Alena Bogatyrenko/iStock via Getty Images

N-able, Inc. (NYSE:NABL), a provider of cloud-based software solutions for managed service providers (MSPs), was spun off from its parent company SolarWinds Corporation (SWI), in July 2021 and IPO-ed at $15.37 per share. Since then, the price has dropped by 26.73%. It is a small-cap stock of $1.986 billion.

Stock Trend since IPO (SeekingAlpha.com)

The company met EPS expectations in the most recent third-quarter earnings report while beating consensus numbers for Q1 and Q2 financial results. The spinoff allows the company to invest in technology and growth specific to its target market. Although the business has a strong and profitable business model delivering software as a service to MSPs aimed at the SME market, there is a lot of uncertainty and changes in the market concerning M&A activity, technological advancements and generally poor performance in the technology industry stocks. Therefore I give this stock a hold rating for the time being.

Overview

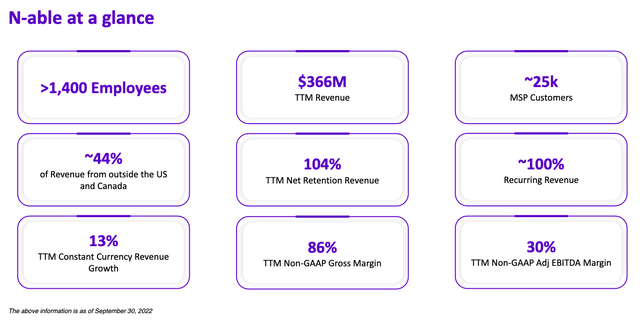

NABL was founded by Mark Scott in Canada in 2000 to provide MSP service automation for their SME sector clients. It was acquired by SWI in 2013 for $120 million and served approximately 2,600 MSPs at the time. In 2016 SWI received competitor LOGICnow, creating SolarWinds MSP. The spinoff in 2021 has brought the service back to its original name, N-able, now serving approximately 25000 partners globally. The company has a 100% recurring revenue model through subscriptions to its SAAS solutions. It also has an impressively high gross margin of 86%.

Company at a glance (Investor Presentation)

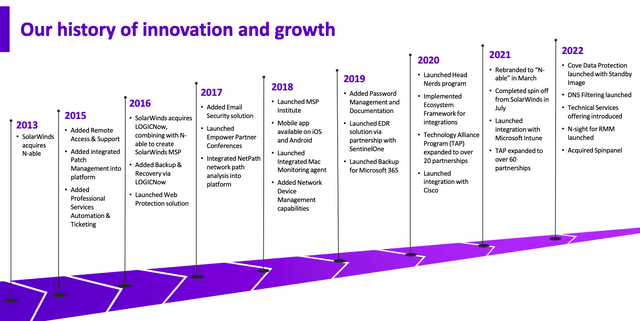

One of the main reasons for the spinoff was to allow both companies to focus better on their respective markets; NABL on the MSP market and SWI on IT management software for IT professionals. NABL can invest and grow technologies most suited for its partners and their vision. The timeline below shows the company’s growth through technology and acquisitions. Most recently, the company acquired Spinpanel, a Microsoft solution used by many MSPs end customers.

Growth timeline (Investor Presentation 2022)

Third Quarter Results

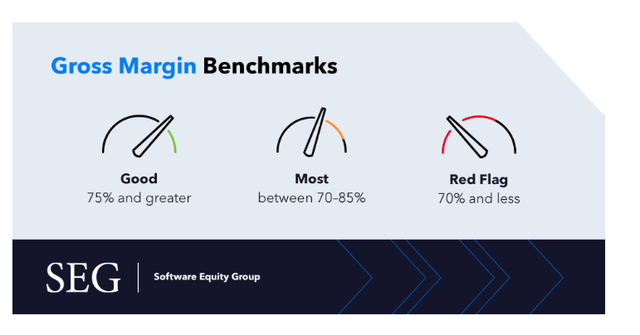

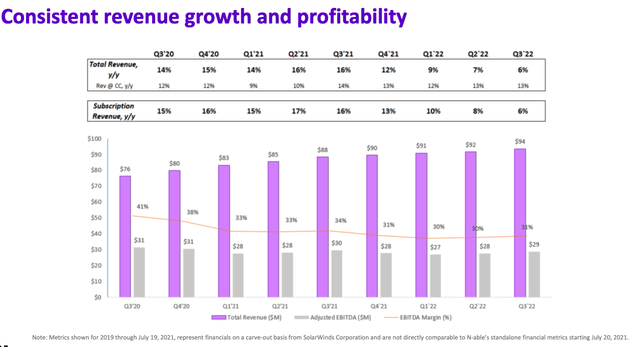

Last month NABL released its third-quarter results. The total revenue grew year on year by 6% to $93.5 million. Most of that revenue is subscription revenue, which totalled $91.2 million, and saw a 6% year-on-year growth. It is essential to look at the GAAP gross margin of 83.9%. This is a critical indicator of potential growth success in the world of scalable SAAS solutions, in which, as an investor, you want to avoid seeing the margin eating heavily into the profits.

Gross margin rating (softwareequity.com)

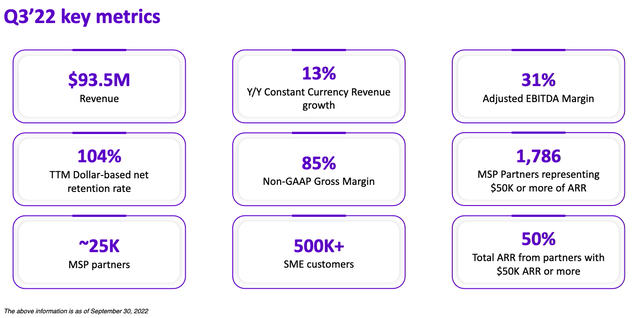

Furthermore, the GAAP net income was $0.3 million. The non-GAAP net income gives us a higher value of $12.3 million, and the adjusted EBITDA was $28.8 million, which indicates a margin of 30.9%. In the image below, we can see the highlights for the third quarter results.

Q3 Financial metrics (Investor Presentation)

Looking at the company’s revenue and profitability since 2020, we can see consistent and healthy growth.

Revenue and Profitability per quarter (Investor Presentation 2022)

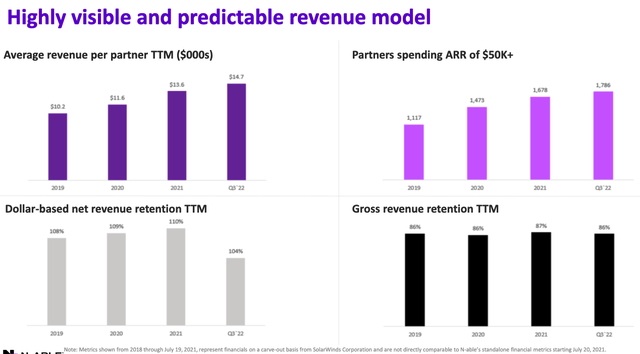

N-able has successfully increased average revenue per partner since 2019 and is on its way to the fourth year of growth. Furthermore, more partners are spending annual recurring revenues above $50,000. The business model allows for a predictable growth timeline from existing customers due to the recurring revenue model.

Revenue growth per customer (Investor Presentation 2022)

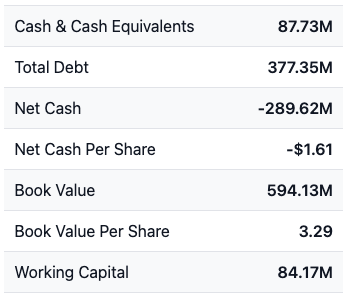

On the balance sheet front, we see that NABL has $87.73 million in cash and $377.35 million in debt, giving it a negative net cash position of $289.62 million, which we see the company is spending more than it is receiving, which is something to be cautious of. However, it has a current ratio of 2.42, which means it has enough asset value if liabilities need to be paid off. It also has a relatively safe debt-to-equity ratio of 0.64.

Balance Sheet (stockanalysis.com)

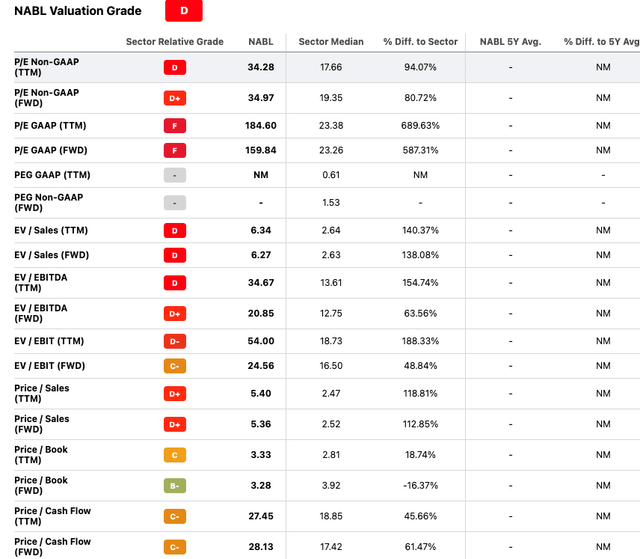

Although the company has a healthy gross margin for a SaaS company, it is growing its revenue per customer and the number of customers. If we look at Seeking Alpha’s Quant rating, we see a valuation grade of D and a price-to-earnings ratio of 34.28 compared to the information technology sector median of 17.66, indicating that the company may be overvalued.

SeekingAlpha’s Quant Rating (SeekingAlpha.com)

Risks

The market is fast-paced and changing quickly. There is a lot of M&A activity which is changing up the market and the strength and capabilities of competitors. We saw competitor Datto, which IPO-ed in 2020, get acquired by another competitor, Kaseya, similar in size but still a private company, for a value of $6.2 billion. These companies are targeting the same customer base, which could impact NABL’s growth plans if there are better, cheaper, safer alternatives.

Final thoughts

The recent spinoff from SWI has put a better spotlight on the value proposition NABL brings and its business focus. It is one of the few SaaS solutions for MSPs that cater to SMEs to go public, although competitor DATTO was previously on the market before Kaseya’s acquisition earlier this year. The business has a robust solid revenue model and is investing in technology, assets and growing customer value. However, the stock has yet to be well received by the market and has been trending downwards since its IPO. For this reason, I recommend investors Hold and see the further developments and continued quarterly report performances.

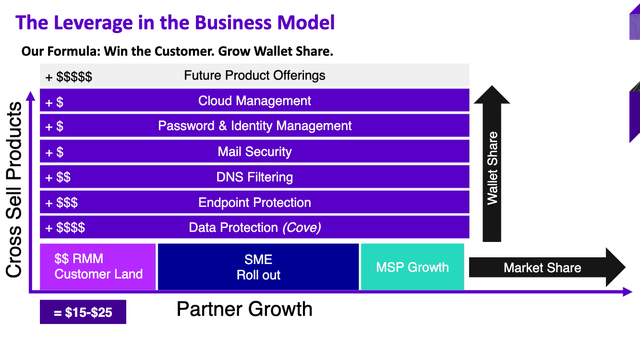

Business Model Growth Potential (Investor Presentation 2022)

Be the first to comment