lyash01

Two weeks ago – on July 25th, 2022 – natural gas player Range Resources (NYSE:RRC) announced its Q2-2022 earnings. Results were quite outstanding and better than expected, with the stock gaining 8% on the same day and 14% in the three days post announcement. In this article, I will provide an overview of the financial and operating results and I will explain my BUY recommendation.

As some readers might know, this is not my first article on Range Resource: in April 2022 I analyzed the Q1-2022 results while in March 2022 I published another article where you can find a general overview of the company.

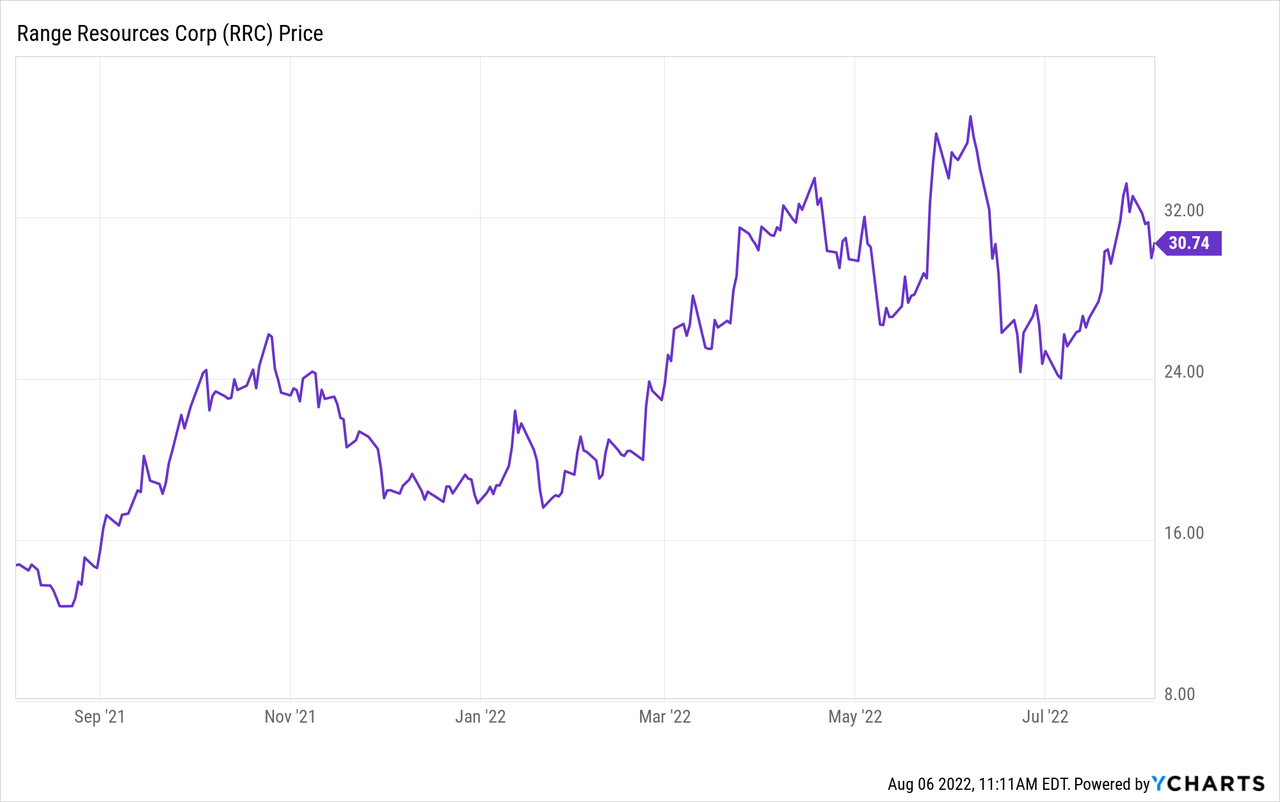

Range Resources is up 72% year-to-date

The stock is currently trading at $30.74 per share, quite in line with the trading price of my last article ($30.99/share), and the market capitalization is $7.4 billion.

Range Resources is up 97% year-on-year and 72% year-to-date with the 54-week low being $12.72/share (August 20th, 2021) and the 52-week high being $37.02/share, recorded on June 7th, 2022.

Impressive Q2-2022 results driven by higher prices

Total revenues after hedging were $1.22bn, up 182% versus the $0.43bn of the same quarter of the previous year. Going into more detail, revenues from the sale of natural gas, NGLs and oil were $1.35 bn, up 118% versus the $0.61 in Q2-2021 while sales generated by the brokered natural gas also saw an increase, from $61 M in Q2-2021 to $106 M in Q2-2022. On the other side, the impact of hedging was -$239 M, quite in line with the previous year.

The increase in revenues was almost exclusively driven by higher realized prices (+121% year-on-year, pre-hedging) and slightly offset by a ca 1% reduction in delivered volumes.

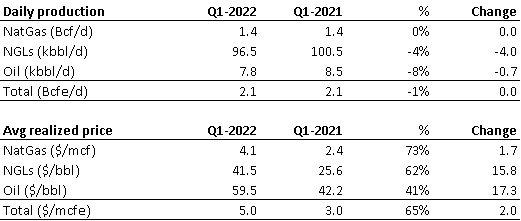

Indeed, the daily production of NatGas was 1.44 Bcf/d (exactly like in Q2-2021), while NGLs production dropped by 4% YoY to 97 kbbl/d and the crude oil production decreased by 8% YoY to 8 kbbl/d. Realized prices post hedging saw a weighted average increase of $1.99/mcfe, or 65%.

Range Resources 10-Q

Overall operating expenses have increased by 13% YoY, from $592 M to $668 M with “transportation, processing and compression” accounting for 48% of total OpEx ($320 M in Q1-2022, up 13% YoY). Despite production being in line with the previous year, transportation and processing cost increased mostly due to the impact of higher NGLs prices which led to higher electricity and fuel costs. Other relevant cost items were D&A (13% of total OpEx) and G&A (5% of total OpEx).

The large increase in revenues and the slightly higher costs mean that Range Resources was finally able to generate a positive net income of $452 M, showing a clear change in performance versus the losses recorded in the past (-$156 M in Q2-2021 and -$456 M in Q1-2022).

Cash flow generation and leverage are improving

Cash flows from operations saw a large increase going from $174 M in Q2-2021 to $324 M in the current quarter (+86%). The increase in total CFFO is even more impressive if we look at the first six months of the year, with cash flow generated from operations reaching $731 M in H1-2022, +158% versus the $283 M in H1-2021.

During Q2-2022, Range Resources reduced the total outstanding debt by $217 M through the retirement of the 5% and 5.875% senior notes due in 2022. Overall, at the end of Q2-2022, the outstanding debt amounts to $2.4 bn leading to a net-debt/EBITDAX ratio of 1.2x with Range Resources’ top management expecting to further reduce the leverage in the next months.

Significant shareholders’ return via buyback and dividends

During the previous quarter, Range Resources announced the intention to carry out a $500 million buyback program to support the stock price which the management believes to be intrinsically undervalued. During Q1-2022, 0.6 million shares were purchased at an average price of $27/share while, in Q2-2022, the buyback became stronger with 4.5 million shares purchased at an average price of $28.85/share. In the next months, additional shares will have to be bought for a total equity value of $354 M.

Range Resources is also planning to pay an annual dividend of $0.32/share, likely starting from Q3-2022.

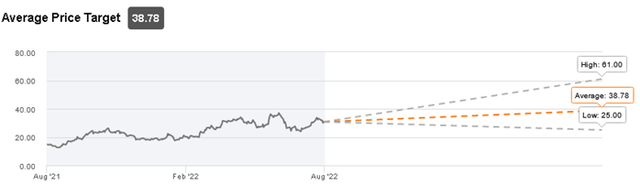

Wall Street consensus overview

According to Seeking Alpha’s Wall Street consensus, 24 analysts have rated Range Resources in the last 90 days with 14 recommendations being Hold. However, most of the Hold ratings are prior to the Q2-2022 result presentation and, in addition, the average target price, $38.78/share, is higher than the current trading price (ca. 26% upside).

Range Resources is a BUY

Overall, I believe that Range Resources – at the current trading price of $30.7/share – is worth a BUY recommendation. Indeed, the debt leverage has already improved thanks to the strong FCF generation and I believe that in 2023 it will go below the 1.0x net-debt/EBITDAX threshold. Capital return to shareholders is likely to increase both via dividends but also with the buyback program that – if the commodity market remains bullish – might even exceed the $500 M initial target. Finally, the large presence in the Appalachian Basin provides Range Resources with a significant production base at least until 2030.

Be the first to comment