Jerod Harris

Introduction

On August 10, Sonos (NASDAQ:SONO) reported poor results for fiscal Q3 2022 and revised full-year revenue and adjusted EBITDA guidance downwards. To top it off, the Company announced the departure of Brittany Bagley, who has served as CFO since April 2019.

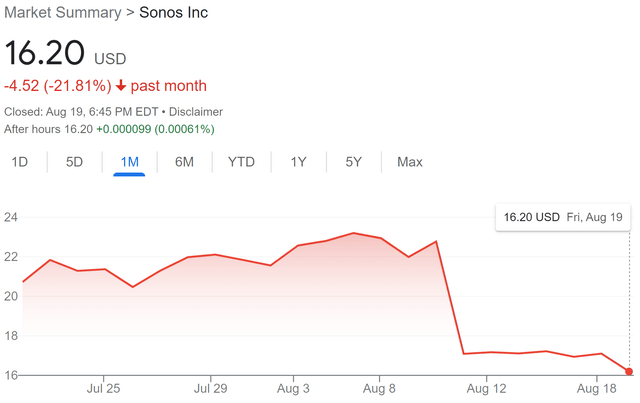

Shares have responded by sliding over 25%, settling at ~$16, more than 60% off all-time highs.

Sonos Price Change (Google Finance)

The Company has a solid track record of execution, which I’ve alluded to in previous articles (December 2021, April 2020). The most recent quarter, however, is far from what I would consider good execution. So, what caused the slip-up? Can it be attributed to short-term headwinds (“macro”), or is the investment thesis significantly impaired?

This article focuses on the quarter’s results, as well as my thought process as an investor concerned with the long-term prospects of the business (my first purchase was in January 2019).

Setting The Stage

Let’s start with a recent quote from (soon-to-be former) CFO Brittany Bagley at the Bank of America Global Technology Conference on June 8:

We have been pleased and impressed with the demand we continue to see from our customers, both in EMEA and really across all of our regions…so far for us, business continues nicely.

From this statement, it appears Sonos was humming along through the first two months of FQ3 (April and May). June is clearly the problem month. So, what happened in June that caused Sonos to miss analyst revenue estimates by nearly $50 million and revise guidance to no-growth for the year?

On the conference call, CEO Patrick Spence mentioned three factors:

- Softening consumer demand;

- Continued supply constraints; and

- Foreign exchange headwinds.

I’ll ignore foreign exchange headwinds as it’s not a factor in the long-term thesis, and I have no special insight into future rates. (It’s worth a mention that constant currency revenues were +2% Y/Y vs. reported -2% Y/Y).

Supply constraints have plagued the company for over a year now, with component shortages having a disproportionate impact on the availability of Amp in FQ3. On Sonos’ website, Amp is on backorder until October 14, with several others (Beam, Five and Sub) on a one-week backorder.

Amp’s limited availability is evident in the 19% decline in sales of Sonos system products in the quarter. But on the demand front, it appears customers continue to be willing to wait. Ms. Bagley noted on the call:

I can tell you from what we are seeing, and as we talk to installers, they continue to have an enormous amount of demand for that product and can’t wait for us to get back in stock on it.

Supply constraints are not something to ignore, particularly as they have persisted for well over a year now. But, customers’ willingness to wait speaks to the strength of the Sonos brand.

Further, it seems the difficulties are not exclusive to Sonos but rooted in the unprecedented operating environment over the past two years (lockdowns, shipping issues, etc.). As such, I don’t see any real impairment to the long-term business. If evidence of customers switching to other brands rather than waiting begins to mount, this will quickly change.

A Demand Problem Surfacing?

The long-term investment thesis rests on sustained growth in demand for Sonos speakers. Therefore, the softening demand in the quarter is concerning, but it’s necessary to determine whether the poor results represent a temporary blip, or a fundamental problem with the business.

Let’s start in the broadest sense by looking at demand in the consumer electronics category. Consumer electronics are a highly discretionary purchase. When wallets get pinched, it’s often one of the first categories to be hit.

Proving this point, sales at Best Buy (NYSE:BBY) have declined the past two quarters (ending January 31 and April 30) as inflation has continued to trend upwards. Most recently, Best Buy announced its fiscal FQ2 (ending July 31) results would be substantially below expectations, anticipating a 13% decline in comparable sales.

Walmart (NYSE:WMT) recently called out electronics as a particularly weak category in the most recent quarter. Target (NYSE:TGT) also noted “softness in lower-margin discretionary categories, most notably electronics.”

Rounding it out, the Wall Street Journal published a piece discussing the broader trend of a pullback in consumer spending on premium gadgets. Among the victims mentioned, iRobot (NASDAQ:IRBT) suffered a 30% drop in Q2 sales, and even Apple’s (NASDAQ:AAPL) wearables segment (including HomePod speakers) felt the pressure with an 8% Y/Y decline.

Clearly, the softening demand is not limited to Sonos. However, as a premium product, one might expect Sonos to have a greater degree of resilience. And, broadly speaking, that would be accurate.

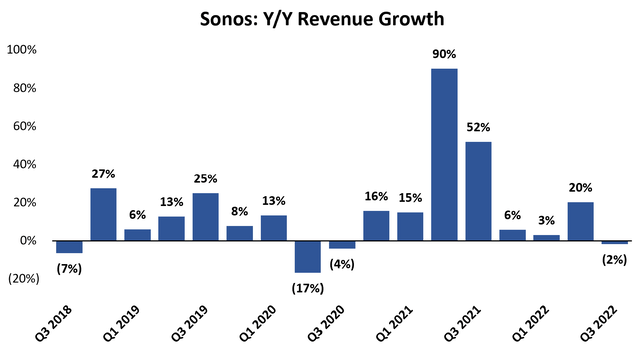

Sonos: Y/Y Revenue Growth (Quarterly Filings)

In FQ2, Sonos reported rather robust 20% growth on the back of 90% growth in the prior year. At this point, inflation was already above multi-decade highs, yet consumer demand remained strong. Demand for premium speakers can’t remain immune for long, however, as evidenced by a 2% decline in Q3 2022. It’s also worth mentioning the 2% decline laps a 52% increase in Q3 2021.

In the context of all this, a 2% revenue decline is certainly not the end of the world, though the market certainly seemed to think so. Importantly, management noted:

Despite the macro dynamics of Q3, we gained or held share in key categories across our geographies and saw steady repurchase trends among our growing base of existing households…And the feedback from retailers has been that we are holding or gaining share.

This demonstrates two facts:

- No new competitive threat has emerged that threatens Sonos’ long-term competitive position; and

- The Company’s flywheel (existing customers repurchasing as new customers are added) remains in motion, contributing to the sustainability of revenue growth.

Conclusion

When you put it all together, the natural conclusion is Sonos remains a good business selling a discretionary product in a period of extreme macroeconomic uncertainty. Most importantly, the long-term opportunity remains intact.

Of note for long-term investors, management outlined a 10% revenue CAGR target in FQ3 2018, shortly after going public. Over the four years ending FQ3 2022, Sonos has delivered a 16% CAGR, significantly exceeding the stated target.

My conclusion is this quarter seems to be a temporary blip, and management remains focused on executing for the long-term. CEO Patrick Spence summed it up quite well:

Regardless of short-term economic fluctuations, our category leadership is proven and established, our brand is strong, and awareness among our affluent target customer base is growing.

I believe the sound is not off at Sonos, but temporarily turned down. It could come roaring back with an improving economic backdrop, just as it did after the start of the pandemic.

Be the first to comment