NicoElNino/iStock via Getty Images

Vermilion Energy (NYSE:VET) is a Canadian oil and gas company with broad asset base that includes Canada, the U.S. Australia and several European nations, among which Ireland is of biggest cash flow significance. Despite the global footprint, most VET investors are in for the exposure to European gas prices, which have been 10 times greater than the U.S. benchmarks. Therefore, when the EU council announced at the end of September its decision on energy windfall taxes, this was bad news for Vermilion.

A couple of months back I wrote an article to provide a preliminary estimate of what the new tax could mean for Vermilion. I would refer to the prior article for background on the windfall tax framework. My conclusion was that despite the tax impact, VET’s FCF yield was still attractive.

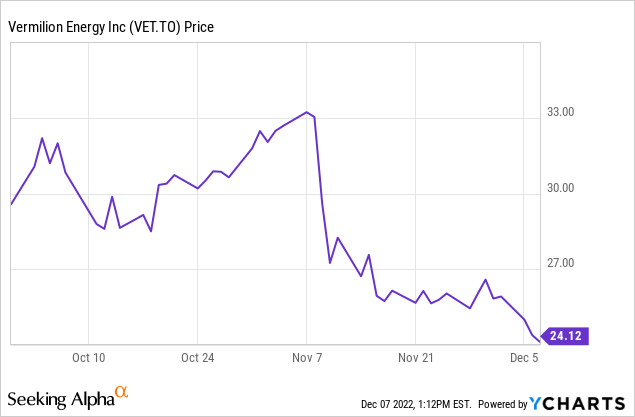

What is interesting is that the stock didn’t really drop until November 9, when Vermilion released its Q3 results and management confirmed on the earnings call that the windfall tax was indeed real (as if there was any doubt):

The tax parameters discussed by management were broadly in line with was already announced on September 30. Perhaps the trigger point was the suspension of buybacks announced by VET, in order to preserve cash for the tax payment, or possibly the general selloff in oil prices which also started around that time:

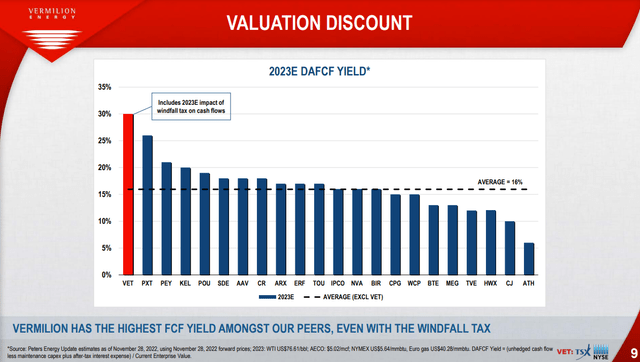

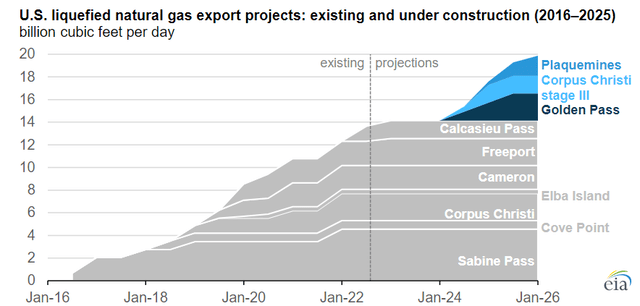

Regardless the reason, the drop to C$24 / US$17 dollar seems like an overcorrection. Accounting for both the worsened pricing environment and the windfall tax, Vermilion still has a 30% FCF yield that exceeds the yields of many of its peers. The European gas crisis won’t be over this winter either, and it will take at least until 2025/2026 when global LNG liquefaction capacity will increase meaningfully.

In my view, Vermilion is a buy at the current price level.

Estimating the windfall tax effect

Management’s official estimate of the cash impact of the tax is from C$250 to C$350 million:

We have provided an estimate for 2022 windfall tax impact of $250 million to $350 million within our Q3 release. There continues to be many unknown variables related to the final implementation of the tax. However, our current estimate of the potential two-year exposure for 2022 and 2023, if the tax was implemented as framed by the EU, would be approximately $650 million to $750 million, again, over two years based on the current strip pricing. This estimate is inclusive of the incremental core working interest.

My initial estimate was about C$670 million based on 2022 exit production numbers. While this is twice management’s estimate of C$250 – C$350 million, most of the gap is due to two assumption differences:

- Management’s 2022 estimate is without the incremental Corrib interest, the acquisition of which is now delayed to Q1 of 2023. My estimate included Corrib. Removing the incremental 36.5% of Corrib interest from my original calculation reduces my estimate from C$670 to C$470 million.

- The average 2022 estimated prices for the key European gas markers have also gone down. Replacing the latest management price deck in my original calculation reduces the estimate further from C$470 to C$390 million.

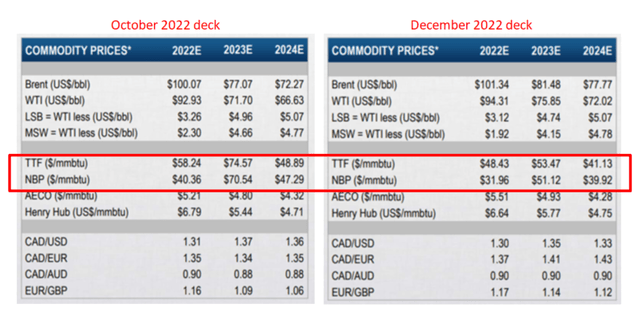

As can be seen by putting together the company’s October vs. December presentations, the price decks for the European TTF and NBP gas markers have changed quite a bit:

Vermilion Investor Presentations

Finally, to get from C$390 million to management’s C$250 – C$350 million range, my guess is one needs to know specifically the deductions taken against 2022 profit, which isn’t something available in the public filings. As I warned in my prior article, in the absence of this information, I had conservatively assumed no offsets to put an upper bound on the tax amount.

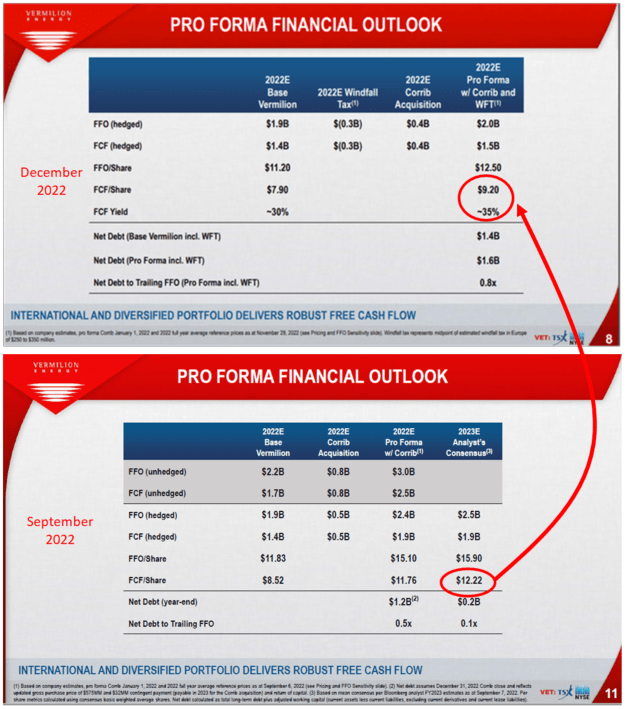

So with these clarifications in mind, where does VET stand? Accounting for the windfall tax and the worsened pricing, the pro forma FCF/share estimate has fallen by 25%, from C$12 to C$9:

Vermilion Investor Presentations

It isn’t a small hit, but the stock price is down 40%-45% from September. So the FCF yield is still high and remains above 30%.

VET continues to look discounted when compared to Canadian peers which aren’t subject to the windfall tax:

Vermilion Investor Presentation

So maybe we shouldn’t focus as much on the windfall tax but rather on how long we expect European spot gas to remain in the US$40/MMBtu zone.

How high will Ireland go?

The 33% tax on surplus profits (defined as taxable profits above 120% of the 2018-2021 average) is the minimum requirement from the EU Council. Some EU countries have already implemented the Council’s regulation and have gone above and beyond the 33%. The Czech Republic, for example, set its windfall tax at 60% and also went beyond energy to include banks in the scope.

Of the countries relevant to Vermilion, Germany’s Bundestag already implemented the minimum 33% windfall rate in its annual tax bill. The Netherlands has a proposed bill that will also be at the 33% rate.

In Ireland, the form of the local implementation is still under consideration. According to some recent reporting, a 75% windfall rate may have been floated around:

The windfall tax will raise between €340 million and €1.9 billion, according to the Government. The tax will be levied at €120 per megawatt hour. While the solidarity charge will be 75% of the excess profits of fossil fuel producers. They will be allowed to earn a baseline average plus 20% before that charge kicks in.

The 75% rate is quite scary and would be an additional cash outlay above management’s estimates, as presumably management is projecting the 33% scenario. However, I haven’t been able to corroborate that Ireland indeed intends a 75% windfall rate for Corrib. My interpretation is that the 75% may be in consideration for power generators which collect revenue above a set cap. For example, Ireland is considering setting a cap of €120 per MWh for wind and solar. This actually makes some sense because the marginal cost of wind and solar is zero; the cap prevents the generators from benefitting from the marginal price of electricity that may be set by expensive gas.

However, with Ireland’s announced plans to get nine new gas-fired power plants by 2024, I don’t think going above the 33% rate would be productive for their long-term agenda. Calls for nationalizing Corrib should probably not be taken seriously either.

Vermilion is also implying they have open channels of communication with the relevant governments:

Vermilion has been actively engaged with government officials in the countries where we operate to identify opportunities, where we can contribute to domestic gas needs. Natural gas is an important energy source that should be produced locally where possible to ensure security of supply.

If Ireland is serious about its energy agenda, it would make sense to avoid short-term opportunism and stick to the minimum EU requirement.

European gas prices remain strong

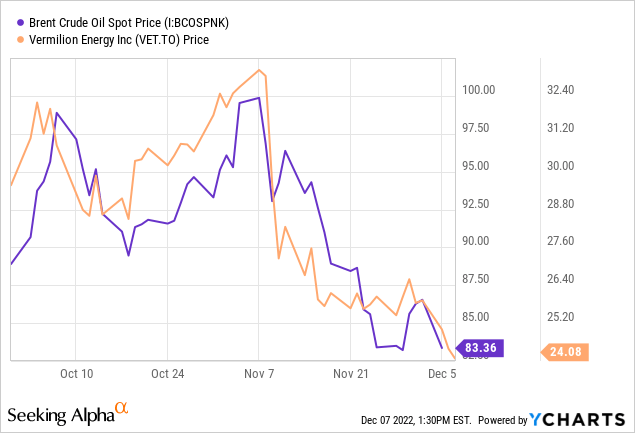

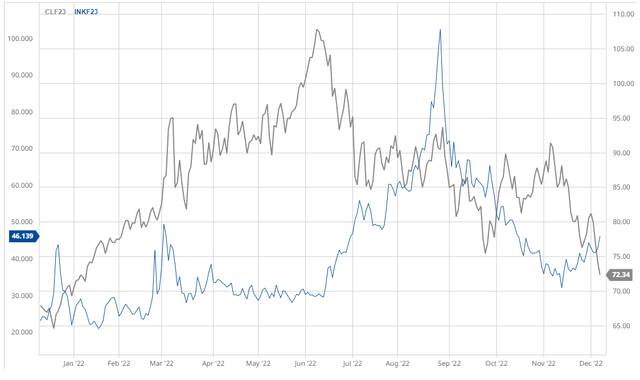

The last piece in the investment thesis is where European gas prices will go. As oil is testing $70, one obvious point should be that there has been very little correlation between oil and European gas prices:

Oil has been trending down since June due to recession fears and the China lockdowns. European gas prices also peaked in August, around the time storage facilities were filled up. Prior to that, European governments had basically provided their utility companies with a blank check to purchase gas at any price available. Since that has no longer been the case, front-month gas futures dropped quite a bit due to mild weather, but have been trending up again as Europe is heading into deep winter. Context matters too. Even though TTF is down to $40/MMBtu from over a $100, this is still 7-8 times the U.S. price.

From Vermilion perspective, this is relevant because when oil goes down, all oil equities tend to follow. However, since VET is tied to TTF and NBP which have little correlation to oil, this tends to open significant discount windows as the case may be right now.

Ultimately, European gas should trade at high levels at least until 2025-2026, when more significant LNG capacity is set to come online:

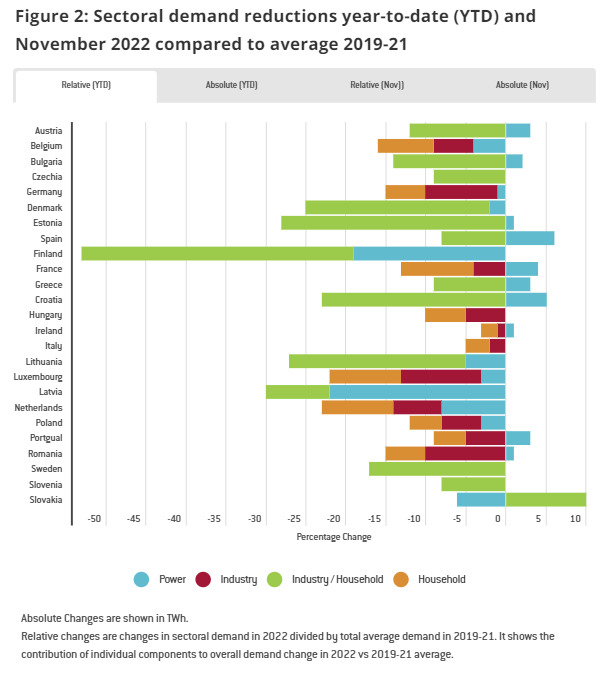

Europe is arguably already in a recession, but gas demand has already fallen a lot:

bruegel

With much of the reduction in 2022 coming from industry, what is left is power generation and household consumption, which likely won’t move much from here. Even if a recession pushes down oil a bit more and for longer, I am skeptical it could do much to lower European gas prices.

Takeaway

Despite the windfall tax and some remaining policy uncertainty in Ireland, Vermilion is still a 30% FCF yield stock. The price drop in the last weeks more than makes up for the cash flow lost to the new taxes. The struggles of oil shouldn’t affect VET much either because European gas prices have remained in the $40/MMBtu region. The US$17 price seems quite low.

Be the first to comment