential target price.

The starting point of the valuation is the revenue forecast: in particular, I assumed a modest growth for service revenues (2% annual growth, in line with past performances) while I have been more aggressive on the ZTlido and Gloperba sales. For the ZTlido I have assumed an accelerated growth due to the recently announced entry in the Middle East and North Africa markets (150% growth rate in 2023, 100% in 2024, 50% in 2025, and then gradually down to 5% in 2028) while for the Gloperba I have assumed that Sorrento Therapeutics could realistically target a 2% market share in the gout treatment market (worth about $8.3bn in 2025). For clarity, I have not considered revenues from COVISTIX since, in Q2-2022, the company had no sales, and – with COVID-19 that appears to be in the past – it is unlikely that COVISTIX will generate significant revenues in the future.

For the costs side, I assumed that the ratio of COGS-to-sales (for both products and services) remains constant over time and in line with past figures while for research and development I assumed a gradual reduction of ca 15% per year since Sorrento has already carried out significant investments in the past years. To derive free cash flows to the firm, I also estimated the annual capital expenditure assuming a 10% annual growth since the company will have to keep up with the increasing production.

FCFs have been discounted with a 10% discount rate and the terminal value (after 2030) has been calculated with the Gordon growth formula using a 3% long-term growth rate.

As a result, the DCF model calculates a $2.44/share, 15% higher than the current trading price.

Conclusion

Overall, I believe that Sorrento is moving in the right direction for what concerns the business development, with many agreements being signed that could help to diversify the business and enhance revenue streams. However, one cannot overlook that sales are down year-on-year and the COVISTIX has not met expectations, with almost any sales at all in Q2-2022. In addition, the company management does not organize quarterly conference calls with analysts and, considering the non-exceptional performance, this is starting to become a small red flag. Moreover, the target price calculated with the DCF model only provides a 15% potential upside, which I do not think is worth the risk of investing in Sorrento Therapeutics. In conclusion, for investors that have bought shares at higher valuations, I would recommend holding the stock and seeing how the future turns out, while I would not recommend to new investors to buy now.

Be the first to comment