Justin Sullivan

Thesis

As investors have fully digested Google’s (NASDAQ:GOOG) (NASDAQ:GOOGL) mixed Q3 earnings report, it is a good time to look past its immediate speed bumps and form a long view. Warren Buffett expressed his regrets in 2019 for not buying Google. As you know, he never regrets missing stocks that he does not understand. But GOOG, behind its technology cover, is actually a simple business that clearly demonstrates all the Buffett hallmarks: a wide moat filled with alligators, a toll status, and an extraordinarily high return on capital employed (“ROCE”).

The thesis of this article is to argue that all these traits are still valid today, and yet GOOG is now for sale at 17x PE, a substantial discount from its pre-2019 valuation (on average 25+ PE).

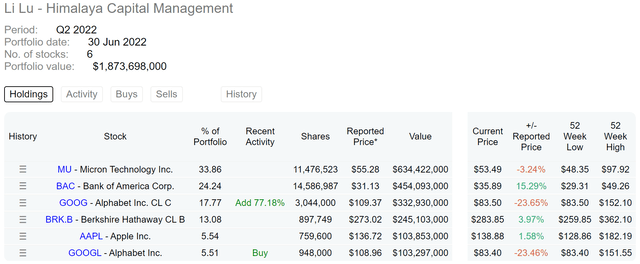

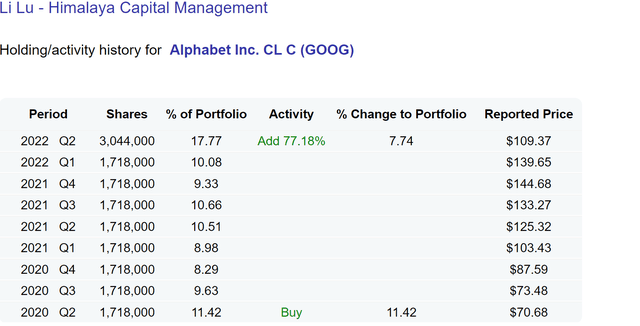

Indeed, Li Lu, an investor that Charlie Munger described as the “Chinese Warren Buffett” has been building a large Google position lately as you can see from the two charts below. The first chart shows that GOOG is the 3rd largest holding in his Himalaya Capital Management, representing more than 23% of his total portfolio (when the GOOG and GOOGL positions are combined). The second chart shows that he almost doubled his stake (a 77% increase) recently in Q2 2022.

Behind both Buffett’s and Lu’s thinking, I see several common principles and why GOOG is a perfect fit for these principles under current conditions. And next, I will start with the principle of not being afraid to apply risk-free interest rates as the discount rate.

Source: dataroma.com Source: dataroma.com

The choice of discount rates

Buffett promotes the uses of risk-free interest rates as the discount rate for stocks that he well understands. And the following quotes serve as a good example

… But we believe in using a government bond-type interest rate. We believe in trying to stick with businesses where we think we can see the future reasonably well – you never see it perfectly, obviously – but where we think we have a reasonable handle on it (BRK 1996 annual meeting. The emphases were added by me).

As a logical equivalent to his above principle, he views the various models to message the discount rates as “mathematical gibberish” as shown in the quote below. I share the view completely. With the multitude of models available for computing discount rates (and the ambiguity of the parameters in these models), you can essentially get any number to justify any valuation for any stock, which of course doesn’t make up for the lack of understanding of their business. As Buffett said below, you are better off sticking with businesses I understand and just using the risk-free interest rates.

If you say I’m going to stick an extra 6 percent in on the interest rate to allow for the fact – I tend to think that’s kind of nonsense. I mean, it may look mathematical. But it’s mathematical gibberish in my view. You better just stick with businesses that you can understand, use the government bond rate. And when you can buy them – something you understand well – at a significant discount, then, you should start getting excited. (BRK 1996 annual meeting. The emphases were added by me).

And next, we will see why discount rates obtained from the well-accepted CAPM model (capital asset pricing model) have little relevance in the case of GOOG. The CAPM, detailed in my earlier articles, has the following key inputs:

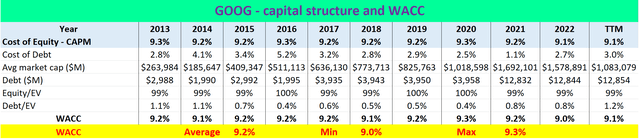

This analysis uses the Weighted Average Cost of Capital (“WACC”) to evaluate its cost of capital. The WACC is calculated as:

WACC = portion of equity * cost of equity + portion of debt * cost of debt * (1- tax rate)

And the next chart shows the WACC results. Note that the cost of equity, according to the CAPM model, is determined by the volatility of the stock (the beta) and the risk-free return (the 10-year treasury bond yield).

Beta is assumed to be 0.9 here, and the 10-year treasury rates are taken as the annual average. As seen, the cost of equity for GOOG has been quite stable between 9.2% to 9.3% in the past 10 years. A large reason is its low level of debt (its debt/EV ratio has been below 1% most of the time) so its WACC is not sensitive to borrowing rates.

Source: author based on Seeking Alpha data

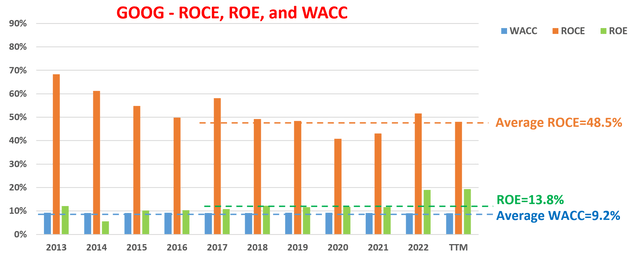

The next chart compares its WACC against its return on capital employed (“ROCE”) and ROE. And this comparison illustrates why WACC is quite irrelevant in the case of GOOG in my mind. A few thoughts,

- As seen, its ROE has been consistently exceeding its WACC by a good margin already. Its ROE has been on average 13.8% vs. its average WACC of 9.2%.

- Then the ROE itself underestimates its profitability. The ROCE is a more accurate profitability measure as detailed in my blog article. In GOOG’s case, a large part of the equity is idle cash and is not needed for its actual profit generation. For example, the parent holding company of GOOG exited the September quarter with a whopping $116.3 billion of cash. While at the same time, its long-term debt remained fairly low at only $14.7 billion. As a result, its ROCE has been on average 48.5%, higher than ROE by more than 3x and then WACC by more than 5x.

As a result, its ROCE dwarfs any variation in the WACC or the choice of the detailed parameters in the CAPM model (such as beta or interest-free rates).

Source: author based on Seeking Alpha data

Discount cash flow model

Based on the above, as Buffett taught us, it is simply more sensical to stick with the risk-free interest rates as the discount for businesses that we understand, and just stay away from businesses that we don’t.

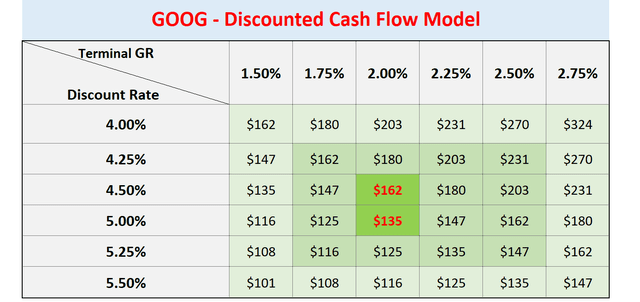

Under this spirit, the next table shows my valuation of GOOG using a simple discounted cash flow model (“DCF”) with the risk-free rates as the discount rates. And the key assumptions here are:

- I will apply a long-term risk-free rate of 4.5% to 5.0% as the discount rate, which is consistent with the Fed’s current dot-plot and also consistent with average 10-year treasury rates in the long term (say over a 30 to 50 years period spanning a macro debt cycle).

- I am assuming a free cash flow of $4.05 per share ($6.1 per share of cash flow minus $2.05 per share of CAPEX expenditures)

- Its terminal growth rates are obtained as the product of its average ROCE (48.5% as shown above) and its reinvestment rates (taken to be 4% based on its long-term historical average). As a result, its terminal growth rate is estimated to be about 2% (1.94% to be exact = 48.5% ROCE x 4% reinvestment rate).

With the above inputs, the DCF analysis is somewhere between $135 and $162. If the risk-free interest rate stabilizes at 4.5%, then it’s worth $162 per share ($4.05/(4.5% – 2.00%)). If the risk-free interest rate stabilizes at 5%, then it’s worth a bit less, $135 per share ($4.05/(5.0% – 2.00%)). But in either case, compared to its current price of ~$84, it provides a wide margin of safety of up to 50%.

Source: author based on Seeking Alpha data

Risks and final thoughts

As aforementioned, GOOG just reported mixed Q3 results and cited several speedbumps in the near future. Its YOY revenues growth slowed to 6% in Q3 2022 and net income decreased by 27% to $13.9 billion. The business is dealing with a range of challenges, both macro and also business-specific. These challenges include supply chain logistics, the strengthening of the U.S. dollar, a continued pullback in advertising spending, lower user engagement in gaming, and also a sharp increase in its headcount that it yet needs time to fully digest.

All told, I see the market overacted to these short-term headwinds. Thanks to such overreactions, GOOG is now for sale at 17x PE, a substantial discount from its historical levels. Yet its moat and profitability remain largely unchanged from its 2019 level the way I see it, a time when Buffett expressed his regret of not being at PE averages of 25+. For perpetual compounders like GOOG, Buffett is not afraid of applying risk-free rates as discount rates. And the results show that GOOG should be worth about $135 per share, even if we assume a 5% risk-free interest rate.

Be the first to comment