aprott/iStock via Getty Images

Instagram was originally acquired for $1 billion. Late last year, it hit 2 billion in monthly active users. For comparison, Meta Platforms (NASDAQ:FB) has almost 3 billion monthly active users. As we’ll see throughout this article, the doubling in Instagram’s monthly active users from June 2018 to YE 2021 (1 billion to 2 billion) combined with continued growing earnings per user highlights Meta’s potential.

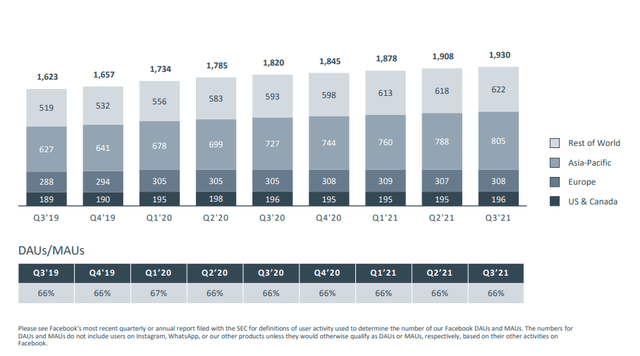

Meta Active Users

Meta has focused on growing its core property active users along with users in other properties.

Meta Platforms’ Active Users

One of the signs of Meta’s strength is for its core property, one that’s much less exciting than newer properties, the company has still been able to steadily grow it. The property has been growing at the mid-single-digits annually with growth not only in new markets (Rest of World) but also in Europe and the US and Canada.

The company’s strength here is also in monthly active users which have grown to almost 40% of the world’s population. Given forecasts for a population of 9.7 billion people by 2050, and even faster industrialization, there’s a significant runway for Meta to continue adding users. We can see the company’s 3 billion MAU becoming 5 billion by 2050 with these trends.

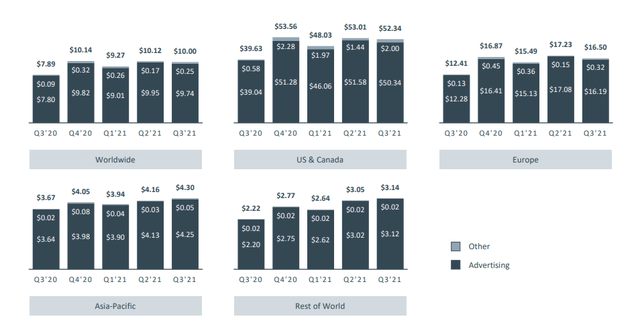

Meta Earnings Per User

Meta has a double-whammy of strength. Not only is the company’s user base growing but so is its ARPU.

Meta Platforms ARPU

Meta Platforms Investor Presentation

Meta has managed to grow its worldwide APRU by more than 25%, turning single strong quarter ARPU into sustainable growth. The growth has been evidenced across markets such as the US and Canada along with the Rest of the World. That substantial growth in the ARPU along with user growth has driven up the company’s overall revenue.

The majority of the revenue continues to be “advertising” but the strong success in “other” from late-2020 highlights the strength of the company’s other businesses such as Oculus. That’s a business that could also expand outside of the US and Canada, supporting even more rapid growth internationally.

The combination of growth here means faster overall revenue growth for the company.

Meta Metaverse

Lastly, we want to touch on Meta’s Metaverse, an incomplete project for virtual reality, where people are spending hundreds of thousands if not millions on real estate.

In our view, the long-term potential of the metaverse is subjective. However, its primary benefit is that it represents another form of insurance for the company as social networks are constantly competing against. Myspace was once the most popular website on the internet. With Meta’s existing resources, the Metaverse is a manageable capital expense.

If it pans out, it could add another massive source of advertising dollars for the company. If it doesn’t, there’s no significant downside.

Meta Shareholder Return Potential

Overall, Meta has the ability to generate substantial shareholder returns from this combined increase in both users and ARPU.

The company recently announced a $50 billion increase in its buyback. That’s enough to repurchase 6% of the company. The company’s growing net income for the TTM was ~$40 billion, meaning even with the company’s significant continued capital spending of almost $20 billion annualized, it can afford to do similar buybacks each year.

In our view, Meta’s current market position can be seen as most similar to where Apple (NASDAQ:AAPL) was in the early 2010s when the ‘iPhone’ was viewed to have peaked along with the company. However, despite that “peak”, the company will be able to continue growing its margins and users steadily and using cash flow for reliable share buybacks.

That potential is significant. We expect that through the 2020s the company will generate substantial shareholder rewards.

Meta Risk

The company’s risk is competition. The company has an impressive portfolio of assets and it’s done a good job to grow continuously. However, the one truth of the tech industry is that it’s constantly changing. Should substantial new competition emerge, it has the ability to massively drive down Meta’s shareholder returns.

Conclusion

Instagram has grown significantly since the original 2012 acquisition, however, one of the more significant takeaways is that since mid-2018 until the end of 2021, the business has doubled in size. Overall, the company has several properties that are massive, and with market penetration and the business growing, it has significant additional potential.

The company recently announced a $50 billion share buyback, enough to repurchase 6% of its shares and highlight its financial strength. In our view, the company is where Apple is in 2012, the market has written off its growth but it still has reliable growth and a unique ability to continue generating substantial cash flow.

Be the first to comment