happyphoton/iStock via Getty Images

Third Quarter Market Discussion

Just as stocks generally don’t shoot straight up in a rally, they usually don’t fall straight down in difficult times. Even in bear markets, heart-dropping downturns can be followed by sharp rebounds, as investors discovered early in the third quarter. The net effect of this back-and-forth, though, can feel like being stuck in a holding pattern, which was one of the themes of this summer.

Throughout the second quarter, investors turned decidedly pessimistic as stocks slid into a bear market. That pessimism allowed us to add to existing holdings and dust off high-quality cyclical ideas that could eventually lead out of a downturn once the risk/reward profile improves, either through lower stock prices or better earnings prospects. The latter is unlikely; thus, we are waiting for our “watch list” stocks to be sufficiently beaten down, anticipating more selling—and better prices—once companies begin to slash their profit guidance meaningfully.

Forecasts haven’t come down as quickly as was expected. At the same time, earnings season proved to be “less bad” than feared, with nearly three-quarters of companies in the S&P 500 ® Index reporting better than expected sales and profits. This helped bolster the performance of equities, especially early in the quarter.

Given how bearish sentiment became in the second quarter, it was not surprising to see a short-term rally in areas hit hardest in the first half of the year. This included faster-growing, lower-quality, and more-levered businesses. The market’s “risk- on reversal” was further evidenced by the Russell 2000 ® Index (small caps) outperforming the Russell 1000 ® Index (large caps) by more than 350bps in the first half of third quarter.

However, the outlook remains decidedly mixed, with many management teams highlighting continued inflationary pressures and pockets of weakening demand. There are finally signs that companies are resetting earnings expectations. In September, the number of companies cutting their third quarter and full year outlook has risen materially, and this trend is likely to continue. Furthermore, Federal Reserve Chair Jerome Powell began overtly signaling that economic pain will be required to tame inflation during his presentations at the Jackson Hole Economic Symposium in late August and at the Federal Reserve Board meeting in late September. It’s uncertain if this view of the global economy will prove to be right, and we don’t claim to be economic forecasters. All that is certain is that not a lot has changed—outside of stock prices—related to our fundamental views.

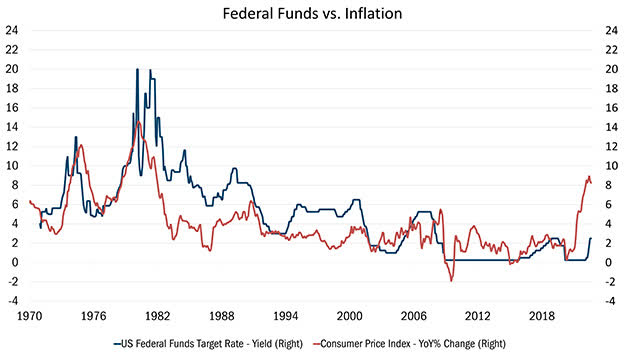

Inflation remains a headwind to real economic growth, the economy continues to weaken, and further pressure is coming as history indicates that interest rates must rise to a level closer to headline inflation before it is tamed (see chart below). Although it may be on a lag, this is likely to weigh on the economy. The early third quarter rebound in risky assets seems to have been temporary as evidenced by the renewed selling pressure throughout the latter part of the quarter. Investors should be rewarded for owning high-quality assets with sound financing and attractive valuations. Your portfolio skews toward the three aforementioned qualities.

Much More Room to Rates to Rise

|

Source: FactSet Research Systems, Inc., Monthly data 1/1/1970 to 8/31/2022. The data in this chart represents the United States Federal Funds Target Rate – Yield versus Consumer Price Index (year over year change for Federal Funds versus inflation). Consumer Price index has a base of 1982-84=100 (the average of the monthly index values is 100 over the 36 months in 1982 through 1984). All indices are unmanaged. It is not possible to invest in an index. Past performance does not guarantee future results. |

We continue to look for opportunities to either trade up in quality or pivot toward more cyclical exposure. The market, however, remains in the early stages of a negative earnings revision cycle. A combination of materially lower earnings estimates and stock prices is still needed to improve the risk-return profile of early-cycle cyclicals. This is time to be extremely patient. Our Team continues to demand a margin of safety to help protect against permanent capital destruction.

Attribution Analysis

The primary driver of the Strategy’s performance in the third quarter was stock selection including robust stock selection in the Utilities, Materials, and Information Technology sectors. Conversely, underperformance in the Consumer Discretionary and Energy sectors detracted from returns. The Strategy’s overweight to Health Care was a drag on performance.

Utilities

Our best-performing holding in the quarter was Constellation Energy (CEG), the leading provider of clean energy in the U.S., derived primarily from nuclear power. CEG is the largest nuclear power operator in the U.S. and delivers one of every four megawatt hours of clean electricity to commercial and industrial customers in the country.

Earlier this year, the company was spun-off from a long-term utility holding, Exelon Corporation (EXC). Post spin-off, we increased our position in CEG on the belief that the company was materially undervalued and catalysts were in place to change investors’ perception. One of those catalysts was the August passage of the Inflation Reduction Act of 2022. Nuclear power has never benefitted from its zero-carbon emitting properties, like wind and solar. This legislation provides nuclear power plants with zero-carbon treatment, establishing a “floor” under power prices that could protect CEG from much of the potential downside swings in commodity power prices.

Effectively, this should remove the risk related to questions about the terminal asset value of CEG’s nuclear assets and creates an environment for more stable cash flows. The stock jumped 45% in the third quarter as investors began to recognize the value of CEG’s assets.

Consumer Discretionary

We added to our position in Advance Auto Parts (AAP) during the quarter as the stock fell and the risk/reward profile improved. In August, shares fell further after the company reported second quarter earnings that disappointed because of weaker-than-expected same-store sales. Furthermore, management reduced its full-year earnings outlook by ~4%, citing softening consumer purchasing patterns within AAP’s “do-it-yourself” business.

Stepping back, the most important driver of Advance Auto’s earnings power seems to be the management team’s ability to improve margin expansion. However, the market remains myopically focused on sales growth. The margin expansion opportunity originates from the consolidation of an overly complex and inefficient distribution network. Management is rolling out new distribution center software through 2023 that will reduce costs, improve network productivity, and enhance customer experience through better inventory availability.

In addition, the auto parts retailing industry tends to be less cyclical than the Consumer Discretionary sector because consumers often hold onto their used cars longer and make necessary repairs rather than buy new vehicles when their financial prospects weaken. AAP is currently trading at less than 12 times forward earnings, well below the company’s long-term median P/E of more than 15—while having significant room to improve profitability owing to its self-help initiatives.

Technology

Before the risk-on rebound early in the quarter, we were searching for opportunities to shift from our defensive stance, looking for beaten-down, high-quality “early cycle” leaders. Existing holding, Skyworks Solutions (SWKS), represents one such opportunity that was added to on weakness.

Skyworks is one of two leading providers of radio frequency system components to smartphone makers and electronics manufacturers. With every step-up in product complexity, over the past two decades, the competitive landscape has shrunk while gross margins have increased significantly. 5G represents another such step-up, which is likely to increase how much Skyworks can make per smartphone.

Apple (AAPL) is a big customer, accounting for more than half of Skyworks’ sales. That customer concentration has depressed Skyworks’ valuation over time. More recently, fears surrounding a global recession and risk to consumer demand have further pressured valuation. However, the handset business is expected to benefit from 5G content, which may help offset some macroeconomic pressures. Away from the handset business, Skyworks’ growth is expected to accelerate thanks to other secular drivers such as WIFI 6 and growth of the industrial internet (i.e., “Internet of Things”).

At a P/E of less than eight and a 2.3% dividend yield, SWKS rarely gets this cheap, making this high-quality stock compelling for long-term investors.

Outlook and Positioning

Year to date, the Opportunistic Value Strategy has outperformed the Russell 3000 Value® Index, despite a negative absolute return. The Strategy’s outperformance has been primarily driven by stock selection. While we put no weight on our short-term performance, our bottoms-up research and focus on valuing businesses on a “through-the-cycle” basis has helped weather the downturn. Looking forward, being underweight leverage and overweight profitability should prove beneficial for investors when viewing returns over the long-term—measured in years, not quarters. Year to date, neither have provided a meaningful boost to returns.

An example of this focus is Starbucks (SBUX), a position initiated during the quarter. The coffee giant’s moat is driven by its global scale and brand recognition. Recently, Starbucks grappled with shifting challenges as a result of COVID-19. During the pandemic, demand migrated from Starbucks’ urban locations to overwhelmed suburban stores, as the remote workforce increased, and many remain in a hybrid or work-from-home mode. This, along with stricter COVID-19 lockdowns in China, resulted in margin compression while many of sector peers enjoyed unprecedented margin expansion owing to government stimulus.

Starbucks has been investing aggressively to address these inefficiencies. Actions taken include raising wages to reduce turnover, redesigning stores to respond to the rise in mobile ordering, and reengineering equipment to improve barista productivity as more complicated cold beverages now account for more than 50% of total sales.

Starbucks also happens to be well-positioned to deal with inflation given the company’s history of pricing power. Over the past year, the company has raised its prices by approximately 5-7%, which is less than the rate of headline inflation. Starbucks likely has room to hike prices further because of the brand recognition and a loyal customer base, as evidenced by more than half of U.S. sales being derived from the Starbucks reward members.

We continue to look for opportunities to make a definitive early cycle pivot. Until the “risk on” rebound gives way to a more sober perspective, which is starting to occur in real time, we will remain cautious—and defensive. As stated last quarter, in our opinion, the disciplined application of our value-oriented stock-selection process will be key to navigating the quarters ahead.

Thank you for your continued trust and confidence.

Composite Returns*

9/30/2022

| Since Inception (%) | 10-Year (%) | 5-Year (%) | 3-Year (%) | 1-Year (%) | YTD (%) | QTD (%) | |

|---|---|---|---|---|---|---|---|

| Opportunistic Value Equity Composite (Net of Advisory Fees)** | 9.20 | 8.86 | 5.47 | 4.53 | -8.54 | -12.72 | -4.12 |

| Opportunistic Value Equity Composite (Net of Bundled Fees) | 7.16 | 6.84 | 3.60 | 2.79 | -9.87 | -13.67 | -4.47 |

| Russell 3000® Value | 6.73 | 9.08 | 5.11 | 4.37 | -11.79 | -17.97 | -5.56 |

| Source: FactSet Research Systems Inc., Russell Investment Group, and Heartland Advisors, Inc.*Yearly and quarterly returns are not annualized. The Strategy’s inception date is 9/30/1999. **Shown as supplemental information. The US Dollar is the currency used to express performance. Returns are presented net of advisory fees and net of bundled fees and include the reinvestment of all income. The returns net of bundled fees were calculated by subtracting the highest applicable sponsor portion of the separately managed wrap account fee from the net of advisor fees return. |

|

Past performance does not guarantee future results. The Opportunistic Value Equity Strategy seeks to capture long-term capital appreciation by investing in companies with market capitalizations greater than $500 million. The Strategy’s flexible pursuit of value positions it as a core holding for investors. In addition to stocks of large companies, the Opportunistic Value Equity Strategy invests in stocks of small- and mid-cap companies that are generally less liquid than large companies. The performance of these holdings generally will increase the volatility of the strategy’s returns. Value investments are subject to the risk that their intrinsic value may not be recognized by the broad market. Heartland Advisors, Inc. (the “Firm”) claims compliance with the Global Investment Performance Standards (GIPS®). The Firm is a wholly owned subsidiary of Heartland Holdings, Inc. and is registered with the Securities and Exchange Commission. For a complete list and description of Heartland Advisors composites and/or a presentation that adheres to the GIPS® standards, contact Institutional Sales at Heartland Advisors, Inc. at the address listed below. As of 9/30/2022, Advance Auto Parts, Inc (AAP), Constellation Energy (CEG), Exelon Corporation (EXC), Starbucks Corporation (SBUX), and Skyworks Solutions, Inc (SWKS) represented 2.37%, 2.35%, 0.94%, 1.42%, 2.68% of the Opportunistic Value Equity Composite’s net assets, respectively. The future performance of any specific investment or strategy (including the investments discussed above) should not be assumed to be profitable or equal to past results. The performance of the holdings discussed above may have been the result of unique market circumstances that are no longer relevant. The holdings identified above do not represent all of the securities purchased, sold or recommended for the Advisor’s clients. Statements regarding securities are not recommendations to buy or sell. Portfolio holdings are subject to change. Current and future portfolio holdings are subject to risk. GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein. Separately managed accounts and related investment advisory services are provided by Heartland Advisors, Inc., a federally registered investment advisor. ALPS Distributors, Inc., is not affiliated with Heartland Advisors, Inc. The statements and opinions expressed in this article are those of the presenter(S). Any discussion of investments and investment strategies represents the presenters’ views as of the date created and are subject to change without notice. The opinions expressed are for general information only and are not intended to provide specific advice or recommendations for any individual. The specific securities discussed, which are intended to illustrate the advisor’s investment style, do not represent all of the securities purchased, sold, or recommended by the advisor for client accounts, and the reader should not assume that an investment in these securities was or would be profitable in the future. Certain security valuations and forward estimates are based on Heartland Advisors’ calculations. Any forecasts may not prove to be true. Economic predictions are based on estimates and are subject to change. There is no guarantee that a particular investment strategy will be successful. Sector and Industry classifications are sourced from GICS®.The Global Industry Classification Standard (GICS®) is the exclusive intellectual property of MSCI Inc. (MSCI) and S&P Global Market Intelligence (“S&P”). Neither MSCI, S&P, their affiliates, nor any of their third party providers (“GICS Parties”) makes any representations or warranties, express or implied, with respect to GICS or the results to be obtained by the use thereof, and expressly disclaim all warranties, including warranties of accuracy, completeness, merchantability and fitness for a particular purpose. The GICS Parties shall not have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of such damages. Heartland Advisors defines market cap ranges by the following indices: micro-cap by the Russell Microcap®, small-cap by the Russell 2000®, mid-cap by the Russell Midcap®, large-cap by the Russell Top 200®. Because of ongoing market volatility, performance may be subject to substantial short-term changes. Dividends are not guaranteed and a company’s future ability to pay dividends may be limited. A company currently paying dividends may cease paying dividends at any time. There is no assurance that dividend-paying stocks will mitigate volatility. In certain cases, dividends and earnings are reinvested. CFA® is a registered trademark owned by the CFA Institute. Russell Investment Group is the source and owner of the trademarks, service marks and copyrights related to the Russell Indices. Russell® is a trademark of the Frank Russell Investment Group. Data sourced from FactSet: Copyright 2022 FactSet Research Systems Inc., FactSet Fundamentals. All rights reserved. Heartland’s investing glossary provides definitions for several terms used on this page. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment