Erik Khalitov

Introduction

During the Warner Bros. Discovery (NASDAQ:WBD) 3Q22 call, Rich Greenfield from LightShed Partners asked about past mistakes from previous management like abandoning Amazon channels. CEO David Zaslav answered by saying people have been using the “subs” metric over the last few years in the same type of way that people irrationally used the “clicks” metric in the 90s. Current management is looking at the fuller picture, focusing on average revenue per user (“ARPU”), free cash flow (“FCF”) and adjusted earnings before interest, taxes, depreciation, and amortization (“EBITDA”). CEO Zaslav said they now get to play Monday morning quarterback and make decisions based on numbers that were previously unavailable:

What we did, which is lucky, is we’re a Monday morning quarterback. It’s easy to do that. We can now take a look at what happened with the old Time Warner leadership team, what happened with the AT&T leadership and how many subs did that actually get them, how – what was the engagement for that? How much money did they spend to get that? How much money are they spending in this area? And is there any return? So it’s very easy for us because we can be Monday morning quarterbacks, and we’re taking full advantage of that.

My thesis is that WBD management continues to pivot as they have plenty of data to use when playing Monday morning quarterback. In other words, they have data-driven results that were unavailable to previous management, and they are acting on that information to make changes accordingly to improve the economic outlook.

The DTC Segment

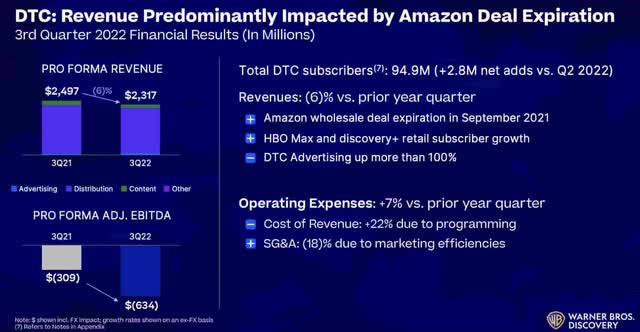

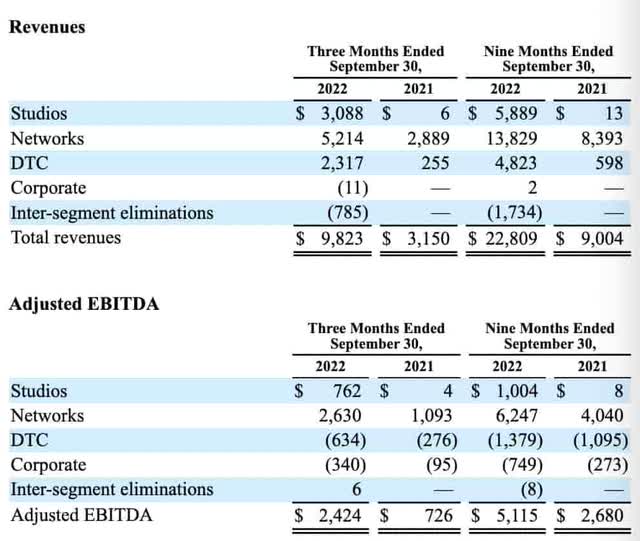

The 3Q22 presentation shows that revenue and adjusted EBITDA have come down for the DTC segment. Adjusted EBITDA has gotten worse, as it went from $(309) million in 3Q21 down to $(634) million in 3Q22. DTC adjusted EBITDA losses have gotten heavier on a 9-month basis as well, going from $(1,095) million in 9M21 to $(1,379) million in 9M22. The September 2021 expiration of the Amazon (AMZN) wholesale deal is cited as a factor in the 3Q22 presentation:

DTC revenue (3Q22 presentation)

CEO Zaslav said during the 3Q22 call that they are now open to pivoting, which probably means renewing their relationship with Amazon:

And we’re not going to make those same mistakes or we’re going to change strategy more importantly because those strategies could work. It could have been that in many areas, we could be sitting here saying – so should Amazon and should a number of other distributors be out there sub distributing for us? We’re looking very hard at it because we need as many people – we got the best product. We should have as many people pushing it as possible. We have a great relationship with Amazon.

Current management recognizes that the negative adjusted EBITDA drag in the DTC segment needs to stop. CEO Zaslav is focused on delivering $1 billion of positive adjusted EBITDA in streaming by 2025. Current management gets to play Monday morning quarterback with numbers that show direct-to-streaming movies don’t work for them at this time with respect to HBO Max viewership, retention or love of the service:

We’ve learned what doesn’t work. And this is what doesn’t work for us based on everything that we’ve seen and we’ve looked at it hard. One is direct-to-streaming movies. So spending $1 billion [while] collapsing a motion picture window into a streaming service, the movies that we launched in the theater do significantly better. And launching a 2-hour or an hour and 40-minute movie direct-to-streaming has done almost nothing for HBO Max in terms of viewership, retention or love of the service.

Another pivot being analyzed by management is the increase of pricing. Discovery International CEO Jean-Briac Perrette talked about pricing power in the 3Q22 call:

And then pricing, we think, is one of the meaningful ones. Two data points on that, that I think are important. Number one is by 2023, HBO Max will not have raised prices since its launch. So it’d been 3 years since pricing has moved, which we think is an opportunity, particularly in this environment. And number two, when we look internationally, our wholesale and retail ARPUs are meaningfully lower than the market leaders. And for us, that spells opportunity and an ability as we think about the new product coming to market and even some initiatives before the new product comes to market for growth on ARPU internationally.

The WBD pricing is indeed low when we make comparisons with Netflix (NFLX). The WBD DTC ARPUs of $10.54 for domestic subs and $3.69 for International subs are modest. By contrast, the Netflix 3Q22 letter shows ARPU of $16.37 for UCAN, $10.81 for EMEA, $8.58 for LATAM and $8.34 for APAC.

Valuation

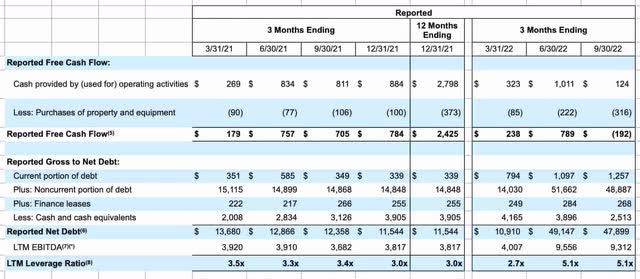

Relying heavily on adjusted EBITDA as a valuation metric can be dangerous seeing as depreciation and amortization are serious ongoing expenses. However, at WBD we know that 6 month capex is much less than depreciation and amortization with the former being $538 million or $222 million + $316 million and the latter being $3,599 million or $1,841 million + $1,758 million. The above capex figures come from the Free Cash Flow & Debt sheet of the Trending Schedule and Non-GAAP Reconciliations excel document on the IR web page:

WBD FCF (Free Cash Flow & Debt sheet)

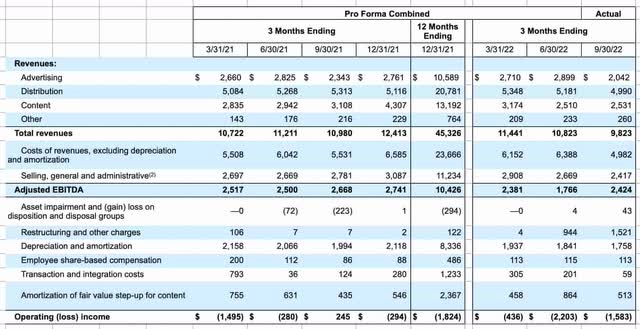

Again, the above depreciation and amortization figures come from the Consolidated WBD Results sheet of the Trending Schedule and Non-GAAP Reconciliations excel document:

WBD results (Consolidated WBD Results sheet)

Knowing that capex is small relative to depreciation and amortization, the adjusted EBITDA metric has more merit at WBD than it does at other companies. TTM adjusted EBITDA is $9,312 million and management expects it to grow substantially in the near future.

I also think about TTM free cash flow (“FCF”) but this is hard to piece together given the merger. For the periods ended December 31, 2021 and March 31, 2022, reported FCF represents standalone Discovery, Inc. FCF. We do know that the combined FCF from the last 6 months is $597 million or $789 million + $(192) million. Of course this is suppressed by TTM interest payments of $1,104 million or $551 million + $553 million so we have to take those out when making comparisons to the enterprise value.

During the 3Q22 call, CFO Gunnar Wiedenfels said seasonality as well as integration costs contributed to the negative quarterly FCF:

Reported free cash flow was negative $192 million, and let me provide some more detail here. Cash flow from operations decreased nearly $700 million, primarily due to seasonality from the semiannual cash interest payment on a large portion of the acquisition debt as well as merger and integration-related costs, which totaled nearly $400 million during the quarter, including payout of retention bonuses to legacy Warner Media employees put in place prior to the closing of the transaction.

CFO Wiedenfels went on to say 2022 adjusted EBITDA should be $9.2 billion and he gave more color on FCF and adjusted EBITDA moving forward:

We continue to see reported free cash flow for the year at $3 billion and now see net leverage at the end of the year at approximately 5x. Building off of this projected baseline and looking to 2023, we continue to target, and our teams are working towards, $12 billion in adjusted EBITDA. And in the more normal advertising environment, we believe that target should be achievable.

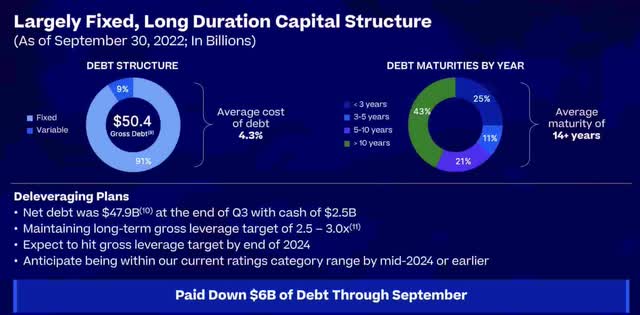

If WBD has adjusted EBITDA of $12 billion in 2023 with a FCF conversion rate of 1/3rd to 1/2, then 2023 FCF should be $4 billion to $6 billion. If we compare this to enterprise value then we have to add back the interest payments which could be about $2 billion for the year if 2023 is anything like 2022. There are puts and takes here; interest rates are rising but the company paid down $6 billion worth of debt through September. The 3Q22 presentation shows the debt structure and the maturities by year:

The 3Q22 presentation sums up the future outlook:

WBD outlook (3Q22 presentation)

CFO Wiedenfels didn’t seem to be worried about the large amount of debt in the 3Q22 call:

I really view our capital structure as a huge asset. We put the structure in place with the purpose. It’s cheap, largely fixed and long-dated debt. And so from that perspective, I feel very, very good about it. Very limited maturity coming up over the next couple of years. We run scenarios, obviously. And there is – even in the most dire scenarios, no requirement for us to come back to the debt markets to refinance anything. So it really is a bit of an asset. It’s not lost on us where the debt is trading.

I believe that Netflix and WBD will continue to be two of the largest streaming companies in a decade but their capitalization is different; WBD is more highly leveraged. WBD has 3Q22 revenue of $9.8 billion, most of which is not from streaming, and they have net debt of $47.9 billion. Meanwhile Netflix has 3Q22 revenue of $7.9 billion and their net debt is just $7.8 billion or $13.9 billion – $6.1 billion.

Management now has the numbers needed to make the right decisions that will stop the bleeding in the DTC segment but it is the networks segment and to a lesser degree, the studios segment, that are generating positive adjusted EBITDA and FCF. We need to think about the durability of these segments when considering adjusted EBITDA multiples for a valuation range. The studios segment had 3Q22 adjusted EBITDA of $762 million which is a relatively small part of the total adjusted EBITDA of $2,424 million:

During the 3Q22 call, CEO David Zaslav said they are going to focus on movie franchises moving forward and this could improve the adjusted EBITDA prospects for the studios segment:

One, we’re going to have a real focus on franchises. We haven’t had a Superman movie in 13 years. We haven’t done a Harry Potter movie in 15 years. What the – the DC movies and Harry Potter movies provided a lot of the profits of Warner Brothers Motion Pictures over the last 25 years. So focus on the franchise. One of the big advantages that we have, House of the Dragon is an example of that. Game of Thrones, taking advantage of Sex in the City, Lord of the Rings, we still have the right to do Lord of the Rings movies.

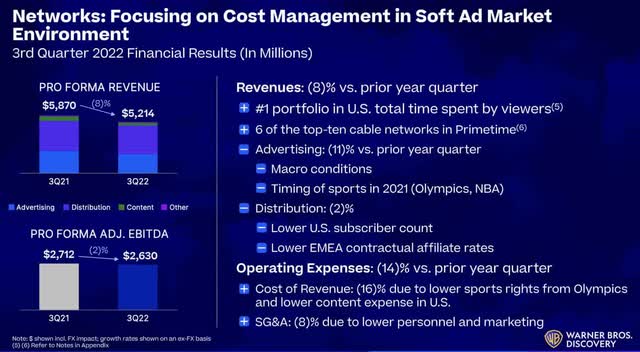

The networks segment is the main driver for adjusted EBITDA:

Networks segment (3Q22 presentation)

Footnotes [5] and [6] show that Nielsen 3Q22 for 6/27/22 to 9/25/22 is the source for the #1 U.S. portfolio mention and the top-ten cable networks in Primetime. Here are those top-ten WBD networks:

TLC #2

TBS #4

Discovery Channel #7

HGTV #7 [tied]

Food Network #9

TNT #10

I think a reasonable multiple for WBD’s TTM adjusted EBITDA of $9,312 million is 7 to 9x during this era of rising interest rates such that the stock is sensibly priced with an enterprise value close to this valuation range of $65 to $84 billion.

The 3Q22 10-Q shows 2,428,396,015 shares as of October 21st and we get a market cap of $25.3 billion by multiplying this share count times the November 4th share price of $10.43. The enterprise value is significantly more than the market cap due to prodigious levels of debt. The 3Q22 balance sheet shows $48,612 million noncurrent portion of debt, net + $1,257 million current portion of debt which comes to $49.9 billion. However, the 3Q22 release mentions gross debt of $50.4 billion as total debt of $50.1 billion, plus finance leases of $268 million. On the balance sheet, debt is shown net of premiums or discounts, while the earnings release shows the face value of the debt. Hence, we see $49.1 billion on the former and $50.1 billion on the latter. We can tie to the $50.1 billion face value figure by going to the Trending Schedule and Non-GAAP Reconciliations excel document on the IR web page. The Free Cash Flow & Debt sheet shows that the $48,887 million noncurrent portion of debt + the $1,257 million current portion of debt comes to a little more than $50.1 billion and adding the $268 million of finance leases gets us to $50.4 billion. $2,513 million in cash and equivalents partially offset this such that the net debt is $47.9 billion. We also have $318 million in redeemable noncontrolling interests plus $1,245 million noncontrolling interests for a sub total of $1.6 billion such that the enterprise value is $49.5 billion or $47.9 billion + $1.6 billion more than the market cap.

The enterprise value is inside my valuation window so I think the stock is reasonably priced.

Disclaimer: Any material in this article should not be relied on as a formal investment recommendation. Never buy a stock without doing your own thorough research.

Be the first to comment