Dr_Microbe/iStock via Getty Images

The Growing Field of Cell Visualization and Analysis

Modern medicine now focuses on highly specific targeting principles, rather than unspecific or generalized treatments. Think monoclonal antibodies and genetic treatments such as CRISPR-Cas9 or RNA vaccines. These modern techniques require a new generation of research tools that focus on the cellular level, rather than traditional multicellular analysis. This includes visualizing the complex components on the inside and outside of a cell, the genetic makeup, and even analysis of the interactions the cell may have with other molecules.

These companies are also similarly complex, as vertical integration of hardware, software, and consumable components is required for the systems to work. Both Cytek Biosciences, Inc. (NASDAQ:CTKB) and 10x Genomics, Inc. (NASDAQ:TXG), two major innovators in the sector, sell hardware, consumables, and software to go along with their platforms. This may be a point of risk for an investment, mostly due to the high cost of developing and producing a vertical system. However, data suggest that the field is growing and of ever more importance, leading to a positive outlook for both:

Cells are small and complex. It is hard to see their structure, hard to discover their molecular composition, and harder still to find out how their various components function. What we can learn about cells depends on the tools at our disposal, and major advances in cell biology have frequently sprung from the introduction of new techniques.

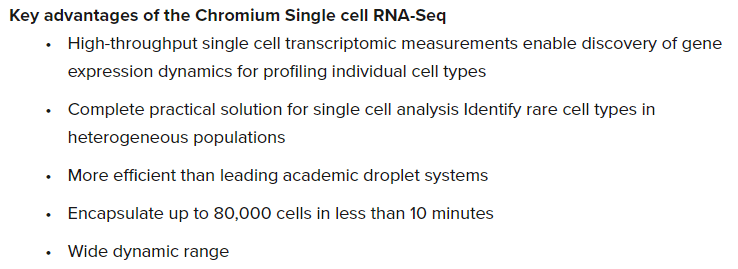

TXG is a leader in sequencing techniques, basically understanding the composition of target cells or tissues. Outcomes of TXG tools include understanding cellular composition, reactions with molecules, and expression dynamics, all important for current R&D. While 10x Genomics has amassed a large following since IPO 2019, partially thanks to the boom and bust of ARK funds (held in genomic and flagship funds (ARKG) and (ARKK), respectively), issues with growth, profitability, and overvaluation have caused the share price to fall 40% since the IPO.

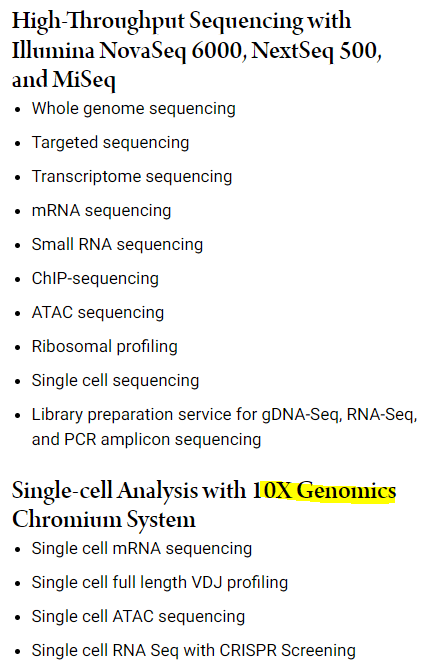

A summary of TXG’s Chromium platform (Yale Center for Genomic Analysis)

Meanwhile, Cytek has a smaller following, has had two years of profitability, but now offers a higher valuation for a slightly better growth profile. The major difference is that CTKB operates in the “boring” field of flow cytometry, rather than genomics. However, lack of publicity does not indicate a lack of growth potential. In fact, due to flow cytometry’s diverse capabilities, it is quite the opposite:

Flow cytometry is a powerful tool that has applications in multiple disciplines such as immunology, virology, molecular biology, cancer biology and infectious disease monitoring. For example, it is very effective for the study of the immune system and its response to infectious diseases and cancer. It allows for the simultaneous characterization of mixed populations of cells from blood and bone marrow as well as solid tissues that can be dissociated into single cells such as lymph nodes, spleen, mucosal tissues, solid tumors etc. In addition to analysis of populations of cells, a major application flow cytometry is sorting cells for further analysis.

Industry Outlook and Competition

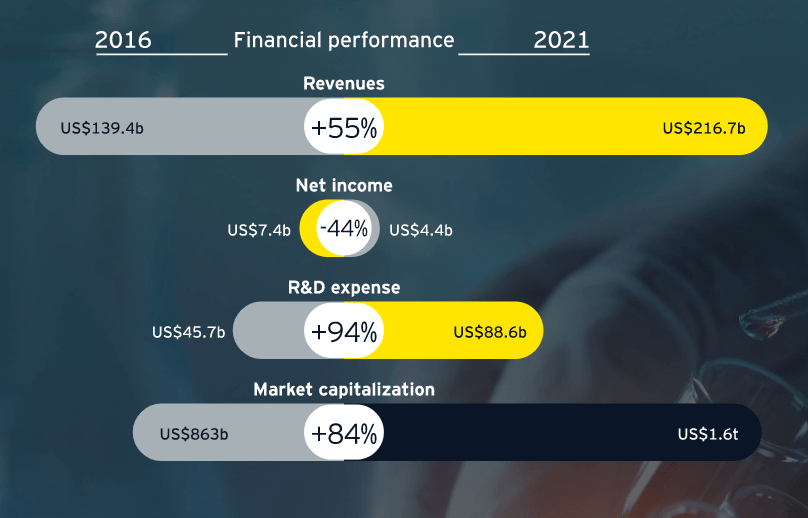

While it is not necessary to understand the complex intricacies of the technologies, it is important to understand the business environment. Investors have one important bullish point to rely on: the incredible growth of the drug discovery and biotechnology industry. Research by EY indicates that the public biotech sector remains strong, even after a bull market through the latter half of the last decade.

Importantly, total revenues and R&D expenses increased 55% and 84% between 2016 and 2021, with 2022 fundamentals remaining strong even as economic headwinds exist. As biotech spending remains, and even continues strong secular growth, we can anticipate that companies like Cytek and 10x Genomics will have no issue in finding revenues. However, there are many sharks in this sea, and the competition is a huge risk.

Financial performance data of public biotech companies (EY)

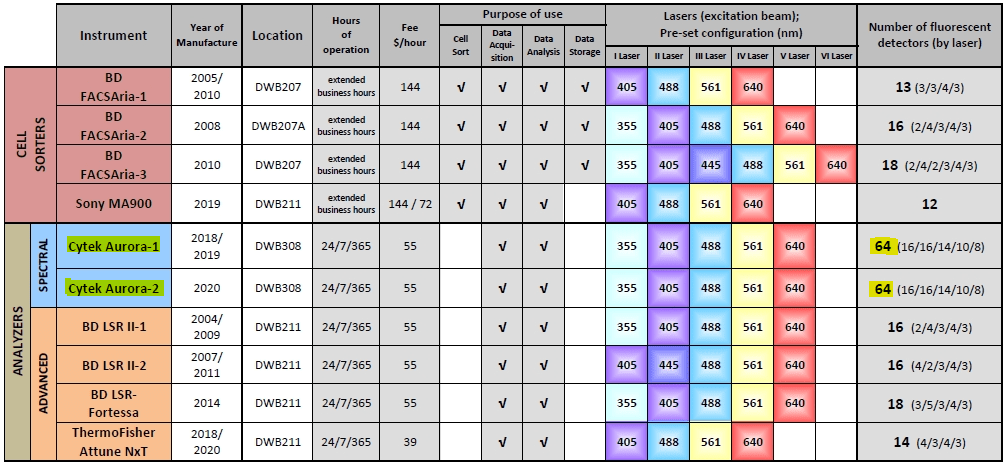

While it is difficult to assess the effects of competition, and even understand the true scale of the threat, I believe CTKB and TXG have small, protective niches. For Cytek, the advantage is in the “unique capability of measuring the entire emission spectra of the fluorescent dyes” and then using proprietary algorithms for far higher quality analysis. While competitors Becton, Dickinson (BDX), Sony (SONY, OTCPK:SNEJF), and Thermo Fisher (TMO) offer alternatives, Cytek remains the highest-quality option. In the chart below, one point to note is the fact that Cytek also offers an Aurora Cell Sorter and the options below are just the devices at the Rockefeller University flow cytometry lab.

Rockefeller University

10x Genomics is also a leader in their segment, high-throughput sequencing, and in fact, is one of the few providers of single cell genomic analysis. Competition is fierce from original leader Illumina (ILMN), and the latter’s recent platform expansions have eaten away at TXG’s competitive edge. Also, HTG EdgeSeq (HTGM) is also a small, specified competitor that encroaches on TXG’s domain. However, I expect the underlying growth of all areas of the market to be strong and reduce the load of competitors. Let’s take a comparative look at the financials next.

Rockefeller University

Financial Comparisons

Revenue Growth

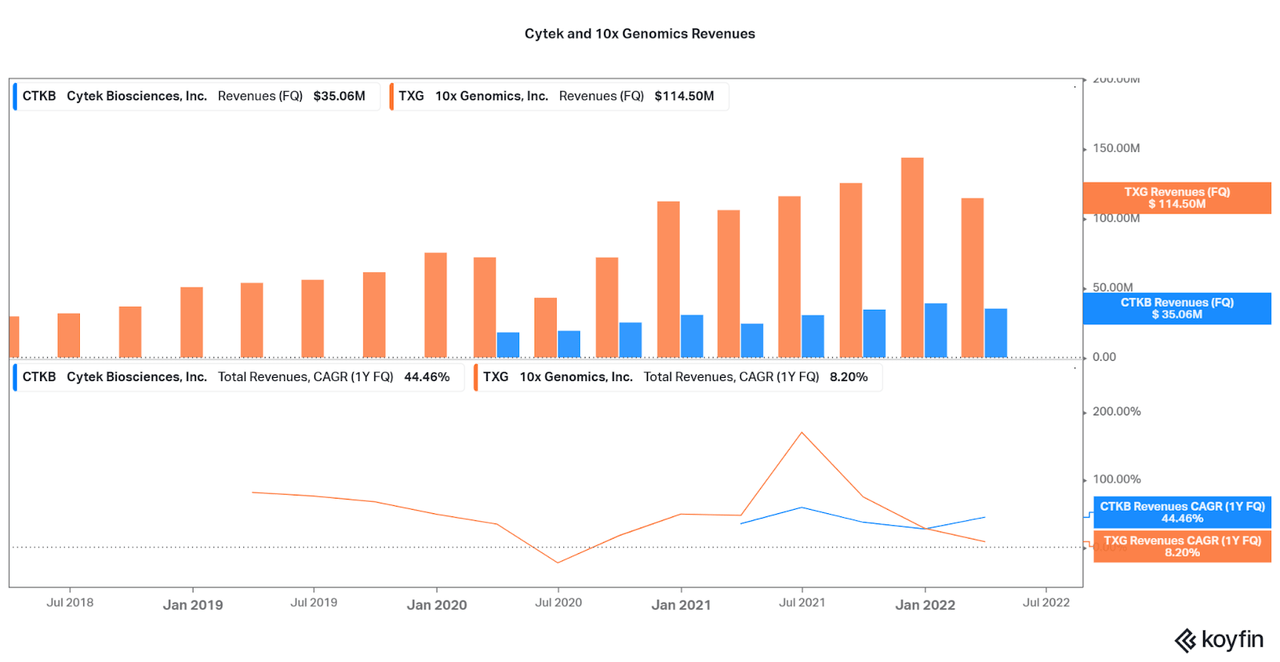

Cytek and 10x Genomics are similar in terms of the business side of things, but financially are quite different. Below, I lay out a few charts of the major differences between the two names. However, I think the most important difference is in profitability.

While CTKB is about 1/5th the size of TXG, CTKB has positive net income for two years (although quarterly extra items brought income to the negative slightly). Cytek also offers a 5.5% EBITDA margin while TXG is negative 13%. It is true that losses can be tolerated in both early-stage growth companies, but problems arise for investors in the long term. When considering that 10x has seen a slowdown in growth over the last quarter, the losses may be seen as unproductive.

Koyfin

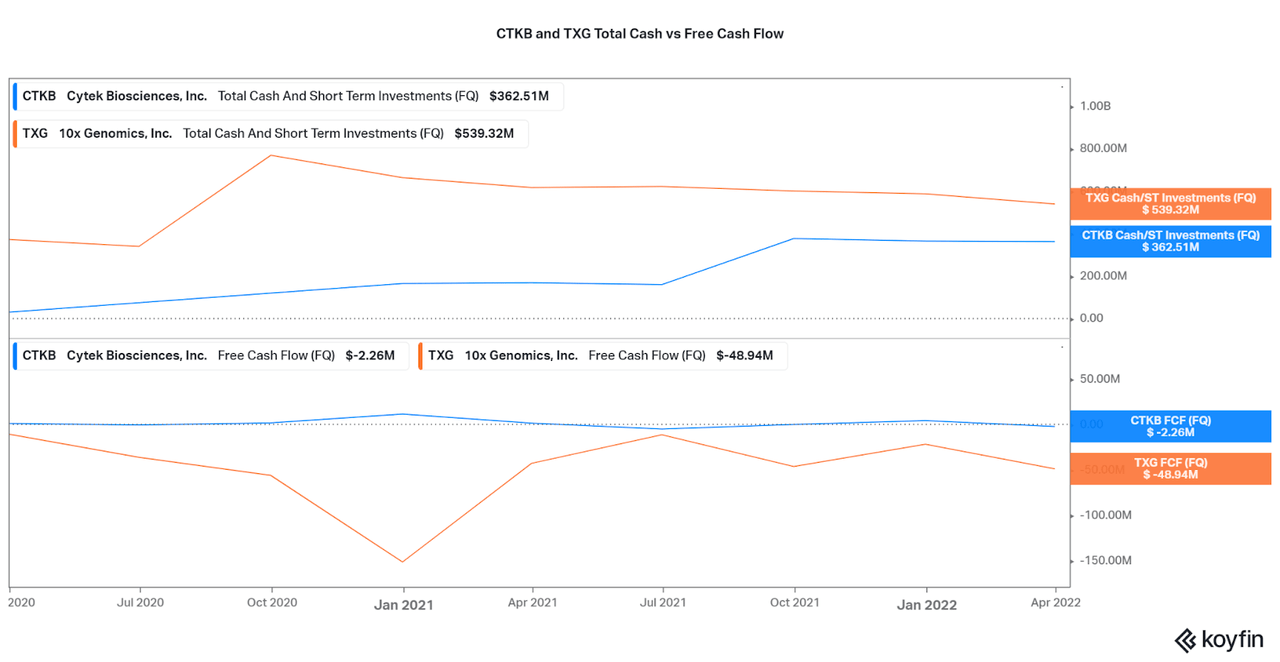

Cash Vs Free Cash Flow

So far, Cytek can be seen in a more favorable light thanks to profitability and stable upward revenue growth, even into 2022. Another way to look at things is by comparing cash on hand to operating expenses. While profitability plays a role, early-stage companies have their outlook based on how many quarters of expenses can be supported by the total cash.

As shown below, Cytek has a better cash advantage that can support operations for many quarters. TXG, on the other hand, can only support operations for three years before needing to either dilute or take on more debt. This would add to the already established $100 million in long term debt. Therefore, Cytek is also stronger in terms of losses and the balance sheet.

Koyfin

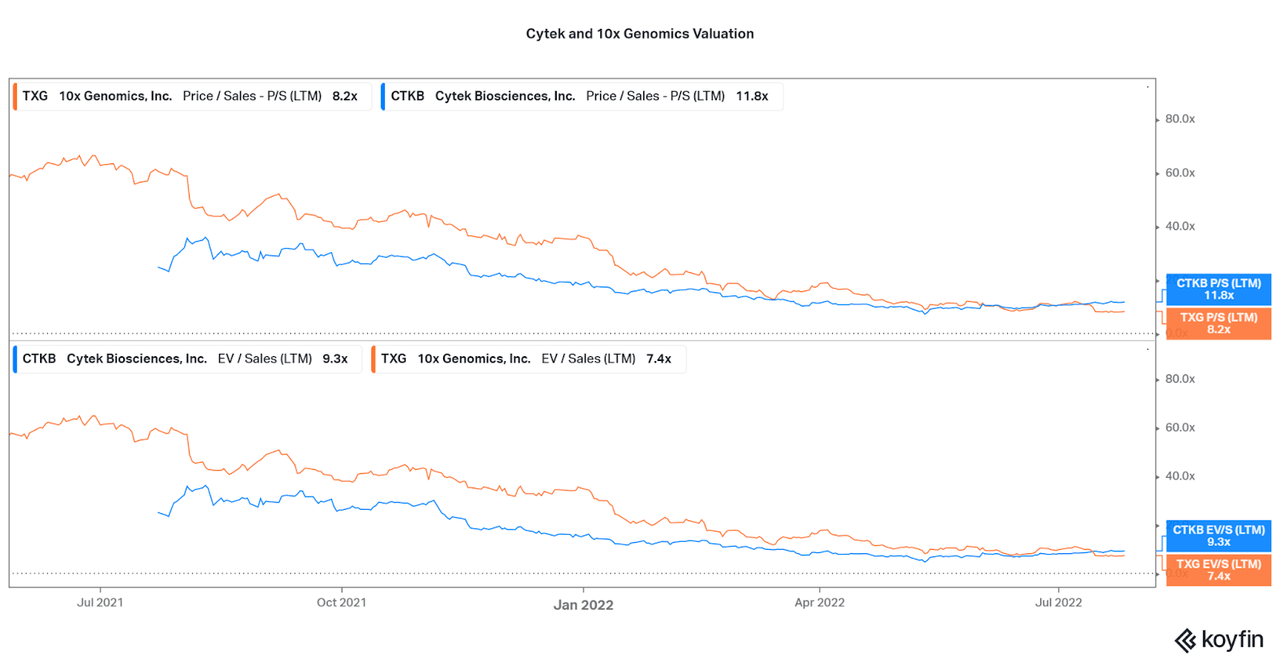

Valuations

One would imagine now that 10x Genomics would trade at a lower valuation due to the financial weaknesses, but the company only recently sold off lower than CTKB. Now both companies are falling to reasonable levels, and it will be important to assess each for the pros and cons.

Those with a long-term mindset should consider beginning to add to their holdings on a recurring basis, especially as growth has been seeing favorable price action over the past month or so. Both companies are in it for the long-game and 10x Genomics tough comparables against 2020/21 will soon be the past.

Koyfin

Conclusion

I believe both 10x Genomics and Cytek are strong investments thanks to their proprietary platforms. However, I tend to be leaning more towards favoring Cytek for the time being as I favor the stable and profitable profile. I believe TXG will continue to see significant volatility and may continue to trade down.

Instead, I will be setting recurring investments in Cytek for the time being and I hope to gain as sentiment for small cap companies returns to the positive. I hope this article provided an interesting comparison between two companies who offer similar services and outlook, but are certainly worlds of way in terms of the investment.

Thanks for reading, and feel free to share your thoughts in the comments.

Be the first to comment