Oselote

Silver Could Be Responsible for The Positive Momentum In Basic Materials

The next easing of monetary tightening coupled with an economic recession that is on track to be less severe than predicted a few months ago is buoying market sentiment.

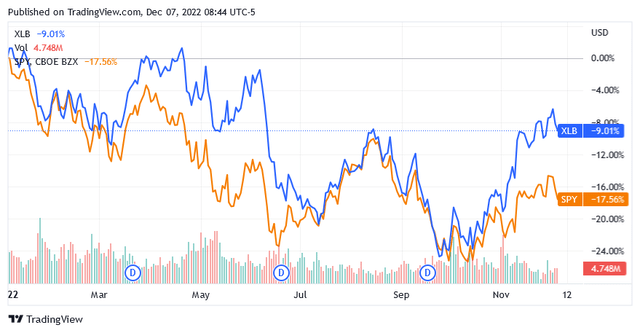

Investors have regained risk confidence in recent months, as illustrated in the chart below, where the SPDR S&P 500 Trust ETF (SPY) has been rallying since October.

The Materials Select Sector SPDR ETF (XLB) is even outperforming the broader U.S. market, a sign that investors are anticipating a strong rebound in the sector after months of bearish sentiment.

Source: Seeking Alpha

High silver demand and price expectations could be a key driver of positive momentum in materials, and investors should take advantage of this by increasing their exposure to the metal through Gatos Silver, Inc. (NYSE:GATO).

This company seems poised to get the biggest tailwind should silver market conditions really improve.

Gatos Silver, Inc. In the Basic Materials Sector

Based in Greenwood Village, Colorado, Gatos Silver, Inc., is primarily a discoverer of silver ore properties and a producer of the metal.

The company’s flagship is the 70% interest stake in the Cerro Los Gatos mine in the Mexican state of Chihuahua.

Gatos Silver: Performance That Matters

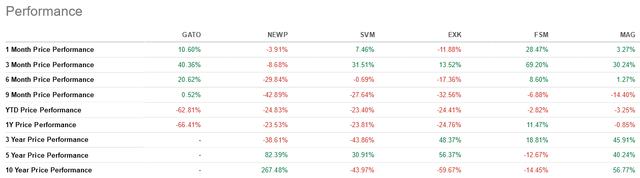

The stock price has shown a positive correlation with silver price changes in a remarkable way and has fared much better than 80% of its peers over the past 1, 3, and 6 months when the metal has been bullish.

Source: Seeking Alpha

Silver futures, a benchmark used to measure the metal’s performance, are up 9.4% over the past month, are up 28% over the past 3 months and are up 3.7% over the past 6 months.

As the metal traded higher, Gatos Silver, Inc. improved several key operating metrics over the past 9 months, including a 6% year-over-year increase in the volume of the mineral milled to 709,666 tonnes, or 2,600 tonnes per day, an increase in average silver grade by 28% YoY to 361 grams per tonne of ore and silver recoveries up 220 basis points to 89%.

These advances drove silver production up 39% year-on-year to 7.40 million ounces as of September 30, 2022. In addition to silver, the company also produced 47.1 million pounds of zinc, 34.2 million pounds of lead and nearly 4,000 ounces of gold.

All these secondary productions have improved year by year; however, silver is the primary source of revenue for Gatos Silver, Inc.

Silver’s Prospects Bode Well for Gatos Silver

Silver producers are on track to make a strong contribution to the global goal outlined in International Energy Agency [IEA]’s Renewables 2022 report. The global goal is to accelerate the development of renewable energy sources, which will generate more than 90% of all electricity worldwide by the end of 2027.

The precious metal is involved in the production of clean energy technologies such as photovoltaics and green infrastructure, and on a large scale in the components of electric vehicles.

For this reason, after a strong 2022, industrial demand for silver will most likely continue to play a key role in global metal demand growth.

The Cerro Los Gatos mine is poised to accommodate higher demand for silver with 9.35 million to 9.65 million ounces in 2022 [up 7.2-10% from 2021] and thereafter thanks to the commissioning of a new paste backfill facility for further exploitation of the orebody.

On the other hand, the global silver supply may not be as strong as demand since a prolonged period of higher fossil fuel prices has significantly increased miners’ operating costs, and this could deter plans for higher production.

But Gatos Silver’s 70% interest in the Cerro Los Gatos mine is expected to continue to benefit from the operation of a more efficient mill facility and a well-planned production schedule to minimize waste.

While many miners’ profitability is at stake because the recession will weigh on revenues from secondary metal production, Gatos Silver is unlikely to be affected.

The US silver miner is reducing its total annual cost per silver equivalent ounce by benefiting from more efficient operations and targeting higher non-silver production of lead, zinc and gold.

Just for the full-year 2022, Gatos Silver reduced all-in sustaining costs 6.1-10.8% year-over-year to $15.50-$16.50 per ounce of silver equivalent and expects higher zinc production of 58- 61 million pounds, lead to 43-46 million pounds and gold to 5,000-5,300 ounces.

A Shortage in The World Silver Market Becomes Routine and Puts Upward Pressure on The Silver Price

The silver shortage in the global market is a recurring concern and the theme is on track to set new records beyond 2021 that will provide a solid support for higher prices in the future.

Looking ahead, economists are targeting an 11.6% rise in silver prices to $25.37 an ounce within 12 months.

The Stock Price

Gatos Silver, Inc. is in a better position than many other operators due to strong factors such as lower costs, higher production and operational efficiencies, and this will allow the company to get the best tailwind from rising silver prices.

Therefore, investors should consider increasing their position in Gatos Silver, Inc. and not hesitate for too long since shares may not remain low forever.

Shares, which are trading at $4.05 apiece at the time of this writing, are slightly above the long-term trend of the 200-day simple moving average line of $3.48.

Source: Seeking Alpha

The current share price of $4.05 apiece is well below the $7.11 median of the 52-week range of $2.20 to $12.02.

The stock has a market cap of $282.07 million and a 5-year monthly beta of 2.27. The beta market indicator suggests a high probability that Gatos Silver, Inc. shares will rise faster than the market if the latter continues to recover from bearish sentiment.

There is also a risk that the share price will not increase. If the Federal Reserve doesn’t get the feedback it wants from consumers, it will still take an aggressive stance on interest rates, which could hurt the silver industry as more expensive borrowing weighs on demand and discourages investment in silver activities.

Regarding the feedback from consumers, the situation for the US central bank remains quite challenging.

Conclusion

This stock appears to have good upside potential as it is well-positioned to benefit from the anticipated strengthening in silver industry fundamentals.

Additionally, certain competitive advantages in the form of lower costs and higher production may attract investors’ attention as many other peers will face multiple challenges due to operational inefficiencies.

Be the first to comment