grandriver/iStock via Getty Images

Plains All American Pipeline (NASDAQ:PAA) is a large midstream company focused heavily on the Permian Basin along with numerous other midstream assets. The company stands to benefit from news of the Permian Basin’s production recovery as the field stands to become the largest producing oil field in the world and surpass its prior production records.

As we’ll see throughout this article, Plains All American is an impressive company that stands to be a unique addition for any portfolio.

Plains All American Financial Performance

The company had strong financial performance for the quarter, highlighting its strength.

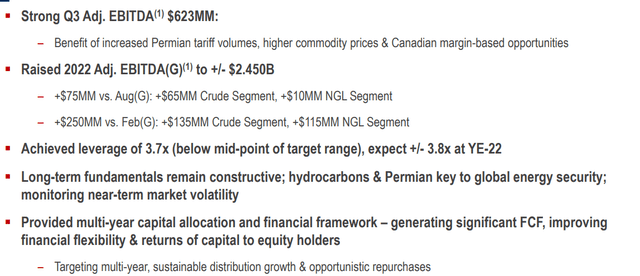

Plains All American Investor Presentation

The company had more than $600 million in adjusted EBITDA in the quarter with its guidance raised to $2.45 billion in adjusted EBITDA. The company’s leverage is below its target with its leverage ratio at 3.7x and the long-term fundamentals of the basins where the company operates remain strong, at least in its key basins.

The company continues to see long-term demand for energy security as key to its businesses and continues to invest. The company has a multi-year framework for continuing to invest which it expects to generate substantial FCF for investors. Financially, the $8.7 billion company, with a dividend yield of just under 7% expects a 265% coverage ratio and $1.5 billion in DCF.

Plains All American Volume Growth

As a midstream toll operator, the company’s success is dependent on volume growth of its business.

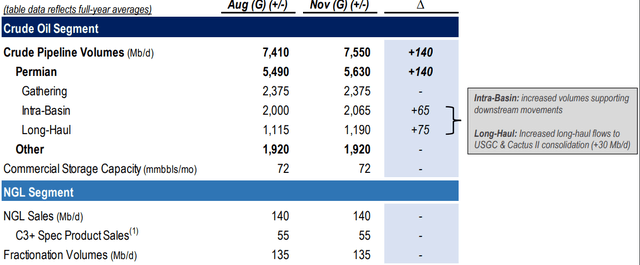

Plains All American Investor Presentation

The company saw 7.6 million barrels / day in volumes for the quarter, with 5.6 million barrels / day in Permian volumes. Permian volume growth contributed to 100% of the company’s overall volume growth. That volume growth is expected to accelerate with volume growth of almost 500 thousand barrels / day going into the 4Q 2022.

Supported by Permian volume growth the company has adjusted its guidance. As long as the company has spare capacity, Permian volumes can be expected to continue improving. That will continue to improve the company’s YoY cash flow.

Plains All American Improving Business

The company’s improving business is expected to enable it to continue improving its asset portfolio and improve shareholder returns.

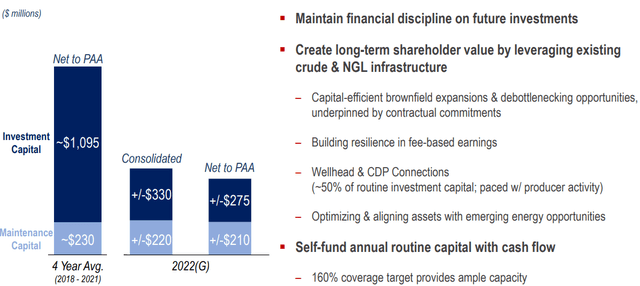

Plains All American Investor Presentation

The company has worked to improve its maintenance capital spending, impressive given the current inflationary environment. The company’s maintenance capital is expected to be just over $200 million for the year. At the same time, the company is going to continue investing in growth capital, cash it can comfortably afford, to the tune of just under $300 million / year.

The company has toned down its capital spending significantly, similar to other midstream companies, freeing up cash to return to shareholders while enabling growth to continue.

Plains All American Shareholder Returns

Putting this all together, Plains All American will be able to generate substantial shareholder returns.

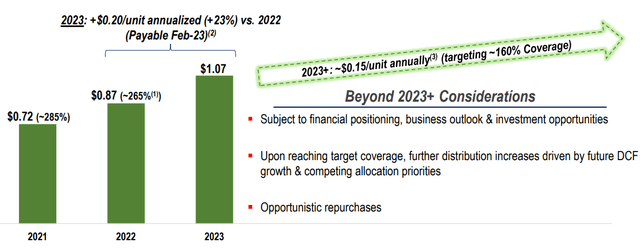

Plains All American Investor Presentation

The company’s anticipated 2023 dividend is $1.07 / share. That’s a dividend yield of almost 8.6%, a dividend that the company can comfortably afford. From that point the company expects $0.15 / unit annual growth while maintaining 160% coverage, a dividend growth rate that it can continue to afford.

It’s important to highlight that that means those who invest today can have a 10% yield on their investment by 2025. As the company continues to improve its financial position its options should free up. The company’s total debt has declined from just under $11.4 billion to just over $9.3 billion a $2 billion reduction.

The company’s interest rate is affordable, but in a high inflationary environment, we’d like to see the company reduce it faster. Overall, we expect the company to continue generating substantial shareholder returns.

Thesis Risk

The largest risk to the thesis for Plains All American is the company’s volumes. The company’s volumes are dependent on demand in the oil market which has remained strong recently. However, that can change, and long-term, with a shift to renewables, it will change. The company’s adjustments to these changes could hurt its returns substantially.

Conclusion

Plains All American is a mid-size oil company with a market capitalization of just under $9 billion. The company has a dividend yield of just under 7%, with its strong recent recovery, however, it remains well below the prices just a few years ago for the company. The company’s dividend is comfortably affordable with a strong coverage ratio.

The company is continuing to invest in growth. Additionally, the company’s debt has reached its targets, with just over $9 billion in long-term comfortably affordable debt. With $1.5 billion in annual DCF, we’d like to see the company spend hundreds of millions of reduce its debt and interest expenses further in an expensive market.

Be the first to comment