Evgenii Mitroshin

Contrarily to my recent publication which was about shorting oil stocks, this thesis is about trading oil futures, and for this purpose, I use the ProShares UltraShort Bloomberg Crude Oil ETF (NYSEARCA:SCO) which, as its very name implies, enables traders to profit from bearishness.

Leveraged and inverse SCO (www.proshares.com)

My objective is to assess whether there is a window of opportunity in trading SCO which has just delivered a five-day upside. Also, I make sure to provide details about factors that determine the price of oil, in order to reduce the probability of losing money when shorting with two times (2x) inverse leveraged ETF, whose fund managers charge fees of 0.95%.

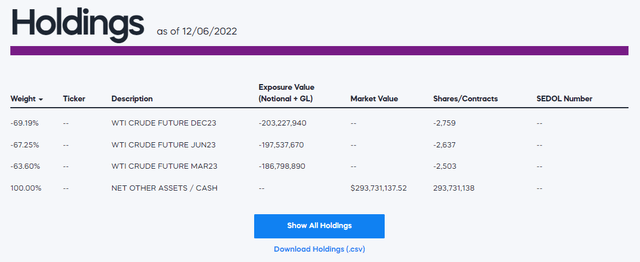

I start by providing insights into the holdings, from the demand-supply perspective.

SCO’s Exposure to WTI Futures

First, supply mainly comes from three different places, the U.S., Russia, and OPEC (Organization of the Petroleum Exporting Countries) led by Saudi Arabia as I will elaborate upon later. As for demand, it comes from the largest economies in the world like America, China, and Europe. Then, there are other large economies that do not have a supply of their own like India and Japan. The balance between demand and supply determines the price of crude oil.

In this respect, the two most popular benchmarks are WTI (West Texas Intermediary) and Brent crude. As for SCO, it holds futures from WTI as pictured below.

SCO Holdings (www.proshares.com)

The price of WTI varies widely and trading oil futures is a way to speculate on the evolution of oil prices without ever having to own the physical asset. Now, trading oil using SCO is different from investing using the Energy Select Sector SPDR ETF (XLE). Moreover, when trading, you can take advantage of both bull and bear markets, because you speculate exclusively on price movements via oil contracts.

In this case, oil futures are contracts on which you agree to exchange a set amount of oil at a pre-agreed price and date. As such, futures contracts are primarily used by buyers to fix the price of oil at an advantageous level and thus hedge against potential unfavorable price movements. They are traded on futures markets like the New York Mercantile Exchange (NYMEX) and remain the most widely used method of buying and selling oil.

However, as I will show below, trading oil futures directly provides better rewards but also involves more risks than trading the stocks themselves.

Risks due to SCO’s Sensitivity to Crude Oil Prices

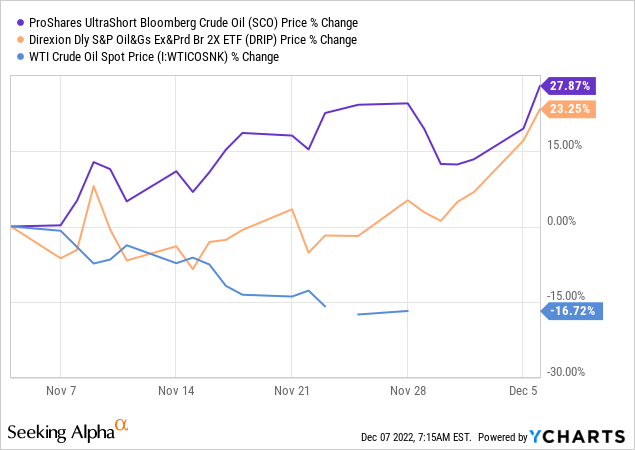

The price of oil futures contracts changes as the value of oil increases or decreases. It may sound like I am repeating myself here, but, the point is to differentiate between SCO and another ETF that holds oil stocks, the Direxion Daily S&P Oil & Gas Exp. & Prod. Bear 2x Shares ETF (DRIP). Thus, SCO is directly correlated to oil’s performance, in this case, two times the inverse. Also, as seen by the average daily dollar volume, trading oil futures is popular, because neither does it require the trader to hold barrels of oil nor the stocks of individual companies.

Moreover, as seen in the chart below, SCO, is more sensitive to commodity price fluctuations. Thus, when WTI crude oil was down by 16.72% in the past month, the ProShares ETF delivered 4.62% (27.87 – 23.25) more gains than DRIP.

Now, while more daring traders would love this gain, SCO’s sensitivity to oil price movements can also work the other way around and deliver worst performance than DRIP during highly volatile market conditions. This means more downside risks, especially in case you are holding to the ETF for a long period.

On the other hand, with DRIP you have a higher degree of insulation against volatility given that you are trading the stock and not the commodity itself.

This risk adds to the one related to the compounding effect where leveraged ETFs can deliver fewer gains than initially anticipated due to the price of the commodity exhibiting a higher degree of volatility between two trading dates. As an example, SCO appreciated by 27.87% during the last month or less than two times the inverse of the 16.72% decrease in WTI. The shortfall of around 5.57% (16.72 x 2 – 27.87) is due mostly to the compounding effect.

This is the reason why ProShares advises against holding SCO for “periods of greater than one day” as returns can be significantly different from what one is expecting.

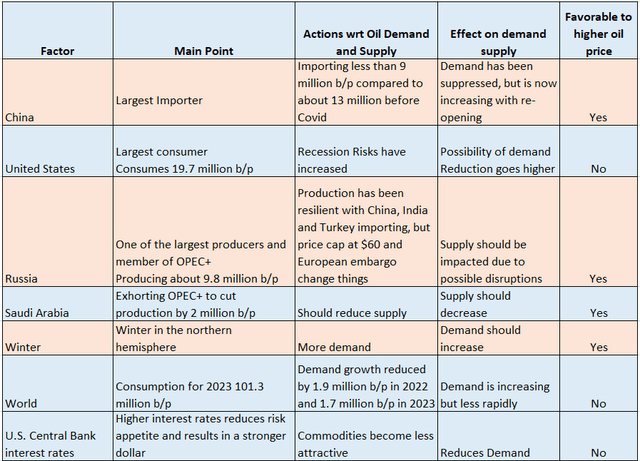

Coming back to the demand-supply equation, another factor that determines the price is interest rates as determined by the U.S. central bank.

Factors determining the price of crude oil

Here, quite controversially, the oil market has been bearish since the beginning of this week despite indicators showing that the US economy is proving resilient amid high inflation. The reason is simply that this sets the stage for further interest rate hikes which will effectively slow down the economy as it will increase borrowing costs and reduce the risk-taking appetite.

Now, a higher cost of capital decreases businesses’ willingness to spend more on growth which in turn reduces the demand for oil. At the same time, with higher interest rates, the dollar becomes stronger as has been the case for most of this year which again reduces the appeal for commodities. These factors are listed in the table below.

Table built using data from (www.seekingalpha.com)

Pursuing further, winter should be colder than normal, and there is also uncertainty as to whether the main buyers of Russian crude which are China, India, and Turkey will continue to source their energy requirements from that country. Here, investors will note that many of the tankers which transport crude from Russia to other parts of the world are registered in Europe and as such, they are bound by the G7’s price mechanism, as in case of a mishap during transit, insurance may not cover the costs of the oil cargo.

Continuing with the supply side, OPEC+ which is OPEC and its allies recently opted for the status quo, or a reduction in their production objectives of two million barrels per day until the end of 2023, in line with the target set during the October meeting in Vienna.

Shifting to demand, with China as the world’s largest importer (above table) on a reopening path, demand for oil should normally get further support. Also, as seen in the above table, there are more factors that favor higher oil prices over the short to medium term.

Conclusion

However, oil markets remain highly volatile as there are so many variables at play. Thus, in contrast to my above bullish position on oil, the contrary has happened this week with WTI falling below $80. Thus, SCO has gained more than 18% during the last five days, mainly due to two factors, namely rising recession risks adversely impacting demand and the EIA (Energy Information Administration) raising its oil production expectations for 2023, which favors supply.

However, this situation should not last as Russia which previously proved resilient as an energy supplier to China and India is now the subject of uncertainty, namely pertaining to the oil embargo by Europe which entered into effect on December 5th. There is also the $60 price cap for the Russian Ural crude agreed upon by the G7 countries, the EU, and Australia, as I touched upon earlier. With the price cap, Russian oil has now gone below the $58 level as freight (tanker) charges have gone up.

In these conditions, supply is likely to be impacted, at least in the short term, while Chinese demand gets support from the Covid reopening. There may even be a reaction from Russia like interrupting supply, which could benefit prices and conversely, prove detrimental to SCO. Thus, the window of opportunity for trading this ETF may have elapsed.

Be the first to comment